Unfair Advantage -The Power of Financial Education (18 page)

Read Unfair Advantage -The Power of Financial Education Online

Authors: Robert T. Kiyosaki

Tags: #Personal Finance, #unfair advantage, #financial education, #rich dad, #robert kiyosaki

This is why

debt-free

is an oxymoron, even if you are debt-free.

FAQ

How long do we have?

Short Answer

I hope it never happens. But if the biggest countries collapse under mountains of debt, who will be left to save the world? If Japan goes, the crisis will spread to the rest of the world.

Explanation

In 2010, Japan’s debt was 200 percent of GDP. The United States is approximately 58.9 percent debt to GDP and growing. England’s is 71% and growing.

Fin Ed Definition

Debt-to-GDP ratio is a comparison of what a country owes to what it produces, indicating the country’s ability to pay back its debt.

For example, in Japan’s case, their GDP is approximately $5 trillion, the fourth largest economy in the world, and their reported debt is approximately $10 trillion. This is approximately $75,000 per person.

Japan’s debt-to-GDP ratio is similar to a worker earning $50,000 a year with $100,000 in credit-card debt. To make matters worse, the worker is using credit cards to pay the interest on their $100,000 debt, an action that only increases the debt.

In very simple terms, debt-to-GDP ratio is a country’s credit score.

FAQ

Why is debt rising?

Short Answer

Countries are like many people: They spend more than they produce and make promises they cannot afford.

Explanation

The largest growing debt for the United States comes from Social Security and Medicare, aka promises we cannot afford.

FAQ

Were the social promises made by Democrats or Republicans?

Short Answer

Both.

Explanation

Social Security was created under President Franklin Roosevelt, a Democrat, during the last depression.

Medicare was created under President Lyndon Johnson, a Democrat.

Medicare comes in three parts, A, B, and C.

Medicare Part C is one of our largest growing liabilities, and it was created under President George W. Bush, a Republican. It was a multibillion dollar gift to the pharmaceutical industry.

FAQ

Are politicians to blame?

Short Answer

No. The people are.

Explanation

Politicians will say anything and make any promise to get elected. Once they leave office, the politician receives their paycheck and medical benefits for life, and the voters are left paying for promises they cannot afford.

FAQ

How long can this go on?

Short Answer

Not much longer.

Explanation

No fiat currency has ever survived. The U.S. dollar has lost 90 percent of its purchasing power in forty years. It will not take much time for it to lose the last 10 percent. There is only so much debt the system can tolerate.

Time to Take Action

FAQ

What can I do?

Short Answer

Reduce risk.

FAQ

How do I reduce risk?

Short Answer

Take control.

Explanation

The opposite of risk is control.

For example, if the brakes on your car went out, you have less control and risk would go up.

FAQ

What do I take control of?

Short Answer

Your education.

Explanation

When we are in school, we have very little control over what we learn and who our teachers are.

For example, at the military academy in New York, I was required to take three years of calculus. Every time I asked my teacher, “Why am I studying calculus?” his reply was, “Because calculus is a requirement for you to graduate.”

When I asked, “How will I use three years of calculus in the real world?” his reply was, “I don’t know.”

In the 40 years since I graduated, I have yet to use any of the calculus I learned. Simple math—addition, subtraction, multiplication, and division—is all I need to build and control my wealth.

If you are going to be a rocket scientist, you need calculus. If you just want to be rich, grade-school math is all that is required.

Earlier I stated that my rich dad advised me to learn three things if I wanted to follow in his footsteps. Those three are:

1. Learn to sell (control income).

2. Learn to invest in real estate (control debt).

3. Learn technical investing (control markets).

These three courses are important for people who want to be in the B and I quadrants. These three courses reduced my risk and increased my control in the B and I quadrants.

FAQ

I understand why selling is important if you want to be an entrepreneur. I know why using debt to achieve long-term cash flow is important if you want to invest in real estate.

But why technical investing?

Short Answer

To see the past, present, and future.

Explanation

Technical investors use charts based upon facts to know the past, the present, and hopefully see the future.

Pictured below is the chart for the price of gold over the past 10 years.

As you can see, gold has been climbing in price for ten years.

Pictured below is the price of gold starting in April 2010.

To me, this shows that gold will climb for a while longer. It is like a climber just about to take on the summit. The steepest part is yet to come. That is the story the chart is telling me. People who do not like gold and look at the same chart would say the bubble has burst and the price will plunge.

This is why I prefer silver. Silver is still sleeping and affordable for everyone, even poor people.

As I write, gold is close to $1,400 and silver is over $30. Gold is hoarded, and silver is consumed. Silver is the sleeper, but you have to do your own research and come to your own conclusions.

What does the future hold? All I do is look at the latest trend of the U.S. dollar, pictured below, and I continue to buy and hold gold and silver.

Obviously, charts are always changing as the economy changes, which is why a course on technical analysis is essential.

Charts allow you to see the past and present, and provide you with a better chance of accurately predicting the future. Charts reduce risk and may increase rewards. This is why rich dad recommended that I take classes on technical analysis, or charts, because charts are based upon facts, not opinions.

A Different Focus

My rich dad suggested that I learn to sell, learn to invest in real estate, and learn technical analysis, because I was preparing for the B and I quadrants.

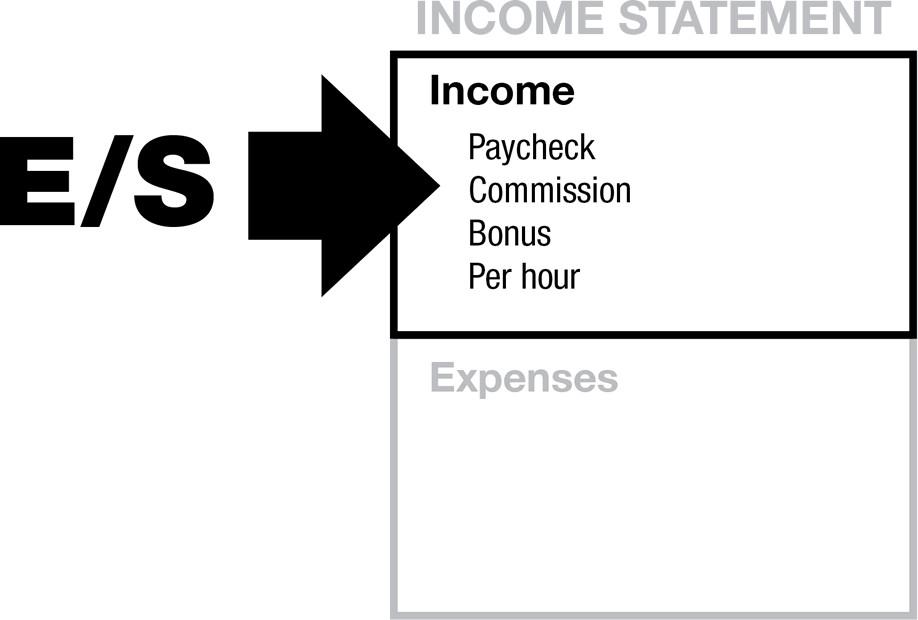

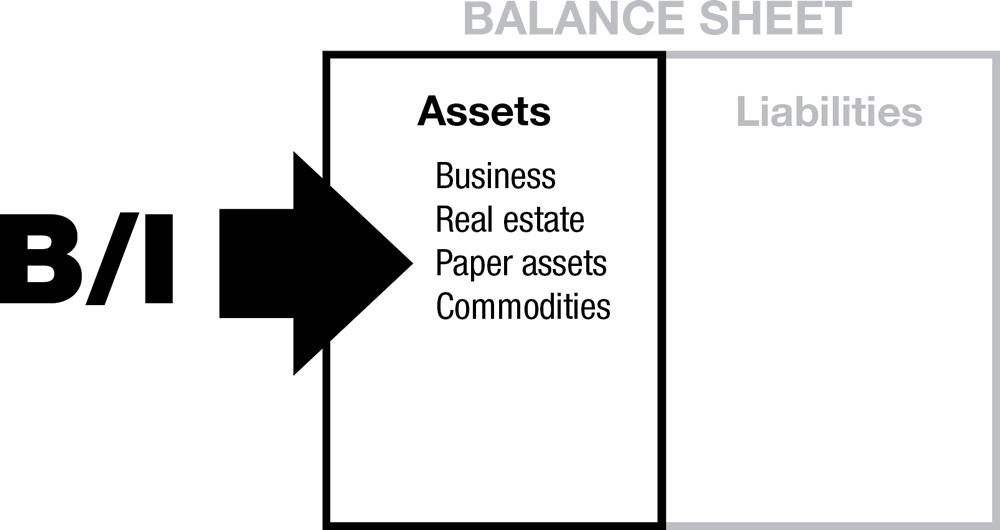

Looking at a financial statement, you will see the difference between E/S and B/I. They focus on different parts of the financial statement, which is why a different education is required.

E’s and S’s focus on income:

B’s and I’s focus on assets:

What is Risky?

E’s and S’s believe investing is risky because they have limited, if any, financial education about assets in the asset column. Investing is not risky. A lack of financial education is very risky.

B’s and I’s focus on assets which teaches them to manage assets and reduce risk.

Four Different Asset Classes

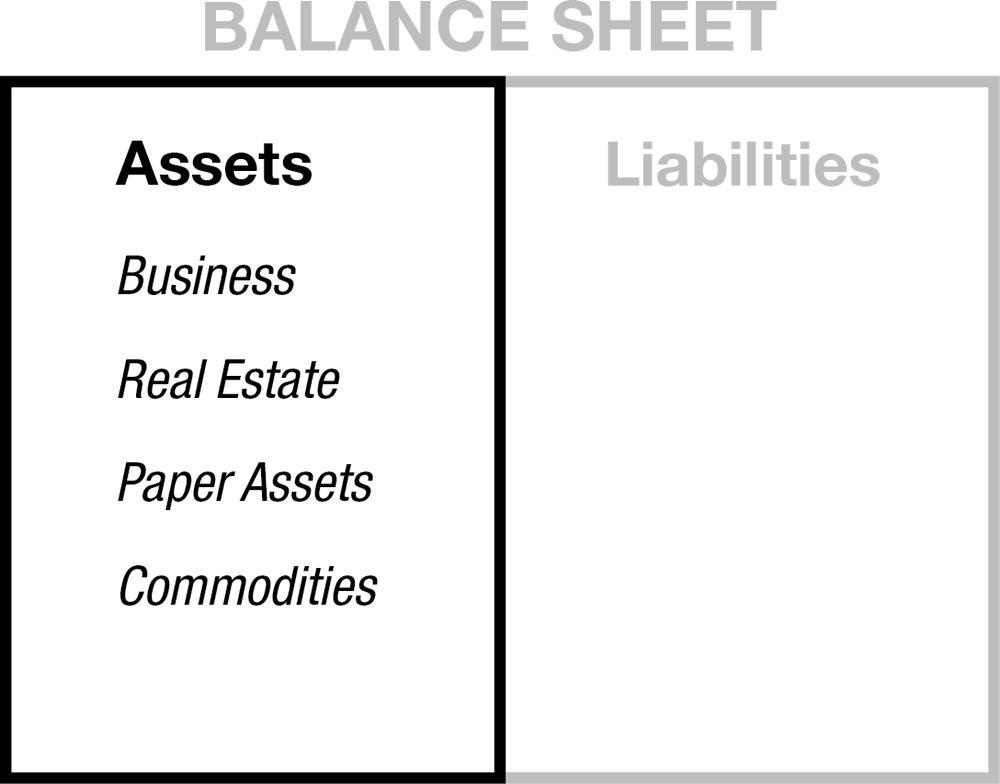

As a young boy, my rich dad taught me about the four basic asset classes in the asset column. He said, “The more you know about the different asset classes, the more your control goes up and your risk goes down.”

There are four basic asset classes in the asset column pictured below.