I.O.U.S.A. (24 page)

Authors: Addison Wiggin,Kate Incontrera,Dorianne Perrucci

Tags: #Forecasting, #Finance, #Public Finance, #Economic forecasting - United States, #General, #United States, #Personal Finance, #Economic Conditions, #Economic forecasting, #Finance - United States - History, #Debt, #Debt - United States - History, #Business & Economics, #History

O ’ Neill told us that he agreed that the economy was up to the fi rst round of tax cuts. When these fi rst cuts came through, the United States was in surplus condition, and on top of that, taxes had crept up above 20 percent of GDP.

Historically, 18 percent of GDP is healthy for the economy, provided the government can keep its spending in check. Even more would be healthier.

However, as Bush began to argue for further cuts, O ’ Neill became concerned.

“ I honestly

didn ’ t think that was the right thing

I argued during the second half

to do because I continue to believe

of 2002 that we should not have

we needed the revenue that we

another tax cut because we needed

were then collecting to work on

the money to work on important

policy issues that would shape

the Medicare/Social Security prob-

the nation going forward, and we

lems, ” he explained. “ To work on

needed to have, in effect, “ rainy

fundamental tax redesign after 9/11

day money ” for the prospect of Iraq

while worrying about whether there

and another set of attacks like 9/11.

was going to be another attack or

— PAUL O ’ NEILL

a series of attacks would cost hun-

dreds of billions of dollars.

This was not a popular view, and it led to the now infamous discussion that the former Treasury secretary had with Vice President Cheney on the effect of tax cuts on defi cits.

O ’ Neill tried to warn the administration that the budget defi cit was expected to top $ 500 billion in 2002 alone. Since Americans were paying low taxes now, he argued that their children and grandchildren would have to pay off their debt by paying higher taxes in the future. He also argued that Social c05.indd 79

8/26/08 9:00:52 PM

80 The

Mission

Security and Medicare were in dire need. Since the economy

Ronald Reagan

proved defi cits

was going to be in the positive territory and would likely stay

don ’ t matter?

that way for the next couple of years, why risk a budget defi cit

During Reagan ’ s

and add more to the national debt?

tenure at the White

At this point in the conversation, the Vice President cut

House, the United

O ’ Neill off and uttered the now infamous words:

“ When

States ran very

large defi cits, and

Ronald Reagan was here . . . ” According to O ’ Neill, Cheney

those within that

said that “ he proved that defi cits don ’ t really matter and so

administration

it ’ s not a consideration or a good reason not to have an addi-believe that there

tional tax cut. ’ ”

was very little

short - term effect

“ I was honestly stunned by the idea that anyone believed

on the economy.

that Ronald Reagan proved in any fashion that defi cits don ’ t

More importantly,

matter, ” said O ’ Neill. “ I think it is true on a temporary basis

there was no

that a nation can have a defi cit and have a good reason for

political backlash

having a defi cit. I think with the Second World War there was

from running

these large and

no way we could avoid having a defi cit, but when we came

persistent defi cits.

out of the Second World War we started running budget sur-The government

pluses again and did that through the 1950s and into 1960.

and the American

It ’ s interesting, it ’ s really only been in the past forty years or so

people had become

that we ’ ve accepted the notion that it ’ s a bipartisan thing that

desensitized to the

numbers.

we don ’ t have to have fi scal discipline. ”

This heated conversation over further tax cuts carried on until the end of 2002, until O ’ Neill received a phone call from the vice president telling him that the president had decided to make some changes — and he was one of them. He requested that O ’ Neill come and meet with the president and then issue a release saying that he had decided to go back to the private sector.

“ You know, for me to say that I ’ ve decided to leave the Treasury is a lie, ” O ’ Neill told us candidly, “ and I ’ m not into doing lies and so that was it. I went back to my offi ce, packed up my briefcase and went down to the parking space that ’ s reserved for the secretary of the Treasury, got in my car, and drove back to Pittsburgh.

“ It was the fi rst in my life . . . I ’ ve ever been fi red before.

I ’ d only been promoted to ever higher levels of responsibility, c05.indd 80

8/26/08 9:00:52 PM

Chapter 5 The Leadership Defi cit

81

but it was okay with me. I would have really been uncomfort-

Medicare:

able arguing for policies I didn ’ t believe in. ”

Initiated in 2006,

O ’ Neill believes the path the United States is head-

this federal drug

ing down — burdening our children with a massive national

program subsidizes

the costs of

debt and soaring defi cits — is unsustainable, to say the least.

prescription drugs

Americans need to understand what is happening in this

for Americans

country, he told us, because the government doesn ’ t have any

who are Medicare

money “ that it doesn ’ t fi rst take from its taxpayers. ”

benefi ciaries. Since

its inception, the

“ A year ago [in 2006] there was this signing ceremony in

program spending

the Rose Garden for the new prescription drug entitlement and

is running around

it ’ s going to cost us trillions of dollars, ” O ’ Neill recalled. “ This

$ 40 billion per year

event was not unlike any of the others in the Rose Garden on

(2008 is projected

a nice sunny day, with the president sitting at the signing table

to be $ 36 billion)

and the total

with a bunch of grinning legislators behind him taking credit

unfunded liability

for this ‘ great gift ’ they ’ re giving the American people. There

for this program

was no mention of the fact that this in effect was a new tax

is greater than

on the American people, and we didn ’ t know how we were

the entire Social

going to pay for it. It was only grinning presidents and legisla-

Security trust fund.

tors taking the credit for a gift, which strikes me as a ridiculous continuing characteristic of how we do political business in our country.

“ When we, the Bush 43 adminis-

We only need to look at the fate

tration, took over, we had something

of other countries who ’ ve lived

over $ 5 trillion, maybe $ 5.6 trillion

beyond their means for a long time

you inevitably get into trouble.

worth of national debt. Today, the

When you get extended to the

number ’ s $ 8.8 trillion. That ’ s not an

point that you can ’ t service your

innocent change, it is a monumen-debt, you ’ re fi nished.

tal change in the debt service that we

— PAUL O ’ NEILL

have to do in addition to and on top

of all of the other things that our country needs to do. We only need to look at the fate of other countries who ’ ve lived beyond their means for a long time before you inevitably get into trouble. When you get extended to the point that you can ’ t service your debt, you ’ re fi nished. ”

The United States runs a great risk of following in the foot-steps of other democracies that have descended and decayed.

c05.indd 81

8/26/08 9:00:52 PM

82 The

Mission

“ If you look at what ’ s happened to great republics in the past, ” says David Walker, “ they generally have not fallen because of external threats. They ’ ve fallen because of internal threats. Let ’ s look at Rome as an example, which is the longest - standing republic in the history of mankind. The Roman republic fell for many reasons but three seem to resonate today: declining moral values and political civility at home; overconfi dent and overextended militarily around the world; and fi scal irresponsibility by the central government. You know we need to wake up, recognize reality, and make sure that we start making tough choices sooner rather than later so that we can be the fi rst republic to stand the test of time. ”

“ Washington Is Badly Broken ”

Paul O ’ Neill refused to compromise when it came to making decisions that he knew would affect not only Americans today, but also future generations. David Walker and the Fiscal Wake - Up Tour participants have a similar goal. By warning Americans about what is ahead for their country if action isn ’ t taken now, and educating them on the fi scal problems the United States has, they hope to empower the average citizen to become involved in insisting that changes are made. And from what we saw, the attendees at the town hall meetings they were hosting were ready for a change.

By the time we joined them at a town hall meeting in Los Angeles, after 18 months of intermittent fi lming, the Fiscal Wake - Up Tour had visited 23 cities.

“ It ’ s a lot of fun being able to get out and meet people, ”

says David Walker. “ It gives you a lot of energy and it gives you a lot of hope. When you state the facts and speak the truth to the American people, they get it and they ’ re ahead of their elected offi cials. We can ’ t borrow our way out of this problem.

Anyone who tells you we can does not study economic history and is probably not very good at math. ”

c05.indd 82

8/26/08 9:00:53 PM

Chapter 5 The Leadership Defi cit

83

“ Here ’ s the thing about the future, ” Bixby chimes in. “ If you knew that a levee was unsound and you knew people were moving into the area and you knew they were at risk, would you stand by and do nothing and say nothing about it?

Of course not — that would be irresponsible. Yet that ’ s what we ’ re doing as a nation to the future. We know we have this problem, we know that the fi scal/federal levees are unsound, we know that the structure ’ s not sound for the long term. And yet we ’ re ushering future generations in and saying nothing about it, doing nothing about it, and that ’ s the immoral part of it. ”

Indeed, Washington is “ badly broken, ” as David often says in his presentations at the town hall meetings and in interviews.

Americans can ’ t continue to rely on their government to make the tough choices that are needed to restore the U.S. economy.

When many Americans think of debt and defi cits, their knee -

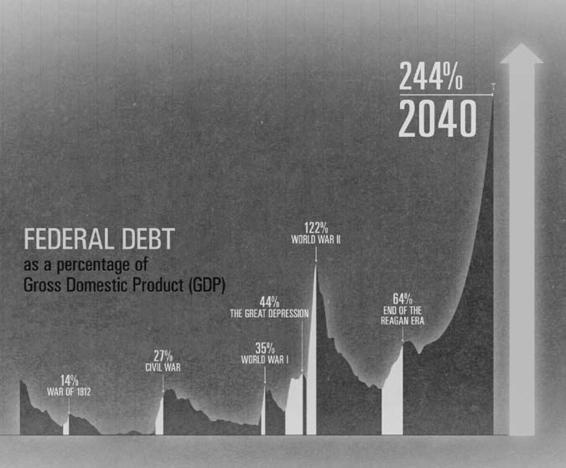

jerk reaction is to blame it on the war in Iraq, or on defense spending. Some people think that we can solve the country ’ s fi nancial problems by stopping fraud, waste, and abuse, or by canceling the Bush tax cuts. The truth is, the United States could do all three of these things and still would not come close to solving the nation ’ s fi scal challenges. (See Figure 5.1. )

2008 Federal Debt $9.7 TRILLION

2008 Federal Spending $2.9 trillion

Social Security $610 billion

Defense Department $479 billion

Medicare $330 billion

Interest on the Debt $244 billion

2008 Budget Items

(a partial list)

Source: President's 2009 Budget

Figure 5.1

Where the Money Goes c05.indd 83

8/26/08 9:00:53 PM

84 The

Mission

The United States already has

$ 11 trillion in fi scal

liabilities, including public debt. To this amount, add the current unfunded obligations for Social Security benefi ts of about $ 7 trillion. Then add Medicare ’ s unfunded promise: $ 34 trillion, of which about $ 26 trillion relates to Medicare parts A and B, and about $ 8 trillion relates to Medicare D, the new prescription drug benefi t which some claimed would save money in overall Medicare costs. Add another trillion in miscellaneous items and you get $ 53 trillion. The United States would need $ 53 trillion invested today, which is about $ 175,000 per person, to deliver on the government ’ s obligations and promises.

How much of this $ 53 trillion do we have? Nada.

“ By the time today ’ s college graduates are ready to retire forty years from now, ” says David Walker, “ the only things our government will be able to pay for are interest on the federal debt and some of the Social Security, Medicare, and Medicaid benefi ts. All other parts of the federal government will be closed and out of business! ”

As far as taxes go, the United States would have to raise income tax rates across the board by about 2.5 times today ’ s levels to close the fi nancing gap — and some politicians complain when there is any talk of tax increases. Americans are facing a 150 percent increase in federal taxes if they continue down this road. By the year 2048, the United States ’ debt - to -

GDP ratio will be over 400 percent, more than two times the debt levels we hit at the height of World War II. Good luck trying to get any country to lend the United States money then.

No matter which way you slice it, whether you are a Democrat or Republican, the magnitude of this fi scal challenge is much larger than most realize.

For example, let ’ s assume that the Bush tax cuts expire at the end of 2010. That would only solve about 10 percent of the country ’ s federal fi nancial hole. And what about Iraq? Even if the Iraq War ended in 2009, the ultimate estimated cost over time is less than 3 percent of our total fi nancial problem.

America ’ s budget, savings, trade, and leadership defi cits individually are bad enough, but in combination they create c05.indd 84

8/26/08 9:00:53 PM