I.O.U.S.A. (20 page)

Authors: Addison Wiggin,Kate Incontrera,Dorianne Perrucci

Tags: #Forecasting, #Finance, #Public Finance, #Economic forecasting - United States, #General, #United States, #Personal Finance, #Economic Conditions, #Economic forecasting, #Finance - United States - History, #Debt, #Debt - United States - History, #Business & Economics, #History

Some would argue that the dollar is being kept weak to help close the trade gap. “ If I could fi nance all my own consumption today by handing out something called Warren Bucks or Warren IOUs and I had the power to determine the value of those IOUs over time, believe me, I would make sure that when I repaid them ten or twenty years from now that they were worth less, per unit, than they are today. So any country that piles up external debt will have a great temptation to infl ate over time, and that means that our currency, relative to other major currencies, is likely to depreciate over time. ”

And this is just what the United States is doing. From November 2002 through August 2008, the dollar has fallen more than 50 percent aganist the euro. Some experts will argue that a weaker dollar benefi ts the United States — at least where the trade defi cit is concerned.

What is not pointed out in this argument is that a falling dollar paired with low domestic productivity means that the c04.indd 62

8/26/08 8:59:53 PM

Chapter 4 The Trade Defi cit

63

country is consuming more than it produces. In that sense, since the dollar is losing purchasing power, Americans are paying more for these imports, and the rise in these import costs erases any sort of benefi ts the country would have seen because of a falling dollar. In other words, America is getting

Purchasing

fewer goods for the same amount of money — but that isn ’ t

Power:

What

slowing down the rate of American consumption. “ In the past

money is

considered to be

six or eight years, ” Buffett explains, “ the United States has

worth, as measured

started consuming considerably more then it produces. It ’ s

by the quantity and

relied on the labor of others to provide things that are used

quality of products

every day. Because the country is so rich, this can continue for

and services it

a long time, and on a large scale — but not forever. ”

can buy.

Buffett likens it to a credit card. “ My credit ’ s pretty good at the moment, ” he says, which usually draws snickers from the audience. “ If I quit working and have no income coming in but keep spending, I can fi rst sell off my assets and then, after that, I can start borrowing on my credit card. And if I ’ ve got a good reputation, I can do that for quite a while. But at some point, I max out. At that point, I have to start producing a whole lot more than I consume in order to clean up my debts. ”

The trade defi cit aside, Buffett doesn ’ t believe that the economic situation in the United States is as dire as many of the other experts with whom we ’ ve spoken have made it out to be. While he warns to not “ bet against America ” because he believes that we have an overall healthy economy, what does keep the Oracle of Omaha up

at night is the imbalance between

imports and exports.

The rest of the world is buying

“ The rest of the world is buying

more and more of our goods all

more and more of our goods all the

the time, but at an even greater

rate, we ’ re buying more and more

time, but at an even greater rate, we ’ re

of theirs. More trade, overall, is

buying more and more of theirs.

good — as long as it ’ s true trade.

More trade, overall, is good — as long

If it ’ s pseudo trade, where we ’ re

as it ’ s true trade. If it ’ s pseudo trade,

buying, but not selling, I do not

where we ’ re buying but not selling, I

think that ’ s good over time.

do not think that ’ s good over time. ”

— WARREN BUFFETT

c04.indd 63

8/26/08 8:59:53 PM

64 The

Mission

This is why the U.S. trade defi cit remains high. The United States is consuming more than we are producing. The country ’ s dependence on foreign oil, automotive parts, and cheap consumer products from China accounts for almost the entire defi cit.

Welcome to Thriftville

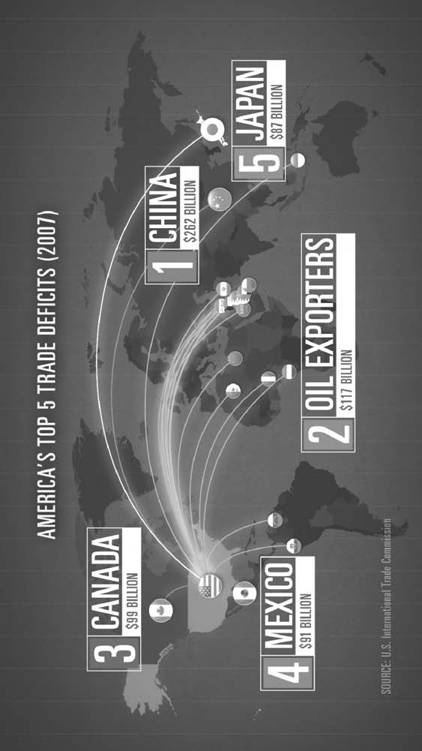

Although the United States is China ’ s largest export market, it is importing far more Chinese products than it is exporting to the Far East. In order to fuel America ’ s consumption, the Chinese are the second - largest holders of U.S. Treasury Securities after Japan. In less than 10 years, China ’ s ownership of U.S. securities has gone from around $ 50 billion to more than $ 500 billion. And the economic ties between the two countries are getting tighter every day. (See Figure 4.1. ) In the past few years, China has become the country to watch. In Jonathan Fenby ’ s book

Modern China: The Fall and

Rise of a Great Power, 1850 to Present

(Harper Perennial, 2009), he points out that “ in 2007, for the fi rst time since the 1930s, another country contributed more to global growth than the United States. A Gallup poll in early 2008 reported that 40 percent of Americans considered the [Peoples ’ Republic of China] to be the world ’ s leading economic power, while only 33 percent chose their own country. ”

And who could blame them? China has been the world ’ s leading producer of commodities such as steel, copper, aluminum, and coal for years. The country has edged out Japan as the second - largest importer of petroleum — and this from a country whose vast majority, just a decade ago, didn ’ t even own cars!

The Chinese manufacturing sector is putting the United States to shame — and in 2007, the country had the largest trade surplus in the world (the United States ranked dead last).

Of course, the idea of China “ taking over the world ” has provided those in the fi nancial media with plenty of fodder over the past three years or so. One such writer is James Areddy, c04.indd 64

8/26/08 8:59:53 PM

rade Commission.

cit Chart

Trade Defi

4.1

U.S. International T

Figure

Source:

65

c04.indd 65

8/26/08 8:59:53 PM

66 The

Mission

who was part of the Pulitzer Prize – winning team at the

Wall

Street Journal

that chronicled the effects of China

’ s rush to

capitalism.

“ China ’ s probably the biggest global economic story that there is going right now. It affects everything from big business, Wall Street, to down - home America, ” Mr. Areddy told us in his offi ce in Shanghai.

We traveled to Shanghai, China, to get a fi rsthand glimpse of this economic boom. The country was bounding with energy. As we walked through the streets, we got the feeling this is what it would have been like to witness the United States ’ Industrial Revolution. Around every corner was a construction crane, putting in new skyscrapers.

While we were in China, we were introduced to one gen-tleman, David Chia, who embodied what most would consider the American entrepreneurial spirit.

“ I have a mission, ” he told us, while we drove to visit the worksite of his new factory. “ We want to make a brand name, we want to make a good factory. We want to make some nice

We noticed

something that is

products. We want to catch up with somebody in front of us.

uniquely Chinese:

We know what our future is, and frankly, I never imagined

By and large, they

I could own such a land and make such a big building. ”

save their money —

While the Chinese may embody the pursuit of the

even if it means

American Dream, we noticed something that is uniquely

living with a sort of

frugality that would

Chinese: By and large, they save their money

— even if it

never cross most

means living with a sort of frugality that would never cross

Americans ’ minds.

most Americans ’ minds.

While touring Mr. Chia ’ s existing factory, where they made light bulbs, we sat down with a young Chinese couple to ask them what everyday life is like for them. The young man told us, “ Saving money is one of the Chinese traditions. We each make ten dollars a day. After paying our bills, we can save more than half our earnings. We know what a rainy day looks like so we know how important it is to save. Everyone should have a goal in life. Our goal is to live in a quiet neighborhood.

Or maybe have a car. ”

c04.indd 66

8/26/08 8:59:54 PM

Chapter 4 The Trade Defi cit

67

Although the Chinese had different attitudes about saving their money and were much more willing to live a very simple life, without many personal belongings, there are some striking similarities between the Chinese and American people. Our visit to Shanghai showed us that Chinese people are worried about the same things that Americans worry about: their health care, their retirement, and how to boost their income. However, what scares a lot of Americans about China ’ s growing prowess — and the $ 1 trillion - plus in foreign exchange reserves — is that a lot of that money is invested in U.S. Treasury bonds and U.S. government debt.

“ A lot of people worry that

A lot of people worry that some-somehow China ’ s going to suddenly

how China ’ s going to suddenly

ask for its money back and walk

ask for its money back and walk

away from the U.S. economy, ” said

away from the U.S. economy. One

Mr. Areddy.

“ One wouldn

’ t exist

wouldn ’ t exist without the other,

and I think, increasingly, the rela-without the other, and I think,

tionship between China and the

increasingly, the relationship between

United States is growing tighter —

China and the United States is grow-

at least economically.

ing tighter — at least economically. ”

— JAMES AREDDY

We Think, They Sweat

In China, the emphasis is very much centered around saving and preparing for the future. We know that in America, the opposite is true. The United States is focused on consumption and living in the now. However, if the country is going to fi nance its debt and have any chance of meeting its long -

term obligations to its retiring elderly or underprivileged, the United States should be hard at work producing more than it consumes. But, as we learned when we visited a scrap process-ing facility outside of Long Beach, California, that is simply not the case.

Kramer Metals buys scraps — we saw mostly metal and aluminum in the yard — and processes it in a form that steel mills, aluminum mills, and copper and brass foundries can c04.indd 67

8/26/08 8:59:54 PM

68 The

Mission

consume in their furnaces to produce new metal. This material then goes to China, Korea, Thailand, and is now starting to ship into Vietnam, India, and some into Japan. This scrap metal is being consumed by what would otherwise be a U.S.

mill — now those materials are going to foreign mills.

“ We ’ ve killed our industrial base, ” the owner of the facility, Doug Kramer, told us. “ We ’ ve killed, or are killing, what made us a great nation. We ’ re giving it to China, to India, to all the other nations of the world to produce our goods. We ’ re a net importer when we should be a net exporter.

“ The only thing we ’ re net exporting is scrap. ”

In 2007, the largest U.S. export to China was electrical machinery. Right behind it was nuclear machinery, and coming in third was scrap metal. Instead of producing things of value, the United States is consuming products from all over the world and sending back scrap.

For a time, there was a theory circulating among economists suggesting that the United States could innovate its way out of a slowing economy. “ We think, they sweat ” was a popular refrain. Unfortunately, there ’ s a lot at play in the global economy. Who ’ s to say the Chinese won ’ t think and sweat, too? As China, India, Brazil, and the Middle East economies develop their own domestic demand, they are less and less dependent on U.S. consumption to fuel their economies. The United States, however, is increasingly dependent on cheap goods from abroad.

The bottom line: The United States is not manufacturing goods the way that it used to. And this is having a very real and very serious effect on the economy and on the citizens ’ — especially the working class ’ s — quality of life. A recent study by the Economic Policy Institute showed that between 2001 and 2007, the United States lost 2.3 million jobs, including 1.5 million manufacturing jobs. As the China story is illustrating, part of being seen as a strong nation is showing that you bring something to the table. Production in the United States is dwindling, and with it goes the strength of the U.S. economy.

c04.indd 68

8/26/08 8:59:55 PM

Chapter 4 The Trade Defi cit

69

Likewise, as trillions of dollars have been shipped overseas to buy goods, a different, more ominous threat has arisen.

The Nuclear Option

Given the stagnant pool of savings in the United States, every year that we run budget or trade defi cits, we have to borrow that money from somewhere.