The Price of Civilization: Reawakening American Virtue and Prosperity (3 page)

Read The Price of Civilization: Reawakening American Virtue and Prosperity Online

Authors: Jeffrey D. Sachs

Tags: #Business & Economics, #Economic Conditions, #History, #United States, #21st Century, #Social Science, #Poverty & Homelessness

What occurred at the household level was echoed in Washington. Just as households were abandoning their personal financial prudence, Congress and the White House lost the discipline of budget balance. The trajectory of the budget deficit is shown in

Figure 2.4

. For the period 1955 to 1974, the budget deficit was mostly below 2 percent of GDP. Then, from 1975 to 1994, it increased markedly, mostly above 3 percent of GDP. A squeeze on spending (both domestic and military) combined with higher tax collections during the years 1995 to 2002 temporarily brought the budget deficit back under control. Yet as soon as the surplus was achieved, the politicians were eager to spend it for political gain. In 2001, the new Bush administration cut taxes sharply while increasing military spending, thereby sending the federal budget back to deficit. The deficit soared in the wake of the 2008 financial crisis, which lowered tax collections, led to a financial bailout, and prompted Obama to push for a two-year stimulus package.

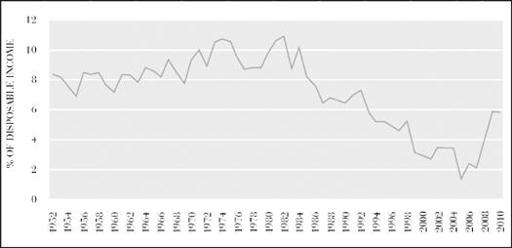

Figure 2.3: Personal Savings Rate as Percentage of Disposable Income, 1952–2010

Source: Data from U.S. Bureau of Economic Analysis.

Figure 2.4: U.S. Deficit as Percentage of GDP, 1955–2011

Source: Data from Office of Management and Budget Historical Budget Tables.

12

The chronic lack of saving by households and by government (especially state and local government) means an impending retirement crisis for baby boomers. The oldest of the baby boomers were born in 1946, meaning that they hit the retirement age of sixty-five

in the year 2011. With this long track record of undersaving, millions of baby boomer households will suffer a significant decline of living standards as they enter retirement. The Center for Retirement Research at Boston College prepares a “National Retirement Risk Index” of the percentage of households whose financial assets are insufficient to preserve their living standards during retirement. The evidence suggests that the percentage of households “at risk” has soared, from 43 percent in 2004 to around 51 percent in 2009, including 60 percent of all low-income households.

13

What is true at the household level regarding retirement risk for private-sector workers is also true for public employees at the state and local level. Pension plans for state and local employees are chronically underfunded relative to the promised benefits, though by exactly how much remains in dispute.

14

The consequences of underfunded pension plans will be some combination of a squeeze on public spending, a rise in state and local taxes, and a renegotiation of pension benefits.

The Investment Squeeze

The decline of net national saving has also meant a decline of funds available for domestic investment to build capital stock.

Whereas China, which saves around 54 percent of its national income, is building hundreds of miles of subway lines and tens of thousands of miles of fast intercity rail lines, America is building hardly any infrastructure at all.

15

In fact, our existing infrastructure is increasingly decrepit, a point of shock to foreign visitors when they arrive. The American Society of Civil Engineers (ASCE) has been our eyes and ears on the growing crisis, publishing every few years a report card detailing the estimated five-year investment needs to correct major deficiencies in key systems. The report card is sobering reading, with few passing grades. The roads are worn out; bridges and dams are vulnerable to collapse; and levee and river

systems need major upgrades, as the tragedy in New Orleans shockingly exposed. The water supply is widely contaminated. The overall grade is D, “poor,” with an estimated five-year bill of $2.2 trillion to correct deficiencies in basic systems. At roughly $400 billion per year, we require a scaling up of infrastructure investment equivalent to 2 to 3 percent of GDP each year.

16

Intellectual capital, the pride of America, is also diminishing, as America cedes technological leadership to China and other countries in areas such as renewable energy and stem cell research. The energy system is in a deepening crisis. The power grid is outmoded, yet there is little advance in building a new state-of-the-art national transmission system. There is policy paralysis regarding many kinds of possible power generation: nuclear, coal plants with carbon capture and storage (CCS), offshore wind power, biofuels, gas shale, deepwater drilling, and many others.

The most serious threat is to our human capital. The quality of the labor force will be the most important single determinant of American prosperity in the decades to come. The evidence, therefore, that America’s public schools are falling behind those of the rest of the world in core attainments in reading, science, and math is a harbinger of a deepening crisis. There is now a systematic global comparison of scholastic performance of fifteen-year-olds carried out every three years as part of the Program for International Student Assessment (PISA), currently covering sixty-five countries. The 2009 results are chastening. On the one hand, the United States ranked only fifteenth in reading, twenty-third in science, and thirty-first in mathematics.

17

On the other hand, Shanghai, China, ranked number one in all three categories, and the fast-rising developing economies of Asia (including South Korea, Singapore, and Hong Kong) all ranked in the top ten, dramatically outperforming the United States. This is perhaps the starkest wake-up call in recent memory about our lagging educational performance and its implications for the future, yet it made hardly a blip in the U.S. media.

There are other similarly stunning developments. The higher

educational attainment of the United States, once the world’s unchallenged pacesetter, is falling behind. Currently, the United States ranks twelfth in the world in the proportion of twenty-five- to thirty-four-year-olds with at least an associate’s degree (meaning a degree from a two-year college or higher).

18

Many other countries are enjoying a surge in college completion rates, especially in four-year colleges, which register the biggest returns to earnings, employment rates, and job security. In the United States, more students are attending college, but the percentage completing a four-year bachelor’s degree has stagnated since the year 2000.

19

After decades of enjoying the world’s best-educated labor force, America’s educational credentials are now falling behind many countries’ in Europe and Asia.

The Divided Workplace

Workplace conditions have also deteriorated during the past three decades. We derive most of our income and many of life’s pleasures from productive work. A healthy workplace is key to a healthy society. Yet the overriding reality of the past thirty years has been a sharply widening gap in power, compensation, and job security between senior management and professionals, on the one hand, and the rest of the workforce, on the other. This has been an era of soaring CEO pay combined with a grinding squeeze on the wages and working conditions of production and clerical workers. Job security has plummeted for relatively low-skilled workers (those with a high school diploma or less). The working class has been caught in the pincers of low-wage competition from abroad combined with the technological obsolescence of many traditional low-skilled jobs.

The top CEOs have cashed in as never before. As shown in

Figure 2.5

, the compensation packages of the top hundred CEOs soared from the mid-1970s onward. At the start of the 1970s, average top 100 CEO pay was roughly 40 times the average worker’s pay. By the year 2000, it had reached 1,000 times the average worker’s pay! The most important component of this compensation boom was the increased payment of stock options to CEOs and senior management teams.

Figure 2.5: Ratio of Top 100 CEO Compensation to Average Worker Compensation, 1970–2006

Source: Data from Database for “Income Inequality in the United States” (Saez and Piketty).

While top CEO pay has been soaring, the median take-home pay of male full-time workers (adjusted for inflation) has stagnated since the early 1970s. This is shown in

Figure 2.6

. Incredibly, the median earnings of male full-time workers actually peaked in 1973. And it’s not just earnings that have declined. So, too, has job satisfaction, which has been on the wane for a quarter century, according to the surveys of the Conference Board.

20

Figure 2.6: Real Median Earnings of Full-Time Male Workers, 1960–2009 (in Constant 2009 Dollars)

Source: Data from U.S. Census Bureau.

The New Gilded Age

The CEO-friendly political environment, the economic effects of globalization, and specific regulatory and tax policy choices made in Washington over the past thirty years have combined to create an inequality of income and wealth unprecedented in American history. We are living through a new Gilded Age exceeding the gaudy excesses of the 1870s and the 1920s. The extent of riches at the top of the income and wealth distributions is unimaginable to most Americans, especially at a time when one in eight Americans depends on food stamps.

21

The wealthiest 1 percent of American households today enjoys a higher total net worth than the bottom 90 percent, and the top 1 percent of income earners receives more pretax income than the bottom 50 percent.

22

The last time America had such massive inequality of wealth and income was on the eve of the Great Depression, and the inequality today may actually be greater than in 1929. As we see from the figure, the New Deal and post—World War II reforms led to a dramatic narrowing of income inequality. Economic growth was widely shared from the end of the war until the 1980s. Then all the economic benefits tilted toward the rich (see

Figure 2.7

).