Nolo's Essential Guide to Buying Your First Home (32 page)

Read Nolo's Essential Guide to Buying Your First Home Online

Authors: Ilona Bray,Alayna Schroeder,Marcia Stewart

Tags: #Law, #Business & Economics, #House buying, #Property, #Real Estate

BOOK: Nolo's Essential Guide to Buying Your First Home

5.72Mb size Format: txt, pdf, ePub

W

ith competing payment pressures from student loans and other bills, and the high cost of housing, it’s hard—if not impossible—to come up with all the cash needed to buy a house. You may be struggling to get a down payment together or to qualify for a mortgage you can live with. And most traditional loans don’t provide much flexibility, especially if down the road you want to make an adjustment to your payment schedule.

ith competing payment pressures from student loans and other bills, and the high cost of housing, it’s hard—if not impossible—to come up with all the cash needed to buy a house. You may be struggling to get a down payment together or to qualify for a mortgage you can live with. And most traditional loans don’t provide much flexibility, especially if down the road you want to make an adjustment to your payment schedule.

If this sounds familiar, we suggest you look into alternative, more flexible or affordable forms of financing. (Yes, this could mean your mother—but keep reading; it may be worth it.) We’ll cover:

No Wrapping Required: Gift Money From Relatives or Friends• gifts or loans from family members and friends

• financing directly from your house’s seller

• low-down payment loan programs available through federal, state, and local agencies, and

• special financing options available for new homes, such as direct financing from developers (buydowns).

Don’t be shy: Many first-time homebuyers (nearly one-quarter) get some gift money from a relative (usually their parents) or a friend, according to the National Association of Realtors®. If used for the down payment, such gifts help buyers reduce their monthly mortgage payments or increase the amount of house they can afford. Large gifts may even be used to finance the entire purchase. Some buyers also use gifts for moving costs, home furnishings, and remodeling.

By making your home purchase possible, the giver gets not only emotional satisfaction, but financial and tax benefits. If someone is planning on leaving you money by inheritance anyway, a gift is a way to reduce the size of their taxable estate (large enough gifts can be taxed, though the laws on this are continually in flux). And better yet, your parents or other gift givers can watch you enjoy the money during their lifetime, rather than watch you pay extra interest to a bank.

For advice on approaching your parents or others for a cash gift, see the discussion below on borrowing money from family or friends.

How Gift Givers Can Avoid Owing Gift TaxBelieve it or not, the IRS attempts to keep track of cash gifts—and if someone makes total gifts over a certain amount during his or her lifetime, that person’s estate can end up owing “gift tax,” even though the recipients of the money don’t! Fortunately, not every gift counts toward this total, and the gift giver has to give away quite a bit of money for it to apply. Anyone can give a tax-free gift up to $12,000 per year to another person (2008 figure, it’s indexed to go up with inflation) without any tax implications. That means, for example, that every year, your mother and father can give you $24,000 (plus $24,000 to your spouse or partner, if you have one), without it counting against the lifetime tax-free limit.

EXAMPLE:

Leslie and Howard would like to buy a house for $240,000 and hope to raise a 20% down payment, or $48,000. If each set of parents gives Leslie and Howard $24,000, the couple have reached the needed amount, with no tax liability for anyone.

Leslie and Howard would like to buy a house for $240,000 and hope to raise a 20% down payment, or $48,000. If each set of parents gives Leslie and Howard $24,000, the couple have reached the needed amount, with no tax liability for anyone.

If a relative or friend wishes to give you more than $12,000 during a single year, that person will need to file a gift tax return (Form 709) with the IRS. This doesn’t mean the gift giver will have to pay gift taxes, because computing the gift tax debt is (as of recent years) put off until the giver’s death. At that time, the first $1 million of all the gifts made over the person’s lifetime will be exempt from the tax. For more information, see IRS Publication 950,

Introduction to Estate and Gift Taxes

, available at

www.irs.gov

. If a sizable amount of money is involved, your relative or other gift giver should consult an estate planning or tax attorney.

Why You Need—and How to Get—a Gift LetterIntroduction to Estate and Gift Taxes

, available at

www.irs.gov

. If a sizable amount of money is involved, your relative or other gift giver should consult an estate planning or tax attorney.

If you use gift money to buy your house (not just furniture), your bank or mortgage lender will require written documentation from the gift giver stating that the money is in fact a gift, not a loan. Remember, the lender is carefully evaluating how heavy a debt load you’ll have. It wants to make sure it’s not competing with another creditor for your monthly payments.

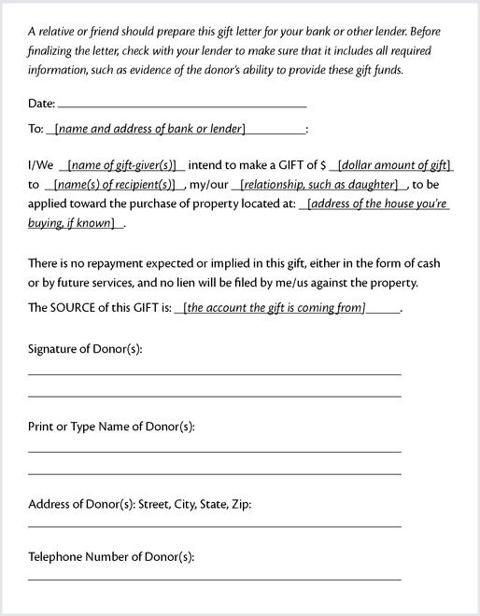

The “gift letter” should specify the amount of the gift, your relationship to the gift giver, and the type of property (the exact address, if you know it) for which the money will be used. Most important, it should state that the money need not be repaid. Ask the gift giver for a letter or prepare your own for the giver’s signature. Your lender may also have a gift letter form.

CD-ROMThe Homebuyer’s Toolkit on the CD-ROM includes a “Gift Letter” you can tailor to your situation.

A sample is shown below.

If the gift money hasn’t been transferred to your account yet, the lender may want verification that the money is available, including the name of the financial institution where the money is kept, the account number, and a signed statement giving the mortgage lender authority to verify the information.

Preventing Emotional Fallout From Gift Money or Family LoansTo avoid family blow-ups, it’s usually best if parents or relatives discuss the gift or loan with other close relatives (like your siblings). Intrafamily loan expert Asheesh Advani advises that parents offer to make similar loans on the same terms to all children and document the transactions. Asheesh explains: “Preferential treatment, or lack of documentation of intentions, can cause jealously and conflict, especially if loans remain outstanding at the time of death and the children have differing recollections of the parents’ intentions.”

Gift Letter

Private loans are an increasingly popular way to finance a home: About 7% of first-time homebuyers borrow money from family or friends, according to the 2008 NAR “Profile of Home Buyers and Sellers.” (And that’s just for their down payment. It doesn’t include those lucky buyers whose parents lend them the entire purchase amount.) Before you say, “Oh no, not my family,” consider that the numbers probably wouldn’t be this high unless there was something in it for the family member or friend, too. Take a look at the total amount of interest you’re likely to pay before your mortgage is paid off—wouldn’t it be better to keep that amount within the family?

This section will explore private (also called intrafamily) loans, including:

Structuring the Loan• different ways to structure a loan from family or friends

• the benefits for borrower and lender

• how to raise the issue with your family member or friend, and

• dealing with the legal and tax issues concerning private financing.

You can use a loan from family or friends for your:

•

Down payment.

An intrafamily loan can be helpful if you’re short on cash and want to avoid paying for private mortgage insurance (PMI), but can save up to pay back your private lender over time or when the house is sold.

•

First mortgage.

You could sidestep the traditional lending industry and finance your entire purchase price with a mortgage loan from your relatives, friends, or others.

•

Second mortgage.

A private loan may also be used to supplement a bank mortgage. How is that different from a down payment loan? Your private lender records the mortgage publicly, putting themselves in line behind the bank for repayment if the house is foreclosed on—a good way to protect the private lender. It’s unwise to forgo this step unless the loan is relatively small (less than $10,000), for the reasons discussed below.

If you’re borrowing part of the house’s purchase price from an institutional lender, check whether it requires you to structure your private loan in a certain way or limits the amount you can privately borrow. For example, if you’re borrowing down payment money, many institutional lenders require that at least 5% of the purchase price comes from your own funds.

Especially if a sizable amount of money is involved, you should get some advice on how to structure the loan from a real estate attorney. You may also find it useful to work with an outside firm such as Virgin Money (described below).

Benefits of Intrafamily Loans to the BorrowerSome of the reasons that first-time homebuyers turn to family and friends for help financing their houses include:

•

Interest savings and tax deductions.

Family and friends often charge 1½% to 2% interest points less than conventional lenders, resulting in thousands of dollars in interest savings over the life of the loan. And if you document the loan properly (as we describe below), you can usually deduct the mortgage interest charged on your taxes, just as with a traditional mortgage.

•

Flexible repayment structures.

While a bank is probably going to require an unchanging monthly payment schedule, a private mortgage holder might be more flexible. For example, you may mutually agree that you’ll make quarterly (not monthly) payments or delay all payments for the first few years. And if down the road you want to temporarily pause payments (perhaps to take unpaid leave from work after the birth of your first child), your parents or other private lender may agree to that. Good luck finding such a flexible institutional lender.

•

No points or loan fees.

Institutional lenders often charge thousands of dollars in loan application and other fees. Family and friends don’t.

•

Easier qualifying.

Your relatives or friends probably won’t require that you have a great credit score. You qualify as long as your lender trusts that you’ll pay back the loan.

•

Saving on private mortgage insurance.

If you borrow more than 80% of the house purchase price from an institutional lender, you’ll have to pay PMI. By borrowing privately, you can avoid this cost.

•

Minimal red tape.

To borrow from an institutional lender, you must fill out an application form and provide documentation verifying every item on the form, then wait for approval. Friends and family don’t usually adopt this level of scrutiny.

•

Better deal on the house.

If you’ve arranged private financing in advance and can close quickly, sellers who are time pressured may accept a slightly lower offer.

•

No lender-required approval of house’s physical condition.

Private lenders don’t usually require that a house’s major defects be repaired before closing, as institutional lenders do. That would let you buy a fixer-upper and take care of its defects later. (Of course, you should still have the house professionally inspected.)

Other books

Hurt Like HELL (new adult contemporary romance) by Casey, London

Risen (Book #6 of the Vampire Legends) by Knight, Emma

The Breeding Lands (An Epic Erotic Fantasy Novel) by Eva Fellheart

Gladiator Clash (Time Hunters, Book 1) by Chris Blake

Fearless (Broken Love Book 5) by B.B. Reid

The Great Theft: Wrestling Islam From the Extremists by Khaled M. Abou el Fadl

Sun Cross 2 - The Magicians Of Night by Hambly, Barbara

The Drifter by William W. Johnstone

Romeo's Secrets by Price, Ella

Snow by Tracy Lynn