Red Capitalism (8 page)

Authors: Carl Walter,Fraser Howie

Tags: #Business & Economics, #Finance, #General

Source: China Statistical Yearbook, various; China Financial Statistics 1949–2005.

The Great Hainan Real Estate Bust

On April 6, 1988, the entire island province of Hainan was made a Special Economic Zone (SEZ). At that time, Hainan was not the home of super five-star resorts and skinny fashion models it has become today. It was a backward tropical island with few natural resources other than its beauty and geographic position near disputed oil and gas fields in the South China Sea. Thanks to Beijing’s decision, however, it unexpectedly became, for a brief time, China’s version of the Wild West. Hundreds of thousands of enthusiastic young people poured into the boom towns of Haikou and Sanya, attracted by the promise of economic growth that more than 30 favorable investment policies were expected to generate. These policies encouraged the creation of an export industry and this, in turn, was expected to lead to a boom in hotels, entertainment and, of course, real estate.

If Shenzhen was the most westernized SEZ because of its proximity to Hong Kong, then Hainan was the pure Chinese version. In a territory the size of Taiwan, and in a complete financial vacuum, 21 trust companies sprang into existence. In Hainan, the trust companies

were

the banking sector; there was nothing else. Competition was intense in what was the nearest to virgin economic space that China could present. No one thought about any export industry. Everyone understood their opportunity: real estate. In China, it is always real estate. The special status of the trust companies, together with new policies permitting the sale of land-use rights, created explosive profit opportunities. Suddenly, 20,000 real-estate companies materialized—one for every 80 people on the island. Housing prices doubled twice in three years.

The catalyst to Hainan’s real-estate craze came from the outside: the Japanese developer Kumagai Gumi, later bankrupted by the Asian Financial Crisis, acquired a 70-year lease on 30 square kilometers of land encompassing the entire port area of Haikou. Imagine

that

deal! Instead of developing port facilities, the company turned to residential development, selling 900

mu

(about 150 acres) of land at RMB3 million per

mu

. Why would any businessman develop port facilities when industrial land only sold for RMB130,000 to RMB150,000? With such opportunities, it was not an empty boast when people spoke of buying up every inch of land in Haikou. The Hainan get-rich-quick business model soon became the envy of the entire country in 1992, the year Chinese history seemed to come to an end and everything seemed possible.

Then came 1993 and the start of Zhu Rongji’s efforts to bring the national economy, and the real-estate sector in particular, under control. The geese and their golden eggs disappeared; speculators fled, leaving some 600 unfinished buildings and RMB30 billion (US$4 billion) in bad debt behind. In this one SEZ alone,

publicized

bad debt totaled nearly 10 percent of the national budget and eight percent of the national total of non-performing property assets! This is what creative local financing in China means. Today in 2010, in every provincial capital across the country, exactly the same kind of real-estate boom has developed and for the same reasons: Party-driven bank lending.

The Hainan debacle led directly to the Party’s first effort to develop “good” bank/“bad” bank reforms in 1994. As part of a host of initiatives, three policy banks, including the now-prominent China Development Bank (CDB), were established to hold strategic, but non-commercial, loans. At the same time, the Big 4 banks were meant to become fully commercial institutions. This strategy to modernize the Big 4 banks, however, never gained traction until 1998 when GITIC collapsed.

Guangdong International Trust & Investment Corporation

The Hainan blowout was containable within the Chinese system; the GITIC implosion was not because it and Guangdong were exposed to the global economy. GITIC’s financial collapse in 1998 posed a real threat to China that has been all but forgotten. But GITIC, and how it was controlled by the provincial Party, is little different from how today’s financial institutions are managed and regulated. After all, as recently as 2008, the mighty Citic Pacific burned up over US$2 billion on a purely speculative and un-hedged foreign-exchange bet (and had to be recapitalized). GITIC came at the time when the entire Asian development model had exploded into the Asia Financial Crisis. Despite the calm face it presented to the outside world, China was severely affected by dramatically decreased export demand channeled through Guangdong Province, which was then, as now, that part of the country most exposed to international trade and investment. At the time, just 10 years ago, China’s total foreign-exchange reserves were only US$145 billion, as compared to its international debt of US$139 billion.

GITIC’s bankruptcy, still the first and only formal bankruptcy of a major financial entity in China, threw unwanted light on the Party’s financial arrangements. It called into question the central government’s commitment, if not its capacity, to stand behind its most important financial institutions. GITIC in the 1990s was, after CITIC, the nation’s largest and most prominent trust company and acted as the international borrowing “window” for Guangdong, its richest province. In 1993, prior to issuing its first (and only) US$150 million bond in the US, GITIC received the same investment-grade rating from Moody’s and Standard & Poor’s as the MOF. Its senior managers were well known among foreign bankers for their active participation in cross-border foreign-currency and derivatives markets. One of its subsidiaries was publicly listed in Hong Kong and its chairman had been the subject of a

BusinessWeek

cover story.

2

All foreign bankers were “close” friends with Chairman Huang and all had drunk his premium wines in the club at the top of the company’s 60-storey tower in Guangzhou. GITIC was a National Champion before there were National Champions.

The outcome of what started as a familiar story of poor management showed how seriously Premier Zhu Rongji took the issue of moral hazard and the threat posed by a weak financial system. This stands in direct contrast to the government’s approach to the banks in 2009, as will be discussed in later sections. The proximate cause of GITIC’s collapse was its inability to repay US$120 million to foreign lenders in 1998. Zhu Rongji, outraged that its financial losses were unquantifiable, ordered Wang Qishan, then senior vice-governor of Guangdong, to close GITIC in October 1998. In January 1999, it was declared bankrupt in what was a huge shock to the international financial community’s view of China. Rumors rapidly began to spread, both inside and outside the country, that “China’s commercial banks are technically bankrupt.” These threatening assertions forced Premier Zhu to make the following clarification to reporters at a news conference following the National People’s Congress in March 1999:

I think that those [international] banks and a few financial institutions are too pessimistic in their estimates of this problem; that is, they believe that China is already in the midst of a financial crisis and does not have the capacity to support its payments and is not creditworthy. China’s economy is rapidly growing; we have US$147 billion in reserves and balanced international payments. We are completely able to repay our debt. The issue is whether or not the government should repay this kind of debt.

3

Given the level of international concern and a desire to enforce financial discipline, Zhu ordered GITIC’s bankruptcy to proceed in accordance with international standards. A fully transparent process was led by the international accounting firm KPMG acting as the company’s liquidator. GITIC was publicly investigated more thoroughly than perhaps any Chinese financial institution before or since. The findings are a matter of public record and should not be forgotten. The scale of its failure was breathtaking. A preliminary KPMG review of its finances as of April 1999 showed total assets of US$2.6 billion set against liabilities of US$4.4 billion. During the four-year liquidation process, 494 creditors registered claims totaling US$5.6 billion, of which US$4.7 billion represented those of 320 foreign creditors.

In the end, GITIC’s creditors faced the fact that 90 percent of the company’s loans and commitments were unlikely to ever be met. Over 80 percent of its equity investments in some 105 projects spread across the province had also failed and were without value. The recovery rates for GITIC alone was 12.5 percent and for its three principal subsidiaries ranged from 11.5 percent to 28 percent. The picture this presents of the operations of a major financial institution was shocking and continues to be shocking: just where did these billions of dollars go? The answer is that many of the real-estate and infrastructure projects GITIC financed are still there, but are now owned by other arms of the government.

Today, in 2010, bank officials and regulators readily admit that much of the lending in 2009 went to projects without immediate cash flow, such as real estate and high-speed railways. Even so, they continue, in the future such infrastructure will be of great value. What they are describing is the GITIC financing model. The only question is: which entity will end up holding today’s bad loans?

In 1998, however, Zhu Rongji did not take such a sanguine view of bad lending. The collapse of GITIC led to the closure of hundreds of trust companies and thousands of urban credit cooperatives across the country. More importantly, it initiated a serious effort to centralize control of the Big 4 banks in Beijing’s hands and marked the start of their restructuring. Zhu Rongji got it: if GITIC was a hyped-up financial fraud, were the state banks any different? The answer was “No” and so began the strong effort to recast China’s banking system after that of the United States, which was seen then as the best.

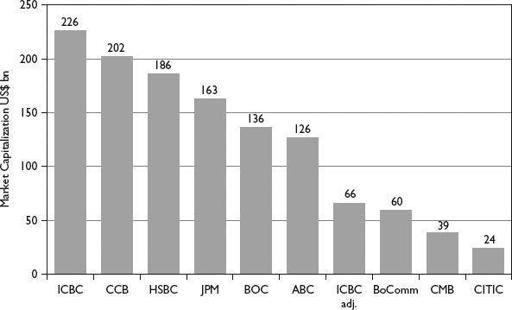

CHINA’S FORTRESS BANKING SYSTEM IN 2009

It is a testimony to the extensive bank restructuring demanded by Zhu Rongji that China’s banks have withstood the global financial crisis so well. While many major banks in developed countries were bankrupted by the crisis in 2008, China’s banks have emerged seemingly untouched and, some would argue, even strengthened. Listed on the Hong Kong and Shanghai Stock Exchanges, six of these banks now rank highly in the Fortune 500 and one, ICBC, is the largest by market capitalization in the world and the second-largest company overall, behind only ExxonMobile (see

Figure 2.3

). In contrast, JPMorgan, currently America’s strongest bank, comes in at a distant nineteenth place. Compared to 1998 when their non-performing loan ratio exceeded 40 percent, China’s banks have obviously come a long way.

FIGURE 2.3

Fortune

500 ranking of Chinese banks vs. JPMorgan Chase, FY2008

Source: Bloomberg and Fortune

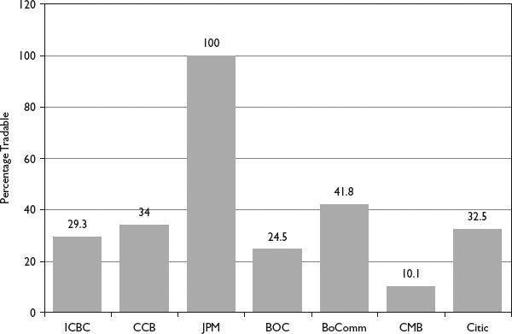

It is true that China’s banks today are stronger and their staff more professional than 10 years ago. Senior management has been quick to learn to “walk the walk” and talk the banker talk and there is a more sophisticated, internationally savvy banking regulator. A closer look, however, suggests that organizational miracles are miracles precisely because they are few and far between. The market-capitalization data shown in

Figure 2.3

is a misleading comparison of apples to oranges. Can a JPMorgan, with 100 percent of its shares capable of being traded in the market each day, be compared to banks such as ICBC that have less than 30 percent of their shares tradable (see

Figure 2.4

)? Market-capitalization figures are based on a traded market price for one share multiplied by the bank’s total number of shares. This assumes, as is always true in international markets, that the entirety of a company’s shares is listed. The resulting market-cap figure, therefore, represents investors’ consensus on the valuation of a company’s ongoing operations. As has been shown elsewhere,

4

since A-shares, H-shares, and China’s famous variety of non-tradable shares all have different valuations, the value of the ICBC’s market-cap figure will vary enormously depending on which price is used.

FIGURE 2.4

Comparative share floatation of listed banks, FY2008