Red Capitalism (6 page)

Authors: Carl Walter,Fraser Howie

Tags: #Business & Economics, #Finance, #General

In 1998, in the wake of the Asian Financial Crisis and the collapse of Guangdong International Trust & Investment Corporation (GITIC), the families united in crisis. They agreed that financial weakness threatened their system and they supported a thorough bank restructuring inspired by international experience. Now, years later, the appearance of success has been highlighted by the global financial crisis from which their banks and economy were largely insulated. It has made the families supremely confident in their own achievements. How could there be a problem with more than US$2 trillion in reserves and banks at the top of the

Fortune

500? Besides, the reforms of the Jiang/Zhu era produced a group of fabulously wealthy National Champions around which many of the families cluster. Family business in China had become Big Business. The US$120 billion and more that was spent on the Beijing Olympics, the Shanghai World Expo and the Guangzhou Asian Games seemed almost immaterial; the hundreds of millions for the Sixtieth Anniversary Parade was nothing. Each of these events was bigger, better, and more expensive than anything any other country has ever managed, but each is little different from individuals being seen driving a Benz 600 or carrying the latest Louis Vuitton bag: they give the appearance of fabulous wealth and, therefore, success; they became a self-fulfilling prophecy. Given the apparent strength of the financial system, where is the need for further reform?

Failing to grasp the impact of unbridled Western-style capitalism on its elite families in a society and culture lacking in legal or ethical counterbalances is to miss the reality of today’s China. Greed is the driving force behind the protectionist walls of the “state-owned” economy “inside the system” and money is the language. A clear view over this wall is obscured by a political ideology that disguises the privatization of state assets behind continuing “state” ownership. The oligopolies dominating the domestic landscape are called “National Champions” and the “pillars” of China’s “socialist market” economy, but they are controlled by these same families. As the head of an SOE once wisely commented, “It doesn’t matter who owns the money, it only matters who gets to use it.” In China, everyone wants to use the money and few are willing to be accountable for how it is used.

The Chinese commonly joke that China is now passing through the “primitive stage of capital accumulation” described by Karl Marx. The occasional lurid “corruption” scandal provides a critical insight into what is, in fact, the mainstream privatization process: the struggle between competing factions for incremental economic and political advantage. The state-owned economy, nominally “owned by the whole people”, is being carved up by China’s rulers, their families, relations and retainers, who are all in business for themselves and only themselves. From the very start of political relaxation in 1978, economic forces were set in motion that have led to the creation of two distinct economies in China—the domestic-oriented state-owned economy and the export-oriented private economy. The first, which many confuse with China, is the state-owned economy operating “inside the system.” Sponsored and supported by the full patronage of the state, this economy was, and has always been, the beneficiary of all the largesse that the political elite can provide. It is the foundation of China’s post-1979 political structure and the wall behind which the Party seeks to protect itself and sustain its rule.

Over the past 30 years China’s state sector has assumed the guise of Western corporations, listed companies on foreign stock exchanges and made use of such related professions as accountants, lawyers, and investment bankers. This camouflages its true nature: that of a patronage system centered on the Party’s

nomenklatura

. The huge state corporations have adopted the financial techniques of their international competitors and raised billions of dollars in capital, growing to an economic scale never seen before in all of Chinese history. But these companies are not autonomous corporations; they can hardly be said to be corporations at all. Their senior management and, indeed, the fate of the corporation itself, are completely dependent on their political patrons. China’s state-owned economy is a family business and the loyalties of these families are conflicted, stretched tight between the need to preserve political power and the urge to do business. To date, the former has always won out.

Of course the “National Champions” dispose of great wealth and, consequently, interest groups within the Party have formed around what one official once called “these cash machines.” But misjudgment forms the character of all human beings; a simple misstep can bring down a powerful wealth machine and the families behind it. The issue then becomes how to remove the political targets while preserving the machine. The “Party”—that is, the winning interest group—can intervene for any convenient reason, changing CEOs, investing in new projects or ordering mergers. Due to these characteristics, the adoption of laws, accounting standards, markets, and other mechanisms of international capitalism are just examples of the formalism that characterizes China today. The names are the same as in the West, but what things are and how they work is hidden beneath the surface. Given the state’s scale in critical sectors, together with the enormous power of the government, the influence of this patronage system pervades all aspects of China’s economy. It inevitably undermines the very contents of its superficially internationalized institutions.

The 30 years encompassed by the policy of reform and opening have been the most peaceful and economically successful in the past 170 years of China’s history, lifting more than 300 million people out of poverty. This achievement must be acknowledged. But the character of China’s style of capitalism is marked deeply by how the political elite has coalesced around certain institutions, corporations and economic sectors, how the government and various interest groups have used Western financial knowledge, and the crises the state has met along the way. After all, every country and all economic and political systems experience booms and busts, scandals and wild speculative sprees. The difference lies in how each country manages the aftermath. The aim of this book is to pull back the edge of the Chinese curtain and peer at what is behind, to match the reality of the system’s operations with the familiarity of the names it uses to describe them and then to look into the future in the belief that a straight forward look will benefit all.

ENDNOTES

1

See Xing 2007: 739.

2

This figure could be much higher since the market capitalizations of H-share companies listed on the HKSE value

only

the H-shares, excluding all other shares.

3

See Wu 2009.

4

For greater detail, see Walter and Howie 2006: Chapter 9.

5

The PBOC’s statement in June 2010 that the yuan is free to float against a basket of currencies remains just that, a statement, and is unlikely to lead to significant change in the currency’s value.

CHAPTER 2

China’s Fortress Banking System

“[W]e should not bring that American stuff and use it in China. Rather, we should develop around our own needs and build our own banking system.”

Chen Yuan, Chairman, China Development Bank

July 2009

In China, the banks are the financial system; nearly all financial risk is concentrated on their balance sheets. China’s heroic savers underwrite this risk; they are the only significant source of capital “inside the system” of the Party-controlled domestic economy. This is the weakest point in China’s economic and political arrangement, and the country’s leaders, in a general way, understand this. This is why over the past 30 years of economic experimentation, they have done everything possible to protect the banks from serious competition and from even the whiff of failure. In spite of the WTO, foreign banks consistently constitute less than two percent of total domestic financial assets: they are simply not important. Beyond the pressures of competition, the Party treats its banks as basic utilities that provide unlimited capital to the cherished state-owned enterprises. With all aspects of banking under the Party’s control, risk is thought to be manageable.

Even so, at the end of each of the last three decades, these banks have faced virtual, if not actual, bankruptcy, surviving only because they have had the full, unstinting and costly support of the Party. In the 1980s, the banking system had barely been re-established when uncontrolled lending at the insistence of local governments led to double-digit inflation and near civil war. The Asian Financial Crisis of 1997 drove internationally significant financial institutions such as Guangdong International Trust & Investment Corporation into actual bankruptcy. This compelled the government to undertake a bottom-up reorganization of the banks that it admitted publicly had 40 percent non-performing loan (NPL) levels. The origins of this restructuring can be traced to 1994, when the framework of a system that closely followed international arrangements was sketched out, including an independent central bank, commercial banks, and policy banks. The 1994 effort was stillborn, however, given the priority to bring raging inflation, which peaked at over 20 percent in 1995, under control. In short, China’s banking giants of 2010 were under-capitalized, poorly managed and, to all intents, bankrupt just 10 years ago.

A third decade has now gone by during which the banks completed their restructuring and subjected themselves to international governance and risk-management standards. By 2006, three of the four state banks had completed successful international IPOs. After the outbreak of the global financial crisis in 2008, China’s banks emerged as apparent world-beaters, besting their peer group in the developed economies in size of market capitalization and even topping the

Fortune

500 list. They seemed to have weathered the global financial crisis well. But just, at this point, the Party, facing the seeming collapse of China’s export-driven economy, reverted to its traditional approach and ordered the banks to lend unstintingly to drive the economy forward. This green light may have erased whatever standards of governance and risk control that bank management had learned over the previous decade.

By the end of 2009, the banks had lent out over RMB9.56 trillion (US$1.4 trillion) and warning lights were flashing as capital-adequacy ratios approached minimum internationally mandated levels. In 2010, these banks are scrambling to arrange huge new capital injections totaling over US$70 billion (if Agricultural Bank of China’s IPO is included). Looking forward, the lending binge of 2009 threatens, and will most certainly generate problem loans of sufficient scale to require yet a third recapitalization in the next two to three years. China’s major state banks, the National Champions of the financial sector, appear to be heading toward a situation not unlike that of 1998. But their problems will, in fact, be much worse than 1998 since the old problem loans of the 1990s were only swept under the carpet. The “bad” banks, which took on those NPLs, were poorly structured, with the result that the “good” banks have remained liable. The government’s penchant for

ad hoc

funding arrangements, an unwillingness to open the problem-loan market to foreign participation, and the belief that it can perpetually put off the realization of losses pose a threat to the financial strength of China’s banks long before the NPLs of 2009 arise.

China’s banks look strong, but are fragile; in this, they are emblematic of the country itself. The Chinese are masters of the surface and excel at burying the telling detail in the passage of time. Their past experience tells them that this strategy works. But China, perhaps more than at any time in its long history, is now closely enmeshed with the larger world. The collapse of GITIC would never have taken place had it not been caught up in international financial arrangements. China’s financial system, similarly, has become increasingly complex; this complexity has begun to erode the effectiveness of the Party’s traditional problem-solving approach of simply shifting money from one pocket to another and letting time and fading memory do the rest. Tied up as it is in financial knots, the system’s size, scale and access to seemingly-limitless capital cannot forever solve the problems of the banks.

BANKS ARE CHINA’S FINANCIAL SYSTEM

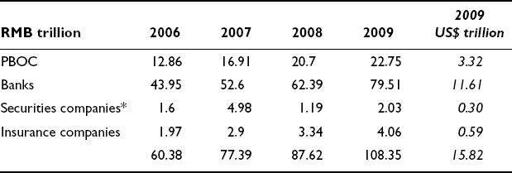

In China, capital begins and ends with the Big 4 banks. The banking system has thousands of entities if the 12 second-tier banks, the urban and rural banks, Postal Savings Bank, and credit cooperatives, are included. But the heart of the system includes just four: Bank of China (BOC), China Construction Bank (CCB), Agricultural Bank of China (ABC) and, the biggest of them all, Industrial and Commercial Bank of China (ICBC). In 2009, state-controlled commercial banks held over US$11 trillion in financial assets, of which the Big 4 banks alone accounted for over 70 percent (see

Table 2.1

). These four banks controlled 43 percent of China’s total financial assets.

TABLE 2.1

Relative holdings of fi nancial assets in China, FY2009 (RMB trillion)

Source: PBOC Financial Stability Report 2010, various.

Note: *includes brokerages and fund-management companies.