Nolo's Essential Guide to Buying Your First Home (31 page)

Read Nolo's Essential Guide to Buying Your First Home Online

Authors: Ilona Bray,Alayna Schroeder,Marcia Stewart

Tags: #Law, #Business & Economics, #House buying, #Property, #Real Estate

BOOK: Nolo's Essential Guide to Buying Your First Home

4.87Mb size Format: txt, pdf, ePub

The appraiser’s job is to determine the value of the house, and thus make sure you’re not borrowing more than it’s worth. The appraiser will take a good look at the property, inside and out, floor to ceiling. Any flaws that make the property less marketable will be noted. The appraiser will also consider how the local real estate market is doing and comparable sales data from nearby homes.

If the appraiser says your house is worth as much as or more than the amount you’re paying for it, and everything else in your application looks good, your loan should be approved. Most often, appraisal reports come out positive. If the appraisal report says you overpaid, however, you may be in for trouble. The lender won’t want to approve the loan, and you may have to dispute the appraisal or ask for a second one. But think twice before pushing too hard: What if you really did overpay? Unless the property is uniquely valuable to you, you may not want to buy it at that price after all. (And you should be able to back out, based on your contract’s “financing contingency,” to be discussed in Chapter 10.)

Monitoring Your Loan Once You’re ApprovedAfter you’re approved for the loan, you can focus your energy on other things. Trust us, plenty of other tasks will be competing for your attention. But realize that the loan isn’t actually made until the day you close on the house. It’s worth staying in touch with your broker or lender, particularly if you have continuing concerns about the terms of your loan or approval. Also be mindful of any date restrictions (for example, lock-in deadlines) as you finish the purchase process.

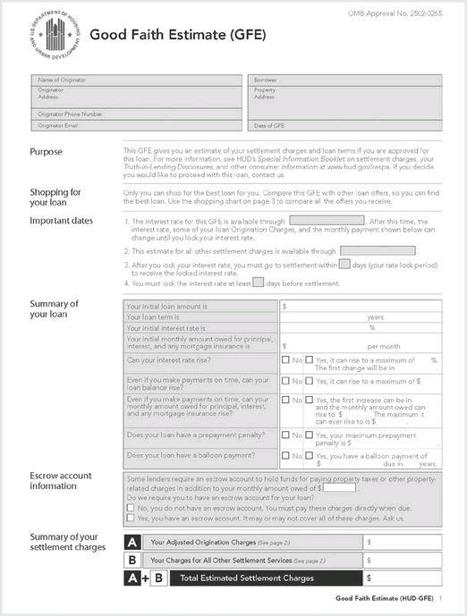

But before you forget about the details of your loan entirely, make sure you get a Good Faith Estimate (GFE) from the lender. You’re entitled to receive this document within three days of applying for your loan.

Beginning January 1, 2010, lenders are required to give you a standard GFE that looks like the sample below. Read it carefully. It spells out some very important details about the loan you’re getting—for example, the initial interest rate, the initial payment amount, whether the amount can rise, and whether the loan has a prepayment penalty or balloon payment.

The new GFE is important in another respect too: it prohibits lenders from raising certain costs at closing, and it locks the amount other costs can go up. For example, lenders cannot increase the origination fee (the up-front fee paid to the broker, usually a percentage of the loan amount), and can only increase title insurance costs by up to 10% over the estimate on the GFE. This prevents lenders from tacking on “junk fees” at closing. The U.S. Department of Housing and Urban Development (HUD) estimates the use of the new GFE will save borrowers an average of $700 at closing.

CD-ROMThe Homebuyer’s Tool Kit on the CD-ROM

contains a blank “Good Faith Estimate.” A partial sample is shown below.

Sample From Good Faith Estimate (page 1)

Much of the standard financial advice regarding homeownership doesn’t apply to co-ops. Here’s a summary of what’s different:

•

Two-tiered financing.

Two loans are often involved with co-ops. First, the cooperative will take out a mortgage for its purchase of the property (which you’ll probably help pay for, as part of your regular maintenance fees). Later, you’ll probably need a loan to purchase your shares.

•

Higher down payment.

Co-op boards frequently require buyers to make large down payments—often upwards of 25% of the purchase price. Your co-owners have good reason for this: They want to make sure you’re in sound financial shape and can afford your monthly maintenance payments.

•

Higher interest rates.

Some lenders are reluctant to finance co-op purchases, because if a buyer fails to pay on time, there’s no house to foreclose on, only intangible shares in a corporation. Fewer willing lenders and greater risk translates into higher interest rates.

•

Tax deductions.

Tax deductions for co-op mortgage and maintenance payments are more complicated than with condos or single-family homes. While the co-op management will help you calculate how much of the maintenance payment can be deducted, you may need to consult a tax professional.

•

Flip taxes.

A “flip tax” is a misnomer—it’s really a transfer fee levied by the co-op when a member sells. It can be calculated different ways: for example, based on the number of shares the seller holds, a flat amount, or the sale price. Usually the seller is responsible for this fee, but the seller may pass it off to the buyer.

What’s Next?You’ve probably got a good idea of which traditional method for financing your home works, if any. Still, you might want to consider alternatives. In Chapter 7, we’ll discuss such methods as borrowing from family or friends or getting government-assisted or seller-backed financing.

CHAPTER 7

Mom and Dad? The Seller? Uncle Sam? Loan Alternatives

Meet Your AdviserAsheesh Advani

, President of Virgin Money USA, Inc. (based in Waltham, Massachusetts; see

www.virginmoneyus.com

), and an expert in alternative forms of home financing.

What he doesWith a background in finance and development economics, including a stint at the World Bank, Asheesh came to realize the enormous volume of loans that are informally done between individuals rather than through banks. He founded CircleLending Inc. in 2000, which managed thousands of ʺperson-to-personʺ loans and mortgages (including seller financings) every year. The company was acquired in 2007 by Sir Richard Bransonʹs Virgin Group and rebranded Virgin Money.First houseʺIt was a condo in Boston, on the top floor of a two-story house—a beautiful older house that had been totally renovated inside, with stainless steel appliances, hardwood floors, and still the old-house trim. The yard was tiny, about 10’ x 10’. Weʹd planned to live there for about five years, figuring we would have had a child by then. Then within less than two years, we realized we were having twins! We quickly moved to a single-family home in a Boston suburb. In fact, we bought the new house before selling the condo, which everyone advised us was terribly risky. But this was still during the real estate heyday, and we ended up selling quickly, at a six-figure profit.ʺFantasy houseʺIʹd like what Iʹd call a ʹGeorge Washington slept hereʹ house—very New England, with historical significance and atmosphere. In fact, our current house was built in 1836 and was a broom factory—we like to joke that itʹs haunted, though itʹs not. Ideally, the place would be partially fixed up so that weʹre not doing major renovations but would still have potential for personalizing.ʺLikes best about his workʺCreating something new! CircleLending was a totally new concept and was a joy to grow from idea to company. And weʹre continually brainstorming—itʹs great working with people who have more ideas than we can ever hope to bring to life. We feel like our product helps people get the home of their dreams, sometimes when theyʹd almost given up on finding adequate financing with a reasonable interest rate and repayment plan. One client said that the banks she approached were ready to approve a certain amount for the home purchase, but nothing for her moving expenses—and she figured sheʹd need $20,000 to move her and her young family, a prohibitive sum. We helped her arrange to borrow this amount from her mother, at a lower interest than a bank would have offered, and she proceeded with her home purchase.ʺTop tip for first-time homebuyersʺPick the house based on where you like to actually live, not based on how much money youʹll make. People obsess about whether itʹs the right neighborhood, or whether theyʹre timing the market correctly. Buying a house is such an emotional decision—making it a financial one could, in the end, hurt you.ʺCD-ROMFor more tips from Asheesh Advani, check out his audio interview on the CD-ROM at the back of this book.

Other books

Starlight & Promises by Cat Lindler

Putting the Madge in Danna by Mia Natasha

Wicked Designs (The League of Rogues) by Lauren Smith

Open: Love, Sex and Life in an Open Marriage by Jenny Block

Offworld by Robin Parrish

Valkyrie Burning (Warrior's Wings Book Three) by Currie, Evan

The Sexorcist by Vivi Andrews

When Good Bras Go Bad (Myrtle Crumb Series) by Trent, Gayle

Broken Spell by Fabio Bueno

Star Wars - Ewoks - The Ice Princess! by Unknown