Nolo's Essential Guide to Buying Your First Home (22 page)

Read Nolo's Essential Guide to Buying Your First Home Online

Authors: Ilona Bray,Alayna Schroeder,Marcia Stewart

Tags: #Law, #Business & Economics, #House buying, #Property, #Real Estate

BOOK: Nolo's Essential Guide to Buying Your First Home

9.26Mb size Format: txt, pdf, ePub

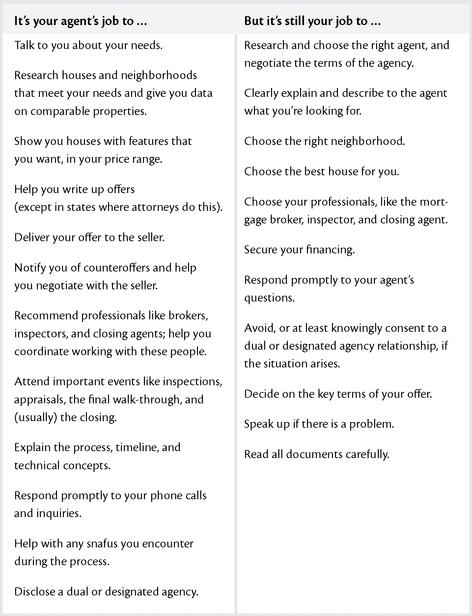

Who Does What

Even in inexpensive housing markets, you’ll likely be taking out a mortgage to finance your purchase. In the next chapter, we’ll talk about how to research options, select the best loan, and actually apply for it. Here, we’re going to talk about the people you’ll work with to do that.

As many as two-thirds of all buyers get their loans through a mortgage broker—a professional who’s in the business of compiling and filtering through the options for you. Your other primary alternative is to go directly to a bank, credit union, or other commercial lender.

If you’re buying a newly constructed home, the developer may line up financing for you—but it’s worth checking out other options. While developers often form relationships with specific lenders, the terms offered sometimes favor the developer more than the buyer.

TIPA “mortgage broker” and a “mortgage banker” aren’t the same thing.

A mortgage broker is the middleman who brings you and a lender together. A mortgage banker is a lender who actually lends you money.

A mortgage broker acts as your agent to “shop lenders” for the best possible loan terms, given your financial situation and goals. Many states require mortgage brokerages to be licensed, and individual mortgage brokers are sometimes certified by the National Association of Mortgage Brokers (NAMB). To be NAMB-certified, brokers must show a certain amount of work experience and other qualifications, pass a written exam, and attend continuing education training. There are two types of NAMB certification: Certified Residential Mortgage Specialist (CRMS) and Certified Mortgage Consultant (CMC).

As for compensation, mortgage brokers make most of their money by marking up the costs on the loan the wholesale lender is offering. This may get passed on to you in the form of points (one point is 1% of the loan value), processing fees, or a higher interest rate. Although the broker’s commission ultimately comes out of your pocket, a savvy borrower can negotiate down a fee that seems excessively high. Of course, a good mortgage broker should be able to save you the equivalent of his or her earnings and then some, by finding you a more affordable mortgage than you could locate on your own.

TIPChoose a mortgage broker before you find a house.

If you wait to get a broker until you’ve found a property you want to buy, you’ll have very little time to find the best professional.

To help you find the best loan possible, a good broker will:

• Talk with you about your financial situation and goals.

• Find and explain financing options available to you.

• Work with you to get preapproved for a mortgage.

• Help you complete and assemble the documentation the lender needs. This might include your loan application, confirmation of employment and wages, financial information, and credit report.

• Once approved, review loan documents before you sign them. If the lender refuses to approve your loan, your mortgage broker should explain what went wrong and help find alternative mortgage options.

• Coordinate the property appraisal.

• Continue to act as a liaison between you and the lender up through the closing day.

TIPRun your own numbers.

The mortgage broker’s view of your finances will be much like the lender’s—a measure of what you can qualify for based on your debt-to-income ratio. Don’t look to the mortgage broker to tell you what you can comfortably afford: Conduct a personal evaluation of your finances, as explained Chapter 3.

Good mortgage brokers possess many of the same traits as good real estate agents—integrity, professionalism, and experience. They should also be skilled (and patient) at explaining complicated financing concepts. In addition, good mortgage brokers stay informed about the policies, requirements, and products of various mortgage lenders, so as to provide you with up-to-date and accurate advice.

Get recommendations from friends, coworkers, and other homeowners. Your real estate agent, if you have one, is another good resource. A less reliable option is the “search for a mortgage broker” feature on the NAMB website,

www.namb.org

. NAMB membership is just a starting point: You’ll want to learn more about each broker’s education, experience, and philosophy. Ask whether the broker will tell you up front about every fee they’ll charge you (you may want to negotiate these fees, as we’ll discuss in Chapter 6).

www.namb.org

. NAMB membership is just a starting point: You’ll want to learn more about each broker’s education, experience, and philosophy. Ask whether the broker will tell you up front about every fee they’ll charge you (you may want to negotiate these fees, as we’ll discuss in Chapter 6).

Next, interview two or three prospective mortgage brokers. Ask about their experience and certifications, plus any questions special to your situation (like whether they can provide help getting an FHA or other government-backed loan). Also ask for the names of three references, and follow up to check whether these folks enjoyed working with the broker and are still happy with the loan they got.

CD-ROMFor a handy set of questions to use in your interview and when checking references:

Use the “Mortgage Broker Interview Questionnaire” and the “Mortgage Broker Reference Questionnaire” in the Homebuyer’s Toolkit on the CD-ROM. Samples of these forms are shown below.

Mortgage Broker Interview QuestionnaireTo get the best mortgage broker on your team, ask the following questions, as well as any special to your situation (for example, concerning a credit history issue, your interest in an FHA or other government-backed loan, or the broker’s experience with self-employed buyers).Name of mortgage broker and contact information (phone, email, etc.):Date of conversation:1. Do you work full time as a residential mortgage broker?2. How long have you been in the residential mortgage business?3. Are you licensed (if applicable) and certified by the National Association of Mortgage Brokers?4. How many residential mortgages have you brokered in the past year?5. How many of those transactions were with first-time home buyers?6. Can you provide at least three names of recent clients who will serve as references, at least one of whom was a first-home buyer?NOTES:Best Answers:1. Yes.2. The longer the better, but at least two years.3. Yes.4. Should be a minimum of ten.5. The more the better, but should be at least five.6. Only acceptable answer is “Yes.”

Mortgage Broker Reference QuestionnaireHere’s what to ask the mortgage broker’s references. You can add any other questions that interest you, for example, whether the person tried to negotiate the broker’s fee down.Name of mortgage broker:Name of reference:Date:1. How did you choose the mortgage broker? Did you know the broker before you worked together?2. What kind of loan did you get? Are you happy with it?3. Was the broker responsive? Did the broker return calls and emails promptly, follow through on promises, and meet deadlines?4. How long did you look?5. Did the broker give you a variety of options?6. Are you happy with the loan you got?7. Did the broker help you coordinate other details of your purchase, like working with the title company or insurance agents?8. Did the broker keep you up to date, and explain everything in terms you understood?9. Would you work with the broker again?OTHER COMMENTS:

Other books

The Book Borrower by Alice Mattison

Man of Passion by Lindsay Mckenna

Voices in the Wardrobe by Marlys Millhiser

Following My Toes by Osterkamp, Laurel

Big Easy Murder (The Peyton Clark Series Book 3) by H. P. Mallory

Rise of the Blood by Lucienne Diver

A Flock of Ill Omens by Hart Johnson

The Song Remains the Same by Kelli Jean

The Triumph of Katie Byrne by Barbara Taylor Bradford

The Loveliest Dead by Ray Garton