Unfair Advantage -The Power of Financial Education (19 page)

Read Unfair Advantage -The Power of Financial Education Online

Authors: Robert T. Kiyosaki

Tags: #Personal Finance, #unfair advantage, #financial education, #rich dad, #robert kiyosaki

The ability to sell, manage debt, and analyze market trends is essential to all four asset classes.

Asset Class: Business

The richest people in the world are entrepreneurs such as Bill Gates of Microsoft, Steve Jobs of Apple, Richard Branson of Virgin, and Sergey Brin of Google.

The ability to sell is essential for entrepreneurs. The reason most businesses fail is because the entrepreneur lacks adequate sales skills. In 1974, IBM and Xerox had the best sales training. I was hired by Xerox and was sent to Leesburg, Virginia, for intensive sales training. It took me four years of training to go from last place to first in sales.

I never did well in English in school because I could not write.

I still do not write well. Yet, as stated in Rich Dad Poor Dad, I am not a “best-writing” author. I am a best-selling author.

Rich dad often said, “Sales equals income.” If you want more income, learn to sell.

Asset Class: Real Estate

Real estate is the asset that requires the ability to control debt and manage property and tenants.

In 1973, I took my first real estate-sales course. Today, Kim and I are tens of millions of dollars in debt, debt that produces millions in income, much of it tax-free. In the past year, banks have lowered interest rates which reduces our mortgage payments and increases our profits. Real estate is great because debt and taxes make the investor rich.

Asset Class: Paper Assets

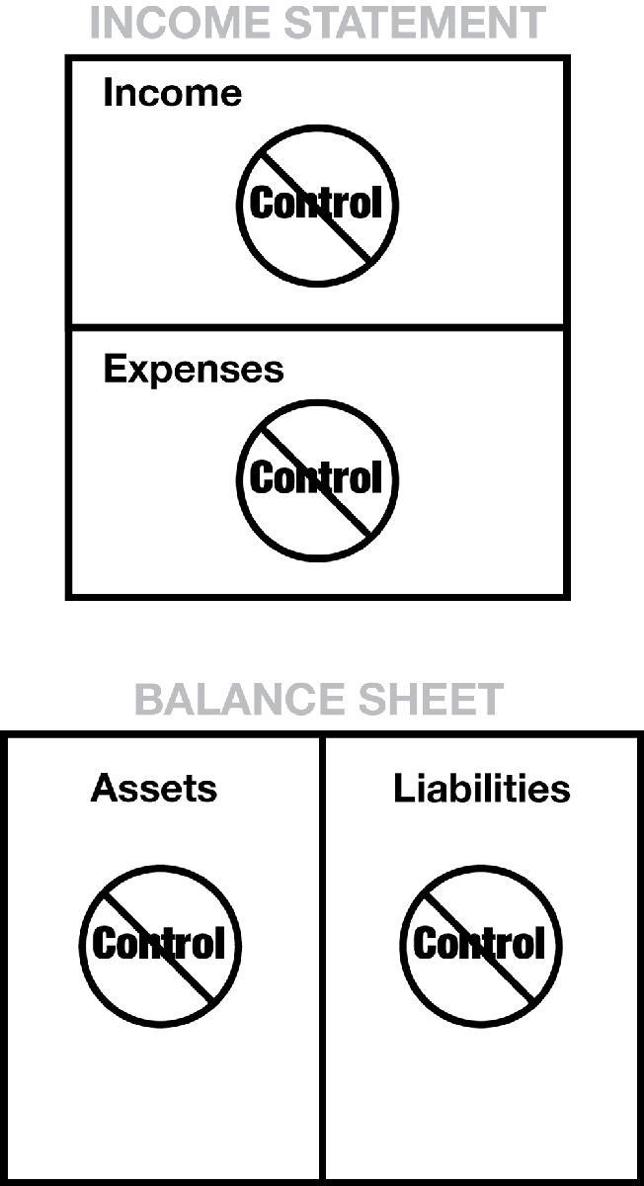

Kim and I rarely invest in paper assets because paper assets offer the least control. When you look at stocks, bonds, or mutual funds, the investor has zero control over income, expenses, assets, and liabilities.

Asset Class: Commodities

Buying gold and silver coins takes the least financial education, yet you still need to know something about the asset class. Gold and silver do go up and down in price. Also, there are many con artists in the gold and silver business, especially today with prices climbing.

Which Asset Class Is Best for You?

FAQ

Which asset class is best for me?

Short Answer

The ones you are interested in.

Explanation

Remember, a business creates most of the truly wealthy people, but a business takes the most financial education. Real estate requires the second-highest financial education. Paper assets are easy to get into, but are the riskiest. Commodities like gold and silver take the least financial education but are not risk-free.

FAQ

Which asset class do most people invest in?

Short Answer

Paper assets.

Explanation

Paper assets are the most liquid, which means they are easy to get into and get out of. Getting into paper assets requires the least financial education, zero sales skills, and zero management skills. All you have to do is go online or call a broker and say, “I want to buy 100 shares of this or sell 100 shares of that.” You can train a monkey to buy and sell paper assets.

FAQ

Why don’t you invest more in paper assets?

Short Answer

Not enough control.

Explanation

As an entrepreneur, I want control of the income, expense, asset, and liability columns of the financial statement.

If I invest in, let’s say, Microsoft, Bill Gates will not take my call. He does not care if I think his expenses are too high or too low. I care.

When I invest in oil, I can call the president and he will take my call. When I invest in real estate, I can call Ken McElroy or my manager on duty. When I run my business, I can call anyone in the offices around the world and discuss the business. That is what I mean by control.

This does not mean paper assets are a bad investment. Paper assets make a few people very rich. Paper assets have also lost trillions for unsophisticated investors forced into the stock market by government laws, laws which created pension plans such as the 401(k) in America.

Fin Ed History

In 1974, the U.S. government passed ERISA, the Employee Retirement Income Security Act.

This act eventually became known as the 401(k) Act. In simple terms, corporations were no longer willing to pay an employee a paycheck for life. Employees were too expensive, and the United States could not compete with low-wage countries.

Without any financial education, workers throughout the world were forced to become investors. When this happened, the number of financial planners exploded. It was like throwing lambs to a group of lions.

Many schoolteachers, nurses, checkout clerks, and insurance salespeople changed professions and became financial planners. Again, the problem is that most financial planners get their financial education learning to sell in the S quadrant, rather than the I quadrant.

To be fair, I have met a few excellent, very smart, very dedicated financial planners. The problem is that I have met only a few. Most financial planners are in the business to make money. They know how to sell their products, generally paper assets. In fact, most financial planners can only sell the products of the company they work for. Since they do not make money selling other assets, most know little about real estate, oil, taxes, debt, technical analysis, and the historical reasons why the price of gold is going up.

Good financial education is essential for knowing good financial advice from bad advice.

If your financial advisor lost your money, I would not blame the advisor. I would look at myself and ask whether I’m willing to reduce risk by increasing my financial education, which you are doing now.

There are some horrible and stupid financial advisors in the real world. But if you do not know good advice from bad, any advice will do.

FAQ

How does a person make money and reduce risk in paper assets?

Short Answer

Start at the shallow end of the pool. Take classes and practice, aka paper trading.

Commercial Message:

Rich Dad suggests playing the

CASHFLOW 202

game, a fun and fantastic way to learn to reduce risk and increase returns with paper assets. You need to understand

CASHFLOW 101

before going on to

202.

Explanation

In the world of investing, there are always professionals and amateurs. The stock market is a great place for professionals because there are so many amateurs who are forced to be in the deep end of the pool where the sharks wait.

I am not good at paper assets, so it’s best I defer to Andy again and let him explain the world from his point of view. He is great at investing in paper assets and is a great teacher. Here’s Andy’s explanation:

Andy Tanner explains:

When it comes to paper assets, I’d say the biggest differences between amateur investors and professional investors are:

a) how they seek to generate income, and b) how they manage risk. The easier of the two discussions is their approach to managing risk.

In real estate, the battle cry is usually “location, location, location.” It seems that in paper assets the battle cry is “diversification, diversification, diversification.” In my opinion, in both real estate and paper, the battle cry should be “cash flow, cash flow, cash flow.”

Less-sophisticated investors seem more likely to turn to managing risk by what they have been sold as diversification. This brand of diversification is a hope that the winners will outnumber losers at a pace that will achieve financial objectives, outpace inflation, and not be hurt by possible changes in the tax law. But professionals will often seek to manage risk by purchasing contracts. While these contracts cost money, they give the investor the chance to regain some control. While I can’t prevent or control a hurricane Katrina, a flood-insurance contract controls the risk associated with the event if it happens.

For example, one investor will simply spread her money around lots of different stocks and hope winners outnumber losers in the long run. Another investor will purchase a contract that gives them the right to sell their stock at a set price, no matter how bad the stock price falls. A put option contract is one simple type of contract that does this.

The discussion of generating income from paper is a little more involved. When an investor plays the

CASHFLOW 202

game, one of the important things that’s taught is the difference between an investment that has a goal of producing cash flow and an investment with a goal of producing a capital gain. It’s my opinion that amateurs rely more on capital gain, and the professionals tend to seek cash flow.

So, in a nutshell, amateurs often seek to earn their money in paper from capital gains and to manage risk by diversification. The professionals often seek to earn their money with cash-flow strategies and to manage risk by using contracts.

Insurance for Paper Assets

Andy put it very well. In 2007, it disturbed me deeply to watch the stock market crash, knowing the consequences for millions of investors, investors who believed that the stock market always goes up over the long term and that diversification was insurance against losses.

Making matters worse, in 2010, uninsured investors were reentering the market, hoping prices would go up again (capital gains).

Professional investors invest with insurance, even in the stock market.

Again, I turn to Andy to explain how he uses insurance to protect his paper-asset investments.

Andy Tanner explains:

One of the things I purchase on a regular basis is rental insurance. I do this in case my tenants damage my property by accidentally starting a fire, for example. Imagine trying to manage that risk with diversification. It wouldn’t make much sense to me to buy a whole bunch of houses and just hope that while some might burn down, most will not.

I like the idea of having a contract that I pay a relatively small amount of money for to protect an asset that is worth a much larger amount of money. Most of us call these types of contracts “insurance.” When a person gets in an automobile accident, the first question that is often asked is, “Are you covered?” or “Do you have insurance coverage?”

In the stock market, we don’t usually use the word insurance. Instead, we use the word “hedge.”

Like insurance, we can protect a relatively large amount of money against loss by spending a relatively small amount of money on a contract, such as a simple put option, as I mentioned above. Many professional investors will spend money on put options during times of uncertainty and when they’re faced with events that are beyond their control, such as an earnings report or an announcement by the Federal Reserve. The more risky the situation, the more expensive the contract. In fact, these kinds of contracts can give an investor insight as to how risky the situation is.

An example of this is the credit-default swaps for countries like Greece, Portugal, Ireland, and Spain. Lenders don’t want to lend money to all these countries and hope that some pay them back and some won’t. They want contracts that protect them against default. Lately, the price of these contracts has been soaring, which tells me things are getting more unstable.