What Stays in Vegas (6 page)

Read What Stays in Vegas Online

Authors: Adam Tanner

In the 1960s, manufacturers livened up slot machines by adding electronics. They were further augmented in the 1970s with microchips. In 1960, only a slot machine in

The Twilight Zone,

that

wondrous land whose boundaries are that of imagination, could talk. But slot machines became ever more exciting as electronics and computerization added flashing lights, video, and audio dialogue. One-armed bandits took on personalities of their own, often grafted from television shows and movies. One manufacturer even introduced a

Twilight Zone

theme. Today some of these machines cost as much as a new car. Such innovation has dramatically increased revenue; slots now bring in nearly two-thirds of casino floor revenue in and around Las Vegas.

2

As the machines have improved, casino operators have paid more attention to them. In Nevada, a state that beckons gamblers not only to Vegas but also to Reno and Lake Tahoe, casinos decided to reward slot players to lure repeat business. Beginning in the 1960s, slot attendants at Harrah's in Lake Tahoe and Reno noted how much a player put into the machine. Based on their observations, clerks wrote out tickets worth a certain number of points. Gamblers could trade a stack of tickets for prizes such as a blender, radio, or TV. By the early 1980s, the decade when slot machines really took off in popularity, casinos had started installing automatic dispensers that issued tickets for standard amounts of play.

A fundamental problem plagued these early loyalty programs. Until someone redeemed tickets, management had no way of identifying who the biggest players were. US retail loyalty programs had faced the same challenge since the late eighteenth century.

3

The best-known pre-computer era program started in 1896, when Sperry & Hutchinson introduced Green Stamps. Stores gave away the stamps based on the spending of customers, who in turn could redeem them for a variety of goods. Stores bought the stamps to boost business, but the program did not gather information about customers, making it of limited value to the retailer. Like the businesses that eventually abandoned Green Stamps, casinos did not want to just give out free prizes. They wanted to learn about their best customers so they could market more effectively.

* * *

US airlines led the way in compiling information about their best customers by introducing the modern-day loyalty program. When American Airlines designed the first frequent flyer program in 1981, it turned to outside consultant Hal Brierley. A Harvard Business School graduate who founded Epsilon Data Management, a leading personal data marketer (see

Chapter 7

), he had a simple mandate: build a database of people and track their flights to better target news and offers to the right people.

American had to motivate passengers to give not only a name and address but also a number that linked them to their previous purchases. That way the airline could understand the value of each passenger. The lure was the chance to earn a free ticket. “If they could identify their best customers, they thought they could better reallocate their marketing spend to the right customers and hopefully gain a bit of market share,” Brierley said. “The goal was not to give away two tickets to Hawaii.”

Airlines and other businesses are ready to give away perks to identify their best customers because they represent such a disproportionate percentage of total sales. When Brierley worked on airline loyalty programs in the early 1980s, he says the top 2 percent of passengers generated 25â30 percent of revenue, and even more important, the top 0.2 percent generated 7â8 percent of revenue. Other airlines quickly followed American's lead. Looking back, it seems obvious that someone would develop an airline loyalty program. But at the time, the program represented a game-changing innovation. Car rental agencies, hotels, supermarkets, and many other businesses later embraced similar programs, allowing them to accumulate information about their best customers.

It might appear that airlines should be able to figure out their best clients on their own, since passengers give their names, phone numbers, and credit card information when they buy a ticket. Yet Brierley says the airlines needed a unifying number to identify them correctly. “They had spent a lot of money trying to develop customer databases in a more stealth manner matching names and phone numbers,” he says. “But when you have a lot of Bill Smiths and people use different

telephone numbers, they had very little luck figuring out who it was that was flying back and forth to London.”

As casinos sought to keep better tabs on slot customers, they too looked to the US airline industry's loyalty programs. Over time, casino companies such as Caesars gathered an especially wide array of transactional data about customers.

Tracking Players

When airlines adopted frequent flyer programs, they only had to record a customer's number in the centralized reservation system. Collecting loyalty program numbers from thousands of slot machines proved more challenging. Casinos had to reconfigure the machines to bring together information about who was playing. Setting up card readers proved an especially expensive proposition. John Acres wanted to find a cheaper solution. He found inspiration from an unlikely source.

Like Gary Loveman, Acres cherished mathematics and applied his knowledge to tinkering and inventing for the casino industry. He had already figured out how to build ticket dispensers for slot machines, eliminating the need for clerks to write out tickets to reward frequent slot players. But such retrofitting cost about $400 per machine in the early 1980s (about $1,000 today, adjusted for inflation). Even at that price, the ticket dispensers could not identify players by name.

On Christmas Eve 1983, as Acres was wrapping gifts for his children, he paused to marvel at a game called Speak & Spell. For less than $50, the manufacturer offered a plastic keyboard, electronic display, and electronic voice. He wondered how it could do so much for so little moneyâat least in terms of what computer parts cost at that time. Santa took out a screwdriver and dissected the toy on his kitchen table. He looked inside and marveled at the low-cost circuitry. He then thought back to a visit he had made a few weeks before to the Sun City Casino in South Africa. There Acres had seen an electronic plastic hotel key for the first time. He felt a flash of inspiration. Within a few weeks he had devised a prototype card reader for slot machines to identify who exactly was playing the game. On that Christmas Eve, however,

his probing destroyed the toy. It never spoke or spelled again. Santa delivered one less gift to the Acres home that year.

Inserting a Total Rewards loyalty card into a slot machine at Caesars Palace. Source: Author photo.

Like a credit card that identifies shoppers from a small slab of plastic, Acres's new card reader allowed casinos to track their slot players accurately by name. Gamblers happily whipped out their cards and gave up data. Harrah's officials crowed about how they helped personalize service, added people to their mailing lists about special events, and counted a player's bonus points precisely.

Gathering data on gamblers expanded from there. In the 1990s, Harrah's CEO Phil Satre wrote personal letters to customers who had visited multiple properties to ask where they planned to visit next. His staff tried to track the responses, but found that system time-consuming and difficult to maintain. Harrah's spent years and millions of dollars installing a common database across all of its properties, and in 1997 the company introduced the first full-scale casino loyalty program.

4

Harrah's WINet (Winners Information Network) quickly gathered five million names.

5

The executives hoped the new database would allow them to target their direct mail offers with greater precision. But things did not work out as hoped. “To be honest with you, I was disappointed with the early results, which is one of the reasons I hired Gary,” says Satre. “I didn't think we were getting enough traction with our customers. We were getting the data, but we were not using the data in a sophisticated way to market back to the customer with offers and rewards that would meaningfully change their behavior.”

As the new chief operating officer plotting changes at Harrah's, Loveman started searching for new aces to pilot his customer data operation. He turned first to Rich Mirman, a consultant at Booz Allen Hamilton.

6

Mirman was a math whiz who had dropped out of a PhD program at the University of Chicago. He was a newcomer to the world of casinos, but Loveman saw him as a like-minded data analytics guy. As the new chief marketing officer, Mirman learned the ropes and created many models to fine-tune the company's approach.

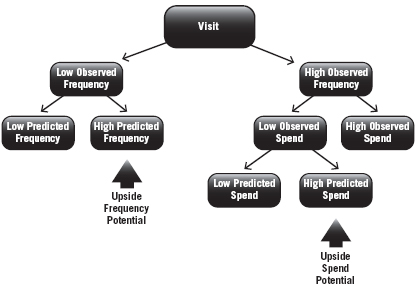

One showed a decision tree of customers, divided into those who came a lot and those who did not. The next level down showed those who spent a lot when they came and those who did not. The next level showed customers who had a high predicted budget and those who did not. Along each section of his marketing map Mirman identified what he called “opportunity segments.” Such groups might be gamblers who came often but spent little, even though they appeared to have money. Another potential group might be those who came infrequently but could be encouraged to come more often. The company would market differently to each segment.

Mirman also thought about the life cycle of a typical casino customer, one of Loveman's favorite themes. When new customers first arrived, Harrah's could observe only part of their long-term value to the company, because they might be sharing their business with other Vegas casinos. For long-standing customers, the company might already have a good idea of their full potential to spend. So Mirman started spending more money than before marketing to new customers with bigger long-term potential.

Rich Mirman's chart of opportunity segments that had previously been neglected. Source: Rich Mirman.

In another model, Mirman tried to figure out when customers would be most likely to come back to Las Vegas. He found that gamblers were many times more likely to return exactly twelve months after their previous visit. Marketers would gain an edge if they sent offers around the time gamblers began planning their return visitâusually around nine months after the previous visit. Studying the customer database, Mirman also noticed the greatest business opportunity not from “whales,” the biggest spenders, but from those who played $100 to $400 per trip. Such players were far from the most lucrative on any one day, but in a year they might spend $1,500 to $5,000. This group represented 80 percent of the opportunity for growth, he calculated.

“We built our entire strategy around that one insight that surely we could do better and convince a customer to give us a larger share of their wallet,” Mirman says. At the time, Harrah's estimated that customers gave 64 percent of their business to other casinos. With little incentive to show unwavering loyalty to any one establishment, clients

regularly gambled away most of their money elsewhere. “Everything that we did was based on the mantra that we were going to convince them that it was in their best interest to consolidate up their play.”