Unfair Advantage -The Power of Financial Education (11 page)

Read Unfair Advantage -The Power of Financial Education Online

Authors: Robert T. Kiyosaki

Tags: #Personal Finance, #unfair advantage, #financial education, #rich dad, #robert kiyosaki

5. We want more income every year. Every year, our cash flow increases at a lower tax rate, whether we work or not.

A Word of Caution:

Drilling for oil is an extremely risky venture and that is why such investments are, by law, available only to accredited investors, investors who have the money and knowledge.

The high risk is not in oil itself, but in the entrepreneur who is drilling for oil. Even successful oil drillers drill dry holes. If you do not have the education or the money, it is best that you not invest in oil-drilling partnerships. It is safer for you to invest in shares of oil companies, companies such as BP and Exxon. Shares can be purchased through your stockbroker. Investing in stocks of oil companies, you can achieve capital gains and cash flow from dividends, but you do not receive the tax advantages.

FAQ

What about the environment? What about global warming?

Answer and explanation

I get this question all the time. My reply is, “I too am concerned with the environment.” This is why some of the money my investments earn is invested in alternative fuels and power companies. I have a substantial investment in a small start-up solar company. Having seen an atomic bomb go off with my own eyes when I was a kid, I am against nuclear power because nuclear waste stays harmful for thousands of years.

I am confident someone will discover an alternative to fossil and nuclear energy in the next five years. When that happens, the world will be dramatically changed, just as the Internet has dramatically changed the world.

Regardless of your views on oil and the environment, remember that civilization requires energy. We need cheaper, cleaner, alternative energy for civilization to grow. If alternative sources of energy are not developed, civilization goes backwards. This is why I invest in oil and alternative fuels.

Final Comments

Tax is a massive subject. Taxes are also your largest single expense. Due to the current financial crisis, taxes will have to go up. That is why knowledge of taxes is essential to a person’s financial education. Remember, tax rules are written for specific quadrants, not professions. This is why the advice, “Go to school to get a job or become a doctor,” is bad advice from the tax viewpoint. If a person wants to reduce taxes, they often have to change quadrants or add quadrants.

More important than taxes is your happiness with the quadrant you are in. In other words, changing quadrants just for taxes is not a good idea. If you are happy and successful in the E or S quadrant, stay there and find ways to earn more money, even if you will pay more in taxes.

In the following chapters, I will explain how a person can remain in the E and S quadrants but learn to be an investor in the I quadrant.

Before doing anything with taxes, always seek competent professional tax advice.

In closing, not all tax advisors are equal. Most are in the E and S quadrants and think like accountants in the E and S quadrants. In other words, be careful from whom you get tax advice, even if they are tax accountants or tax attorneys.

An incompetent, lazy, arrogant, or corrupt accountant or attorney can cost you a lot of money. I know from personal experience. Just because someone is an “A” student in school does not mean they are competent or honest in real life.

Professional Answer from Tom Wheelwright

Taxes are a part of life. The simple question is whether you are going to use the tax law to make them a smaller part of your life, or do nothing and let them stay a huge expense. With a sound education on how the tax laws work coupled with better tax planning from a competent tax advisor who understands the laws, most entrepreneurs and investors can permanently reduce their taxes by 10 percent to 40 percent. And the money you save in taxes can be used to invest and build your wealth. So don’t wait. Take action now and learn how you can reduce your taxes.

Final Question

FAQ

But what if everyone became B’s and I’s? Who would pay the taxes?

Short Answer

While possible, it is highly unlikely.

Explanation

It is much easier to be an E or S working, saving, and investing for earned income, the highest taxed of all three incomes.

Chapter Three - UNFAIR ADVANTAGE #3: DEBT

In 1971, President Richard Nixon took the U.S. dollar off the gold standard. The result: Savers became losers, and debtors became winners.

FAQ

Why did savers become losers?

Short Answer

Because in 1971, the U.S. dollar stopped being real money. And when governments print a lot of funny money, savings lose value.

FAQ

How much money is the U.S. printing?

Short Answer

A lot.

Longer Answer

In 2010, the U.S. national debt was over $13 trillion. Unfunded debt was over $107 trillion and growing.

In 2010, the U.S. government printed nearly $1 billion a day and the amount continues to grow.

How Much Is a Billion?

Let’s say a person works for $10 an hour. That means in an eight-hour day, they gross $80.

Most of us know what $80 is, but most of us have no grasp of what $1 billion is. The following conversions might help us get an idea of what a billion is:

1 billion seconds = 31.7 years

1 billion minutes = 1902.5 years

1 billion hours = 114,155 years

1 billion days = 2,739,726 years

1 billion seconds ago was 1979.

1 billion minutes ago was 108 AD

1 billion hours ago was the Stone Age

1 billion days ago humans did not exist

How Much Is a Trillion?

1 trillion seconds = 32,000 years

A trillion is beyond my meager brain. Just multiply the numbers for billions by 1,000 and you will find that a trillion is beyond comprehension. I cannot imagine 32,000 years or one trillion seconds.

FAQ

What does the future look like?

Short Answer

Lots more money being printed.

Explanation

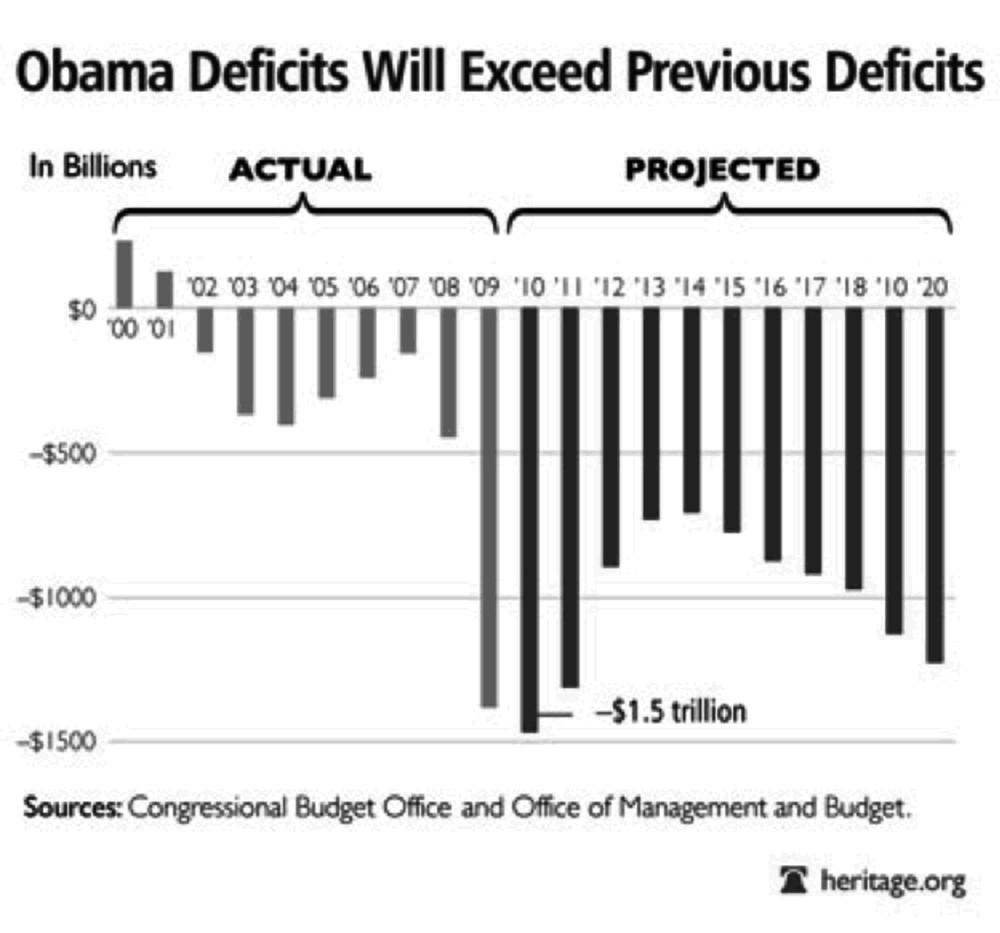

Look at the chart below and you will see how much more money will be printed in the near future.

Reprinted with permission

2010 – U.S. Budget Deficit: $1.5 trillion

2011 – U.S. Budget Deficit: $1.3 trillion

FAQ

What do these numbers mean?

Short Answer

More money will be printed.

FAQ

What does this mean to me?

Short Answer

Higher taxes and inflation.

FAQ

Could the U.S. dollar collapse?

Short Answer

Yes. Currency collapses have occurred many times in America. George Washington issued the Continental currency, paper money used to finance the Revolutionary War. The Confederate dollar was issued by the South to fund the Civil War. These are two of many U.S. currencies that have collapsed.

Today the United States prints money to fight in Iraq and Afghanistan, pay our bills, and buy products from China.

FAQ

What can a person do?

Short Answer

I have two answers:

1. If you have limited financial education, rather than save money, I would save gold and silver. I would buy a little gold and silver with every paycheck and hang on to it. I have been saving gold and silver for years when gold was under $300 an ounce and silver was under $3. I do not save money.

2. If you are financially sophisticated, create your own printing press and print your own money.

FAQ

How do you create your own printing press?

Short Answer

Use debt to acquire assets.

FAQ

Isn’t that risky? Is it legal?

Short Answer

It can be risky, but this is what the government wants us to do, which is why it is legal.

In the previous chapter on taxes I wrote:

1. The harder

you work for money,

the more you pay in taxes.

2. The harder

your money works for you,

the less you pay in taxes.

3. The harder

other people’s money works for you,

you pay even less in taxes. You may even pay nothing, zero, zip, nada in taxes. Obviously, this takes the highest levels of financial education. This is a level of education my rich dad inspired me to attain.

As strange as it may sound to most people, the government not only wants us to get into debt, the government offers tax incentives to get into debt.

To better understand the relationship between money and debt, a little financial history is important.

Fin Ed History

After 1971, the U.S. printing presses began to run as the government began using counterfeit dollars to pay for its expenses and debt.

Because the United States used a lot of oil, U.S. dollars flowed to Saudi Arabia just as oil prices began to rise. As the price for oil rose, more dollars flowed to the Arab world. These petrodollars, as they were called, had to find a home, so these petrodollars flowed to London, because London had banks big enough to handle such a surge in cash. From London, these dollars again needed a home, so the money flowed to anyone who would borrow these petrodollars. Latin American countries gladly borrowed the money and, in the late 1970s and early 1980s, the Latin American economy went into a bubble and burst, causing the Latin American debt crisis. From Latin America, the hot money flowed to Japan, causing a boom and then a bust in 1989. The money then flowed to Mexico, causing the Mexican peso crisis in 1994, the Asian crisis in 1997, and the Russian ruble crisis in 1998.

Arrogantly, American bankers and Wall Street laughed at the rest of the world, since they believed the rolling boom-and-bust bubble would not affect the United States.

During President Clinton’s era (1993-2001), the U.S. government balanced its budget, so the United States did not need to borrow any money. This was bad news for the bankers of the world who then needed to find more borrowers, borrowers who could borrow trillions of dollars. They found big borrowers in Fannie Mae and Freddie Mac, which are GSEs, Government-Sponsored Enterprises, U.S. quasi-government agencies that were anxious to borrow money. They borrowed $3 to $5 trillion of this hot money and loaned the money out to almost anyone to buy a new home or refinance their home. The real estate bubble in the United States had begun.

When Fannie Mae and Freddie Mac and their executives came under investigation, they stopped borrowing this hot money. Again, this ocean of counterfeit dollars had to find a home. In the late 1990s, government officials such as Clinton and Fed Chairman Alan Greenspan changed the rules for the biggest banks, such as Goldman Sachs, Bank of America, and Citigroup, which began taking in this money. Immediately these banks needed to find someone to take this money off their hands. As you know, cash must keep flowing.

To help the banks and Wall Street move this hot money, mortgage brokers working for companies such as Countrywide Mortgage started looking for anyone who wanted to borrow money. They went into the poorest neighborhoods in the United States. Millions who did not have jobs or credit were offered “NINJA” (No Income, No Job or Asset) loans, and soon they too were living the American dream. Unfortunately for many, it was a dream they could not afford. The subprime mortgage bubble grew into a massive balloon.

Once these subprime mortgages were processed, the big banks and Wall Street packaged this toxic debt and sold the debt as assets. These new tranches of debt, aka a pile of debt, were called MBSs (Mortgage Backed Securities) and CDOs (Collateralized Debt Obligations), aka derivatives of subprime debt packaged as prime. The biggest banks and Wall Street sold this toxic debt as assets to other banks, pension funds, and investors all over the world. It was not much different than taking horse manure, deodorizing it, putting it in a plastic bag, and selling it as fertilizer. The only difference between a subprime loan and horse manure is that horse manure, used properly, has real value.

In chapter one, I wrote that the people with the best financial education in the world are the people who profited from this crisis. They may not have caused the crisis, but they went along with it. Many made millions and a few made billions. They are still at work shoveling horse manure—or buying it. Can’t they smell it? And how could Warren Buffett’s rating company, Moody’s, bless this horse manure as AAA?

As the smartest guys in the world began spreading this financial horse manure all over the world, global home prices climbed and millions of people all over the world felt rich. They felt rich due to the wealth effect, which means they felt wealthy because their home had gone up in value—again, they were focusing on capital gains. With an increase in home value, millions mistakenly thought their net worth had gone up. With this feeling of euphoria, they began spending, charging like mad bulls with credit cards, paying off their credit cards by refinancing their homes, and blowing the bubble into a giant hot-air balloon. What makes me sick is that these experts, such as former Fed Chairman Greenspan and current Fed Chairman Bernanke, claim not to have seen the biggest hot-air balloon in history.

The following are some of Bernanke’s comments as the balloon began to burst:

October 20, 2005:

“House prices have risen by nearly 25 percent over the past two years. Although speculative activity has increased in some areas, at a national level these price increases largely reflect strong economic fundamentals.”

November 15, 2005:

“With respect to their safety, derivatives, for the most part, are traded among very sophisticated institutions and individuals who have considerable incentive to understand them and to use them properly. The Federal Reserve’s responsibility is to make sure that the institutions it regulates have good systems and good procedures for ensuring that their derivative portfolios are well-managed and do not create risk in their institutions.”

March 28, 2007:

“At this juncture, however, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained. In particular, mortgages to prime borrowers and fixed-rate mortgages to all classes of borrowers continue to perform well, with low rates of delinquency.”

January 10, 2008:

“The Federal Reserve is not currently forecasting a recession.”

March 16, 2009:

“We’ll see the recession coming to an end probably this year.”

Mr. Bernanke is a graduate of MIT, a professor at Stanford and Princeton, and may be a brilliant economist. Yet it seems he does not live in the same world as you and I live in.