Financial Shenanigans: How to Detect Accounting Gimmicks & Fraud in Financial Reports, 3rd Edition (25 page)

Authors: Howard Schilit,Jeremy Perler

Tags: #Business & Economics, #Accounting & Finance, #Nonfiction, #Reference, #Mathematics, #Management

Warning Sign

: A decline in self-insurance expense as a percentage of revenue.

4. Reduce Expenses by Releasing Reserves from Previous Charges

One benefit of taking a special charge is to inflate future-period operating income because future costs have already been written off through that charge. (This issue is covered in Chapter 9, “EM Shenanigan No. 7: Shifting Future Expenses to an Earlier Period.”) A second benefit of taking a special charge is that the liability created with the charge becomes a reserve that can easily be released into earnings in a later period.

Reserves come in different shapes and sizes and can be found all over the Balance Sheet. In Chapter 6, we highlighted reserves that are recorded on the Balance Sheet as offsets to assets, including the allowance for doubtful accounts, the allowance for loan losses, and inventory obsolescence reserves. Earlier in this chapter, we discussed reserves that are recorded as liabilities and relate to current obligations, such as warranty accruals. In this section, we consider another type of reserve: generic liability reserves that management might have established by taking a charge at some point. These “cushion” reserves can be especially scary for investors because they get swept under the rug and are hidden so well and sometimes for so long that management may not even remember why they were set up in the first place.

Accounting Capsule: Inflating Liabilities Today May Inflate Profits Tomorrow

Liabilities, like income, typically have credit balances. This is quite important and potentially valuable for a management that is intent on inflating future-period profits. The scheme is really quite simple: create a bogus liability with a desirable credit balance and then, whenever needed, make an accounting entry that moves the credit from the liability to an expense account—reducing the expense and boosting profits.

WorldCom Releases Reserves to Reduce Its Line Costs.

In the previous chapter, we discussed how WorldCom inflated its earnings in the early 2000s by aggressively capitalizing line costs rather than recording them as an expense. Well, that was not the only game that management played with line costs. It also reversed various generic reserve accounts and recorded the offset as a decrease to line cost expense.

Watch for the Release of Restructuring Reserves into Income

. Sunbeam Corporation was the master of this trick. When “Chainsaw Al” Dunlap was brought in as CEO, he embarked on a large restructuring plan. Accordingly, the company recorded many restructuring charges, thereby creating reserves to be used for future expenditures related to the restructuring plan. However, according to the Securities and Exchange Commission (SEC), Sunbeam recorded many improper restructuring and other “cookie jar” reserves as a part of this plan. These improper reserves were later reversed into income, inflating profit margins and creating the illusion of a successful restructuring.

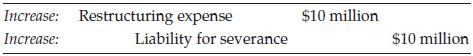

Accounting Capsule: Release of a Restructuring Reserve

Assume that the company announces a 1,000-person layoff with a severance package totaling $10 million.

Six months later, the layoffs have been completed, yet only 700 employees lost their jobs. The company eliminates the remaining liability and boosts income by reducing an expense:

Tip:

Many of these liability reserves (especially the generic ones) are often grouped in a “soft” liability account sometimes called “other current liabilities” or “accrued expenses.” Investors should monitor soft liability accounts closely and flag any sharp declines relative to revenue. Often, companies discuss these soft liabilities in a footnote. Make sure to find them and track the individual reserves as well.

Looking Back

Warning Signs: employing other Techniques to hide expenses or losses

• Unusually large vendor credits or rebates

• Unusual transactions in which vendors send out cash

• Failing to record an expense for a necessary accrual or reversing a past expense

• Unusual declines in reserve for warranty or warranty expense

• Declining accruals, reserves, or “soft liability” accounts

• Unexpected and unwarranted margin expansion

• Unusually “lucky” timing on the issuance of stock options

• Failing to accrue loss reserves

• Failing to highlight off-balance-sheet obligations

• Changing pension, lease, or self-insurance assumptions to reduce expenses

• Outsized pension income

Looking Ahead

Chapter 7 completes our presentation on how management can improperly inflate current-period profits. Management can use two different vehicles to do this:

(1)

recording too much revenue or onetime gains, or

(2)

recording too few expenses

Under certain circumstances, management might choose just the opposite strategy—to deflate current-period profits and shift them to a later period. The next two chapters discuss reasons for this choice and the techniques used to make it happen. Chapter 8 describes methods used by management to improperly shift revenue to later periods, and Chapter 9 presents methods used to improperly shift expenses to an earlier period. The end result of using these tricks leads investors to believe in “deceptively strong” future-period profit growth concocted by management. Read on and learn how not to be duped by these ploys.

8 – Earnings Manipulation Shenanigan No. 6: Shifting Current Income to a Later Period

Here’s a quiz. Why would management at a publicly traded company ever lie to its investors by reporting

smaller profits

? Many of you may be thinking that the goal would be to cut taxes. That would be the correct answer for private companies, which care more about shortchanging the tax collector. Publicly traded companies, however, certainly care about reducing taxes, but they often direct more attention toward impressing investors with smooth and predictable accrual-based earnings growth.

As you recall from Chapter 3, when we introduced EM Shenanigan No. 1, Recording Revenue Too Soon, management used the techniques in that chapter because it believed that current-period results were more important than future-period ones, and thus decided to accelerate revenue from a later period into the current one. Let’s now turn that picture 180 degrees and try to imagine certain times when management might wish to depress current-period results in order to benefit a later period. Consider a company that is growing like gangbusters and is unsure of what tomorrow holds, or one that has benefited from a large windfall gain or a huge new contract. Investors surely would love to see those delicious numbers, but they also would naturally expect management to duplicate or even exceed them tomorrow. Meeting those unrealistically high investor expectations may be virtually impossible, leading management to feel compelled to use the techniques we discuss in this chapter.

Techniques to Shift Current Income to a Later Period

- Creating Reserves and Releasing Them into Income in a Later Period

- Improperly Accounting for Derivatives in Order to Smooth Income

- Creating Reserves in Conjunction with an Acquisition and Releasing Them into Income in a Later Period

- Recording Current-Period Sales in a Later Period

1. Creating Reserves and Releasing Them into Income in a Later Period

As we discussed in Chapter 3, companies should record revenue only when

(1)

evidence of an arrangement exists

(2)

delivery of the product or services has occurred

(3)

the price is fixed or determinable

(4)

payment is reasonably assured

EM Shenanigan No. 1 focused on recording revenue too early by failing to wait for the completion of these requirements. As a result, revenue and net income would be inflated.

However, when business is booming and earnings far exceed Wall Street estimates, companies may be tempted not to report all their revenue, but instead to save some of it for a rainy day. Consider a situation in which management refuses to record some revenue that was rightfully earned during the current period, instead storing it on the Balance Sheet with all the legitimately recorded unearned revenue until it is needed during a later period. This is really simple to do, and the auditors may not even question the move, as they may consider it “more conservative.” All it takes is a bookkeeping entry to increase a Balance Sheet liability account called deferred revenue (or unearned revenue) in the current period; then, when the deferred revenue is needed in a later period (to boost earnings), another entry is made to move it to actual revenue. (The bookkeeping entries are illustrated in the accompanying Accounting Capsule.)

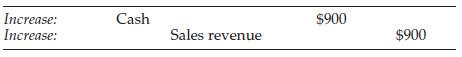

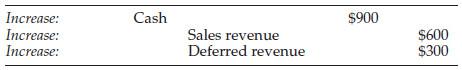

Accounting Capsule: Creating Deferred (or Unearned) Revenue

Assume that a company made a cash sale for $900. The correct journal entry would be

Instead, if management decided to only record $600 of the sale this year and squirrel away the rest for next year, it would record