Unfair Advantage -The Power of Financial Education (27 page)

Read Unfair Advantage -The Power of Financial Education Online

Authors: Robert T. Kiyosaki

Tags: #Personal Finance, #unfair advantage, #financial education, #rich dad, #robert kiyosaki

When we were younger, this same friend made a lot of money. Unfortunately, it was his low financial-intelligence level—zero—that caused him be a zero over the long run. In fact, he is so deeply in debt that he is really a sub-zero investor.

Like many people, everything he buys loses value or costs him money. Nothing he buys makes him richer.

Level 2: The Savers-Are-Losers Level

Many people believe it is smart to save money. The problem is that today, money is no longer money. Today, people are saving counterfeit dollars, money that can be created at the speed of light.

In 1971 President Nixon took the U.S. dollar off the gold standard, and money became debt. The primary reason why prices have risen since 1971 is simply because the United States now has the power to print money to pay its bills.

Today, savers are the biggest losers. Since 1971, the U.S. dollar has lost 95 percent of its value when compared to gold. It will not take another 40 years to lose its remaining 5 percent.

Remember, in 1971, gold was $35 an ounce. Forty years later, gold is over $1,400 an ounce. That is a massive loss of purchasing power for the dollar. The problem grows worse as the U.S. national debt escalates into the trillions of dollars, and the U.S. continues to print more counterfeit money.

As the Federal Reserve Bank and central banks throughout the world print trillions of dollars at high speed, every printed dollar means higher taxes and more inflation. In spite of this fact, millions of people continue to believe that saving money is smart. It used to be smart when money was money.

The biggest market in the world is the bond market. “Bond” is another word for “savings.” There are many different types of bonds for the different types of savers. There are U.S. Treasury bonds, corporate bonds, municipal bonds, and junk bonds.

For years, it was assumed that U.S. government bonds and government municipal bonds were safe. Then the financial crisis of 2007 began. As many of you know, the crisis was caused by mortgage bonds, such as mortgage-backed securities or MBS, also known as derivatives. Millions of these mortgage bonds were made up of subprime mortgages, which were loans to subprime or high-risk borrowers. You may recall that some of those borrowers had no income and no job. Yet, they were buying homes they could never pay for.

The Wall Street bankers took these subprime loans and packaged them into bonds, magically got this subprime bond labeled as prime, and sold them to institutions, banks, governments, and individual investors. To me, this is fraud. But that is the banking system.

Once the subprime borrower could no longer pay the interest on their mortgages, these MBS bonds began blowing up all over the world.

Interestingly, it was Warren Buffett’s firm, Moody’s, that blessed these subprime mortgages as AAA prime debt, the highest rating for bonds.

Today, many people blame the big banks such as Goldman Sachs and J. P. Morgan for the crisis. Yet, if anyone should be blamed for this crisis, it should be Warren Buffet. He is a smart man, and he knew what he was doing. Moody’s was blessing rotting dog meat as Grade A prime beef. That is criminal.

The problem is that these subprime bonds are now causing ripple effects all over the world. Today, countries such as Ireland and Greece are in serious trouble, unable to pay the interest on their bonds. In the United States, governments and municipalities are going broke, unable to pay the interest on their bonds.

In 2011, millions of individuals, many retirees, pension funds, governments, and banks are in trouble as the bond market proves how unsafe bonds can be.

On top of that, rising inflation makes bonds an even riskier investment, which is why savers who only know how to save are losers. For example, if a bond is paying 3 percent interest and inflation is running at 5 percent, the value of a 3 percent bond crashes, wiping out the investors’ value.

China could be the biggest loser of all. China holds a trillion dollars in U.S. bonds. Every time the U.S. government devalues the dollar by printing more money and issuing more bonds, the value of China’s trillion-dollar investment in the United States goes down. If China stops buying U.S. government bonds, the world economy will stop and crash.

Millions of retirees are just like China. Retirees in need of a steady income after retirement believed government bonds were safe. Today, as governments, big and small, go bust and inflation rises, retirees are finding out that savers who saved money in bonds are losers.

Municipal bonds are IOUs issued by states, cities, hospitals, schools, and other public institutions. One advantage of municipal bonds is that many are tax-free income. The problem is that municipal bonds are not risk-free.

Millions of municipal-bond investors are now finding out that the municipal bonds they invested in are in serious trouble. In the United States, more than $3 trillion are invested in municipal bonds. It is estimated that two thirds of those bonds are now at risk because these public institutions are broke. If more money is not pumped in, the United States could implode from the center as states, cities, hospitals, and schools begin to default, just as subprime homeowners defaulted and stopped paying on their home mortgages.

The bond market is the biggest market in the world, bigger than the stock market or the real estate market. The main reason it is the biggest is because most people are savers, Level 2 investors. Unfortunately, after 1971 when the rules of money changed, savers became the biggest losers, even if they saved money by investing in bonds.

Remember that savers, bondholders, and most people who save money in a retirement plan, are people who park their money, investing for the long term, while professional investors move their money. Professional investors invest their money in an asset, get their money back without selling the asset, and move their money on to buy more assets. This is why savers, who park their money, are the biggest losers.

Level 3: The I’m-Too-Busy Level

This is the investor who is too busy to learn about investing. Many investors at this level are highly educated people who are simply too busy with their careers, family, other interests, and vacations. Hence, they prefer to remain financially naïve and turn their money over to someone else to manage for them.

This is the level that most 401(k)s, IRAs, and even very rich investors are at. They simply turn their money over to an “expert,” and then hope and pray their expert is really an expert.

Soon after the financial crisis broke in 2007, many affluent people found out their trusted expert was not an expert at all and, even worse, could not be trusted.

In a matter of months, trillions of dollars of wealth vaporized as real estate and stock markets began to crash. Panicking, these investors called their trusted advisors and begged for salvation.

A few rich investors found out that their trusted advisors were extremely sophisticated con men, running elaborate Ponzi schemes. A Ponzi scheme is an investment scheme where investors are paid off with new investors’ money. The scheme works as long as there are new investors adding new money to pay off the old investors. In the United States, Bernie Madoff became famous because he “made off” with billions in rich people’s money.

There are legal Ponzi schemes and illegal Ponzi schemes. Social Security is a legal Ponzi scheme, as is the stock market. In both instances, the scheme works as long as new money flows into the scheme. If new money stops flowing in, the scheme—be it Madoff’s scheme, Social Security, or Wall Street—collapses.

The problem with the Level-3 investor, the I’m-too-busy investor, is that the person learns nothing if they lose their money. They have no experience except a bad experience. All they can do is blame their advisor, the market, or the government. It’s hard to learn from one’s mistakes if the person does not know what mistakes were made.

Level 4: The I’m-a-Professional Level

This is the do-it-yourselfer investor. When you look at the CASHFLOW Quadrant, they are in the S quadrant as an investor.

Many retirees become Level-4 investors once their working days are over.

This investor may buy and sell a few stocks, often from a discount broker. After all, why should they pay a stockbroker’s higher commissions when they do their own research and make their own decisions?

If they invest in real estate, the do-it-yourselfer will find, fix, and manage their own properties.

And if the person is a gold bug, they will buy and store their own gold and silver.

In most cases, the do-it-yourselfer has very little, if any, formal financial education. After all, if they can do it themselves, why should they learn anything?

If they do attend a course or two, it is often in a narrow subject area. For example, if they like stock trading, they will focus only on stock trading. The same is true for the small real estate investor.

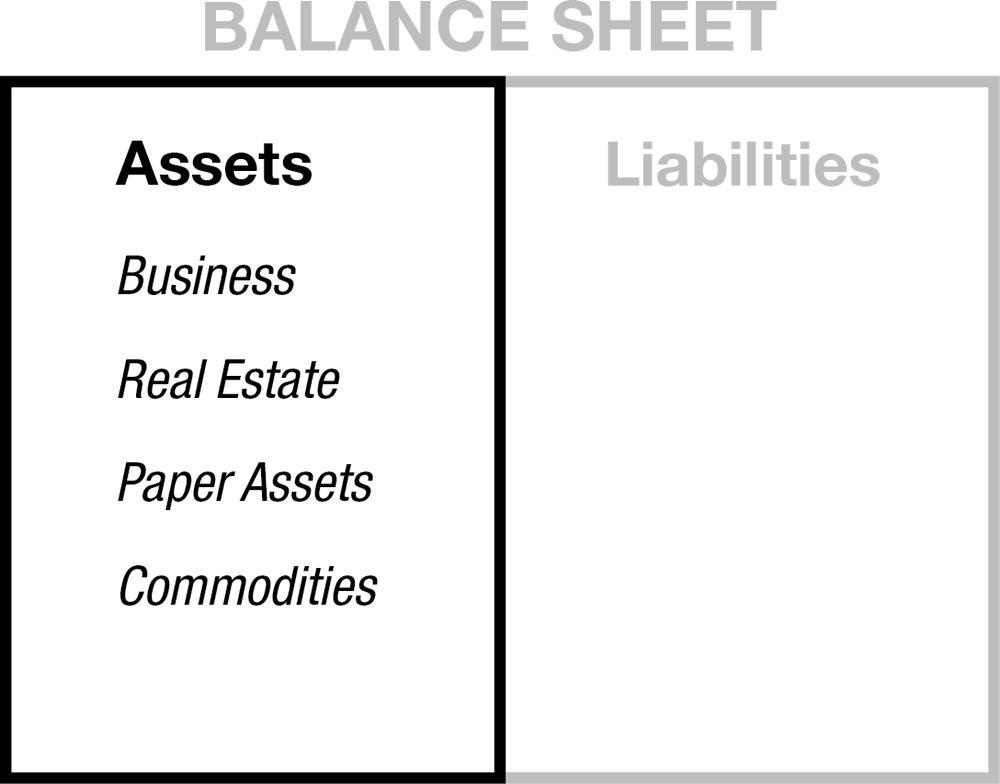

At the age of nine, when rich dad began my financial education with the game of Monopoly, he wanted me to have a bigger picture of the world of investing. The following are some of the basic big-picture asset classes he wanted me to spend my life learning. They are:

As more people realize the need to invest, millions of them will become small Level-4 investors in all four categories.

After the 2007 market crash, millions of people have become entrepreneurs, starting small businesses, and many are investing in real estate while prices are low. Most, however, are trying their hand at stock trading and stock picking. As the dollar declines in value, millions of people are beginning to save gold and silver instead of dollars.

Obviously, those who also invest in their ongoing financial education, taking classes regularly and hiring a coach to enhance their performance, will outpace those who just do it on their own.

With a sound financial education, a few of the Level-4 investors will climb to the next level, the Level-5 investor, the capitalist.

Level 5: The Capitalist Level

This is the richest-people-in-the-world level.

The Level-5 investor, a capitalist, is skilled as a business owner from the B quadrant investing in the I quadrant.

As stated earlier, the Level-4 investor is the do-it-yourselfer from the S quadrant investing in the I quadrant.

The following are a few examples of the differences between a Level-4 investor and a Level-5 capitalist investor.

1. The S-quadrant investor generally uses his or her own money to invest.

The B-quadrant investor generally uses OPM (other people’s money) to invest.

This is one of the major differences between the Level-4 and Level-5 investor.

2. The S-quadrant investor is often a solo investor. (S also stands for smartest.)

The B-quadrant investor invests with a team. B-quadrant investors do not have to be the smartest. They just have to have the smartest team.

Most people know that two minds are better than one. Yet, many S-quadrant investors believe they are the smartest people in the world.

3. The S-quadrant investor earns less than the B-quadrant investor.

4. The S-quadrant investor often pays higher taxes than the B-quadrant investor.

5. The S quadrant also stands for selfish. The more selfish they are, the more money they make.

The B-quadrant investor must be generous. The more generous they are, the more money they make.

6. It is difficult to raise money as an S-quadrant investor.

It is easy for a B-quadrant investor to raise capital. Once a person knows how to build a business in the B quadrant, success attracts money. It becomes easy to raise money in the I quadrant if you are successful in the B quadrant. That is the big “if.”

The ease of raising capital is one of the biggest differences between being successful in the S quadrant versus being successful in the B quadrant. Once a person is successful in the B quadrant, life is easy. The challenge is becoming successful.

The problem with success in the S quadrant is that raising capital is always difficult.

For example, it is easy to take a B-quadrant business public via selling shares of the business on the stock market. The story of Facebook is a modern example of how easy it is to raise capital for a B-quadrant business. If Facebook had remained just a small web-consulting firm, it would have been very difficult to raise investor capital.