Nolo's Essential Guide to Buying Your First Home (26 page)

Read Nolo's Essential Guide to Buying Your First Home Online

Authors: Ilona Bray,Alayna Schroeder,Marcia Stewart

Tags: #Law, #Business & Economics, #House buying, #Property, #Real Estate

BOOK: Nolo's Essential Guide to Buying Your First Home

12.97Mb size Format: txt, pdf, ePub

To make sure you’re choosing the best closing agent, get referrals from not only your agent, attorney, or mortgage broker, but from trusted family members, friends, neighbors, or colleagues. Adviser Sandy Gadow, an experienced closing agent, suggests making sure your referral source had a good experience with the closing and found the closing agent to be efficient, accurate, and able to handle the closing according to schedule.

Strength in Numbers: Other Team MembersAlthough we’ve covered the key players for most homebuyers’ teams, there are a few other professionals whom you’ll either want to consider bringing in or probably interact with along the way. These include:

•

Tax professional.

You may want to consult an accountant or other tax pro to make sure you’re taking advantage of all the tax benefits of buying a home. This is particularly important in the year you buy, when many of your expenses may be deductible.

•

Insurance agent or broker.

You’re going to need to purchase homeowners’ insurance for your house (the lender will require coverage of physical hazards, at a minimum, as described in Chapter 13). To do that, you’ll probably work with an insurance broker. Your other option is to directly contact representatives of insurance agencies whose services come highly recommended.

•

Contractor.

If you’re considering remodeling, it’s worth getting recommendations for a good contractor early on. That way, you can have the contractor look at the house and tell you how much the remodel would cost, or whether it’s worth buying in the first place.

What’s Next?With a team of professionals beside you, you’re ready to really launch your home search. In the next chapter, we’ll discuss one of the most important parts of homebuying: financing your mortgage.

CHAPTER

6

6

Bring Home the Bacon: Getting a Mortgage

Meet Your AdviserFred S. Steingold

, an attorney and author based in Ann Arbor, Michigan.

What he doesFredʹs legal expertise includes real estate and business matters. He has helped hundreds of homebuyers with key tasks like drafting and reviewing sales contracts, checking title insurance commitments, and looking over closing documents. Fred is a coauthor of the Nolo book

Negotiate the Best Lease for Your Business

and the author of several other Nolo books.First houseʺA 1,000-square-foot ranch house in an Ann Arbor subdivision, with just enough room for our two young children. I fondly remember sitting on the back porch during long summer evenings and walking to nearby University of Michigan football games. But I donʹt miss the small size of that house, and the crank-open windows with gears that were always getting stripped.ʺFantasy houseʺAny house designed by Sarah Susanka would be fun to live in. Sheʹs an architect in Minnesota and the author of a series of books on not-so-big houses—theyʹre sparkling gems with alcoves, woodwork, and interesting lighting. She knows how people want to live.ʺ (Note to readers: Check out Sarahʹs work at

www.notsobighouse.com

.)Likes best about his workʺThe range of people I get to work with. My first-time homebuyer clients are always so excited—and often more than a little nervous. I like walking them through the process and helping them overcome problems with the seller, the lender, and sometimes with their own real estate agent. Once in while, a purchase is about to fall apart over some knotty detail, and I can come up with a creative solution to save it. Itʹs all part of helping these (usually) young buyers move up in the world.ʺTop tip for first-time homebuyersʺYouʹre probably expecting me to give law-related advice, but Iʹd say have a thorough inspection! Most us donʹt know how to spot a potentially leaky basement or roof, or other expensive problems. But an experienced inspector can give you a heads up so you can opt out of the deal or have repairs made on the sellerʹs dime. And if youʹre having a house built for you, make sure to learn about the builderʹs reputation. Youʹll be extremely frustrated if the new house isnʹt ready until eight months after the promised date—or if you have to chase the builder to get postclosing warranty work done.ʺ

I

f you’re like most homebuyers (over 90% of them, according to NAR statistics), you simply won’t have the cash on hand to buy a home outright. Thankfully, there are plenty of lenders willing to front you the money you’ll probably need.

f you’re like most homebuyers (over 90% of them, according to NAR statistics), you simply won’t have the cash on hand to buy a home outright. Thankfully, there are plenty of lenders willing to front you the money you’ll probably need.

If you’ve already started researching mortgages, you may have discovered the downside of consumer choice—so many options! People start out promising themselves, “I’m going to learn all about mortgages,” and end up saying, “I’ll take whatever’s available; I just want to buy this house.”

But you don’t need to swing to either extreme—with a little buyer’s savvy, you can avoid a mortgage that’s just plain wrong for you or costs more than it should. We’ll show you how by looking at:

Let’s Talk Terms: The Basics of Mortgage Financing• the basics of mortgage financing—interest rates, points, and more

• different loan options—fixed rates, adjustable rates, and everything in between

• how much to borrow versus how much to put down

• where to research mortgages, and

• the mechanics of applying for and getting a loan.

Before you start mortgage shopping, let’s cover the basics: what a mortgage is and how it works. A mortgage is a loan to purchase property, with the property as collateral. That means that if you buy your dream home, and you don’t make the payments, the mortgagor (the lender, in common parlance) can recover what it’s owed by foreclosing on the property—that is, taking possession of and selling it.

Naturally, the lender gets into this risky business to make money. It does that primarily by charging interest and points (one-time fees when you take out the loan). The variety of mortgage options means you can borrow the same amount of money but with different terms and end up paying very different amounts back. While interest rates and points look like tiny numbers and percentages in the beginning, they add up to real dollars later.

EXAMPLE:

Rob and Amy found their dream house but don’t have a mortgage yet. The local bank offers them a $350,000, 30-year, fixed-rate mortgage at 7% interest, with no points. The monthly principal and interest payment would be about $2,300, and they’d pay about $488,000 in interest over the life of the loan.

Rob and Amy found their dream house but don’t have a mortgage yet. The local bank offers them a $350,000, 30-year, fixed-rate mortgage at 7% interest, with no points. The monthly principal and interest payment would be about $2,300, and they’d pay about $488,000 in interest over the life of the loan.

Meanwhile, Jimmy and Devon are interested in the same house. They go to a broker to discuss their options. She finds them a $350,000, 30-year, fixed rate mortgage at 6.25% interest, with one point. The point will cost them $3,500, but their monthly payment will be about $2,155, and they’ll pay about $426,000 in interest over the life of the loan, $62,000 less than Rob and Amy.

All About Interest RatesMost of us have been borrowing long enough—either to buy a car, go to college, or get this season’s fashion must-haves—to understand what interest rates are and that we don’t like them. An interest rate is an amount charged by a lender, calculated as a percentage of the loan amount. Interest rates are usually high on credit cards (sometimes above 20%), but thankfully lower on other forms of credit, like mortgages. And as we discussed in Chapter 1, interest paid on your mortgage is tax-deductible.

In the early 2000s, home mortgage interest rates hit record lows, dipping below 5% in 2004. When this this book went to print, they’d climbed back up to just above 6%, though still remaining below historic averages. In any case, they’re unlikely to climb toward early 1980s levels (15% and up) anytime soon.

And you’re not stuck with your first mortgage for life. If you sell the house, you’ll get a new mortgage when you buy your next one. And if you decide to stay put, you can refinance your mortgage (essentially, trade it in for a better one) if rates drop and the value of your house holds steady or climbs. Though you’ll pay fees to refinance, it could be well worth it.

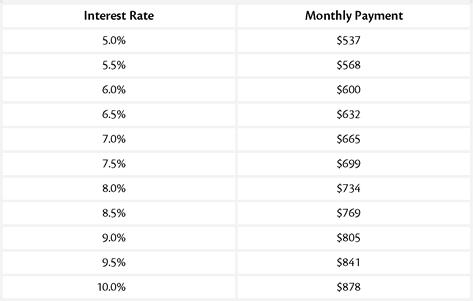

Monthly Payments for a $100,000 Fixed Rate Mortgage

This chart shows the variation among monthly payments for a 30-year, $100,000 fixed rate mortgage at different interest rates.

Unfortunately, mortgage interest rates aren’t always as straightforward as they appear. For one thing, you may see them expressed two different ways: as a base rate and as an annual percentage rate (“APR”). Those two numbers aren’t going to be the same. The base rate is the actual rate used to calculate your payment, while the APR is the total cost of taking out the loan, factored out over the life of the loan and taking into account any fees you pay, like appraisal fees and credit reports. Lenders provide the APR because they’re legally required to.

The APR should be a good indicator of what a loan really costs, except that it factors the costs

over the life of the loan

—and the chances of living in the same place for the whole term of a mortgage, without refinancing, are pretty low. However, the APR can be informative—like when a loan is advertised at a very low interest rate, but a slew of additional fees increase the cost dramatically.

Why You Might Not Be Offered the Advertised Interest Rateover the life of the loan

—and the chances of living in the same place for the whole term of a mortgage, without refinancing, are pretty low. However, the APR can be informative—like when a loan is advertised at a very low interest rate, but a slew of additional fees increase the cost dramatically.

To complicate matters, the rates you see advertised aren’t necessarily what you’ll be offered personally. For starters, interest rates change daily, so if you’re looking at the Sunday paper, by Monday the rates may be higher or lower. And the rates you’re offered will depend on some factors unique to you, such as:

•

The type of mortgage you choose.

You’ll typically be offered a lower initial interest rate on an adjustable rate mortgage (ARM) than on a fixed rate mortgage. Notice we said

initial

—stay tuned for more on that later in this chapter.

•

How risky you are as a borrower.

If you have a history of paying bills on time, a steady high salary or other significant income, low debt, plan to make a hefty down payment, and request a loan that doesn’t break the bank, you’ll probably be offered a comparatively low interest rate. If the opposite is true, your rate may be higher, to compensate the lender for the added risk.

•

The loan-to-value ratio.

A large down payment tells the lender that you’re not likely to walk away from your investment. A small one, however, makes the lender nervous. If you default, the lender will spend time and money chasing you down and may have to initiate foreclosure proceedings. Also, the lender could lose money, if you owe more than the house is worth. It protects itself from such risks by charging you higher interest.

•

Whether the loan can be resold.

Lenders often resell loans on the secondary mortgage market, discussed below. That frees up the lender’s capital to make more loans (meaning make more money). If your loan doesn’t qualify for resale, it’s less desirable for the lender. You’ll pay a premium to make up for that.The Secondary Mortgage Market and Jumbo LoansA whole market exists in which original lenders sell loans to secondary lenders. Usually the original lender is paid a flat fee upon sale, and the new lender gets to collect the rest of your mortgage payments, including interest.Why does this matter to you? Because the primary players in this secondary market, Fannie Mae (the Federal National Mortgage Association) and Freddie Mac (the Federal Home Loan Mortgage Corporation), buy only those loans that meet certain financial criteria, including that the mortgage doesn’t exceed a certain amount (which varies by location and is regularly adjusted: for 2008, it was $417,000 in most places, but as high as $625,500 in high-cost areas). If your loan won’t qualify for sale to Fannie or Freddie (a given if it’s a “jumbo” loan—over the monetary limit), you’ll probably be offered a higher interest rate.

•

Whether the loan has points.

Loans with points (an optional up-front fee) will normally come with a lower interest rate.

Other books

Twilight Is Not Good for Maidens by Lou Allin

Time Travel: A History by James Gleick

The Seventh Apprentice by Joseph Delaney

Take or Destroy! by John Harris

RockYourSoul by Sara Brooks

All or Nothing by Ashley Elizabeth Ludwig

The Information by James Gleick

The Socialite and the Cattle King by Lindsay Armstrong

Beyond The Music (The Rock Gods Book 7) by Ann Lister

Zoobreak by Gordon Korman