What If Ireland Defaults? (13 page)

Read What If Ireland Defaults? Online

Authors: Brian Lucey

The IMF also used 2014 as an endpoint for the programme meaning their 2015 deficit is on a no policy change basis. This put their original 2015 deficit forecast about â¬3 billion higher than will be the case as the budgetary adjustment programme is now extended in 2015.

In total, these developments over the past year mean that the IMF's forecast of Ireland's 2015 GGD can be reduced by more than â¬20 billion. After four years of almost unrelenting bad news and deteriorating projections it is encouraging to see that some forecasts are finally beginning to improve.

Of course, all these deficits, plus the rollover of existing debt will require substantial amounts of funding. Could it be the case that we will default because we will run out of money?

The current EU/IMF programme is designed to run until the end of 2013. Ireland needs â¬46 billion in 2012 and 2013 to fund the annual deficits, meet the payments on the promissory notes and repay the maturing of existing debt. We still have to draw down around â¬34 billion of loans as part of the EU/IMF programme. The remaining â¬12 billion is expected to come from state savings schemes, our existing resources and some market funding.

Ireland had â¬13 billion of cash in the Exchequer account at the end of 2011. Without additional funding the state can meet all its obligations through to the end of 2013. It is also forecast that â¬1.5 billion a year can be raised through the state savings schemes such as savings bonds, prize bonds and the national solidarity bond. In 2011 these raised â¬1.36 billion. If the â¬1.5 billion was achieved we would have around â¬4 billion left in the Exchequer account at the end of 2013. Without market funding this would be a very weak position to be in as there is a â¬12 billion bond maturing on 15 January 2014 and we will need â¬10 billion to fund the Exchequer deficit that year.

We could run out of money in January 2014 but that will not happen. The National Treasury Management Agency has already carried a bond swap that has pushed the maturity of about one-third of the January 2014 bond out to February 2015. This reduced the amount of funding we will need in 2014. It is hoped that the state will âdip its toe' back into the bond market in late 2012/early 2013 to try to raise some new market funding. At this remove it appears unlikely that this will be able to raise the necessary amounts.

However, at the EU summit on 21 July 2011 it was agreed that programme countries would continue to be funded after the terms of the original agreements have ended. At the time, Michael Noonan said, âthere's a commitment that if countries continue to fulfil the conditions of their programme, the European authorities will continue to supply them with money, even when the programme concludes' and also âif we're not back in the markets, the European authorities will give us money until we're back in the markets.' Ireland will not run out of money that will force it into a default.

There are other issues related to the banking collapse that are not included in the GGD. These are, the final outcome of the NAMA process, whether the shutdown of Anglo and INBS will require further injections of capital and how to unwind the â¬110 billion of liquidity the banks have taken from the European and Irish Central Banks. There is also the long-term hope that we will be able to sell off our stakes in the two âpillar' banks to recoup some of the money swallowed by the bailout. There is a great deal of uncertainty about all these.

The NAMA process has seen the creation of â¬31 billion of bonds used to buy over â¬72 billion of developer loans from the banks with an average discount of 58 per cent. These bonds are a liability of the state but following a ruling of Eurostat they are not included in the GGD. It is impossible to know what the final outcome of the NAMA process will be. NAMA did create â¬31 billion of bonds to buy the developer debt, but it bought assets which also had a notional value of â¬31 billion as valued in November 2009. If these levels were to be maintained beyond the November 2009 valuation date, NAMA would have no effect on our net debt position. Of course, property prices have not been unchanged since November 2009 and in fact have tumbled ever downward. There are some estimates that the value of property backing the loans has fallen by a further â¬5 billion since the NAMA valuation date.

It is impossible to use this as a projection of possible NAMA losses. In most cases NAMA has control over the loans and not the assets. NAMA has been making substantial disposals for the past year but we are not told if the agency is making a loss or even possibly a profit on these transactions. These sales have allowed NAMA to begin repaying the bonds issued when the agency was formed. NAMA has the potential to make a call on the state's resources to cover a shortfall in its operations. Of the â¬31 billion of bonds created, â¬1.5 billion are subordinated bonds which will not be repaid if the agency generates a loss. Unless there is an almost complete collapse in asset values it is hard to see how this shortfall could be more than â¬5 billion, and it is likely to be substantially less than that.

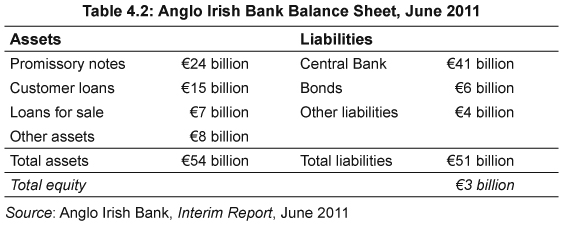

The Irish Bank Resolution Corporation (IBRC) was formed with the merger of Anglo Irish Bank and the Irish Nationwide Building Society in September 2011. The IBRC is a wholly state-owned bank and its liabilities are equivalent to sovereign liabilities. In its last set of accounts, produced for the first six months of 2011 Anglo revealed it has outstanding liabilities of â¬51 billion, of which â¬41 billion was owed to the Central Bank of Ireland. There was around â¬6 billion of bonds and â¬4 billion of other liabilities. A summary of Anglo's last balance sheet is provided in Table 4.2. These liabilities could be included in the GGD and it is possible that a change to reflect this will be introduced.

On the asset side we can see that half of these liabilities are already covered by promissory notes issued by the state and that there is â¬3 billion of equity in the bank. Consolidating the accounts would mean that about â¬20 billion of Anglo liabilities would be added to the GGD. The figure for the INBS part of the IBRC will be less than a quarter of this.

This change would increase the debt ratio by 15 per cent of GDP and push the debt ratio above 130 per cent of GDP. It is important to realise that this change would not put any additional cost on the Exchequer but would merely allow the GGD to better reflect the gross liabilities of the state.

There will only be an additional cost to the state if the assets on the balance sheet are not able to meet the liabilities to be paid (of which 80 per cent is owed to the Central Bank of Ireland). The IBRC has already disposed of some of these. The loans for sale category includes a â¬6 billion US loan book which was sold for around â¬5 billion in October 2011. This loss was provided for in the above accounts. This â¬5 billion was used to repay some of the emergency liquidity assistance the bank is availing of from the Central Bank of Ireland.

Customer loans amount to â¬24 billion, with â¬15 billion in Ireland and â¬9 billion in the UK. All US loans were classed as loans for sale. A loss provision of â¬9 billion on customer loans gives rise to the â¬15 billion figure used in the balance sheet. This is a write-down of around 40 per cent.

Figures on the loan book performance show that only 45 per cent of the loans are non-impaired. It is difficult to forecast what the recovery rate on non-performing loans will be but achieving 60 per cent of the nominal value of the loans seems probable. The bank does have around â¬3 billion of equity (which was provided by the state of course) but this means that a loan loss rate of greater than 50 per cent would be required before any additional state resources would be required.

The inclusion of the IBRC would increase the GGD but would not mean that additional state support for the bank is necessarily required. If no additional support to the bank is required the inclusion of the IBRC in the GGD cannot make debt sustainability any less likely. Only losses on the bank's customer loans above 40 per cent or on its other assets can cause that.

The â¬110 billion of Central Bank liquidity the banks have obtained is also backed by assets that have a nominal value well in excess of â¬110 billion. Outside of the IBRC, these are largely the customer loans the banks have issued. Between the NAMA process and the recent stress tests, â¬85 billion of loan losses have been accounted for in the covered banks. Other losses provided for in the banks' annual accounts (such as the â¬9 billion discussed in the Anglo accounts above) and covered by the former equity they held would bring this even higher. It is likely that well over â¬100 billion of loan losses in the covered banks have already been accounted for and there are no credible estimates that they will be higher.

The banks have substantial liabilities to central banks, bondholders and depositors. Without state assistance they would not be able to meet these liabilities. The state has provided â¬63 billion to the banks to cover this shortfall. If the banks are not to meet their liabilities it would require losses above those already accounted for to materialise. There is little to suggest that this is the case. In time the covered banks can unwind their reliance on Central Bank funding. This will be achieved as loans are repaid or sold and by acquiring deposits, particular inter-bank deposits, as confidence in the Irish banking system is slowly restored.

What all the above shows is why there is such confusion about Ireland's public debt and why there is no hard rule on what constitutes an unsustainable level of debt. Ireland's public debt is massive and is set to grow over the next few years. However, it is very probable that the debt ratio can be controlled and, in time, will fall away from the extreme levels it is currently exhibiting.

Using the current definition, Ireland's GGD was â¬166 billion at the end of 2011. With nominal GDP of around â¬155 billion the debt was equivalent to 107 per cent of GDP. It is possible to get a number that is much larger than this.

If NAMA's â¬30 billion of liabilities are included the debt would be 124 per cent of GDP. If the consolidated liabilities of the IBRC are added the debt would be around 140 per cent of GDP. If we are just picking numbers out of the air we could add another 10 per cent of GDP for no good reason other than the banks have huge levels of Central Bank liquidity drawn down. As we're at it we could add in over â¬100 billion of unfunded pension liabilities that the state will face over the coming decades. In the space of a single paragraph we have gone from a high but manageable debt of 107 per cent of GDP to a huge and unsustainable debt of 220 per cent of GDP.

In fact, neither figure proves that the debt is manageable or unsustainable. What truly decides whether a debt mountain is sustainable or not is the interest burden it puts on the public finances. Japan can carry a debt of 220 per cent of GDP because it can borrow at less than 1 per cent interest over ten years. This keeps Japan's interest expenditure at manageable levels. As countries rarely repay public debt the decisive issue is not the size of the debt but the amount of government revenue that goes to pay the interest on the debt.

State bodies such as NAMA and the IBRC, and even semi-states like the Dublin Airport Authority and the ESB, have huge debt levels. However, because they have their own assets, the interest payments they make do not come out of general government revenue. In fact, most of these bodies have sufficient assets to allow them to not pay the interest but also to fully repay the debts they have accumulated.

These debts could appear on the government's balance sheet and give the impression that the state is going to be utterly overwhelmed by debt. However, it is not the liabilities of these bodies that have to be covered by the state but the losses. And even then it is the interest burden that covering these losses would generate rather than the size of the losses that matters. If NAMA and the IBRC have â¬20 billion of losses to be covered by the state, then borrowing at 5 per cent would put an interest burden of â¬1 billion on the state. This is a huge sum of money but is not one that will result in national bankruptcy. There is no suggestion that these bodies will generate additional losses of more than a small fraction of this amount.

While there is uncertainty about these losses, there is no uncertainty about the ongoing need to fund the annual budget deficit. Taking the end-2011 debt of â¬166 billion, and adding the â¬40 billion needed for the deficits, means that by the end of 2015 the GGD will be in the region of â¬206 billion. This is the Department of Finance's forecast, the European Commission's forecast, will be the IMF's forecast, and, for what it is worth, it is my forecast.

Servicing the â¬206 billion debt mountain we have created will cost about â¬8 billion a year in cash interest payments. This is the total amount of cash interest the state will have to pay on its debt. Different aggregate debt levels can be obtained whether one includes or excludes a whole range of items. The cash interest to be paid is not open to such interpretation. There are huge government debts in NAMA, the IBRC and other bodies but because they have their own resources the interest on these debts will not be a drain on the government's resources.