Unfair Advantage -The Power of Financial Education (29 page)

Read Unfair Advantage -The Power of Financial Education Online

Authors: Robert T. Kiyosaki

Tags: #Personal Finance, #unfair advantage, #financial education, #rich dad, #robert kiyosaki

I know $25 a month is not a lot of money. Yet, it was not the money that was important to me. It was learning a new way of thinking, a way of processing information and producing a result.

One of the reasons that I have so much money today is simply because I was educated and trained to think differently. If you have read

Rich Dad Poor Dad,

you may recall that the title for chapter one of the book is, “The Rich Don’t Work For Money.” One of the reasons why those in the E and S quadrants have problems with that statement is because most went to school to learn to work for money. They did not go to school to learn how to have other people’s money work for them.

When Kim and I started The Rich Dad Company, we borrowed $250,000 from investors. We paid the money back once the company was up and running. Today, the business has returned multi-millions of dollars, not only to Kim and me, but to companies and individuals associated with Rich Dad. As I said, capitalists are generous.

My point is that, the moment a person knows how to make money out of nothing or with other people’s money or a bank’s money, they enter a different world. It’s a world almost exactly opposite the world of those in the E and S quadrants where they experience hard work, high taxes, and low returns on investment.

The reason most people believe saving is smart and a 10 percent return in the stock market is worth it is simply due to a lack of financial education.

Your best ROI is not a return on your investment, but a return on your information. This is why a financial education is essential, especially for the uncertainty of the world ahead.

Remember this about the word “education”: Education gives us the power to turn information into meaning. In the Information Age, we are drenched with financial information. Yet, without financial education, we cannot turn information into useful meaning for our lives.

In closing, I say the I quadrant is the most important quadrant for your future. No matter what you do for a living, how well you do in the I quadrant will determine your future. In other words, even if you make very little money in the E or S quadrant, financial education in the I quadrant is your ticket to freedom and financial security.

For example, my sister is a Buddhist nun. She earns nearly zero in the S quadrant. Yet she attends our investment courses and has steadily been increasing her financial education. Today, her future is bright because she got out of saving money in the bank and buying mutual funds and began investing in real estate and silver. In the ten years between 2000 and 2010, she has made much more money in the I quadrant than she could ever make as a nun in the S quadrant.

I am very proud of my sister. She may be a nun by profession, but she does not have to be a poor nun.

Before Reading Further

This completes the explanation part of the CASHFLOW Quadrant. Before we go on, here’s the big question:

1. What level of investor are you?

_________________________

If you’re truly sincere about getting wealthy quickly, read and reread the five levels. Each time I read the levels, I see a little of myself in all the levels. I recognize not only strengths, but also character flaws that hold me back. The way to great financial wealth is to strengthen your strengths and address your character flaws. And the way to do that is by first recognizing them rather than pretending that you’re perfect.

We all want to think the best of ourselves. I’ve dreamed of being a Level-5 capitalist for most of my life. I knew this was what I wanted to become from the moment my rich dad explained the similarities between a stock picker and a person who bets on horses. But after studying the different levels of this list, I could see the character flaws that held me back. I found character flaws in myself from Level 4 that would often rear their ugly heads in times of pressure. The gambler in me was good, but it was also not so good. So with the guidance of Kim, my friends and additional schooling, I began addressing my own character flaws and turning them into strengths. My effectiveness as a Level-5 investor improved immediately.

Although I do operate today as a Level-5 investor, I continue to read and reread the five levels and work on improving myself.

Here’s another question for you:

2. What level of investor do you want or need to be in the near future?

___________________________

If your answer to question two is the same as that in question one, then you are where you want to be. If you are happy where you are, relative to being an investor, then there’s not much need to read any further in this book. One of life’s greatest joys is to be happy where you are. Congratulations!

Warning

Anyone with the goal of becoming a Level-5 Investor must develop their skills FIRST as a Level-4 investor. Level 4 can’t be skipped on your path to Level 5. Anyone who tries to do this is really a Level-3 investor—a gambler!

Bonus - FAQs SECTIONS 1 through 8

As a bonus...

I have added a special section on FAQs—eight of them—about Rich Dad’s financial education and programs.

With every FAQ answer, I will include why I believe the programs we offer are important and essential for success in the brave new world of the new economy and how they can benefit you as you invest in yourself. You can choose to be a part of the solution in addressing the challenges we face in our world.

Robert Kiyosaki

Bonus FAQ #1: What Is the Rich Dad Difference?

FAQ

What makes Rich Dad’s financial education programs different?

Short Answer

We start by making financial education fun, entertaining, and simple. Then you can decide where you want to go and how far you want to go.

Explanation

Most financial education programs start with the small picture. Ads you see on TV, on the web, or in print are often about investing techniques: techniques such as stock trading, or foreign-exchange currency trading, or flip this house, or real estate foreclosures or short sales. These are techniques, how to do something. In my opinion, that’s the small picture. Techniques are important, but they are more training than education.

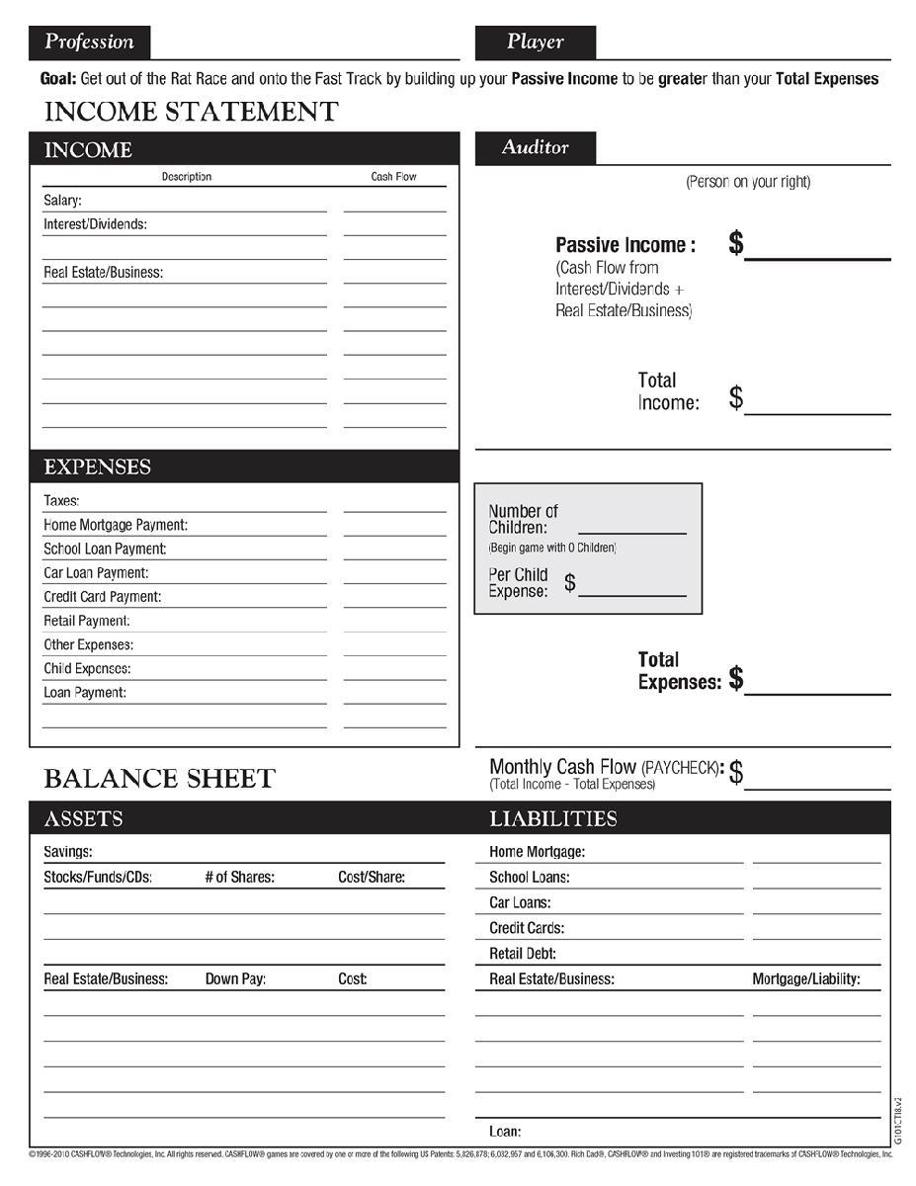

Kim and I created the

CASHFLOW

games—101, 202, and

CASHFLOW for Kids

—in board games as well as online versions to make available the fun, experiential, simple, and big-picture vision of the world of money.

I use the word “fun” because getting rich is fun once you learn the game. Games make learning fun and, as the Cone of Learning illustrates, simulation—which is what the

CASHFLOW

games are—is one of the best ways to learn something new and retain what you learn.

In

Unfair Advantage,

I used the example of the game of golf, a frustrating game when you first start to play. But after taking lessons, practicing, playing regularly, and challenging yourself in tournaments, it can be fun. Most avid golfers say, “The game keeps you coming back.”

Although I do not always win in the game of money, it’s the game that keeps me coming back. It’s fun, challenging, ever-changing, and profitable. Most importantly, once I began to win, I never needed to worry about job security or if I would have enough money for retirement. I earn more money, pay less in taxes, and have the freedom to do what I want with my time.

The Foundation of an Unfair Advantage

CASHFLOW 101

will teach you fundamental investing.

CASHFLOW 202

teaches technical investing.

As you know from reading this book, fundamental investors invest for cash flow, and technical Investors invest for capital gains. And as you also now know, cash flow is taxed at a lower rate than capital gains. Most investment courses, such as stock trading, real estate flipping, or currency trading, focus on capital-gains investing. The

CASHFLOW

games, 101 and 202, teach you to invest for both capital gains and cash flow.

Knowing how to invest for both capital gains and cash flow is the foundation of an unfair advantage in the real markets.

Quantum Leaps in Learning

After playing the

CASHFLOW

games multiple times with other like-minded people and learning the fundamental Rich Dad principles, you will experience a leap in understanding due to the Law of Compensation #3: the power of compounding education.

If you believe you are ready to move on, you may want to assist in teaching others and supporting the leader of your local CASHFLOW club. You may even want to become a CASHFLOW club leader and start your own club.

When you teach, you will find your understanding, once again, takes a quantum leap. This is due to the Law of Compensation #1: the power of reciprocity. Give, and you shall receive.

Basic and Advanced Programs

After this foundational learning, you may be ready to decide which asset class is best for you. As you already know, there are four basic asset classes:

Business/Entrepreneurship

Real estate

Paper assets

Commodities

Rich Dad offers programs in entrepreneurship, real estate, and trading paper assets. We do not offer courses in commodities, such as gold and silver, simply because it does not require much financial education to buy or sell gold and silver.

When I invest in oil, I invest as an entrepreneur. Oil exploration is a complex investment.

In my opinion, entrepreneurship requires the highest level of financial education. Entrepreneurs are also the richest people in the world.

Real estate requires the second highest level of financial education.

Paper assets are the easiest to get into. You can invest with a few dollars—or millions of dollars. Paper assets are also the riskiest of the asset classes, especially in a volatile economy.

Commodities require the least financial education. If you invest in precious metals such as gold and silver, all you have to know is how much money central banks are printing and how much debt the country you live in is carrying. In the United States, gold and silver have been a good investment since 1998. All you have to do is buy and hold.

How long the precious-metals market will remain a good market for investors will depend upon the actions of our world leaders. If our leaders do a good job, gold and silver will decline in value. If our leaders are incompetent, gold and silver will go through the roof.

Courses and Coaching

The Rich Dad Company offers educational courses and coaching programs through Rich Dad Coaching and Rich Dad Education. You can learn more about these programs, and CASHFLOW clubs, at RichDad.com.

Which Programs Are Best for You?

Which courses are best for you depends upon you.

When I returned from Vietnam in 1973, my rich dad recommended that I take a basic real estate investment course because I needed to learn how to manage and profit from debt. Since the dollar was backed by debt, he said that learning about debt was essential to my basic financial education.

When I told him that I was interested in becoming an entrepreneur, he suggested I take formal courses in sales. In 1974, I joined the Xerox Corporation because they had the best sales-training program. I stayed with Xerox for four years until I became #1 in sales.

Today, I am a best-selling author, not a “best-writing” author.

I also recommend technical investing, such as our course which teaches futures and commodities trading, because all markets go up and down and all markets have a past, present, and a future.

My financial education never stops because my financial education is my unfair advantage.

Bonus FAQ #2: Do I Need a Coach?

FAQ

When do you hire a coach?

Short Answer

When something is important to you.

Explanation

Professionals have coaches and amateurs do not.

Superman and Wonder Woman exist only in comic books. The rest of us are human beings.

All professional athletes have coaches. They may be talented, but they know they are not Supermen or Wonder Women.

I know I am not Superman. If I were, I could do everything I wanted. Life would be easy.

And while I may not be Superman, I know I have untapped power and potential. I know I need to be pushed if I want to access that power and maximize my potential.

When I know I need to be pushed, held accountable, challenged to go beyond my resistance, my laziness, my limitations, I hire a coach—if what I want is important to me.

Recently a close friend died. He was a young man. He was a great guy and very successful in every area of his life, except his health. Rather than hire a coach, change his diet, and stop drinking, he simply worked harder. He, like so many, let his health deteriorate while he focused on earning more and more money. Today he is dead, leaving behind a young wife and two kids. I was on the same path. After age 35, I exercised less, ate more, drank more, and worked harder. It was not long before I had gained 60 pounds.

Rather than hire a coach, I kept saying, “I’ll go on a diet tomorrow. I’ll exercise tomorrow. I’ll fit in my old clothes in a month.” The problem was, tomorrow came and went. And my weight kept increasing.

One day, sitting at my desk, I saw a picture of Kim and me at the beach. I was embarrassed. Kim looked beautiful, smiling and loving, and I was twice her size, my gut filling most of the picture. That is when I knew I needed to stop kidding myself and hire a coach.

I worked out with a number of fitness coaches. Finally, I found one of the toughest coaches in town and that made all the difference. Not only does he hold me accountable, but he pushes me as hard as he pushes his 20-and 30-year-olds. There is no mercy for age. This is important to me because I found myself making excuses for my age. For my coach, age is not an excuse. That’s the kind of coach I needed.

Today, in my sixties, I am healthier than I was in my forties and fifties. My weight still goes up and down, but it is not out of control. Most importantly, as I progress into my sixties, I am actually working harder at keeping fit and healthy than I did when I was in my thirties, because I have to. Working out was easy in my thirties. My sixties have presented greater challenges.

I did not hire a coach just for health. My health is important, but not as important as my life with Kim. She makes my life worth living and I want to enjoy this gift of life with her in great health.

So the question is: What is important to you? It’s not just money or health. It’s the things that money and good health can mean to you and your family. Money affects all the things that are important in our lives. I remember feeling embarrassed and angry with myself when Kim and I were flat broke. I felt I had let her down, so I sought help from a coach to speed up my financial recovery.

If you are ready to change quadrants, from E to S, or S to B, I would hire a coach. Changing quadrants is not easy for most people. Any important change is never easy, so a coach is essential when you are serious about changing your life.

Remember that, when deciding which asset class is best for you, it’s not just real estate, or entrepreneurship, or paper assets that are important. It is what being successful as an entrepreneur or real estate investor means to you. When you decide what is most important to you, then it’s time to hire a coach.

Bonus FAQ #3: What if I’m Deep in Debt?

FAQ

I am deeply in debt. Will your financial education programs help me?

Short Answer

Probably not.

Explanation

There is good debt and bad debt. Bad debt is nasty. Bad debt is why the economies of the United States and many countries around the world are stagnant, depressed, and dying.