Unfair Advantage -The Power of Financial Education (7 page)

Read Unfair Advantage -The Power of Financial Education Online

Authors: Robert T. Kiyosaki

Tags: #Personal Finance, #unfair advantage, #financial education, #rich dad, #robert kiyosaki

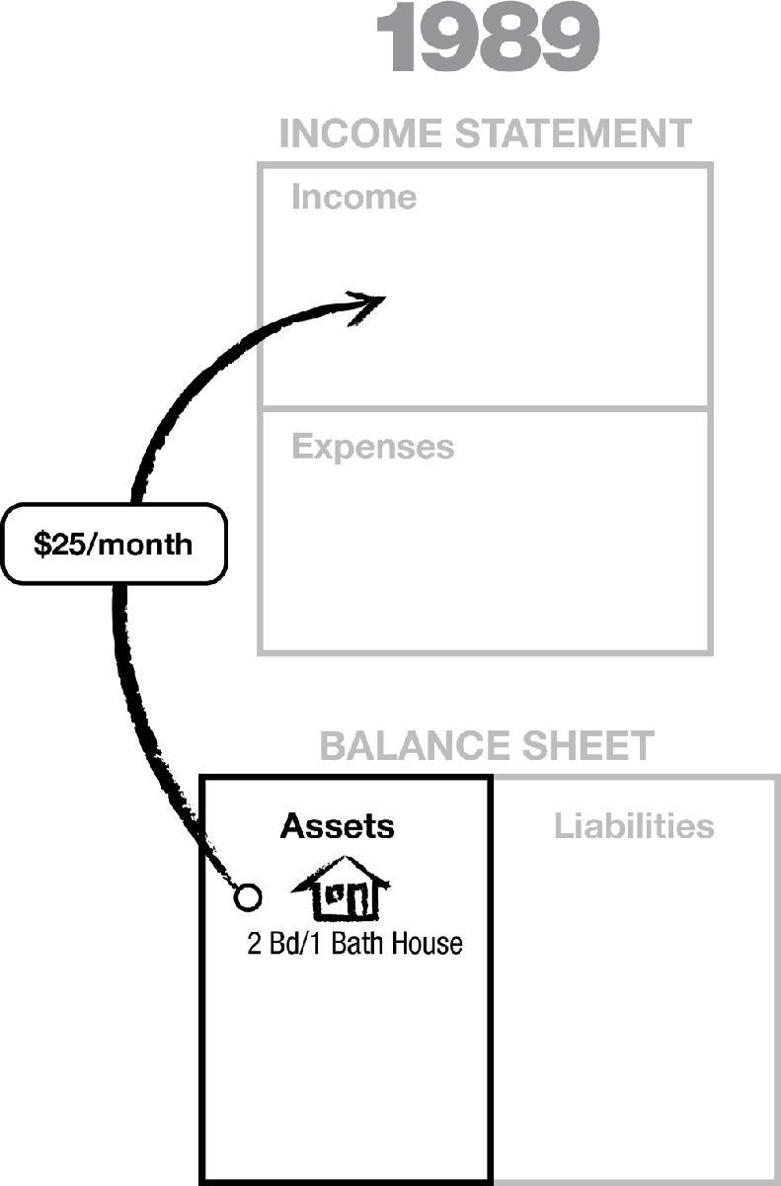

I first started investing in 1989. Fearful and unsure of what I was doing, I stumbled around neighborhoods near our home and finally found a cute 2-bedroom, 1-bath house that seemed to be a good rental prospect. I nervously put in an offer, and with a little back-and-forth negotiation, my offer was accepted. Now more fear kicked in. I was more focused on what I might lose versus what I would get. I looked for every excuse possible for why I shouldn’t buy that house. I somehow quieted my fear long enough to go ahead and buy the property, taking very deep breaths along the way.

When all was said and done, I had my very first rental property and a tenant, and once I collected the rent and paid the expenses and the mortgage, I had a massive positive cash flow of $25 per month!

In 1989, after purchasing my small, but charming, rental house, my asset column looked like this:

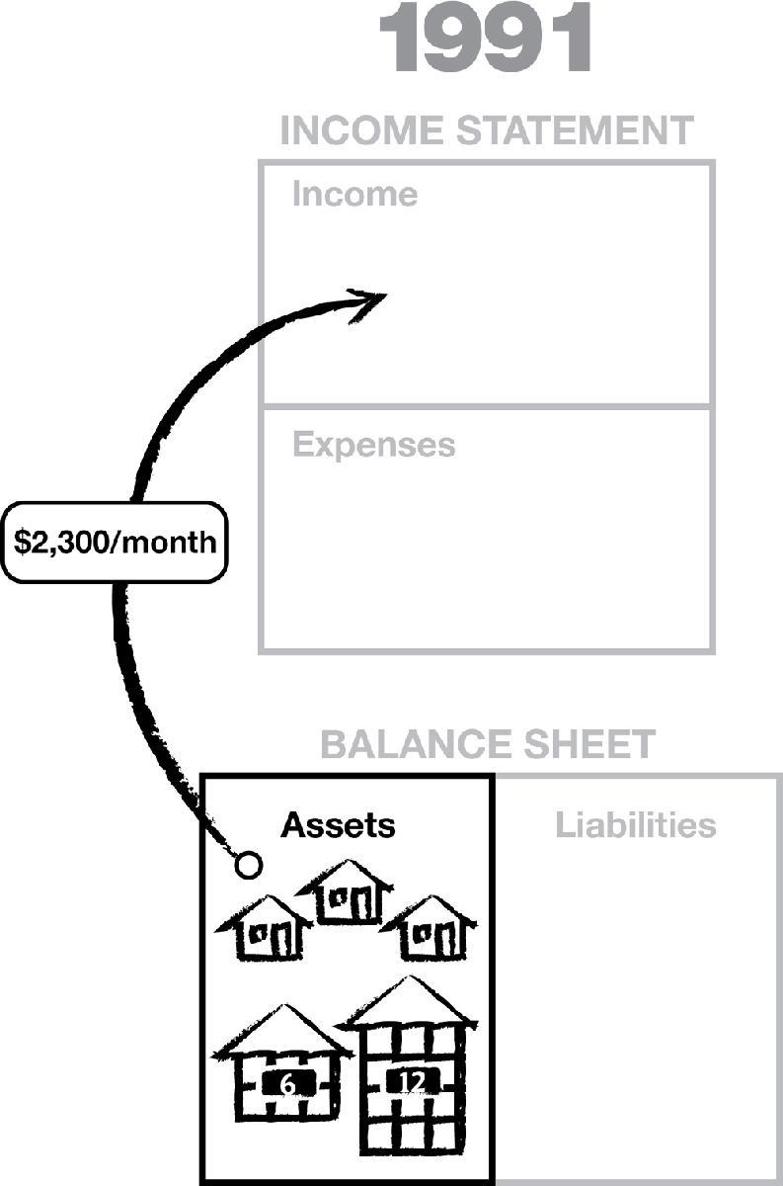

That same year we set our first asset goal. Our goal was to acquire 20 rental units in ten years, or two rentals per year. This was our first smaller goal on the way to our main goal of being financially free. The power of setting the goal is that it is specific and we are crystal-clear on what we want. Setting the goal puts us in motion toward achieving it. The reality is that, once we started toward that goal, my knowledge about real estate investing increased dramatically because I loved it and I was excited about it. I was even more excited about the cash flow that these properties would generate. The fact is that, instead of taking 10 years to reach our goal, we had our 20, actually 21, rental units in 18 months! Now our asset column looked like this:

Accomplishing that goal put us much closer to our main goal of being financially free by having the cash flow from our assets greater than our living expenses. This was now our next asset goal: to have more cash flow coming in to us from our assets than was going out in living expenses. It took us three more years to reach that goal.

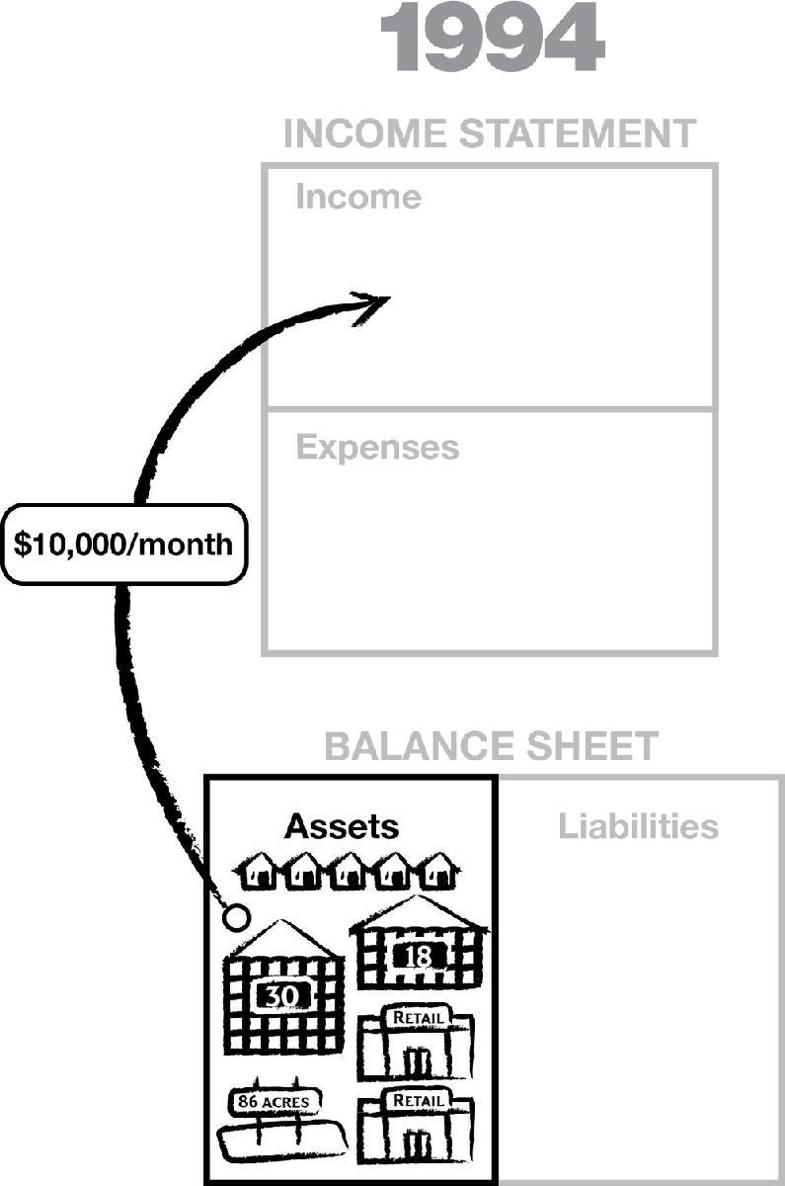

Here is a snapshot of our asset column in 1994:

Financial freedom to Robert and me was not amassing millions of dollars in savings on which to live. It was simply to have the cash flow coming in every month from our investments, whether we worked or not. Our cash flow in 1994 was $10,000 per month. This was not mega-dollars, but our expenses at the time were only $3,000 per month. At that point, we were free. Our cash flow from our assets more than paid for our monthly expenses. It was at that moment that we had the luxury to ask ourselves, “What is it we really want to do with our lives?” Being able to ask that question, more than having the money, is true freedom.

As a couple, what is our unfair advantage? First, we set our financial goals

together.

Second, we study and we learn

together

in order to achieve the goals we’ve set. We attend seminars, read books, meet with real experts, and work with coaches so that we get what we want in life.

My very first gift from Robert when we were first dating was not a nice piece of jewelry or my favorite perfume. No, my first present was a seminar on accounting! I guess he wanted to be sure I knew my assets from my liabilities. When I left college, I vowed I would never step foot inside another classroom again. I was so done with school. But what I discovered when I took this accounting class, in which we played a game for two days, was that I loved learning! I just didn’t like what or how the school system taught. So this first gift was much more than an accounting class. It renewed my passion for learning.

There is a lot of information in the world on any subject, especially money, so we are constantly seeking out the most relevant information we can find. At every workshop we attend, I know I will glean at least one new idea that I can apply. We work with coaches, be it a fitness coach, business coach, or investment coach, because sometimes we need that kick in the butt to keep us moving forward.

That is what I see as our unfair advantage. And it’s something that anyone can do. It’s not rocket science. There is no special sauce. It is, I must say, one of the keys to keeping our relationship new, ever-growing, and fun. And as a couple, it allows us to have what we truly want in our lives.

So every year around New Year’s Day, Robert and I set, along with other important goals, our asset goals. The purpose of the goal is to continue to add assets to that all-important column on our financial statements.

Today our asset column is filled with assets from all four of the main asset classes: businesses, real estate, paper assets, and commodities. We’ve created many businesses that generate cash flow. Our real estate ranges from apartment houses to commercial properties to resorts and golf courses. We have some paper assets in our asset column, and commodities take up a good deal of space in the form of silver, gold, oil, and gas. When the traditional financial advisor recommends you diversify, he or she is usually advising you to diversify within

one

asset class: paper assets. Robert and I diversify, but not within one asset class. We diversify throughout all four asset classes.

It’s my experience that what you focus on expands. Setting an asset goal every year and focusing on achieving that goal has definitely expanded our asset column, and yes, it has brought us cash flow. Even more importantly, it has given us freedom.

In Summary

As Kim explained, the true purpose of education is to give a person the power to take information and process it into knowledge.

If a person has no financial education, they cannot process information. They do not know the difference between an asset or a liability, capital gains or cash flow, fundamental investing or technical investing, why the rich pay less in taxes, or why debt makes some people rich and most people poor. They do not know a good investment from a bad investment, or good advice from bad advice. All they know is to go to school, work hard, pay taxes, live below your means, buy a house, get out of debt, and die poor.

As the Bible states, “My people perish from a lack of knowledge.” Today, millions are perishing because all they have been

trained

to do is send their money to the rich and to the government. That is not education.

Final Question

FAQ

So what should I invest my money in?

Answer

We all have three choices:

Do nothing and

hope

things work out. But as my rich dad said, “Hope is for the hopeless.”Turn your money over to an expert for the long term, and “Buy, hold, and pray.”

Invest in your financial education. Invest your time before you invest your money. That’s something you have already done by reading this far. To me, this is the smart thing to do.

Chapter Two - UNFAIR ADVANTAGE #2: TAXES

Taxes are not fair. Those with financial education can earn more and pay less, even zero taxes, on millions in earnings. Financial knowledge on taxes is an unfair advantage.

FAQ

What do I have to do to earn more money and pay less in taxes?

Short Answer

The harder

you work for money,

the more you pay in taxes.The harder

your money works for you,

the less you pay in taxes.The harder

other people’s money works for you,

you pay even less in taxes.

You may even pay nothing, zero, zip, nada in taxes. Obviously, this takes the highest levels of financial education. This is a level of education my rich dad inspired me to attain.

Explanation

Many people think taxes are punitive, and for most people they are—simply because most people work for money.

Taxes are also incentives, government-stimulus programs, to encourage people to do what the government wants done. If you do what the government wants, you can earn a lot of money and pay less or even zero in taxes.

The problem is that most people are trained, just as Pavlov trained his dogs, to do what they’re told without thinking, namely to

go to school and get a job.

Hence, most people spend their lives working for money and paying more and more taxes.

Simply put, taxes are not fair. For those with the highest of financial education, the more they make, the less they pay in taxes, legally, but only if they do what the government wants them to do.

For most people, taxes make them poorer. Again, they are trained to

send their money to the government.

For a few, taxes make them rich, some very rich. They know how to

have the government send money to them.

Again, it’s about

cash flow,

the most important words in the world of money.

Are the Rules the Same?

FAQ

Is this true just for the United States? Or are taxes the same throughout the world?

Short Answer

Every country has its own tax laws that apply in that country. I am not a tax professional, so I always recommend that people seek professional tax guidance before making any decisions on taxes. To better explain taxes, nationally and internationally, I will have tax expert, Tom Wheelwright, C.P.A., clarify this often-confusing subject.

Professional Answer from Tom Wheelwright

In my study of tax laws around the world, I have found that most countries follow the same basic principles. Tax laws certainly are there to raise revenue for the government. However, they are also used extensively to provide stimulus packages to certain parts of the economy that the government wants to encourage. Similarly, governments throughout the world use tax laws to encourage people to follow the social and energy policies of the government.

FAQ

What is the worst tax advice?

Short Answer

Go to school, get a job, work hard, save money, buy a house because your house is an asset, get out of debt, and invest for the long term in a well-diversified portfolio of stocks, bonds, and mutual funds.

Explanation

Book number two in the Rich Dad series is

Rich Dad’s CASHFLOW Quadrant

which defines the different players in the world of money. Pictured below is the CASHFLOW Quadrant:

E stands for employee

S stands for small business or self-employed

B stands for big business (500 employees)

I stands for investor Chapter Two 60

It takes all four quadrants to make the world of money go around.

The quadrants are not professions. For example, a medical doctor can be an E, such as a doctor who works for a B (a big business such as a hospital or drug company). A doctor can also be an S, working as a self-employed, small-business owner in private practice. A doctor can also be a B, the owner of a hospital or a drug company. And the doctor can be an I, an investor.

There is often confusion about the I quadrant. Many people invest their own money in pension or retirement plans by buying and selling stocks and/or mutual funds. That is not the same type of I referred to in the I quadrant. True I’s have people

send them money.

Most small investors

send their money

to true I’s. Again, the I quadrant is defined by the direction cash is flowing, and that makes a difference in who pays the most in taxes. If you send your money to others to invest for you, you pay more in taxes than the person you send your money to.

My poor dad sent his money to people he trusted to invest for him. My rich dad had people like my poor dad sending money to him.

The difference, from a tax perspective, is like night and day.

FAQ

Which quadrants pay the highest taxes?

Short Answer

The people in the E and S quadrants.

Fin Ed History

The following is a diagram of the CASHFLOW Quadrant showing the historical changes in tax laws:

The U.S. Congress passed the “Current Tax Payment Act of 1943” when the United States needed money to fight two wars, one in Europe and one in the Pacific. The 1943 change gave the government the power to force employers to deduct taxes from the employee’s paycheck. In other words, the government got paid before the employee got paid. The E quadrant lost control over their money. Today, when employees receive their paycheck, they notice there is a lot of money missing, the difference between net pay and gross pay. ES BI 1943 1986Unfair Advantage 61

Due to our present financial crisis and the government’s need for more money, the gap between gross and net pay is increasing for those in the E quadrant. Employees work harder, earn more, and take home less.

In 1986, Congress passed the “Tax Reform Act of 1986.” The purpose of this act was to plug the tax loopholes that people in the S quadrant were enjoying. Up until 1986, most in the S quadrant were using the same tax loopholes the B quadrant enjoyed. Since the government needed more money, they went after the doctors, lawyers, small-business owners, and specialists, such as consultants, real estate brokers, stockbrokers, and other self-employed people.

It was the 1986 Tax Reform Act that helped trigger the 1987 stock-market crash and the 1988 crash of the savings-and-loan industry, which led to the real estate crash, which led to the last recession. It was a great time for B’s and I’s to get ahead.

Today, doctors, lawyers, and accountants in the S quadrant pay the highest percentages in taxes.

Taxes Are by Quadrant, Not by Profession

It is important to note that taxes are defined by

quadrant

, not by profession. Again, a doctor can be a doctor in all four quadrants.

Different quadrants follow different tax rules.

When I was in school, I asked a classmate what his father did for a living. His reply was, “My dad is a garbage man.”

I did not think much about it until I was invited to his home for Thanksgiving dinner. Rather than pick us up in his car, his dad flew us to their home in his private jet, two hours away from New York. Needless to say, his home was a mansion.

When I inquired about his dad’s profession as a garbage man, he said, “My dad owns the largest garbage-collection company in the state. He has over two hundred trucks and over a thousand employees. He also owns the land where the garbage is disposed. His biggest customer is the state and city government.

His dad was a garbage man in the B and I quadrants. He hired garbage men in the E quadrants and uses accountants and attorneys in the S quadrant for specialized advice. If he had good tax advice, paid a much smaller percentage in taxes than his employees.

FAQ

Can a person be in more than one quadrant?

Short Answer

Yes, absolutely. Technically, I am in all four quadrants. I am an E, an employee in my own company. I am an S who writes books and develops games on my own. I am a B with licensed offices all over the world and more than 500 people working to support the business. And I am an I, raising money for my businesses.

FAQ

How does a person change quadrants?

Short Answer

A person begins by deciding to change core values.

Explanation

Again, a medical doctor can be in any or all of the four quadrants. So can you.

Different people seek different quadrants due to core values. I can often tell a person’s core values by the words they use. The sections that follow illustrate what I mean.

The E Quadrant

“

I want a safe, secure job with benefits.”

These are the words of people in the E quadrant. Regardless of whether the person is a janitor or president of the company, they say the same words. These words reflect the core value of

security

. The fear of failing, the need for a steady paycheck, and a fear of change influence their core fears. These people tend to seek long-term careers in the military, the police force, or a big company. If they are ambitious, they may change jobs if a better opportunity to climb the corporate ladder in another company appears, but before they take that leap, they make sure their future paychecks are secure.

Most students in MBA (masters of business administration) programs have dreams of climbing the corporate ladder in the E quadrant, starting near the top. Their MBA gives them an advantage over those who did not get their MBA. A few will make it to the top, becoming president or CEO, and will earn a lot of money. But the problem is that a large percentage of their paycheck will be eaten by taxes.

In the United States, the shining stars of the E quadrant are Jack Welch of General Electric and Meg Whitman of eBay.

FAQ

I am in the E quadrant. What can I do to earn more and pay less in taxes, legally?

Professional Answer from Tom Wheelwright

Not much, so long as you stay in the E quadrant. Most of the tax law is written as a code to reduce taxes for those in the B and the I quadrants. About the best you can do is to postpone taxes through an IRA or 401(k). The real key to reducing taxes is to move into the B and the I quadrants.