Unfair Advantage -The Power of Financial Education (10 page)

Read Unfair Advantage -The Power of Financial Education Online

Authors: Robert T. Kiyosaki

Tags: #Personal Finance, #unfair advantage, #financial education, #rich dad, #robert kiyosaki

In 1986, when I was working in Washington D.C. in the national tax office of a large accounting firm, Congress decided to change this rule and only allow real estate investors and business owners to avoid taxes through a 1031 exchange. Since then, paper-asset investors do not enjoy the same advantages as real estate investors and business owners. Mutual-fund investors can actually end up paying tax in a year when the mutual fund goes down in value. That’s a significant disadvantage to a lack of financial education.

Passive Income

For Kim and me, our objective is always cash flow, aka passive income, which is why we named our game

CASHFLOW

. To us, cash flow for life is our financial freedom. Passive income allowed us to retire early and get on with our lives. Ironically, passive income is also the least taxed of all three incomes.

My book,

Rich Dad Poor Dad,

is about the differences between assets and liabilities. Tragically, most people struggle financially because they refer to liabilities (such as their home, car, boat, and household effects) as “assets.” To make matters worse, when they think about investing, they think in terms of capital gains, which is why they think their net worth is important. The problem is that they base their net worth on liabilities, such as their home, car, boat, household goods, and retirement plans. That is why rich dad often said, “Net worth is worth less.” Kim and I do not know what our net worth is, but we do know how much cash flow we receive every month.

Keeping definitions simple for two young boys, his son and me, rich dad’s definition of an asset is: Assets put money in your pocket, and liabilities take money from your pocket. I came under massive professional attack from so-called highly-educated financial experts for this overly simple definition.

Yet, when you see the world from the viewpoint of an investor and the tax department, you will see the wisdom in the definition’s simplicity. If you save money in a bank and invest in a traditional retirement plan, much of your cash will still flow to the tax department. Your tax dollars are passive income for the government. Why not invest in what the government wants you to invest in, and have the government send money to you? To me, that is the smart thing to do.

Kim and I take this to extremes. Since we have excess cash flow, we are always investing, but not in savings, stocks, bonds, mutual funds, or traditional retirement plans. To us, it does not make sense to receive money from the government, and then give it back to the government.

Kim and I do not save money. Since governments of the world are printing trillions of counterfeit dollars, why save dollars? Rather than save money, we save gold and silver inside a self-directed Roth IRA plan because the capital gains from the price of gold and silver going up grows tax-free.

In the following chapter, you will find out how we get the money to invest with. For now, just know that we do not save money for two reasons. Reason number one is, with governments printing money, the value of money has been falling for years. This is also known as inflation. Reason number two is that the interest on savings is taxed at earned-income rates.

Professional Answer from Tom Wheelwright

The tax laws of most developed countries are thousands of pages long. Of all of these pages, only a few are devoted to raising revenue. In fact, in the United States, there really is only one line that raised revenue. It says, effectively, that all income you receive is taxable unless the law says otherwise. And only a few hundred pages tell you how to use a retirement plan to save taxes. Most of the thousands of pages of tax law are devoted to permanently reducing taxes through business and investment deductions, credits, and special tax rates.

FAQ

From a tax point of view, what specifically is wrong with traditional retirement plans like the 401(k) in the United States?

Short Answer

The 401(k) in the United States is designed for people who plan on being poor when they retire. That is why financial planners say, “Your income will go down when you retire.” This is their reason for justifying the earned income-tax rate when the person retires. Their financial plan is to plan on earning less when you retire. Because you earn less, you will be in a lower tax bracket. Their plan does not work for someone who plans on being richer when they retire.

Professional Answer from Tom Wheelwright

A traditional retirement plan gives you a deduction for savings today and then taxes you when you retire on everything you pull out of your retirement plan. Sounds good, right? Wrong! For three reasons: First, if you plan to live as well when you retire as you do when you are working, meaning you will actually receive as much income then as you do now, then you will probably be in a higher tax bracket when you retire. This is because you won’t have your business deductions, your home mortgage deduction, and deductions for your dependents (hopefully they will be grown and gone).

Second, you could actually be converting passive or portfolio income to ordinary earned income. Consider that if you invest in stocks outside of a retirement plan, you will pay taxes on the gains at the lower capital-gains rates. But if you invest inside a retirement plan, you will pay taxes at the highest ordinary income-tax rates.

Third, and most important, you give up a lot of your control over your money when it’s in a retirement plan. You can only invest in certain types of investments (primarily mutual funds), and your employer and the government tell you when you can take the money out and use it.

I used to be like other tax advisors who tell people to max out their retirement funds—that is, until I figured out just how crazy it is to postpone taxes to a year when you are in a higher tax bracket when there are literally thousands of ways to permanently reduce your taxes in the B and I quadrants without ever paying back the government.

FAQ

Is real estate the only asset class with tax advantages?

Short Answer

Governments have many tax-stimulation plans. Kim and I participate only in stimulus projects we know and understand.

Professional Answer from Tom Wheelwright

Most active investments have some sort of stimulus included in the tax law. This includes investments in oil and gas drilling, timber, agriculture, clean energy, and all business. If you really want to know where Congress would like you to put your money, take a look at the tax law. Chances are good that there is a tax break for anything they would like to have you spend money on.

FAQ

What other tax-advantaged investments do you participate in?

Short Answer

Oil and gas wells.

Explanation

In 1966, at the age of 19, I was a junior officer on board Standard Oil tankers sailing up and down the California coast. It was then that I became interested in oil. In the 1970s, I worked for an independent investment banker packaging and selling oil and gas tax shelters to wealthy clients. Today, Kim and I continue to invest in oil and gas projects.

We do not invest in stocks or mutual funds of oil companies such as BP or Exxon. We invest in oil exploration and development partnerships, which means we partner with oil entrepreneurs in specific projects, primarily in Texas, Oklahoma, and Louisiana, coincidently where many of our apartment houses are located. If successful, we receive a percentage of income from the sale of oil and natural gas, aka cash flow with tax advantages.

Oil and natural gas are essential for transportation, food, heating, plastics, and fertilizers. If you look around your kitchen, oil is in use everywhere, even in the foods you eat. The reason the government offers huge tax incentives is because drilling for oil is very risky and oil is essential for life, our economy, and our standard of living.

Real-Life Investment

FAQ

What did you do with the $100,000 you got back from your 400-unit condominium-conversion project in Scottsdale, Arizona?

Short Answer

We invested in an oil-and-gas project in Texas.

Explanation

Again, our objective is cash flow and tax advantages.

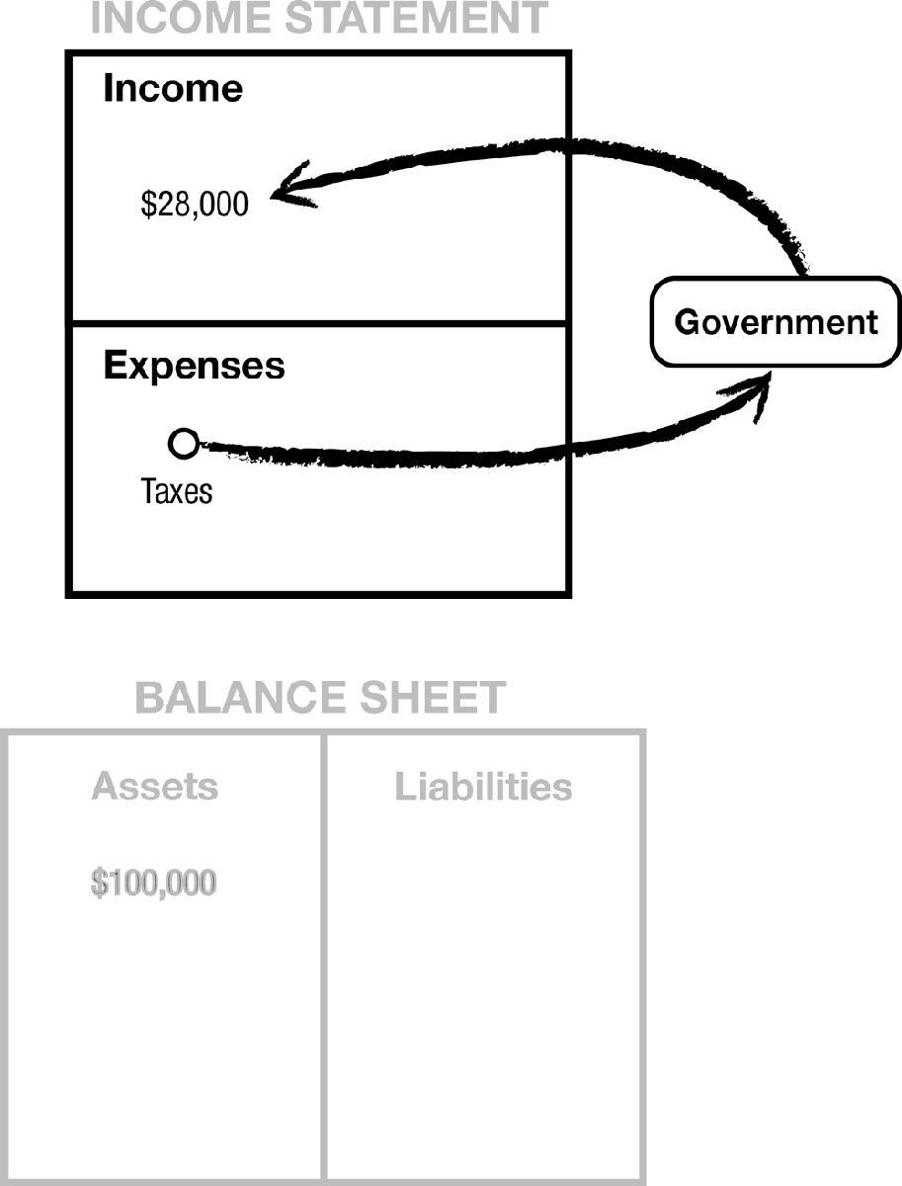

The beauty of some oil and gas partnerships is the ROI, return on investment. The moment Kim and I invested our $100,000 in the Texas project, we received a 70 percent tax deduction. At my earned income-tax rate of 40 percent, that is $28,000 cash back. That is a guaranteed 28 percent ROI in the first year, money the government technically gives back to me because they want me to invest in oil.

I mention this $28,000 return on my $100,000 investment because I receive so many calls, especially from stockbrokers saying, “I can get you a 10 percent return.” Why in the world would I want a 10 percent capital-gains return with so much market risk? I’d rather have a 28 percent guaranteed return from the government in real cash flow, and not have to gamble on fictitious possible returns on capital gains.

This is what the transaction looks like in a financial statement:

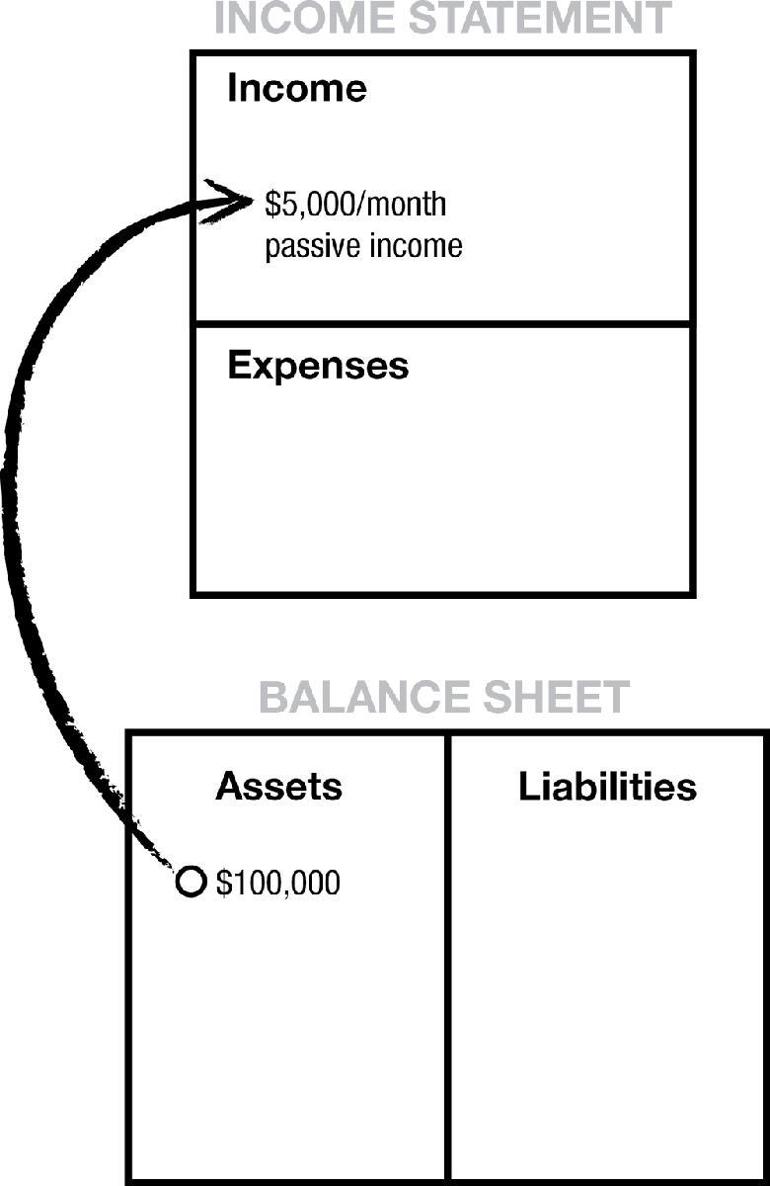

If we strike oil, and that

if

is a real

if,

which is why experience in the oil industry is essential, the financial statement looks like this:

For simplicity, let’s say my income from the well is $5,000 a month. (The income will vary with production and oil and gas prices.) The $5,000 in income is also given a tax break of 20 percent, which means I pay tax on $4,000 instead of $5,000. If I earned $5,000 in the E or S quadrants, I would pay tax on the full $5,000.

To me, this type of tax-advantaged investment makes more sense than investing in my 401(k) for forty years, buying, holding, and praying that I have enough money to last the rest of my life.

Ultimate Objectives:

Kim and I have the following five objectives:

1. We want our money back. At $5,000 a month or $60,000 a year, plus the $28,000 in tax refunds, we get our $100,000 back in a little more than a year. Try that in a 401(k). If the price of oil is high, as it was when it hit $140 a barrel, we get our money back faster.

2. We move our money into another investment.

3. We want cash flow for life. Wells can last from one year to 60 years. That is why choosing the well and the developer is important before investing.

4. We want additional wells. When we strike oil, there are often more opportunities for oil in the same area. Knowing where to drill reduces our risk of drilling dry holes, which does happen. Drilling a dry hole means we lose our money, but we still get that 28 percent tax write-off. So once an area is proven to be successful, we keep drilling there.