Throw Them All Out (3 page)

Read Throw Them All Out Online

Authors: Peter Schweizer

By looking at Department of Housing and Urban Development grants designed to combat economic blight and help "distressed" cities, researchers found that there was no evidence that these factors had any real effect on how the HUD grants were awarded. The decisions were instead based on political influence, by bureaucrats rewarding friends.

32

Has anything really changed since George Washington Plunkitt's day? The methods, techniques, and tools are similar. But while Tammany Hall corruption controlled a city, today's crony capitalism is about a system that operates at the highest levels of an entire nation.

Â

There is a lot of money sloshing around in the nation's capital. As of 2010, seven of the ten richest counties in the United States were in the Washington, D.C., area. During the Great Recession of 2008â2009, Washington boasted the best-performing real estate market in the country. What is it that drives the D.C. economy? Not private enterprise, certainly. And we can only expect these trends to continue, unless we make changes.

33

The upper tiers of the U.S. economy are increasingly a network of individuals who make special deals with politiciansâand the politicians themselves. The distinction between the public and private sectors has become blurred. More than half of the Fortune 1000 companies have an ex-politician or ex-bureaucrat sitting on their corporate boards.

Before plunging into the specifics and key offenders of modern crony capitalism, we need to ask: How is this possible, and why does our system of laws allow all this to happen? As you will see, the answer isn't simply a matter of overlooked corruption. The system of crony capitalism has powerful defenders.

The bank robber Willie Sutton was once asked why he robbed banks. His well-known response: "Because that's where the money is." Why has crony capitalism become so widespread? The response is the same. Let's take a look at how the crony insiders get their loot.

CONGRESSIONAL CRONIES

1. THE DRUG TRADE

O

VER THE PAST

half century there has been a massive web woven between the federal government and the health care industry. Whether due to special taxes, fines, regulations, subsidies, or mandates, there have been enormous sums of money at stake in governmental decision-making for health care companiesâand the companies' investors. By 2007, federal government programs like Medicare, Medicaid, and others accounted for 46% of all health care spending in the United States.

1

Knowing what changes might be in store for those programs, and having advance notice of details of other health care legislation, could translate into a lot of profits. For a sitting United States senator, trading stocks at the same time you are pushing and writing legislation could net you millions in capital gains.

Throughout 2009, Washington was consumed by the Patient Protection and Affordable Care Act, or what became commonly known (at least to its critics) as Obamacare. It began as a campaign promise, became a debate, and ended with horse-trading, political threats, and partisan muscle. The bill that was eventually passed by Congress and signed by President Obama was 2,500 pages long. Very few members actually knew everything that was in the bill or what it all meant. Some members had not even had a chance to read it. The health care industry and pharmaceutical companies employed thousands of lobbyists to shape the legislation. When the dust finally settled, clear winners and losers emerged. The details that determined who came out ahead and who didn't were almost always hammered out behind closed doors. A single event could cause the price of a stock to swing wildly. For example, when six senators announced on July 27, 2009, that they were going to eliminate the "public option"âa government-run insurance policyâfrom their version of the health care reform bill, the share prices of three major insurance companies surged by between 8% and 10% the next day. Trading stocks in such an environment could be highly profitable, especially if you knew about such events in advance.

One of those at the center of shaping the bill was Senator John Kerry of Massachusetts. Kerry, first elected to the Senate in 1984, had been a longtime advocate of health care reform. He serves as a member of the Health Subcommittee on the powerful Senate Finance Committee. The former Democratic nominee for President is a member of the wealthy Forbes family and is the beneficiary of at least four inherited trusts. In 1995, his wealth jumped dramatically when he married Teresa Heinz, the widow of Pennsylvania Senator John Heinz, heir to the Heinz family fortune. Teresa Heinz Kerry is worth hundreds of millions of dollars.

Like other very wealthy people, John Kerry is an investor. His family trusts are relatively small, worth less than $1 million, according to his 2009 financial disclosures. By themselves they could hardly sustain his lifestyle. The bulk of the Kerrys' wealth resides in a series of marital trust and commingled fund accounts. All together, these funds include significant investments in stocks of many corporations. It is his buying and selling of health care stocks during the debate over health care reform that is particularly interesting. While some have reported that the Kerrys' assets are in a blind trust, they have not been designated as such on his financial disclosure forms.

2

Contrary to public perception, the major pharmaceutical companies were in favor of Obama's health care bill. The President's new program was expected to increase the demand for prescription drugs by making health care more accessible. Big Pharma, as the companies are collectively known, decided it could not stop the bill, so it might as well try to influence its provisions. Back in 1994, when the Clinton administration (and notably Hillary Clinton) had pushed for dramatic changes in the health care system, several effective ads sponsored by the pharmaceutical industry, starring "Harry and Louise," helped defeat "Hillarycare." In 2009, Big Pharma hired the two actors again. Only this time they were fifteen years olderâand they were in favor of the bill. "Well, it looks like we may finally get health care reform," said Harry, in one ad.

In July 2009, industry representatives met with key members of Congress and hashed out critical details of the new Obama bill.

3

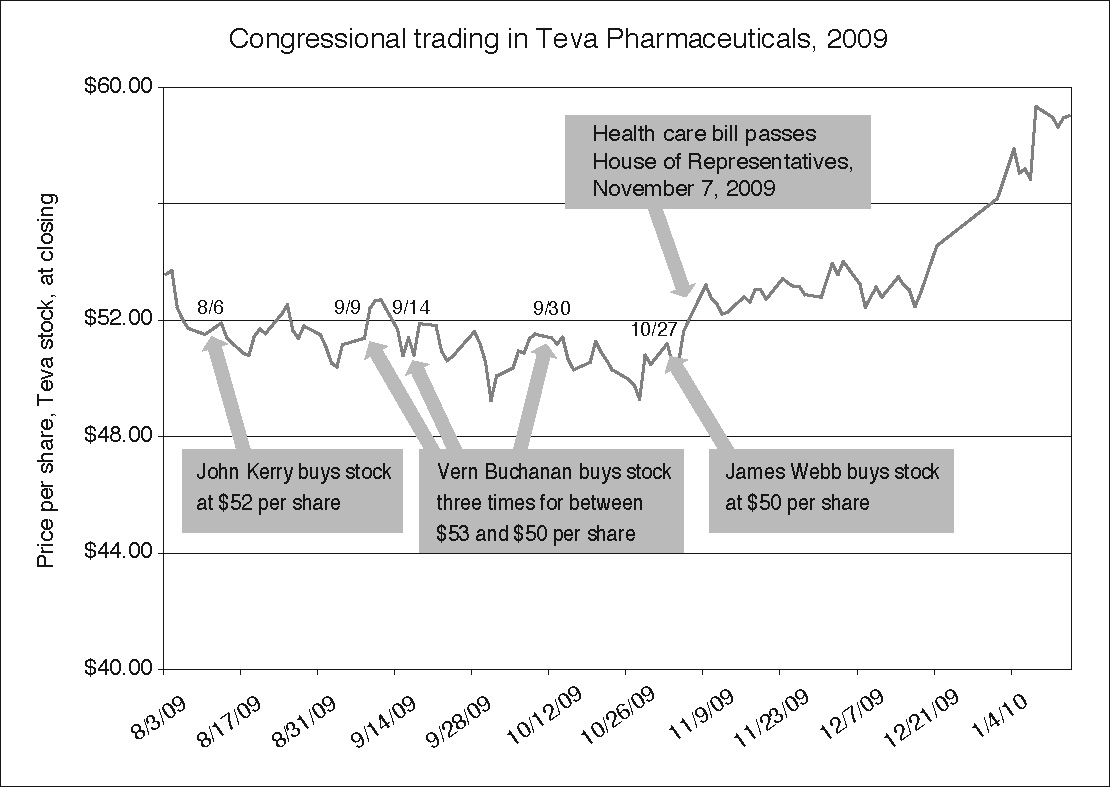

As the bill snaked its way through the House and Senate, where Kerry was actively pushing it, the Kerrys began buying stock in the drug maker Teva Pharmaceuticals as the prospects of its passage improved. In November alone they bought close to $750,000 in the company.

4

When the Kerrys first began buying shares, the stock was trading at around $50. After health care reform passed, it surged to $62. In 2010, after the reform bill was signed, the Kerrys sold some of their shares in Teva, reaping tens of thousands in capital gains. (It's unclear exactly how much because of the way the transactions are reported. Politicians are required to report ranges onlyânot exact dollar amounts.) And they held on to more than $1 million worth of Teva shares. All in all, health care stocks proved to be some of the Kerrys' best investments that year, in terms of return on investment.

To be sure, Senator Kerry wasn't the only congressional trader in pharmaceuticals. John Tanner of Tennessee, a member of the House Ways and Means Committee, bought up to $90,000 worth back in April 2009, when the House was approving reserve-fund budgeting for health care (part of the annual budget process). Also buying Teva were Senator Jim Webb of Virginia and Congressman Vern Buchanan of Florida. Unlike Kerry and Webb, however, Buchanan voted against the bill. Casting a vote is one thing; betting on the final tally is something else. Most members, most of the time, know full well which bills will pass before they cast their votes. Health care was such an important bill, and the Democrats had such a strong majority (even if Scott Brown's surprise election in Massachusetts denied them a supermajority of sixty votes in the Senate), that opposing members like Vern Buchanan could still place bets that the bill would eventually get to Obama's desk.

The very idea that politicians trade stocks while they are considering major bills comes as a shock to many people, but it is standard behavior in Washington. Senator Tom Carper of Delaware sat next to Kerry on the Senate Finance Committee's Health Subcommittee. Carper, more of a centrist than Kerry, was concerned about the public option. And according to former Senator Tom Daschle, who was a point man in the Obama administration's push to pass the bill, Carper was intimately involved in hammering together the health care bill throughout the spring, and summer of 2009. By the fall he'd joined a group known as the Gang of Ten, who were trying to bring about a compromise with Republicans.

5

PRIMING THE PUMP

Â

Â

Just a few weeks after three committees had approved health care bills in rapid succession, Carper began buying health care stocks that would benefit from the legislation he was supporting. He bought up to $50,000 in Nationwide Health Properties, a real estate investment trust that specialized in health careârelated properties. He also picked up shares in Cardinal Health and CareFusion. (As we will see, Cardinal was a popular investment choice for those involved in the health care debate.)

Congresswoman Melissa Bean of Illinois, a moderate, seemed torn over whether to vote for or against Obamacare. But her indecision didn't apply to her stock portfolio. Along with her husband, Bean traded shares as she watched the debate unfold in Washington. Indeed, although Bean and her husband are active traders, the

only stock purchases

they made during 2009 were in the health care sector. They bought shares in Cardinal Health, CareFusion, and two drug manufacturers, Mylan and Teva. Bean bought Teva in April at about $46 a share. After Obamacare passed, shares soared to more than $63. She bought Mylan when it traded at $14 a share. After Obamacare became law, it rocketed to $23 a share, up more than 50%.

6

One of the more creative and cynical plays on health care reform came from Congressman Jared Polis of Colorado. Polis is a young politician who had just taken his congressional seat in January 2009. But he was clearly seen as a rising star, with an appointment to the powerful House Rules Committee. He also sits on the House Democratic Steering and Policy Committee and on the Education and Labor Committee's Subcommittee on Healthy Families and Communities. Polis is wealthy. He grew up amid privilege, and his family became enormously rich after founding and later selling

Bluemountain.com

, the greeting card website.

Throughout 2009, Polis was a tireless advocate for Obamacare, declaring that health care reform "could not come at a better time." Polis sat on two House committees that were central to the crafting and passage of the health care bill. As a member of the House Education and Labor Committee, he was involved in shepherding through one of the three pieces of legislation that would become the final bill. And as a member of the powerful Rules Committee, he helped shape the parameters and procedures to secure passage of the bill in the House.

None of this gave him pause when it came to investing in health care companies as he helped determine the fate of Obamacare. While Polis was praising the benefits of health care overhaul, he was buying millions of dollars' worth of a private company called BridgeHealth International.

7

BridgeHealth describes itself as a "leading health care strategic consultancy." It works with companies to help them cut health care costs. One of the things that BridgeHealth offers is medical tourism: providing less expensive medical procedures in countries such as China, Mexico, India, Thailand, Costa Rica, and Taiwan. In other words, Polis was betting that there would be more, not less, medical tourism after the passage of health care reform. Companies in the medical tourism industry generally agreed, and favored Obamacare. They did not believe the bill would actually contain costs, and if anything, they expected overseas medical procedures to become more attractive.

Medical Tourism

magazine featured an article after the passage of the bill entitled, "Medical Tourism Expands as Alternative to Obamacare." As the article put it, "Interest in medical tourism has expanded rapidly as Americans react to the new federal law."

8

After the reform bill became law, BridgeHealth boasted that it was uniquely positioned to help companies cut medical costs. "What we can offer to the employer and insurer is health care reform today because we've addressed quality and cost," Vic Lazzaro, BridgeHealth's CEO, said in July 2010 after the bill was passed. "This is an opportunity to convert that Cadillac plan to a Buick because you can reduce that cost."

9

In all, Polis put between $7 million and $35 million into the company as the health care bill wended its way through Capitol Hill. When investment timing was crucial, Polis's purchases often coincided with the work of his committees. As the Education and Labor Committee considered health care reform in June and July, he made two large purchases of company stock, worth between $1 million and $5 million, on June 16 and 17. His committee passed the health care bill in mid-July. By October 2009, it was Polis's powerful Rules Committee that was determining which amendments would be considered and what the parameters of the debate would be as the House worked to pass the same legislation that was moving forward in the Senate. On October 13 and 23, Polis made two more purchases of shares worth between $1 million and $5 million. Polis's office, not surprisingly, insists that his investments had no influence on his vote. (It was all a coincidence!) But people do not make multimillion-dollar investments in a vacuum. And Polis was well positioned to know the details of the massive bill as well as what amendments would or wouldn't be considered.