Nolo's Essential Guide to Buying Your First Home (68 page)

Read Nolo's Essential Guide to Buying Your First Home Online

Authors: Ilona Bray,Alayna Schroeder,Marcia Stewart

Tags: #Law, #Business & Economics, #House buying, #Property, #Real Estate

BOOK: Nolo's Essential Guide to Buying Your First Home

7.22Mb size Format: txt, pdf, ePub

Other.

NOTES:

Don’t let the developer rush you! Then create a so-called “punch list” of what remains to be done. Your developer may have a standard form for this.

At the end of your walk-through, the developer will review the list and should agree to make the needed changes by the closing. If that looks impossible, your best bets are to either delay the closing or get a written agreement saying that the developer will put the necessary money to complete your house into an account that the developer can collect on when the work is done. And you can add new deadlines within this agreement, saying that if the work isn’t done by these deadlines, the money will be returned to you. Consult an attorney if you’re not satisfied with the developer’s assurances.

TIP“Now is when you have the most leverage,” says Realtor® Mark Nash.

“Right before the closing, the developer is looking forward to cashing out and moving on. Be pleasant, meticulous, and assertive as you press for everything to get done—and delay the closing if you have to. As soon as the developer has your money, you’re history—the developer is mentally already moving on to the next project.”

Don’t arrange your life around closing day.

When Flora bought a newly built condo in Portland, Oregon, the last inspection was scheduled on a Friday, with closing the following Monday. Flora says, “I arrived Friday to find workers running in all directions. I went around with my punch list of things that should have been done and kept checking off ‘not done,’ ‘not done.’ But we couldn’t put off the Monday closing—I was living in someone’s basement, and my husband was flying up from California. The developer never finished all the items on the punch list; we later sued.”

Your Last Tasks Before the ClosingWhen Flora bought a newly built condo in Portland, Oregon, the last inspection was scheduled on a Friday, with closing the following Monday. Flora says, “I arrived Friday to find workers running in all directions. I went around with my punch list of things that should have been done and kept checking off ‘not done,’ ‘not done.’ But we couldn’t put off the Monday closing—I was living in someone’s basement, and my husband was flying up from California. The developer never finished all the items on the punch list; we later sued.”

Below are the most important things for you to do in the approximately 24 hours leading up to the closing.

Check and Double Check Final Closing Cost AmountYour closing costs include everything that you (and the seller) will have to pay to anyone connected with the sale, including your loan fee, points, and first month’s payment; title and homeowners’ insurance premiums; transfer and property taxes; recording fees; and down payment. Many people are surprised by how high their closing costs go—several thousand dollars is not uncommon.

Co-op buyers may pay a little less, because title insurance isn’t available to them (as owner of shares in a corporation rather than land), and the taxes are normally lower because it’s not considered a real estate transfer. On the other hand, co-op owners may be required to pay a move-in deposit, a stock transfer fee, and a fee for any credit checks run by the owner’s association board.

Condo owners should also be prepared for a few closing costs not owed by ordinary homeowners, such as a move-in fee or move-out deposit and fees for credit checks run by the community association.

TIPRemember next April: Some closing costs are tax-deductible.

These include the points and any prepaid interest you pay for your mortgage, and any reimbursement you pay the seller for already-paid local property taxes. Many other closing costs, while not tax-deductible, can be figured into your house’s adjusted cost basis, helping to reduce your capital gains when you eventually sell.

You should have already gotten some warning of your closing cost amount from your lender, which was legally obligated to give you a “Good Faith Estimate” (GFE) of these costs (not just the ones relating to your loan) within three days of first receiving your loan application. Remember, after January 1, 2010, your GFE should be on a standard form (a copy can be found in the Homebuyer’s Tool Kit on the CD-ROM), and the lender isn’t permitted to raise many of the costs on it, while others can only be raised by up to 10%.

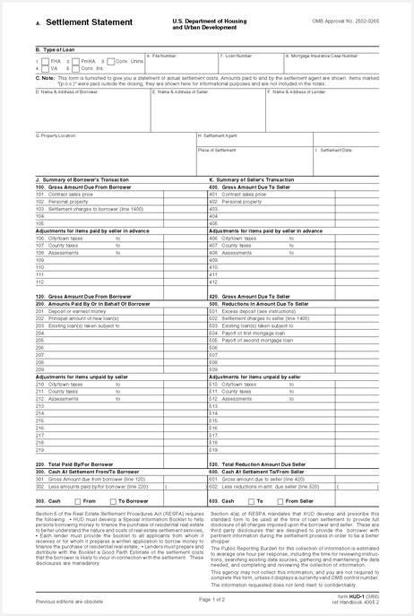

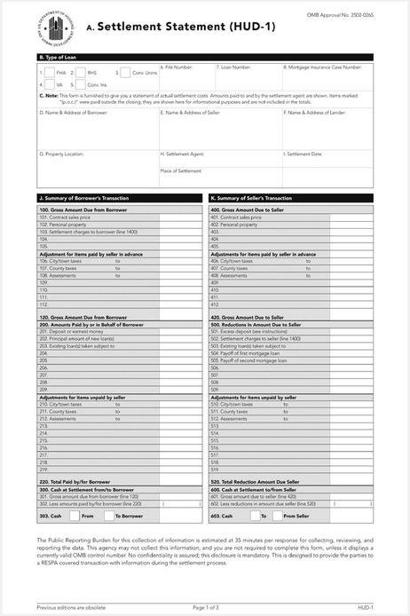

Your current task, on the day before the closing, is to find out whether your total closing costs are adding up as you expected and get ready to pay that amount. To see the latest tally, ask your closing agent for your final draft of your HUD-1 Settlement Statement. This is a standard from developed by the Department of Housing and Urban Development (HUD) that the lender is required to give you at closing. There are two versions of the form currently in use: beginning January 1, 2010, lenders must begin using the more recent version, which is set up to make it easy to compare the final costs to the estimated costs on the GFE.

CD-ROMThe Homebuyer’s Toolkit on the CD-ROM contains a blank HUD-1 form.

Open it to see the full list of possible closing costs. A partial sample is shown below.

At the closing itself, you’ll receive a final version of the closing statement or HUD-1 form. But it’s good to get an advance look, so that you can check for oddities, errors, or failures to credit you for fees you’ve already paid. For example, your earnest money deposit should show up as a credit, reducing what you’ll owe at closing. If you’re buying a newly constructed house, your advance payments to cover customizations or upgrades should be credited against your closing costs. Bring up any errors or questions with whoever is responsible (usually, the lender or the closing agent)

before

you get to the closing.

before

you get to the closing.

Hopefully you won’t be one of the consumers who find that the fees have been added to or padded since the original estimate (sometimes called “junk fees”) to pull in extra profits, usually for the lender or title company. If you see unexpected or questionable fees, realize that you may be able to negotiate them away. The most likely candidates for negotiation are those called “Items Payable in Connection with the Loan,” listed on the lines numbering in the 800s on the HUD-1 form, and “Title Charges,” listed on the lines with “1100” numbers. The sooner you bring these up, the more negotiating clout you have.

Sample Settlement Statement: Effective Until January 1, 2010

Sample Settlement Statement: Required January 1, 2010

CAUTIONDon’t pay junk fees that exceed legal limits.

Remember, beginning January 1, 2010, certain costs can’t exceed the estimates given on the GFE, and other costs can only increase by a maximum of 10%. (Many of the costs on the lines numbering in the 800s or 1100s fall within this category.) For a full list of which costs can’t be changed, review the Good Faith Estimate form that appears in The Homebuyer’s Toolkit on the CD-ROM in the back of this book.

Other books

The Way of the Fox by Paul Kidd

Seduce by Buchanan, Lexi

Death's Door by Kelly, Jim

The Playboy Prince by Kate Hewitt

Declaration by Wade, Rachael

The Draglen Brothers - DRAKEN (BK 1) by Solease Barner

Once Upon a Summer by Janette Oke

Deadly Diversion: A Medical Thriller by Eleanor Sullivan

Love in the Air by Nan Ryan