Fooling Some of the People All of the Time, a Long Short (And Now Complete) Story, Updated With New Epilogue (26 page)

Authors: David Einhorn

Tags: #General, #Investments & Securities, #Business & Economics

On November 18, 2003, I asked Walton about BLX’s cash flow at an investment conference sponsored by Merrill Lynch. He responded, “It is generating enormous amounts of cash” and “is generating great cash flow, great earnings and pays a dividend.” Walton’s statement was a gross mischaracterization of the facts. As shown in

Table 20.3

, Allied’s SEC disclosures indicated that BLX actually burned cash, since 63 percent of revenues and 181 percent of EBITM were non-cash. BLX required additional bank loans and further direct investment from Allied to fill the hole.

Table 20.3

BLX Noncash Revenue

Note:

Dollars in millions

| Total Revenues | 108.3 | (A) |

| % Cash Including Cash from Residuals | 83% | (B) |

| Cash Revenue Incl. Cash from Residuals | 89.9 | (C) = A * B |

| Cash from Residuals | 49.3 | (D) |

| Cash Revenues | 40.6 | (E) = C – D |

| Noncash Revenues | 67.7 | (F) = A – E |

| EBITM | 37.5 | (G) |

| Noncash Revenue/Total Revenue | 63% | (H) = F / A |

| Noncash Revenue/EBITM | 181% | (I) = F / G |

We were able to estimate that BLX recognized revenue of approximately 15 percent on every loan it originated. How could loans with a four-year average life and an interest rate cap of prime plus 2.75 percent be worth 15 percent more than the face value of the loan? Here’s how: The SEC filings revealed that BLX achieved average origination fees and premiums of about 6 percent for selling the guaranteed pieces, plus BLX booked approximately 9 percent of non-cash residuals on every loan. Considering that BLX sold the most valuable portion—the guaranteed piece—it was not reasonable to book the smaller, riskier, unguaranteed piece, and the servicing, at such a high value. BLX could only achieve this through the magic of gain-on-sale accounting supported by super-aggressive assumptions.

While we waited for the SEC to act, Steve Bruce from Abernathy McGregor, Greenlight’s public relations firm, suggested we meet with Kurt Eichenwald from

The New York Times

. Eichenwald had a reputation as an intelligent bulldog, unafraid of investigating crooked companies, and was in the process of writing

Conspiracy of Fools

about the Enron fraud.

Eichenwald invited us to Dallas, where he worked, to meet. Bruce, Jock Ferguson of Kroll, and I flew to Dallas to meet Eichenwald in October 2003. We met at the Crescent Hotel in Dallas for about five hours. We presented the Allied and BLX stories of fraudulent loans and accounting. Ferguson went through the Kroll report with Eichenwald, and we also gave him a copy of some of the SEC letters and the BancLab report.

“Take me through this,” he asked Ferguson. “How did this work?”

Eichenwald seemed interested in the drug den motel loan and the Detroit gas station frauds. He wanted all the details. Eichenwald’s questions were excellent. He had seen this before and knew how to report this kind of story. He was energized and intrigued. Sitting on the couch reading the documents, he was animated. “This is unbelievable,” he said. “Wow. This is great. I love this.”

“What is the SEC doing about this? Why can’t they figure this out? Why didn’t

The Wall Street Journal

jump all over this?”

By the end of the meeting, he said, “I’m going to do it, but I want an exclusive.”

“Sure,” I said. “That’s not a problem.”

He told us that reporting this sort of story takes a long time, but promised that if the facts checked out, he would definitely write it. I left the meeting thinking that we would see something in about six months.

Months went by . . . nothing. At Eichenwald’s request, we kept sending more documents and updates as the story progressed, and he kept enthusiastically expressing that he wanted all the information. Eichenwald claimed he was working on it, but none of the sources we’d suggested he contact said he had called. Not a good sign.

CHAPTER 21

A $9 Million Game of Three-Card Monte

Sometimes, revealing events come from the most insignificant places. Jim Brickman, the retired real estate developer from Dallas who had continued to independently research Allied and BLX, found one of those places in early 2004.

He had been digging through court records of the bankruptcy proceedings of bad BLX loans. In the bankruptcy of a convenience store called Trilogy Conifer in Colorado, lawyers for Allied, rather than BLX, had oddly showed up in court to collect on the loan. Allied told the judge that it owned the loan and submitted the proof to the court. It was a short, but revealing, document: Allied told the court that BLX assigned Allied ten loans, including this one, with balances of $9,062,489, in exchange for Allied forgiving the same amount of BLX’s debt to Allied. The document, dated February 3, 2003, was signed by Sweeney for Allied and by Tannenhauser for BLX. Why would Allied accept a defaulted loan from BLX for full value? Were the other loans in similar shape?

Brickman and I tried to get information on the ten loans. Several appeared on BLX’s August 2001 delinquency report. We were able to find nine of them and all defaulted long before BLX assigned the loans to Allied in February 2003. A look at the court records clearly showed that these were not only troubled loans, but that there was no way anyone other than Vito Corleone could have expected repayment.

Why did Allied accept these loans? My first instinct was to believe they did it to mask BLX’s deteriorating situation. As Allied valued BLX at a minimum of eleven times earnings, a $9 million loss at BLX translates to a $99 million valuation loss for Allied. So shifting the loss from BLX to Allied enabled Allied to value BLX $99 million higher. In contrast, if Allied owned the loans, it would only be a $9 million loss on its books.

Table 21.1

lists the transferred loans.

Table 21.1

Bad Loans Transferred to Allied

| Company | Amount |

| Au Gres Pinewood Inn, Best Western Pinewood Lodge | $1.0 million |

| Avant-Garde Enterprises | $0.4 million |

| Dibe’s Petro Mart | $1.0 million |

| Farmer House Foods and XTRA Foods and Orchard Food Center | $1.0 million |

| Federal One Stop and William Grossi | $1.0 million |

| The Kelfor Companies | $1.1 million |

| The Learning Center at Birch Run’s Playpark | $1.0 million |

| The Links at Birch Run’s Playpark | $1.0 million |

| Trilogy Conifer | $1.0 million |

| 1750 Woodhaven Drive and the ATS Products Corporation | $0.5 million |

In the Trilogy Conifer bankruptcy in 2002, the company already owed Allied $1 million on a promissory note from December 1998. As of August 2003, Allied was owed $1.2 million, but was second in line to BLX, which was owed about $1.1 million plus legal fees and costs on an apparently separate loan.

In a legal proceeding Trilogy filed against Allied, Trilogy claimed that Allied’s representative prepared projections that “overstated revenues and understated expenses, with the result that the unachievable debt service was made to appear reasonable and achievable.” According to Trilogy’s complaint, Allied increased the 1998 loan amount by another $135,000 on August 16, 2000, at a time when “it knew or should have known that the projections of profitability were not possible.” The complaint further adds, “[t]he loan balances were far in excess of a reasonable debt load for such a convenience store operation.” The complaint alleged, “Allied purposefully pursued a pattern and practice of making loans to gas station proprietors that it knew could not service the heavy debt.” Allied later settled the case on undisclosed terms.

The other loans each had its own story—all bad. Most were in bankruptcy, but some had been discharged from bankruptcy; that is, there wasn’t anything more to be done to collect on them.

Yet, Allied paid BLX full value for them

.

Meanwhile, Allied’s stock had performed strongly since April 2003, reaching $31 a share in February 2004. When Brickman posted these findings about the loans and links to the source documents on the Yahoo! message board, Allied stock quickly fell a few percentage points. Allied, as far as I could tell, did not disclose this transaction to shareholders. I found no mention of the loan transfers in any of Allied’s filings with the SEC.

Allied’s poor investments continued to pile up. Two more companies to which Allied loaned money filed for bankruptcy protection. Each bankruptcy filing provided a fresh example of Allied’s failure to mark down loans as they deteriorated.

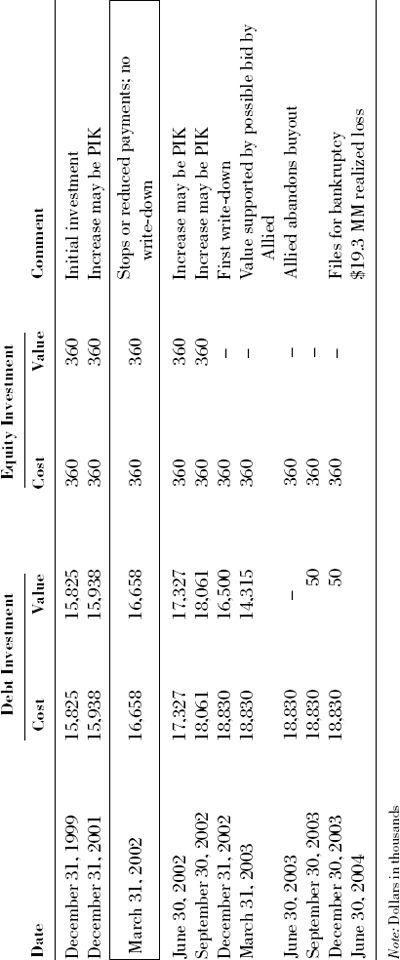

Executive Greetings filed in December 2003. Allied invested $16 million in subordinated debt and warrants in 1999. In early 2002, Executive Greetings either stopped or reduced its interest payments to Allied. Despite this, Allied carried the investment at cost through September and continued to accrue non-cash or PIK income throughout 2002 (see

Table 21.2

). According to Executive Greetings’ plan of liquidation, the company lost one-third of its revenues and more than half its earnings between 1999 and 2002. Plainly, the lack of interest payments and deteriorating results were evident long before the end of 2002. According to the bankruptcy records, Allied held a junior loan that would receive “little or no distribution.”

Table 21.2

Executive Greetings

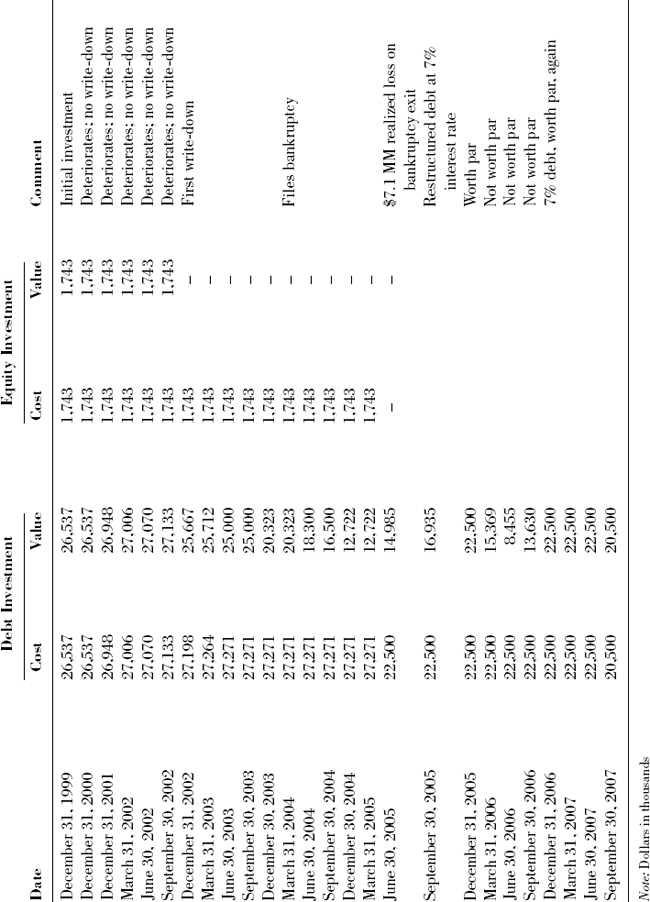

In February 2004, Garden Ridge filed for bankruptcy. In 1999, Allied had invested $28 million in subordinated debt and equity in the retailer. Allied’s 2003 10-K indicated it held a debt investment of $27.3 million, while Garden Ridge’s financial statements reflected only a $25.3 million obligation. We suspected Allied might have recognized an extra $2 million of PIK income that didn’t even appear on Garden Ridge’s books. Garden Ridge’s bankruptcy records indicate that, from 1999 to 2002, comparable store sales fell by 16 percent, and earnings before interest, taxes, depreciation, and amortization (EBITDA) fell from $24.8 million to −$18.3 million. From the time Allied invested—after which its deterioration shortly began—Garden Ridge lost about $45 million. Nonetheless, Allied carried all of its debt and equity investment in Garden Ridge at cost through September 2002. In December 2002, it belatedly wrote down the equity to zero and the debt to 95 percent of cost. Allied took incremental modest write-downs nearly every quarter through the end of 2004 (see

Table 21.3

on page 198).

Table 21.3

Garden Ridge

A few months earlier, around the turn of the year to 2004, I had discussed our Allied investment and the government’s lack of responsiveness with one of our long-time partners. She was aghast at the story and said she knew SEC Chairman Bill Donaldson socially. She offered to pass our information directly to him. I wrote her a two-page summary, to which she attached a personal note. A couple of weeks later, she received a form letter thanking her for her letter. A couple weeks after that, four SEC enforcement officials called her to find out if she had more information on Allied. Apparently, the SEC finally formed a team to investigate our concerns. Now, I was the one aghast that this is what it took to get the SEC off the dime.

Brickman wrote to the SEC about the $9 million loan transfer. The SEC called Brickman and invited him to Washington for a meeting to discuss it. Brickman asked the SEC if I could join him. We scheduled the meeting for April 27, 2004.

Brickman also called Houck, the analyst at Wachovia. Houck initiated coverage of Allied with a “Strong Buy” at $23.20 per share two days after my speech and aggressively argued his bullish view with me. But since then, he repeatedly lowered his opinion of the company. He cut his rating to “Buy” in July 2002 at $22.40 per share after Allied announced the disappointing second-quarter results. In January 2003, he lowered the rating to “Market Perform” at $23.55 per share citing “valuation considerations.” Finally, he lowered his view to “Underperform” in April 2003 at $21.22 “due to increased dependency on capital gains to support the current dividend, anticipation of two consecutive years of declining NOI/share (Net Operating Income), increased risk of a dividend cut in 2004, continued deterioration in credit quality metrics, and valuation considerations.”

Houck lobbied Allied to provide better disclosure, including the secret gain-on-sale assumptions at BLX. When they refused, he wrote, “Given the relative size of BLX, we believe management should provide audited financial statements for BLX.” Houck completed a transition from optimistic to pessimistic about the company and published several critical research notes. In October 2003 he wrote, “We continue to struggle with Allied’s disclosure and lack of transparency with respect to their private finance portfolio. In our opinion, it is difficult to assess the reasonableness of the management’s portfolio company valuations . . .”

He also challenged the valuation of BLX. He said: “We have specific concerns regarding the valuation of BLX. Without disclosures on BLX, it is difficult to assess the appropriateness of management’s valuation of the portfolio company. Specifically, in order for investors to gain comfort with valuations, they need to be able to compare the original assumptions used to calculate gain-on-sale at the time of BLX’s securitizations versus the actual experience (e.g., loss rates, prepayments, discount rates). An increase (decrease) in loss rates or prepayment speeds versus original assumptions can result in a decrease (increase) in the carrying value of the residual asset that is created at the time of securitization. For companies that securitize loans on a regular basis, industry standard is to report monthly loss and prepayment experience on a static pool basis (i.e., AmeriCredit, Capital One, Providian). In the case of BLX, Allied reports aggregate data only on a quarterly basis, and the data is limited in its utility because growth and acquisitions can mask the underlying trends. In addition, we also believe that in Q2 2003, Allied changed the composition of the peer group used to value BLX, which, in our opinion, further obfuscates the valuation of BLX. On its Q2 earnings conference call, Allied management noted that the peer group for BLX had changed but declined to discuss the composition of the peer group at that time. Management indicated that the peer group used to value BLX would be identified in the subsequent 10-Q filing. However, the composition of the peer group for BLX was not identified in the 10-Q.”