What If Ireland Defaults? (14 page)

Read What If Ireland Defaults? Online

Authors: Brian Lucey

A cash interest bill of â¬8 billion is a huge burden to carry. It will be about 4.5 per cent of GDP and most of this will be paid to external creditors. By 2015 general government revenue is forecast to be around â¬62 billion with tax revenue of â¬43 billion. This cash interest will consume close to one-eighth of total government revenue (or one-fifth of tax revenue). The actual servicing cost will depend on the average interest rate, which is estimated to be 5.2 per cent.

Of course if the 5.2 per cent was applied to the â¬206 billion debt then it suggests that the interest payments should be over â¬10 billion. The â¬206 billion will include about â¬20 billion of promissory notes and there will be nearly â¬2 billion of interest added to them in 2015. This interest is paid to the state-owned IBRC which in turn will be paying interest to the Central Bank of Ireland for emergency liquidity. The interest due on the promissory notes is not paid to the IBRC but is rolled up into the capital amount. The IBRC will receive a fixed payment of â¬3.1 billion per year from the Exchequer until the promissory notes plus interest have been paid off. The presence of the promissory notes increases the government debt but does not affect the cash interest payments to be made.

An â¬8 billion annual interest payment is a huge burden for the country. However, at this stage, default remains an option to be considered rather than an inevitability to be endured.

We will also have substantial assets that would allow us to reduce the debt. In the above analysis we will also still have â¬13 billion of cash reserves intact. If we exhaust our cash reserves the debt would be â¬193 billion, but such an action would not be prudent. Although much of the National Pension Reserve Fund has been liquidated to recapitalise the banks there is still around â¬5 billion remaining in the fund. The banks have also been provided with â¬3 billion of âcontingent capital' which is due to be returned to the Exchequer in 2014.

The debt will also be lower once, hopefully, a sale for the banks can be undertaken. We have complete ownership of AIB and Permanent TSB and a 15 per cent stake in Bank of Ireland. Although it seems unlikely at present there may yet come a time where we will be able to offload the banks and use the money generated to repay the debt. The amount raised will be nowhere near the â¬63 billion we have poured into the banks but it will usefully reduce the debt.

It is hard to put a value on the banks but it will be some non-trivial sum. It is easy to suggest that the cash reserves, National Pension Reserve Fund and contingent capital would reduce Ireland's net debt to GDP ratio to around 100 per cent. If 10 per cent of GDP could be obtained for the banks the net debt position would be 90 per cent of GDP. If you prefer GNP as the appropriate measure of the Irish economy we are probably looking at a net debt in 2015 that will be around 115 per cent of GNP: large but by no means terminal.

Table 4.1 shows the breakdown of Ireland's â¬166 billion GGD at the end of December 2011. In November 2011 a Greek âdefault' of 50 per cent on sovereign bonds held by private investors was agreed with the EU. There were many calls that Ireland should seek a similar write-down on its debt. As the table shows, Ireland has â¬85 billion of outstanding sovereign bonds with another â¬5 billion to be repaid in March 2012.

The covered banks have around â¬12 billion of Irish government bonds on their balance sheet. Any write-downs here will have to be made good by capital injections from the state so the net benefit of a default on these bonds would be reduced by the money we would have to put into the banks. The ECB holds an estimated â¬22 billion of Irish government bonds as a result of the bond buying programme that it has been undertaking since the middle of 2011. The ECB has declared itself not to be a private creditor. This means the 50 per cent write-down would apply to about â¬50 billion of government bonds which would generate a total debt reduction of around â¬25 billion. If the Greek âdefault' was applied to Irish debt it would reduce the debt total by 15 per cent and bring it down to 90 per cent of GDP. The ongoing deficit and the likely increased interest cost of the remaining debt would quickly see it rise back above 100 per cent of GDP.

As was pointed out above it is not necessarily the size of the debt that matters but the interest burden it places on the government. If a 50 per cent haircut was applied to privately held Irish government bonds it would reduce our interest bill by â¬1.25 billion per annum, assuming that the average rate on the debt written off was 5 per cent. It is forecast that the general government deficit for 2012 will be â¬13.6 billion. It would still be above â¬12 billion if the 50 per cent debt write-down was applied. Even an 80 per cent write-down would only knock â¬2 billion off the annual interest bill.

It should also be noted that this is only on the assumption that the interest rate on our remaining debt remains unchanged. It would take an increase of only 1 percentage point on the remaining â¬124 billion of debt to fully offset the interest savings from the initial write-down. It is highly probable that such a rise would occur.

Any Irish default would have to focus on sovereign bonds but these are not held in sufficient quantity by private investors to generate sufficient benefits to offset the undoubted costs that would follow such an action. A default worthy of the name would require losses to be forced on official creditors. Much as it might seem desirable or attractive, it is not possible to unilaterally default on the ECB, EU or the IMF.

By going through the debt numbers, we see that we brought â¬47 billion of debt with us into this crisis in 2008. Bailing out the banks will have generated around â¬47 billion of debt by 2015. The annual Budget deficits between 2008 and 2015 will have generated â¬99 billion of borrowings and we have borrowed â¬13 billion to build up a cash buffer.

If the country had avoided assuming the bad debt losses of the banking sector, the debt ratio in 2015 would still be around 90 per cent of GDP, which is better than 115 per cent but would not eliminate the fear of default because of the ongoing annual deficits. Of course, without the bank bailout we would also have a â¬20 billion sovereign wealth fund.

A negative outcome on any of the unknowns described earlier will increase the fear of default, but just because there is a lot of noise suggesting default is inevitable is not enough to mean it will happen. If the necessary steps are taken we can carry the interest burden of a debt of 115 per cent from 2015 and, in time, the debt ratio will fall. It will be painful but it can be done.

We don't need to default on our debt but we may need some further assistance from the EU/IMF. To get through the end of 2015 the government needs to borrow â¬40 billion to fund its expenditure. The government also needs around â¬36 billion to roll over existing debt and pay the promissory notes. We need close to â¬76 billion of funding to see us from 2012 through to the end of 2015.

The EU/IMF deal will provide â¬34 billion of this. We need to raise an additional â¬42 billion, or around â¬30 billion if we use up our cash reserves. The official view is that we will return to the bond markets in late 2013 and begin raising this money then. With current yields on Irish bonds in the secondary market above 7 per cent it is still hard to see how we can raise this money sustainably from private sources. Market sentiment may improve as uncertainty about our situation dissipates, which would allow us to raise the money, but if that does not happen soon enough we will need additional support from the EU/IMF. We could achieve the funding target but if not I believe that this support will be provided because the programme can work.

If the option to default is to be taken, or default occurs because we have not arranged to have the required funding in place, those to suffer will be holders of Irish government bonds. It is more than a little incongruous that senior bondholders who invested in our delinquent banks are getting their money back while those who invested in our country may be forced to carry losses. As with a lot of things in this crisis, including unsupported claims of a â¬250 billion public debt, this just does not add up. I believe we can avoid that outcome and that we can stabilise our public debt. So this is my default story.

A very Irish Default, or When Is a Default Not a Default?

Stephen is a lecturer in Economics at the Kemmy Business School, University of Limerick, Director of the Centre for Organisation Science and Public Policy, and a research associate of the Geary Institute, University College Dublin. His website is

www.stephenkinsella.net

.

Default can be defined simply as not paying interest or the principal on debt owed when it falls due. At the time of writing, November 2011, international bond markets are highly volatile, expecting a Greek default and clearly worried about an Irish default. The stability of the global economic system and the Euro as a currency, and the credibility of the crisis resolution institutions of the European Union, are at stake.

The goal of this chapter is to examine the possible effects of an Irish default on the European economy as a whole. We will look at the past performance of the Irish economy, examine the types of debt Ireland holds at the moment in some detail, and discuss what

type

of default Ireland might engage in. We will finish by sketching out the possible consequences for the European economy and the Eurozone of such a default.

Recent history ensures that there are several complicating factors in the Irish case. It is therefore very important to understand this historical context when examining Ireland's current difficulties.

The scale of Ireland's funding problem is vast. In 2010, Ireland's domestic economy as measured by its gross national income (GNI) was worth about â¬131 billion.

1

In 2010 the sum of Ireland's borrowing was about â¬148 billion. By the end of 2011 it is estimated to be â¬173 billion, and is expected to peak at around â¬193 billion by the end of 2014. In ratio terms, the ratio between the output of the domestic economy in a given year and the total level of debt built up over time to be repaid by the sovereign is expected to peak at 140 per cent in 2014 or 2015. By comparison, in 1988, at the nadir of Ireland's last economic crisis, the same ratio was 119 per cent, with a larger funding cost than today, and with a roughly similar unemployment picture to today â approaching 14 per cent of the total workforce.

Karl Whelan

2

argues that a confluence of factors created the preconditions for an economic miracle during the 1980s. In the 1980s the problem was purely fiscal â increasing taxes and cutting expenditure was sufficient to help the economy recover. Other factors contributed, including a series of currency devaluations in 1986 and 1992/1993, our access for the first time to the European single market following the Maastricht Treaty, Ireland's stable labour market, and the demographic dividend Ireland enjoyed as âthe Pope's children' came of age with a high level of freely provided third-level education, just at a time when foreign direct investment was beginning to wash over the nation. Economic growth and prosperity broke out, with Ireland's GNI rising from â¬49 billion in 1995 to â¬131 billion in 2009.

3

Ireland's unemployment rate fell from 12.9 per cent in January 1995 to 4.4 per cent in December 2007. Throughout this period, Ireland's inflation rate remained low and relatively stable.

From the end of 2007, things only got worse for Ireland. Ireland's debt levels, only 28 per cent of GNI in 2007, grew in three years to over 114 per cent of GNI by the end of 2011. Unemployment rose from 4.4 per cent in December 2007 to 14.3 per cent in September 2011. Household net worth in Ireland has fallen almost 34 per cent from its peak of â¬641 billion at the end of 2006.

Ireland had an old-fashioned asset bubble.

4

Over the period 2002â2006, the structure of the Irish economy became increasingly dependent on the construction sector, and by 2006 construction output represented 24 per cent of GNI, as compared with an average ratio of 12 per cent in Western Europe. By the second quarter of 2007, construction accounted for over 13 per cent of all employment (almost 19 per cent when those indirectly employed are included), and generated 18 per cent of tax revenues.

5

Thus the background for Ireland's current debt problem is a fifteen-year period of robust growth, followed by a four-year period where the gains of the previous fifteen years have been lost to a greater or lesser extent by a large proportion of Irish society. The balance sheets of Ireland's banks were damaged by their exposure to property-related lending. Private bank borrowings on international markets to fund property lending grew from less than â¬15 billion in 2003 to close to â¬100 billion in 2007. When the bubble burst, these banks were highly exposed.

The Irish government in September 2008 agreed to guarantee the liabilities of six of Ireland's banks. A series of policies implemented to nationalise, recapitalise and reformat the banks have taken place since 2008, including the setting up of the National Asset Management Agency (NAMA) to oversee the management of good and bad loans taken on by Ireland's wayward banks on behalf of the taxpayer, while issuing government-backed bonds to help shore up banks' balance sheets. As each policy has been implemented the national debt has risen.

The national debt of any country is the sum of all the previous issuances of debt, usually (but not always) in the form of government bonds that have not been repaid yet. Governments borrow over fairly long time horizons when they can, and must repay the interest (and/or the coupon) on the debt until the time comes to repay the principal. Once that time comes, the debt can also be ârolled over', refinanced or bought back with another debt issuance at higher or lower rates, depending on the conditions in the market at the time. Sometimes the debt is even repaid.

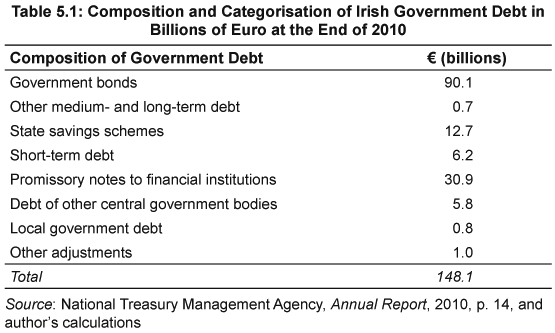

All government debt carries a risk of default. Ireland's national debt profile is composed of several categories, each of which must be considered when thinking about default. We will go through them one by one, but they are government bonds, which includes the pre-crisis government debt; other medium and long term debt; state savings schemes; short-term debt issued for liquidity purposes; promissory notes; debts of central and local government; and sundries.

We will focus mostly on the increasing government deficit financed through international borrowing. We will also look at the emergency liquidity assistance afforded to Ireland's banks, which are being paid off using the promissory notes written to cover some of the cost of bailing out Ireland's banks in addition to the ministerial comforts given for several types of asset classes. We will examine the loans from the European Central Bank (ECB), the European Commission and the International Monetary Fund (IMF), as well as from Denmark, Sweden and the United Kingdom. In addition, the â¬30.7 billion of state borrowing to fund NAMA must be paid back at some stage, though it is not appropriate to treat this as part of the national debt as yet. Interest must also be paid on all of this debt at varying rates. The total cash cost of debt servicing in Ireland is estimated to be â¬5.2 billion in 2011, rising to â¬9.2 billion in 2015.

Table 5.1 shows the various categories and magnitudes of Irish debt as they existed at the end of 2010, and we will go through them one by one in the next section.

Government Bonds

The boom years of the Celtic Tiger are often portrayed as years when the national debt was paid off. In ratio terms, the national debt as a percentage of Ireland's GNI did fall from 89 per cent in 1995 to 28 per cent in 2007. However, the reason for this fall is not that the level of indebtedness fell (the numerator in the fraction), but that total economic output as measured by GNI increased (the denominator). In absolute terms, the Irish state owed â¬43.6 billion in 1995. The Irish state owed â¬47.4 billion just as the economy began to collapse in 2007.

Since 2007 the Irish state has added â¬43.1 billion in state-issued government debt raised on the international bond markets. The cost of funding the state grew at an increasing rate as confidence in the solvency of the state diminished in 2009 and 2010. Because of the erosion of market confidence in Europe's peripheral nations, as well as its own internal problems, Ireland was forced to apply for a loan facility to the International Monetary Fund (IMF) on 21 November 2010.

The EU/IMF loan facility will add to the national debt. The loan facility is worth â¬85 billion over a three- to four-year period. The facility takes â¬22.5 billion from the IMF, â¬17.7 billion from the European Financial Stability Facility (EFSF), controlled by the ECB, and â¬22.5 billion from the European Financial Stability Mechanism (EFSM), controlled by the European Commission, with â¬17.5 billion from Ireland's cash reserves (â¬5 billion) and National Pension Reserve Fund (â¬12.5 billion).

In addition, the United Kingdom has pledged â¬3.8 billion, and Denmark and Sweden have pledged â¬400 million and â¬600 million respectively. Each of these different âpots' of loanable funds comes through the IMF with an interest rate. The rates of interest applied by the EFSF and EFSM, on average 3.9 per cent, in each quarterly tranche have been substantially higher than the IMF rates of 3.1 per cent. The EFSF and EFSM rates have come down from an initial average interest rate of 5.82 per cent.

The EU/IMF loan facility attaches stringent âconditionality' measures to be implemented to receive further tranches of capital. The current set of measures include bringing the budget deficit to within 3 per cent of a primary balance by 2015, various supply side measures, and a privatisation programme of state assets.

State Savings Schemes and Central Government Bodies

A full â¬12.7 billion of state borrowing exists as state savings schemes, where the lender in this case is the Irish citizen through the national postal service An Post, for example. Another â¬6.6 billion (â¬5.8 and â¬0.8 billion, respectively) exists as borrowing from state agencies and for the purpose of financing local authorities. For obvious reasons, no default can occur for these categories of government debt.

Short-Term Debt

Since 2007, mainly due to a fall in taxation revenues from construction-related activities as the construction bubble burst, the Irish government's expenditures have been much greater than its receipts, and so it has had to run a large primary deficit. The deficit is financed through borrowing at different maturities. The short-term borrowing came in the form of treasury bills to the value of â¬6.2 billion. The long-term borrowing came from the international bond markets initially, and from 2011 until 2014 at least will come from a consortium of funding bodies led by the IMF, the ECB and the European Commission, though the Irish government has stated its intention to return to the markets in a small way in 2012.

Promissory Notes

Ireland's banks required taxpayer funds to help fund their losses. In particular, Anglo Irish Bank, Irish Nationwide Building Society (INBS) and the Educational Building Society (EBS) have required â¬30.9 billion in âpromissory notes' just to balance their books, such was the scale of their losses.

A promissory note is an unsecured âpromise to pay' the sum agreed at a later date. The capital injections required were funded by promissory notes issued by the state to Anglo and INBS in lieu of cash, because normal funding channels were not available to these banks.

Promissory notes are not, strictly speaking, government debt, though for accounting purposes by the European statistical agency Eurostat they are treated as such.

Promissory notes are debt vehicles issued by the Central Bank of Ireland, rather than the European Central Bank. They are not, strictly speaking, backed by the ECB, as these notes are not eligible for refinancing operations by the ECB. The liability for these notes falls on the individual issuing state.

The promissory note repayment structure calls for government borrowing of â¬3.1 billion plus interest and other capital payments each year to repay these notes over a 10 to 15 year period at varying interest rates. These interest rates are pegged to the interest rates on an Irish ten-year bond at the moment.

In summary, Ireland's debt levels and debt servicing will increase over the next few years as the repayment of our EU/IMF loans begin, the repayment of the â¬90.1 billion of bond financing takes place, and the promissory note repayment takes place. All of this must be funded from Exchequer receipts at some point, imposing a large opportunity cost on Irish society in terms of the provision of state services.

Having looked briefly at the recent economic history of Ireland, and in some depth at the current and future debt profile of the nation, then this is the picture we must have in our minds when thinking about an Irish default. There is not one single âpot' of cash to be defaulted upon, but rather selective categories of national debt. Two elements of the picture remain: the role of the ECB and the outstanding liabilities of the covered banking institutions.

Central banks exist to dampen the natural fluctuations within the credit and leverage cycles caused by the movement of capital.

6

The ECB has acted as it saw fit to stabilise the European economy, but not as a textbook central bank might. Central banks can issue bonds to âcleanse' the balance sheets of wayward banks, transferring assets to the central bank's balance sheets to contain the contagion effects of banks getting into trouble. Central banks can also call for debt write-downs and enforce them.