The End of Growth: Adapting to Our New Economic Reality (35 page)

Read The End of Growth: Adapting to Our New Economic Reality Online

Authors: Richard Heinberg

Tags: #BUS072000

As World War II neared its end, Japan and the European powers lay in ruins; the United States was relatively unscathed. At the Bretton Woods monetary conference of 1944 the Allied nations laid the groundwork for a postwar international economic system that included new institutions such as the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (IBRD), which today is part of the World Bank. The US would assume a dominant role in these institutions, and the (partially) gold-backed dollar became, in effect, the world’s reserve currency. Throughout the next half-century and more, citizens and businesses in nations around the world — even in the Soviet Union — who wanted a hedge against instability in their own national currency would hoard US greenbacks.

In the early 1970s, as the US borrowed heavily to finance the Vietnam War, France insisted on trading its surplus dollars for gold; this had the effect of emptying out US gold reserves. President Nixon’s only apparent option was to ditch what remained of the gold standard. From then on, the dollar would have no fixed definition, other than as “the official currency of the United States.”

20

After 1973, many currencies kept a fixed exchange rate with the dollar. As of 2008, there were at least 17 national currencies still pegged to the US currency, including Aruba’s florin, Jordan’s dinar, Bahrain’s dinar, Lebanon’s pound, Oman’s rial, Qatar’s rial, as well as the Saudi riyal, –Emirati dirham, Maldivian rufiyaa, Venezuelan bolivar, Belize dollar, Bahamian dollar, Hong Kong dollar, Barbados dollar, Trinidad and Tobago dollar, and Eastern Caribbean dollar.

While the US dollar now had no gold backing, in effect it was being backed by the oil of several key Middle East petroleum exporting nations, which sold their crude only for US dollars (thus creating and maintaining a worldwide demand for greenbacks with which to pay for oil) and then deposited their enormous earnings in US banks, which in turn made dollar-denominated loans throughout the world — loans that had to be repaid (with interest) in dollars.

21

Meanwhile exchange rates for most currencies (including those of the European countries) floated relative to one another and to the dollar. This provided an opening for the emergence of the foreign exchange (ForEx) currency market, which has grown to an astonishing four trillion dollars per day in turnover as of 2010.

In 1999, most members of the European Union opted into a common currency, the euro, that floated in value like the Japanese yen. One of the motives for this historic monetary unification was the desire for a stronger currency that would be more stable and competitive relative to the US dollar.

For decades, China has been one of the countries that kept its currency pegged to the dollar at a fixed rate. This enabled the country to keep its currency’s value low, making Chinese exports cheap and attractive — especially to the United States.

However, for smaller countries, fixed exchange rates have meant vulnerability to currency attacks. If speculators decide to sell large amounts of a country’s currency, that country can defend its currency’s value only by holding a large cache of foreign reserves sufficient to keep its fixed exchange rate in place. This reserve requirement effectively ties the country’s leaders’ hands during the attack, preventing them from spending (for example, to prop up banks); if the pegged exchange rate is abandoned under such circumstances, the currency’s value will plummet. Either way, the nation faces the risk of economic depression or collapse — as occurred in the cases of the recent Argentine and East Asian financial crises.

Altogether, the world’s currencies could hardly even be said to comprise a coherent “system”: harmony and functionality are maintained only at great cost (with most of that cost ending up as profits to currency traders and speculators). But as world economic growth shifts into reverse, stresses within the global community of currencies may become unbearable.

With its enormous levels of public and private debt and its continuing trade deficits, the US has something to gain from a lower-valued dollar. This would make its export goods more attractive to foreign buyers; meanwhile, by making imports more expensive, it would help encourage savings and investment in domestic production. It would also enable the country to pay back its government debt with currency of lower value, effectively wiping out part of that debt. Maintaining low interest rates helps reduce the dollar’s value, and the United States has kept interest rates low since the start of the crisis. But the US doesn’t want to announce to the world that it is seeking to trash the dollar, because this could reduce the dollar’s viability as the world’s reserve currency — a status that yields multiple advantages to America’s economy, and one that is increasingly being challenged.

22

Investment money tends to “chase yield,” which has the effect of driving up the value of the currencies in countries where investment opportunities and higher yields are to be found — currently, the young, industrializing countries of Asia. China and the other industrializing nations are responding by doing everything they can to keep exchange rates for their currencies low relative to the dollar so as to maintain trade advantages and reduce the impacts of an influx of yield-seeking money.

China has led the way in the international competition to weaken national currencies, but Japan and the US are seeking to lower the value of the yen and the dollar, respectively. According to Bill Black, writing in

Business Insider

on December 13, 2010,

The EU, taking its lead from Germany, has allowed the Euro to appreciate against many currencies. Germany’s high-tech exports can survive a strong Euro, but Greece, Spain, and Portugal cannot export successfully under a strong Euro and their already severe economic crises can become much worse. The Irish will have serious problems, and their export problems would have been crippling if they were not a corporate income tax haven. Italy’s, particularly southern Italy’s, ability to export successfully is dubious.

23

If the US dollar tumbles, that hurts China and other countries with fixed exchange rates; they feel pressured to drop their peg or revalue their currencies higher. Countries whose currencies are pegged to the dollar have had to resort to currency interventions and a massive buildup of foreign reserves to stop their currencies from appreciating. This is inflationary for those countries, and is one reason for the housing and equities boom in Asia.

24

China’s way of pushing back against a lowering of the dollar’s value is its threat of ceasing to purchase US Treasury debt (which it has in fact partly done). If neither the United States nor the industrializing nations back down, the result could be a final refusal of the latter nations to continue funding deficits in the US.

25

As the US dollar has weakened, it has done so only against those currencies that are free-floating. This has meant that countries like Japan and Germany have had to endure upward pressures on the value of their currencies. German Finance Minister Wolfgang Schäuble, interviewed in November 2010, had harsh words for his American counterparts, noting that “The US lived on borrowed money for too long,” and adding that:

The Fed’s decisions [to buy US Treasury debt] bring more uncertainty to the global economy. They make it more difficult to achieve a reasonable balance between industrialized and emerging economies, and they undermine the US’s credibility when it comes to fiscal policy. It’s inconsistent for the Americans to accuse the Chinese of manipulating exchange rates and then to artificially depress the dollar exchange rate by printing money.

26

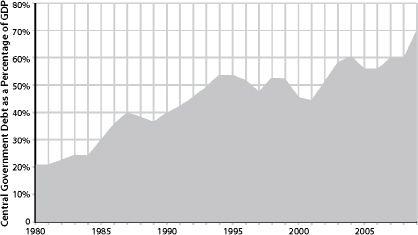

FIGURE 42.

OECD Government Debt as a Percentage of GDP, 1980–2009.

By 2009, the governments of the 34 OECD member countries held debts equal to 70 percent of their combined GDP. Source: Organization for Economic Co-operation and Development (OECD).

Meanwhile, also in November 2010, China and Russia ceased using the dollar in bilateral trade, with Russian Prime Minister Vladimir Putin declaring that his country might eventually adopt the euro. Even though Russia is not one of China’s top trading partners and is unlikely to be welcomed into the eurozone anytime soon, its leaders’ hostility to the dollar helps exacerbate discontent elsewhere. If China excludes dollar trades with other primary non-US trade partners there may be a reason for Washington to worry. For now, Beijing appears merely to be letting off steam with no serious intent of isolating the United States, or of causing its nearly $3 trillion in US foreign exchange reserves to lose a significant portion of their value.

Thus for the time being, pundits who warn of wider and worse currency wars leading to trade or military conflicts may be exaggerating the threat.

27

Currency and trade wars are not in anyone’s interest. A trade war between the US and China, for example, would reduce the GDP of both countries — and China would have more to lose than the United States. As long as cool heads prevail, currency conflicts are not likely to get out of hand. Of course, there is always the possibility that cooler heads may

not

prevail — especially in the politically volatile US, where members of Congress posture by threatening to refuse to raise the debt ceiling.

Over the longer term, the ecosystem of world currencies faces increasing dangers if growth fails to return in the US, and if the Chinese economic juggernaut falters.

Debt-based currencies that are traded without any clear international exchange standard create an inherently unstable situation. The so-called “goldbugs,” economists who advocate a universal return to the gold standard, have plenty of grounds for criticizing free-floating currencies, but their alternative is simply not a realistic option: there isn’t enough gold in the world to support anything like current levels of trade and investment, and much of the gold that exists is held in enormous reserves where it can do little good as a medium of exchange. The transition from the present system back to a gold standard would be intolerably chaotic, if it is even theoretically possible. Other kinds of fundamental national and global currency reforms (such as we will touch upon in the next chapter) may have better practical prospects over the long run, but are currently outside the realm of serious discussion among policy makers.

Without a return to economic growth, there is no sufficient remedy for the rapidly worsening stresses between and among the world’s currencies. The lid can probably be kept on this boiling kettle in the short term, but over the course of the next decade it becomes more and more likely that something will give way.

Post-Growth Geopolitics

As nations compete for currency advantages, they are also eyeing the world’s diminishing resources — fossil fuels, minerals, agricultural land, and water. Resource wars have been fought since the dawn of history, but today the competition is entering a new phase.

Nations need increasing amounts of energy and materials to produce economic growth, but — as we have seen — the costs of supplying new increments of energy and materials are increasing. In many cases all that remains are lower-quality resources that have high extraction costs. In some instances, securing access to these resources requires military expenditures as well. Meanwhile the struggle for the control of resources is re-aligning political power balances throughout the world.

The US, as the world’s superpower, has the most to lose from a reshuffling of alliances and resource flows. The nation’s leaders continue to play the game of geopolitics by 20th-century rules: They are still obsessed with the Carter Doctrine and focused on petroleum as the world’s foremost resource prize (a situation largely necessitated by the country’s continuing overwhelming dependence on oil imports, due in turn to a series of short-sighted political decisions stretching back at least to the 1970s). The ongoing war in Afghanistan exemplifies US inertia: Most experts agree that there is little to be gained from the conflict, but withdrawal of forces is politically unfeasible.

The United States maintains a globe-spanning network of over 800 military bases that formerly represented tokens of security to regimes throughout the world — but that now increasingly only provoke resentment among the locals. This enormous military machine requires a vast supply system originating with American weapons manufacturers that in turn depend on a prodigious and ever-expanding torrent of funds from the Treasury. Indeed, the nation’s budget deficit largely stems from its trillion-dollar-per-year, first-priority commitment to continue growing its military-industrial complex.