Civilization: The West and the Rest (58 page)

It is in this light that we should understand the rise of China in our time. Despite the oft-stated Chinese preference for a ‘quiet rise’, some commentators already detect the first signs of Huntington’s civilizational clash. In late 2010 the resumption of quantitative easing by the Federal Reserve appeared to spark a currency war between the US and China. If ‘the Chinese don’t take actions’ to end the manipulation of their currency, President Obama declared in New York in September of that year, ‘we have other means of protecting U.S. interests’.

43

The Chinese Premier Wen Jiabao was not slow to respond: ‘Do not work to pressure us on the renminbi rate … Many of our exporting companies would have to close down, migrant workers would have to return to their villages. If China saw social and economic turbulence, then it would be a disaster for the world.’

44

Such exchanges did not, however, vindicate Huntington, any more than the occasional Sino-American naval incidents or diplomatic spats over Taiwan or North Korea. They were in truth a form of

pi ying xi

, the traditional Chinese shadow puppet theatre. The real currency war was between Chimerica – the united economies of China and America – and the rest of the world. If the US printed money while China effectively still pegged its currency to the dollar, both parties benefited. The losers were countries like Indonesia and Brazil, whose real trade-weighted exchange rates appreciated between January 2008 and November 2010 by, respectively, 18 per cent and 17 per cent.

No doubt, Chimerica has passed its prime; as an economic marriage between a spender and a saver it already shows all the signs of being on the rocks.

45

With China’s output in mid-2010 around 20 per cent above its pre-crisis level and that of the US still 2 per cent below, it seems clear that the symbiosis has become more beneficial to the creditor than to the debtor. American policy-makers utter the mantra ‘They need us as much as we need them’ and refer back to Lawrence Summers’s famous phrase about ‘mutually assured financial destruction’. Unbeknown to them, China’s leaders already have a plan to wind up Chimerica and reduce their dependence on dollar-reserve accumulation and subsidized exports. It is not so much a plan for world domination on the model of Western imperialism as a strategy

to re-establish China as the Middle Kingdom – the dominant tributary state in the Asia-Pacific region.

46

If one had to summarize China’s new grand strategy, the best way to do it might be, Mao-fashion, as the ‘Four Mores’:

1. Consume more

2. Import more

3. Invest abroad more

4. Innovate more

In each case, a change of economic strategy promises to pay a handsome geopolitical dividend.

By consuming more, China can and will reduce its trade surplus and in the process endear itself to its major trading partners, especially the other emerging markets. China has just overtaken the United States as the world’s biggest automobile market (14 million sales a year to 11 million) and its demand is projected to rise tenfold in the years ahead. By 2035, according to the International Energy Agency, China will be using a fifth of all global energy, a 75 per cent increase since 2008.

47

It accounted for about 46 per cent of global coal consumption in 2009, the World Coal Institute estimates, and consumes a similar share of the world’s aluminium, copper, nickel and zinc production. Such figures translate into major gains for the exporters of these and other commodities. China is already Australia’s biggest export market, accounting for 22 per cent of Australian exports in 2009. It buys 12 per cent of Brazil’s exports and 10 per cent of South Africa’s. It has also become a big purchaser of high-value manufactures from Japan and Germany. Once China was mainly an exporter of low-price manufactures. Now that it accounts for fully a fifth of global growth, it has become the most dynamic new market for other people’s stuff. And that wins friends.

However, the Chinese are justifiably nervous of the vagaries of world market prices for commodities – how could they feel otherwise after the huge price-swings of the period 2004–10? So it makes sense for them to invest abroad to acquire commodity-producing assets, from oil fields in Angola to copper mines in Zambia. In just a single month (January 2010), Chinese investors made direct investments worth a total of $2.4 billion in 420 overseas enterprises in

seventy-five countries and regions. The overwhelming majority of the investments were in Asia (45 per cent) and Africa (42 per cent). The biggest sectors were mining, petrochemical and communications infrastructure.

48

The Chinese mode of operation is now well established across Africa. Typical deals exchange highway and other infrastructure investment for long leases of mines or agricultural land, with few questions asked about human rights abuses or political corruption.

49

When challenged about China’s economic relations with Sudan, at the height of the genocide in Darfur, China’s Deputy Foreign Minister said simply: ‘Business is business.’

50

In July 2008 the Chinese special envoy Liu Guijin restated China’s policy on aid to Africa: ‘We don’t attach political conditions. We have to realize the political and economic environments [in Africa] are not ideal. But we don’t have to wait for everything to be satisfactory or human rights to be perfect.’

51

Growing overseas investment in natural resources not only makes sense as a diversification strategy to reduce China’s exposure to the risk of dollar depreciation. It also allows China to increase its financial power, not least through its vast and influential sovereign wealth fund, China Investment Corporation, which has around $200 billion of assets. And investment abroad justifies China’s ambitious plans for naval expansion. In the words of Rear Admiral Zhang Huachen, Deputy Commander of the East Sea Fleet: ‘With the expansion of the country’s economic interests, the navy wants to better protect the country’s transportation routes and the safety of our major sea-lanes.’

52

The South China Sea is increasingly regarded as a ‘core national interest’ and deep-water ports are projected in Pakistan – in the former Omani enclave of Gwadar – as well as in Burma and Sri Lanka. This is a very different maritime model from Admiral Zheng He’s (see

Chapter 1

). It comes straight from the playbook of the Victorian Royal Navy.

Finally, and contrary to the view that China is condemned to remain an assembly line for products ‘designed in California’, China is innovating more, aiming to become (for example) the world’s leading manufacturer of wind turbines and photovoltaic panels. In 2007 China overtook Germany in terms of the number of new patent applications. It will soon do the same in terms of patents granted, having overtaken Britain in 2004, Russia in 2005 and France in 2006. Since

1995 the number of new patents granted to Chinese innovators has increased by a factor of twenty-nine.

53

This is part of a wider story of Eastern ascendancy. China has increased expenditure on research and development by a factor of six in the past decade, has more than doubled the number of its scientists and is now second only to the United States in its annual output of scientific papers and its supercomputing capability. There remains a significant gap in terms of international citations of Chinese research, but there is good reason to expect this to close.

54

Perhaps the most compelling evidence that the shift from West to East is real lies in the realm of education. In a 2005 study of academic attainment by people aged twenty-five to thirty-four, the Organization for Economic Co-operation and Development found a startling differential between the top countries, South Korea and Japan, and the laggards, Britain and Italy.

55

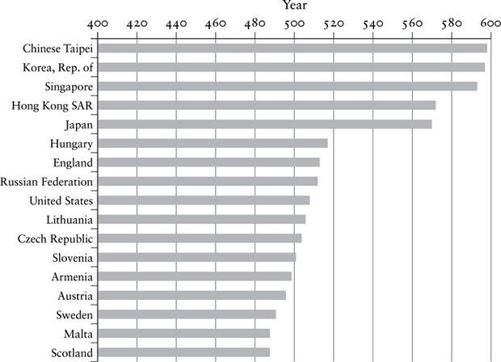

The same gulf manifests itself in standardized tests of mathematical aptitude among fourteen-year-olds, where students from Singapore far outperform students

from Scotland. The former are 19 per cent above the international average; the latter 3 per cent below it.

56

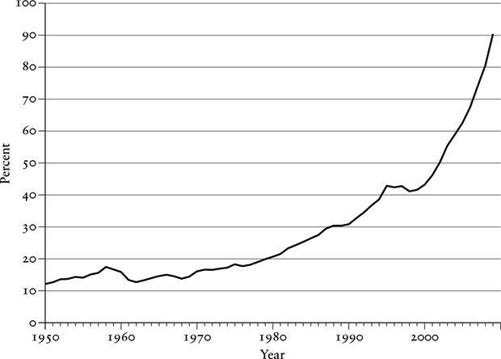

GDP of Greater China (People’s Republic plus Hong Kong, Singapore and Taiwan) as a Percentage of US GDP, 1950–2009

Average Mathematics Score of 8th Grade (~14-year-old) Students, 2007 (International mean = 500)

What could go wrong for the ascending Chinese dragon? There are at least four different hypotheses proposed by those who expect it to stumble. The first is that similar projections of inexorable ascent used to be made for Japan. It too was supposed to overtake the United States and to become the number one global economic superpower. So, the argument goes, China could one day suffer the fate of Japan after 1989. Precisely because the economic and political systems are not truly competitive, a real-estate or stock-market bubble and bust could saddle the country with zombie banks, flat growth and deflation – the plight of Japan for the better part of two decades now. The counter-argument is that an archipelago off the east coast of Eurasia was never likely to match a continental power like the United States. It was credible to predict even a century ago that Japan would catch up with the United Kingdom, its Western analogue – as it duly did – but not that it would overhaul the United States. In addition, Japan’s

defeat in 1945 meant that throughout the period of its economic ascent it was dependent on the United States for its security, and therefore had to submit to more or less mandatory currency appreciation, for example under the 1985 Plaza Accord.

A second possibility is that China might succumb to social unrest, as has so often happened in its past. After all, China remains a poor country, ranked eighty-sixth in the world in terms of per-capita income, with 150 million of its citizens – nearly one in ten – living on the equivalent of $1.50 a day or less. Inequality has risen steeply since the introduction of economic reforms, so that the income distribution is now essentially American (though not quite Brazilian). An estimated 0.4 per cent of Chinese households currently own around 70 per cent of the country’s wealth. Add to these economic disparities chronic problems of air, water and ground pollution, and it is not surprising that the poorer parts of the Chinese rural hinterland are prone to outbreaks of protest. Yet only a fevered imagination could build a revolutionary scenario on these slender foundations. Economic growth may have made China a less equal society, but the capitalist-communist regime currently enjoys uniquely high levels of legitimacy in the eyes of its own people.

57

Indeed, survey data suggest that Chinese people today are more committed to the idea of the free market than Americans. The real social threat to China’s stability is demographic. As a result of the One-Child policy introduced in 1979, China by 2030 will have a significantly more elderly population than its comparably large neighbour India. The share of the population aged sixty-five and over will be 16 per cent, compared with 5 per cent in 1980. And the gender imbalance in provinces like Anhui, Hainan, Guangdong and Jiangxi is already quite without parallel in a modern society, with between 30 and 38 per cent more males than females.

58

The next Chinese revolution, if there is going to be one, will be led by frustrated bachelors. But history suggests that young men without women are as likely to embrace radical nationalism as revolution.