Red Capitalism (20 page)

Authors: Carl Walter,Fraser Howie

Tags: #Business & Economics, #Finance, #General

Source: PBOC

In sum, the absence of active market trading limits the price-discovery function of China’s bond markets. In turn, unreliable prices mean that the market participants cannot value risk accurately. A simple question such as how much a AA issuer would have to pay investors to buy its 10-year bonds cannot be answered with any certainty. On the other hand, China’s market investors don’t really care. Why should they when the majority of bonds offer “riskless” yields well over the one-year bank-deposit rate of 2.25 percent but, at the same time, well under demand in the secondary market? As long as inflation remains under control, why shouldn’t banks be happy to hold the bulk of these securities to maturity, just as they do their loan portfolios?

Cash vs. repo markets

China’s repo markets illustrate just what liquidity means in a bond market.

Figure 4.9

shows the seven-day repo interest rate for 2008. Contrast the active trading in interest rates here with the anemic yield curves traced by the CGBs and CDB bonds shown in

Figure 4.6

. Clearly the cost of capital is being driven by supply and demand. What accounts for such trading? The wildly speculative bidding on shares offered in Shanghai IPOs forces investors to put together the largest amount of funding possible to secure an allotment in the share lottery. In IPO subscription lotteries, massive amounts of capital—often equivalent to tens of billions of dollars—are frozen to secure allocations of shares. A large portion of these funds is raised by repo transactions. This market, however, is much more akin to the pure short-term inter-bank loan market than to the long-term capital-allocation function of bond markets. The point, however, is that demand drives the price of capital here, but not in the bond market.

FIGURE 4.9

Seven-day repo volumes, interest rates vs. capital frozen in IPO lotteries

Source: Wind Information

Note: “Offline Frozen” indicates amount of capital used in bids for shares in the institutional “offline” IPO lottery.

As is obvious to even infrequent observers of China’s economy, speculation is a fact of life. This largely stems from the artificially fixed returns on bank deposits, loans and bonds, the only available investment alternatives outside of real estate, shares and luxury goods. Set at levels unreflective of the true demand for capital, the managed rates for these products create a stillborn fixed-income market and force investors to speculate. Capital gains, which are untaxed, are the main play for investors in China, whether retail or institutional, and none can be found in the debt-capital markets.

The “327” Bond Futures Scandal

If any one incident highlights why the government seeks to strictly control markets, it must be the bond futures scandal of 1995. This story is already ancient history, but it explains why there is still no financial-future product of any kind in China’s capital markets.

7

At its simplest, the scandal was a struggle between a major local broker backed by the Shanghai government, and the MOF; in other words, between local and central government interests. Wanguo Securities, owned by the Shanghai government, received inside information that the MOF planned to issue 50 percent more bonds in 1995 than it had the previous year. Expecting this larger volume to offset any gains from declining inflation, Wanguo’s traders, in contrast to the overall market view, expected bond prices to remain low. Over the early part of 1995, they accumulated a huge (and illegal) short position in bond futures contracts, in particular, the March 27 contract (which gave the scandal its name). News of this leaked out (nothing in China remains secret for long) and other market participants began to accumulate long positions, expecting prices to be higher in the future. This trend increased when other brokers learned that the MOF had determined to significantly reduce its issuance plans. Somehow, Wanguo remained ignorant of this and continued to build its short position in an effort to corner the market.

Acting through its wholly-owned China Economic Development Trust and Investment (China Development Trust; Zhongjingkai), the MOF took a corresponding long position. As the head of the China Development Trust was Zhu Fulin, the former Director of the Treasury Bonds Department of the MOF, this was never going to be a fair fight. When the MOF at last announced its much-reduced issuance plans and bond prices remained high, Wanguo frantically sought to square its position during the last eight minutes of market trading. Market volumes soared to unprecedented levels. By the end of the day, Wanguo’s actions had driven prices down but at the cost of a market collapse and the technical bankruptcy of many other brokerages. That evening, the Shanghai exchange, facing the reality that the futures market had collapsed, canceled all trades that had taken place in the last 10 minutes of trading and closed the market for three days so that contracts could be unwound and renegotiated. This meant that Wanguo itself faced being bankrupted.

An investigation ensued and Wanguo’s chairman, a respected founder of the Shanghai exchange, was arrested and later sentenced to 17 years in prison. The fallout continued when Wanguo itself was merged with Shenyin Securities, then Shanghai’s second-largest firm, to become today’s giant Shenyin Wanguo. The very reformist chairman of the CSRC, Liu Hongru, took responsibility, although he had no direct control over the exchange at this time, and the financial-futures product was eliminated and remains so. Soon thereafter, Beijing took over control of both securities exchanges. Shanghai was most definitely the loser in this battle.

In this zero-sum game, someone had to be the winner and, of course, it was the MOF. China Development Trust was rated the top broker on the Shanghai exchange for 1995 “due to its massive trades in treasury bond futures . . . accounting for 6.8 percent of total annual exchange turnover.”

8

Politically astute, China Development Trust seems not to have booked for itself what must have been massive profits. Rather, it allowed its “clients,” who no doubt included the MOF, to do so. In the following years, this powerful company became a major institutional market manipulator, whose actions could be seen in some of the most outrageous cases of stock ramping and corporate collapse. However, given its MOF background, Zhongjingkai escaped censure and closure until Zhou Xiaochuan finally closed it in 2001. It was not the only such institutional player with a central government background.

Ironically, one month before the 327 Incident, Vice Premier Zhu Rongji, who was then responsible for the financial sector, had fiercely criticized the rampant speculation in the bond futures market “by a number of huge interest groups, taking funds of the state, the local governments and the enterprises to seek profits.” Zhu had identified a growing problem but was apparently unable to do anything about it. He could, however, eliminate the futures product. Given the political cost associated with this scandal, it should not be surprising that the Party prefers an orderly, controlled bond market, even if this is, after all, moribund. But by refusing to reform the market, the Party simply promotes the forces of speculation which, as China has become more prosperous, become all the stronger.

THE BASE OF THE PYRAMID: “PROTECTING” HOUSEHOLD DEPOSITORS

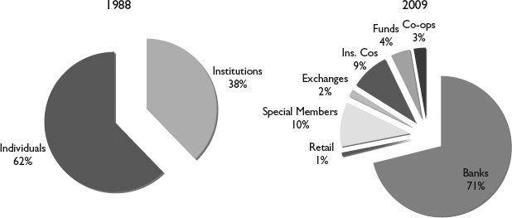

At the base of China’s bond and loan markets are China’s household savers. Today, banks hold more than 70 percent of all bonds in value terms, but this was not always the case. In the earliest days of the market in the 1980s, individuals became the dominant investors, annually snapping up 62 percent of all bond purchases. By 2009, however, they had nearly disappeared from the field, accounting for only one percent in outstanding bond value (see

Figure 4.10

). Foreign banks account for another seven percent, which means that state-controlled entities hold 92 percent of total bond investment. What’s more, many of these same state entities are the only issuers in the market.

9

FIGURE 4.10

Change in types of bond investors, 1988 and 2009

Source: 1988, Gao Jian: 49–51; 2009, China Bond

This fact has profound implications for China’s financial system. If the markets today simply function as clearing houses that move money from one pocket of the state to another, then they have developed away from their more diverse origins in the 1980s into something resembling a pyramid scheme. This is exactly why Zhou Xiaochuan has described them as “distorted” and filled with “implicit risk.” Why has the role of the critically important non-state investor become so diminished?

As part of its effort to develop greater market capacity, in 1991 and 1992, the MOF experimented with different underwriting methods. Its own experience had clearly highlighted the problems limiting large-scale bond issuance. First of all, there was the pricing problem. But, secondly, the over-reliance on the retail market created major difficulties. As individuals purchased bonds in small amounts, simple logistics limited the total amount of bond issuance and offering periods were often up to six months before an issue could be closed. Even to access these investors, the MOF found itself having to pay close to market prices. The retail market also tended to buy and hold until maturity, thus inhibiting the emergence of a secondary market. Finally, maturities tended to be short as a result of both inflation and retail preference. Small issue sizes, high cost, shorter maturities and the fact that there was no secondary market prevented the development of benchmark interest rates and, ultimately, meaningful yield curves. All of these are legitimate reasons to seek to develop an institutional investor base.

The MOF had sought early on to develop institutional investors by seeking support from banks and non-bank financial institutions. However, banks in the 1980s had little excess liquidity and, therefore, little capacity to invest. Even if the State Council had allowed the MOF to develop a market-based pricing method, the retail nature of the investor base may have limited its ability to raise funds in line with its needs. It was at this point that the story of stock markets and bond markets came together. Having created stock exchanges to manage the “social unrest” associated with street trading, the government also brought bonds “inside the walls,” especially those of the Shanghai Stock Exchange.

The exchanges enabled demand to be sourced from both individual and institutional investors; all were members of the new markets. The banks also had much deeper pockets given rapidly growing retail deposits (see

Table 4.4

) and it was not long before the government began to lean on them for support as they discovered an interesting fact.

TABLE 4.4

Composition of Big 4 bank deposits, 1978–2005

Source: China Financial Statistics 1949–2005