Financial Shenanigans: How to Detect Accounting Gimmicks & Fraud in Financial Reports, 3rd Edition (30 page)

Authors: Howard Schilit,Jeremy Perler

Tags: #Business & Economics, #Accounting & Finance, #Nonfiction, #Reference, #Mathematics, #Management

Watch for Companies That Create Reserves at the Time of an Acquisition.

In December 2000, Symbol Technologies recorded $185.9 million in charges in connection with its purchase of competitor Telxon Corporation. At the time, Symbol justified these charges as being necessary for restructuring of operations, impairment of assets (including inventory), and merger integration costs. It turns out that the charges improperly included fictitious costs that were used to create cookie jar reserves to help inflate earnings in future periods. The charges also overstated inventory write-offs that would provide a boost to future gross margins as the related inventory was sold.

Similarly, in June 1997, Xerox purchased the 20 percent stake in its own European subsidiary that had been owned by the U.K.-based Rank Group. In connection with this purchase, Xerox improperly established a $100 million reserve for “unknown risks” arising out of the transaction. In establishing the reserve, Xerox violated generally accepted accounting principles by recording a reserve for an unknown and unquantifiable risk. Nonetheless, Xerox began using this reserve as a type of piggy bank, releasing funds from it into income whenever the company’s results fell short of Wall Street’s estimates. It continued to draw on the reserve each quarter for things that were completely unrelated to the acquisition until it was fully depleted at the end of 1999. Using this same trick, Xerox fraudulently released into income approximately 20 other excess reserves totaling $396 million to improve earnings from 1997 through 2000.

Building Up Your Reserve During Times of Plenty.

The Bible tells the story of Joseph’s unique ability to decipher Pharaoh’s unsettling dream. After hearing details of the dream, Joseph warned Pharaoh that a famine was coming; devastating shortages would follow seven years of plenty. Joseph became Pharaoh’s chief steward and immediately began a program to set aside a reserve of food and supplies. Seven years later the famine hit, but Pharaoh and all of Egypt were ready.

Companies also look into the future and can reasonably predict normal business cycles and, less reasonably well, those occasional sudden jolts to the economy. Smart management today understands what Joseph and Pharaoh learned—lean years invariably follow the good ones. In that context, if a company has already met its income projections for the current period, it may attempt to shift next year’s expenses into this earlier period. H.J. Heinz Company had a premonition that one of the lean years was fast approaching and shifted some costs to the earlier period by prepaying expenses to boost the following year’s profit. One of its subsidiaries engaged in other ploys as well, such as misstating its cost of sales, improperly soliciting bills from vendors for advertising, and expensing invoices for services that had not yet been received.

Looking Back

Warning Signs: Shifting Future Expenses to an Earlier Period

• Improperly writing off assets in the current period to avoid expenses in a future period

• Improperly recording charges to establish reserves used to reduce future expenses

• Large write-offs accompanying the arrival of a new CEO

• Restructuring charges just before an acquisition closes

• Gross margin expansion shortly after an inventory write-off

• Repeated restructuring charges that serve to convert ordinary expenses to a one-time expense

• Unusually smooth earnings during volatile times

Looking Ahead

Chapters 8 and 9 illustrated games that management might play in order to

(1)

smooth earnings

(2)

shift income from a particularly strong period to a weaker one, or

(3)

clear the decks of troublesome expenses to produce future-period earnings that will dazzle investors

These two chapters complete Part 2 and our discussion of the seven Earnings Manipulation Shenanigans. As EM Shenanigans No. 1 through 5 illustrated, management has a large arsenal of techniques that can trick investors into believing that a company has generated more profit than it really has. And if management instead desires to make tomorrow look fantastic, EM Shenanigans No. 6 and 7 will get the job done.

If you were reading the 2002 edition of

Financial Shenanigans

, your lessons would now be over. At that time, we believed that the extent of management trickery in financial reporting consisted of misrepresenting its earnings. While today management still spends far too much time coming up with tricks to manipulate earnings, it has expanded the playing field of deception far beyond Earnings Manipulation Shenanigans. Therefore, as management strategy and tactics for financial misrepresentations have evolved, investors must learn new lessons about such tricks.

Part 3 begins teaching these new lessons by focusing on misrepresenting cash flow from operations (CFFO). We call this category of tricks

Cash Flow Shenanigans

. Let’s get started, as we now know that management gallops ahead in finding new tricks, and investors need to work even harder just to keep pace and have a reasonable chance of knowing what lies behind the numbers.

PART THREE:

Cash Flow Shenanigans

With so many recent financial frauds going undetected, investors are increasingly questioning the value of the accrual-based figures shown on the Statement of Income. Time and time again, companies have duped investors by recording revenue too soon or hiding expenses. Some sophisticated investors claim that they realize that earnings can be manipulated and therefore put more faith in the “purer” cash flow from operations.

While that’s certainly a step in the right direction, be extra careful to look both ways as you cross the proverbial street from accrual-based earnings to the cash flow numbers. The reasons for exercising this caution will become abundantly clear as you read through this part of the book.

In Part 3, we showcase four specific types of Cash Flow (CF) Shenanigans, discussing techniques that management employs to inflate reported cash flow from operations (CFFO), a particularly important metric that investors rely upon to assess both a company’s ability to generate cash and its “quality of earnings.” We also present strategies for detecting Cash Flow Shenanigans quickly and offer tips on how to adjust the reported numbers to calculate a more sustainable cash flow metric.

Chapter 10 CF No. 1: Shifting Financing Cash Inflows to the Operating Section

Chapter 11 CF No. 2: Shifting Normal Operating Cash Outflows to the Investing Section

Chapter 12 CF No. 3: Inflating Operating Cash Flow Using Acquisitions or Disposals

Chapter 13 CF No. 4: Boosting Operating Cash Flow Using Unsustainable Activities

Accrual versus Cash-Based Accounting

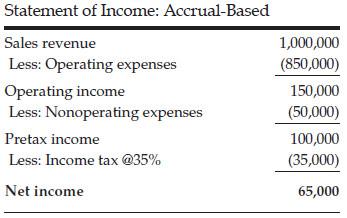

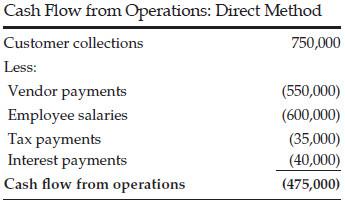

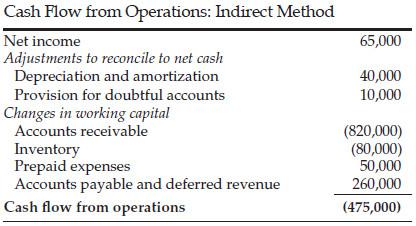

Before digging into the specific techniques, it is important to have a firm grasp of accrual versus cash-based accounting as well as the structure of the Statement of Cash Flows (SCF). Accounting rules mandate that a company report its earnings performance using the accrual basis. For all you nonaccountants, that simply means that you report revenue when it is earned (rather than when cash comes in) and charge expenses when the benefit has been received (rather than when payment occurs). In other words, cash inflows and outflows play a secondary role under accrual-based accounting. Fortunately for investors, companies must also provide a separate SCF highlighting inflows and outflows from three main sources: Operating, Investing, and Financing activities. The information included in the Operating section can be used as an

alternative performance measure

to the accrual-based net income.

As discussed in previous chapters, savvy investors often compare net income with CFFO and become concerned when CFFO lags behind net income. Indeed, high net income along with low CFFO often signals the presence of some Earnings Manipulation Shenanigans.

Let’s compare the form and structure of a typical Statement of Income with the Operating section of the Statement of Cash Flows. Under accounting rules (SFAS 95), companies can use either the “direct” or the “indirect” method to present CFFO. The direct method simply shows major sources of cash inflows (i.e., from customers) and outflows (i.e., to vendors and employees). The indirect method, in contrast, starts with accrual-based net income and reconciles it to CFFO. The direct method certainly seems more intuitive for investors, and rule makers specifically expressed their preference for companies to use that approach. However, this urging by rule makers has failed to convince companies to go along, as the vast majority present only the indirect method. (However, as we write this book, standard setters are in advanced stages of establishing a new rule that would require companies to present cash flows using the direct method.) Here we present the Statement of Income (Accrual-Based), Cash Flow from Operations (Direct Method), and Cash Flow from Operations (Indirect Method).

Although net income and CFFO represent slightly different but equally valid measures of a company’s performance, investors generally should expect them to move in the same direction. That is, if a company reports growing net income to shareholders, it would be discomforting if cash flow from operations is shrinking. Notice that in the illustration just given, CFFO lagged behind net income by a whopping $540,000 (negative $475,000 less a positive $65,000). As we discussed earlier, such an outcome may have investors worried that the company is employing Earnings Manipulation Shenanigans.

Performance Measures—From Earnings to Cash Flow

Management certainly understands that its investors cherish a high “quality of earnings.” They know that investors test earnings quality by benchmarking it against CFFO, as we did in the previous example. They also know that many investors consider CFFO to be the most important measure of company performance; some have even completely turned away from earnings and instead focus primarily on analyzing a company’s ability to generate cash. Management is fully aware that investors are lulled by the old wives’ tale that cash flow cannot be manipulated.

It should therefore come as no surprise that companies have become cleverer in their financial reporting and disclosure practices. Many have found new ways to mislead investors, using deceptive practices that may go undetected in traditional quality of earnings analysis. As you will learn in Part 3, many of these tricks involve shenanigans involving the manipulation of cash flow from operations.