The Crash Course: The Unsustainable Future of Our Economy, Energy, and Environment (26 page)

Read The Crash Course: The Unsustainable Future of Our Economy, Energy, and Environment Online

Authors: Chris Martenson

Tags: #General, #Economic Conditions, #Business & Economics, #Economics, #Development, #Forecasting, #Sustainable Development, #Economic Development, #Economic Forecasting - United States, #United States, #Sustainable Development - United States, #Economic Forecasting, #United States - Economic Conditions - 2009

This illustrates the miracle of compounding in reverse, where exports are eaten into from both ends by declining production and rising internal demand. It turns out that this isn’t just a scenario, but a reality for many exporting countries. For example, in the case of Mexico, the number three supplier of oil exports to the United States in 2009, production declines and demand growth will entirely eliminate their exports somewhere between the years 2011 and 2015 (depending on a variety of economic and petro-investment variables). When this happens, the United States will have to turn to the global market in search of a new number three exporter to replace those lost imports, but global competition for oil supplies is likely to be quite stiff by that time.

When world production will peak is a matter of some dispute, with estimates ranging from 2005 to some 30 years hence. But as I said before, the precise moment of the peak is really just of academic concern. What we need to be most concerned with is the day that world demand outstrips available supply. It’s at that moment when the oil markets will change forever and probably quite suddenly. First we’ll see massive price hikes—that’s a given. But do you remember the food “shortages” that erupted seemingly overnight back in February of 2008? Those were triggered by the perception of demand exceeding supply, which led to an immediate export ban on food shipments by many countries. This same dynamic of national hoarding will certainly be a feature of the global oil market once the perception of shortage takes hold. When that happens, our concerns about price will be trumped by our fears of shortages.

The Ugly Power of Compounding

Remember all those exponential graphs from Chapter 5 (

Dangerous Exponentials

) and how time ran out in a hurry toward the end of the stadium example? In theory, there’s nothing problematic with living in a world full of exponential growth and depletion curves—

as long as the world doesn’t have any boundaries

. However, exponential functions take on enormous importance when they approach a physical boundary, as was the case in the last five minutes of our stadium example and which will soon be the case for oil. We know that oil is finite and have always known that the day would come when we’d bump up against the roof of that particular stadium. All of the data that I’ve been collecting and observing over the past five years strongly suggests that we’ve already reached oil’s exponential boundary.

And here are the question that this possibility raises:

What if our exponentially based economic and monetary systems, rather than being the sophisticated culmination of human evolution, are really just an artifact of oil? What if all of our rich societal complexity and all of our trillions of dollars of wealth and debt are simply the human expression of surplus energy pumped from the ground? If so, what happens to our wealth, economic complexity, and social order when they cannot be fed by steadily rising energy inputs? What happens then?

More immediately, you and I would be perfectly within our rights to wonder what will happen when (not if, but

when)

oil begins to decline in both quantity and quality.

What will happen to our exponential, debt-based money system during this period? Is it even possible for it to function in a world without constant growth?

These are important questions for which we currently have no answers, only ideas and speculation.

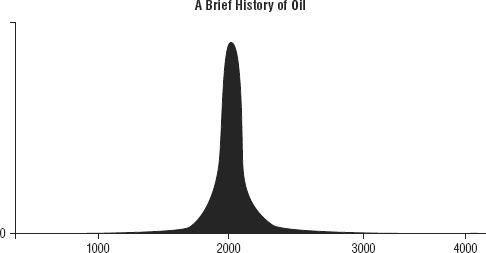

To put our oil bonanza in some sort of appropriate context,

Figure 16.10

shows oil extraction placed on a four-thousand-year time line.

It’s now up to us to wonder what we should expect in the future from a money system in which the most basic assumption might be in error.

What if the assumption “the future will be not just larger, but exponentially larger than the present” is not correct?

CHAPTER 17

Necessary but Insufficient

Coal, Nuclear, and Alternatives

The primary point of this book is that the economy to which we have become accustomed, along with our entire view of wealth in the forms of stocks and bonds, rests upon vast flows of energy (and other resources), the levels of which must not only be maintained but also increased each year. Without this constant growth in energy use, everything else becomes much more difficult, if not impossible, to maintain.

The purpose of this chapter, then, isn’t to completely cover the immense technical discussions that can (and should) surround energy, which economist Julian Simon rightfully called “the master resource.”

1

Nor will we exhaustively cover all the various technologies and sources that could be alternatives. Instead, for our purposes, we will look at our energy predicament from a level that will permit us to address the question,

How likely is it that other major sources of energy can seamlessly replace oil?

A prevalent and hopeful line of thinking found all across the political spectrum suggests that we will simply transition away from oil onto some combination of nuclear energy, increased coal consumption, and/or alternative energy sources, such as solar, wind, or maybe even algae biofuels. While each of these energy sources will play an important role in mitigating the down slope of oil, none of them individually or in combination can ever completely plug the gap left by oil’s slow departure. Remember, the challenge here is not only to replace what will “go missing” as oil fields deplete, but also to increase the total energy supply of the world by a few percent each year as our exponential economy demands. Simple math, combined with the realities of time, scale, and cost, illustrates why this is improbable.

Simple Math

Energy itself comes in many forms. We don’t value one source of energy over another for the form of the source itself, but rather to the extent that each can do useful work for us. By putting different types of energy on equal footing through a singular measure, we can compare them more easily. For our examples, we’ll use a measure of power called watts.

2

3

million barrels of oil per day (mbd), or 30.8 billion barrels for the year. Converting all of those billions of barrels into their energy content using watt hours, we discover that the world consumed around 52.4 quadrillion watt hours of energy in the form of oil. Assuming we wanted to get the same amount of power from other sources, this would be the same as:

- More than 6,800 nuclear reactors running at the same efficiency as the United States’ current 104 reactors (or roughly 6,400 more nuclear reactors than were operating worldwide in 2009)

- Nearly 6 million new 1 megawatt wind towers running at their idealized output (assuming the perfect amount of wind blows every day of the year and no maintenance is ever required), or 17 million running under more realistic conditions

- Nearly 13 million acres, or slightly over 20,000 square miles of land, to be covered by solar PV panels (assuming ideal locations in the southwest United States or elsewhere)

- More than 16 billion acres of farmland converted entirely to soybean biofuel production, representing 135 percent of the total amount of world agricultural land

4

Those are some big numbers. But that only gives us 2009 levels. Now suppose that we want to increase our total world consumption of energy from petroleum at 1.0 percent per year from here to 2030, as the EIA assumes.

5

Each of the above numbers needs to increase by 26 percent by 2030, according to the assumed rate of growth in oil consumption. Of course, there’s demand growth for electricity to consider as well (which we haven’t), but the point here is to merely put our petroleum use into context.

Clearly we aren’t going to instantly need to replace all of the energy that we currently get from oil, because it will not “run out,” but will instead wind down over many decades. So the numbers above are simply a useful way to illustrate how much energy we currently derive from petroleum and how many nuclear reactors and/or alternative sources we’d have to build or pursue to make up for the energy we currently enjoy from oil.

More realistically, instead of scaling these numbers against all oil produced, let’s suppose that the world’s oil output peaks in 2014 and that our goal is to merely replace the amount that goes missing each year. For this scenario we will assume a very modest 5 percent rate of depletion for existing fields (less than the 6.7 percent recorded by the IEA), and we’ll (very) generously assume that OPEC has 5 mbd of spare capacity, Iraq will deliver 9.5 mbd by 2019 (a nearly 500 percent increase from current levels), and another 15 mbd of assorted other new projects will come on line over the next 10 years, which adds up to 30 mbd of new or incremental production.

But,

we’ll also need another 1.3 percent of oil growth each year to reflect the amount of petroleum growth that we’ve enjoyed over the 20 years from 1989 to 2009.

Remember, the point of all this is to see if we can realistically recreate the conditions that will allow the next 20 years to resemble the past 20 years, which means that we will need to keep growing our energy use year after year at the same rate that it grew in the past. A gentle-glide path for our exponentially based economy will require a relatively seamless transition from one source of energy (oil) to some combination of other sources. Can we do it? What’s the math?

Under the above scenario, the difference between oil supplied and oil demanded builds in each and every year after 2014, being driven by the 5 percent depletion of oil on the one hand and the “requirement” for 1.3 percent energy growth on the other.

- More than 200 nuclear plants would need to come on line each year and every year for the next 40 years,

or: - Roughly 200,000 new wind towers would need to be sited and installed each and every year (delivering 1,700 TWh (terawatt hours), or more than 5 times the entire global installed wind base of 2009, (which generated 340 TWh),

6

or: - More than 400,000 acres of land would need to be covered by solar PV panels,

or: - More than 500 million acres of farmland would need to be converted to the production of liquid fuels.

Obviously we could utilize some combination of all four possible solutions, but seeing them individually helps to illustrate the scale of the problem. Ignoring other vital considerations for the moment, such as the fact that virtually none of our almost entirely oil-based transportation network can run on the electricity produced by nuclear, wind, and solar PV technologies, that’s the basic math. Just by the numbers, none of those alternatives looks very likely, but anything’s possible, right?

Now let’s look at the reality.

The Reality—Time, Scale, Cost

People who are hoping for a technological solution to our energy predicament sometimes overlook the realities involved in moving to a new energy technology. There are significant issues of time, scale, and cost involved. Above, we’ve used some simple math to illustrate the scale of the predicament.

From time to time I am accused of significantly underappreciating just how clever and resourceful humans are. Perhaps I do underestimate our species, but the scientist in me knows that cleverness cannot defeat the physical laws of the universe. And the former corporate executive in me knows just how difficult it can be to move from lab, to pilot plant, and then to full-scale operational delivery.

Historically, transitions from one energy source to another have been long, expensive, protracted affairs. Global energy use in the nineteenth century was dominated by wood, not coal, and it wasn’t until 1964 that petroleum overtook coal as the main source of transportation energy. Even a 20 to 30 percent share of a national energy market by a new entrant takes several decades, possibly a century or more. At least historically this has been true.

7

Part of the reason is that the old form of energy has an enormous installed capital base that must be phased out. For example, as our shipping fleets moved from wind power to coal, sailboats were slowly phased out over a period of decades as new coal steamers were individually brought on line. Nobody wanted to dispose of their old capital simply because new technology was available; it wouldn’t have made sense economically. The same was true for the switch from horse-drawn carriages to automobiles. So if we want to move from gasoline-powered autos to electric cars, a good guess would be that several decades of transition will be involved. The current crop of petroleum-powered vehicles will have one or two decades of useful life that their owners will want to wring out of them; service stations will have to be phased out, with their pumps and tanks removed; electric charging stations will need to be installed everywhere; and electric grids will have to be significantly upgraded to handle the new loads.

The rest of the reason that energy transitions take so long is simply the scale involved. Even if the world collectively decided that 1,000 brand new nuclear plants were exactly what it needed (and right away), it would still take decades to complete them all. Why? Because there aren’t enough manufacturing facilities to build the reactor cores. So those manufacturing facilities would have to be built first. Then, there aren’t enough engineers trained in reactor assembly and operation, and training takes time. Further, all of the world’s current uranium mines together wouldn’t be able to supply the required fuel, so new mines would have to be identified and opened. That, too, would take a very long time.

In every historical case, energy transitions required decades to complete, and there’s no reason to suspect that this time will be different. The only way to conceivably avoid this delay would be to override the markets and force the transition by government decree. Perhaps we need the equivalent of a Manhattan Project times an Apollo Project times ten: a massive, sudden, and global decision to put enormous resources into bringing a new energy technology or sources onto the scene without relying on market forces to get the job done. So far there are no signs of that happening anywhere, except possibly China. One example: A 2008 study by the National Research Council found that “plug-in hybrid electric vehicles will have little impact on U.S. oil consumption before 2030” and more substantial savings might be in the cards by 2050, reinforcing the notion that several decades separate the first launch of a new technology from its meaningful contribution to the energy landscape.

8

The Nuclear Option

Even with significant current concerns about carbon in the atmosphere and recent technological advances in the field of nuclear reactor design, nuclear power still cannot step into the lead role and save us all from the effects of depleting oil. It will play a role, just not the lead role. Here’s why.

In 2004, nuclear power represented 8 percent of all energy consumed by the United States,

9

while fossil energy represented 86 percent. Worldwide, there were 440 nuclear power plants operating in 2010, 104 of which were in the United States. In 2010, China had plans for or was already building 33 more nuclear plants to be ready by 2030, and a worldwide total of 61 were under construction in 16 countries.

10

The very first question that must be asked before building a new power plant is,

Where is the fuel for this plant going to be coming from?

Power plants cannot run dry of fuel and need to be constantly fed, so sourcing the fuel is an extremely important task.

When it comes to fueling nuclear plants, there is a bit of an issue. The Chinese are already buying and stockpiling uranium for future use in their plants

11

because they have apparently peered into the future and concluded that fuel security is an issue, so they are buying it now, just to be safe. The United States and France, the two countries with the most operating nuclear reactors, both hit a peak in uranium production back in the 1980s. Both countries only have very modest reserves of relatively low-grade uranium remaining within their borders.