Unfair Advantage -The Power of Financial Education (8 page)

Read Unfair Advantage -The Power of Financial Education Online

Authors: Robert T. Kiyosaki

Tags: #Personal Finance, #unfair advantage, #financial education, #rich dad, #robert kiyosaki

The S Quadrant

“

If you want it done right, do it yourself.”

These are the words of people in the S quadrant, regardless of whether the person is a medical doctor, an attorney, or a yardman. They say the same words. These words reflect the core values of independence and lack of trust that anyone else can do it better. S-quadrant people generally have rigid points of view on the right way, and the wrong way, to do something. Their theme song is: “Nobody Does It Better” or “I Did It My Way.” The trouble with the S quadrant is that if they stop working, their income also stops. People in the S quadrant do not own a business. They own a job.

Many professional people fall into the S quadrant. They could be accountants, bookkeepers, webmasters, and consultants. S also stands for specialized or smart. They value their independence and specialized skill. Most stay small because they focus on becoming more specialized, rather than becoming larger.

Shining stars in the S quadrant are often stars in real life. For example, most movie stars, rock stars, and professional athletes are in the S quadrant. In every city and town, there are stars in the S quadrant. For example, there is always the famous local doctor, real estate agent, or restaurant owner in every town.

I have a friend who owns five restaurants in town. He is famous for great Italian food. He earns a lot of money. His kids work in the business, and five restaurants is as big as he wants to get.

Another friend is a famous cancer surgeon. He has people lining up to see him. Since he can only see a few patients, he simply raises his rates. When asked if he wants to grow his business, he says, “I make a lot of money, and I am busy enough.”

FAQ

I am in the S quadrant. What can I do to earn more and pay less in taxes, legally?

Professional Answer from Tom Wheelwright

The most important thing to do in an S-quadrant business is to begin thinking and acting like a B-quadrant business. This includes hiring employees, increasing your investment in equipment and real estate and setting up your company as a B-quadrant entity. (An entity is simply your legal form of ownership. Most S-quadrant people are sole proprietorships or partnerships and these entities pay the most tax possible. Instead, look at B-quadrant-type entities such as limited liability companies, limited partnerships, S corporations and C corporations.)

The B Quadrant

“

I’m looking for the best people.”

These are the words of a B-quadrant person. B means big—500 employees or more. A person in the B quadrant takes on tasks bigger than he or she can do alone. That means success in the B quadrant requires leadership skills and people skills, not just technical skills. This is why so many entrepreneurs, such as Bill Gates, founder of Microsoft; Walt Disney, founder of Disneyland; and Thomas Edison, founder of General Electric did not finish school. Entrepreneurs have the power and leadership skills to take an idea and turn it into a massive business—a business that creates jobs and creates wealth. For example, Silicon Valley in California is wealthy because it is a hotbed for high-tech entrepreneurs.

Success in the B quadrant requires a team effort, because very few people can manage over 500 people on their own.

Shining stars in the B quadrant are Steve Jobs of Apple, Richard Branson of Virgin, and Sergey Brin of Google.

FAQ

I am in the B quadrant. What can I do to earn more and pay less in taxes, legally?

Professional Answer from Tom Wheelwright

The opportunities to reduce taxes in the B quadrant are virtually unlimited. Almost all expenses in a B-quadrant business are deductible. B-quadrant businesses get tax credits for hiring employees, for increasing their research and development, and for investing in green technology. B-quadrant businesses also can often pay taxes at a lower rate than S-quadrant businesses, especially since the owners pay little or no self-employment taxes.

The I Quadrant

“

How do I raise the money to invest in my project? How do I earn more with other people’s money and pay less in taxes?”

Earlier I stated that a key distinction of an I is that they use as much OPM as possible.

Shining stars in this quadrant are John Bogle, founder of the Vanguard Funds, and George Soros of Quantum Funds.

FAQ

I am in the I quadrant. What can I do to earn more and pay less in taxes, legally?

Professional Answer from Tom Wheelwright

Using other people’s money is literally the best way to reduce your taxes in the I quadrant. That’s because you can take deductions for the purchases you make with other people’s money. Depreciation on real estate is a particularly great way to take tax benefits on someone else’s money. You get a deduction not just for the portion of the real estate you paid for with your own money, but you also get a depreciation deduction for the portion paid for with the bank’s money.

The Quadrant in Simple Terms

E’s work for someone else.

S’s work for themselves.

B’s have others work for them.

I’s have their money or OPM (other people’s money) work for them.

The Bigger Difference

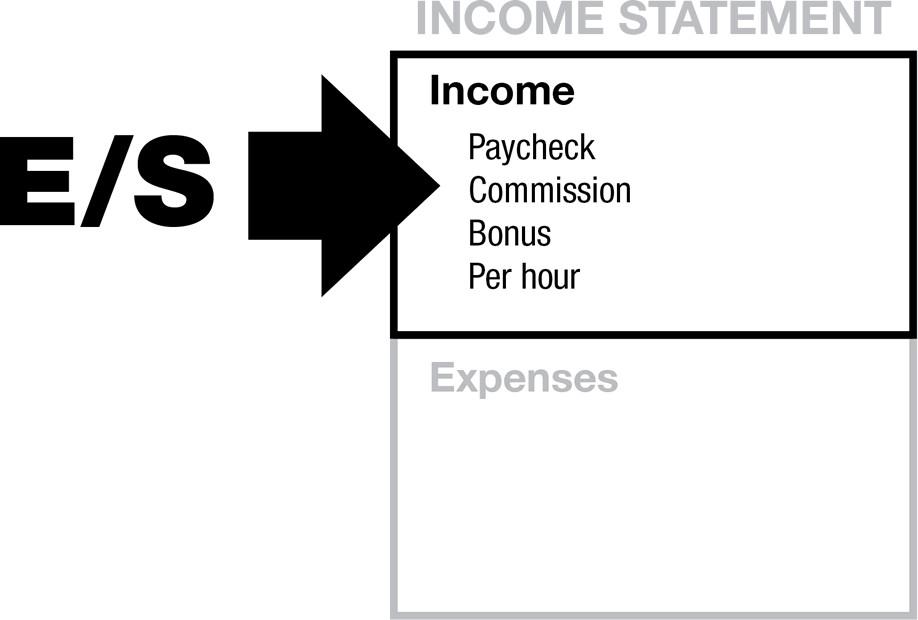

E’s and S’s work for money, which is why they pay more in taxes.

E’s and S’s focus here:

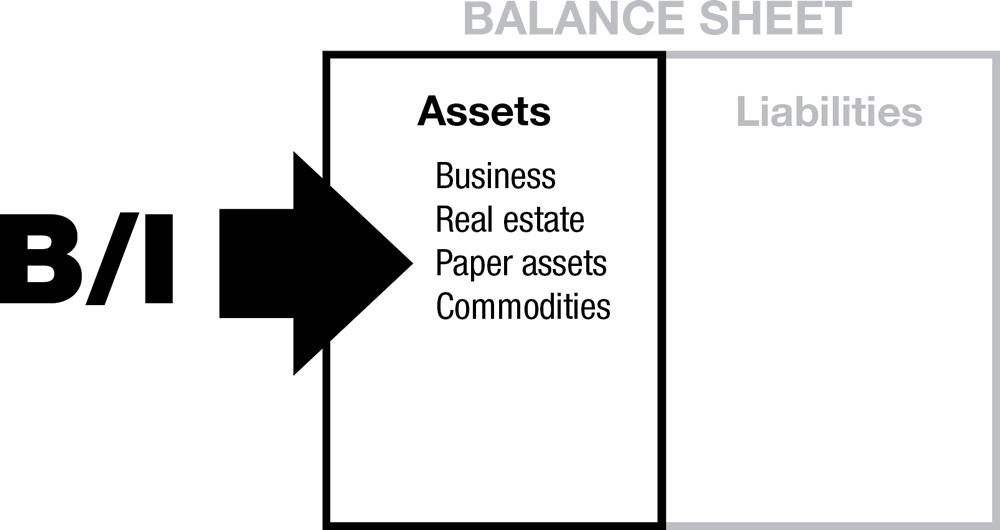

B’s and I’s work to create or acquire assets, which is why they pay less in taxes. B’s and I’s focus here:

True Capitalist

All the shining stars in the B and I quadrants are capitalists, individuals who took their idea, created a business, and used OPM to grow their business. They spent their time thinking big and focusing on asset creation, which makes it easier to attract capital.

The tough part about being in the S quadrant is that there is very little OPM for growth capital because the entrepreneur’s business is small and the S may think too small. There is very little growth potential and too much risk to attract investment capital. That is why most in the S quadrant seek SBA (Small Business Administration) loans that are backed by the government. True capitalists invest in assets, not people.

Most schools do a pretty good job of training students for the E and S quadrants. For example, most universities have MBA programs for students who aspire to be president or CEO of a major corporation, a business that is already built. Most MBA students become employees rather than entrepreneurs because they do not understand the B quadrant. Most recent graduates of MBA programs do not know how to raise capital or how to build assets. The ability to raise capital is the most important skill of an entrepreneur. The inability to raise capital keeps most small businesses small.

Traditional education has great law schools for people who want to be lawyers, and medical schools for those who want to be doctors. There are excellent trade schools training students to be chefs, mechanics, plumbers, auto mechanics, and electricians. The problem with most of these trade schools is that students graduate knowing very little about the B and I quadrants. They graduate knowing very little about money, taxes, debt, investing, raising capital, or how to grow out of the E and S quadrant into the B and I quadrants. If we are to solve the problem of unemployment, we need more people trained and educated to become B’s and I’s, true capitalists.

The Rich Dad Company focuses on training people for the B and I quadrants. The programs are very different because the people who want to be B’s and I’s are very different and the skills required to become a B or I are different. Most people who seek paycheck security do not do well in the B or I quadrants, the quadrants with the tax incentives from the government. As Tom Wheelwright explained, these tax incentives exist because governments need more people who know how to create jobs and create excess capital that can be invested in projects of interest to the government, such as housing. Today’s unemployment problem is caused by our school system which trains too many students to be employees instead of entrepreneurs, to be workers rather than capitalists.

Changing Quadrants

Before changing quadrants, a person needs to be intimately in touch with their core values, because core values define the person in each of the different quadrants. In other words, you do not change quadrants just for tax reasons.

If you want to change quadrants, take time to define your core values before changing. For example:

How important is a steady paycheck to you?

Are you a good leader?

How do you handle stress?

Do you have the skills required for the B and I quadrants?

In which quadrants do you have the greatest chances of success?

How important is your retirement?

How do you handle failure?

Do you work well on teams?

Do you like your work?

Is your work getting you to where you want to go in life?

These are important questions that only you can answer. These questions are far more important than taxes.

Simplifying the core values:

E’s and S’s seek security.

B’s and I’s seek freedom.

What Should I Change?

FAQ

What is the easiest way to start to change quadrants?

Short Answer

Change your friends.

Explanation

There is a lot of truth to the old saying: Birds of a feather flock together. Employees tend to hang out with employees. Doctors tend to hang out with doctors. The same is true with entrepreneurs and investors. In my experience, people in different quadrants do not like people in other quadrants. That is why labor unions tend to vilify the B and I quadrants, and vice versa. Socialists also tend to distrust people who are in the B and I quadrants, and vice versa. I know that there are some of you reading this section on taxes that vilify me because I have employees and use tax laws to grow richer. I know this to be true because my poor dad truly thought my rich dad was a crook who exploited his employees and cheated on his taxes. My rich dad thought my poor dad was a communist because he belonged to the teachers’ union. My poor dad eventually became the leader of the Hawaii State Teachers Union, a promotion that disturbed my rich dad deeply.