Understanding Business Accounting For Dummies, 2nd Edition (96 page)

Read Understanding Business Accounting For Dummies, 2nd Edition Online

Authors: Colin Barrow,John A. Tracy

Tags: #Finance, #Business

Cost of goods sold expense:

Whether to use the first-in, first-out (FIFO) method, or the last-in, first-out (LIFO) method, or the average cost method (each of which is explained in the section ‘Calculating Cost of Goods Sold and Cost of Stock' later in this chapter), cost of goods sold is a big expense for companies that sell products and naturally the choice of method can have a real impact.

Gross margin:

Can be dramatically affected by the method used for calculating cost of goods sold expense (and the method of revenue recognition, if this is a problem).

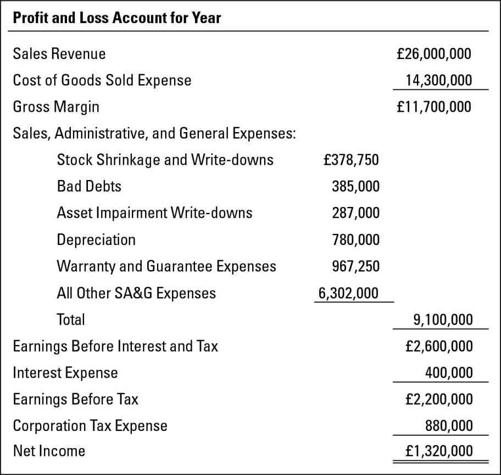

Figure 13-1:

A profit and loss account including certain expenses that are not reported outside the business.

Stock write-downs:

Whether to count and inspect stock very carefully to determine loss due to theft, damage, and deterioration, and whether to apply the net realisable value (NRV) method strictly or loosely are the two main questions that need to be answered. See ‘Identifying Stock Losses: Net Realisable Value (NRV)' later in this chapter. Stock is a high-risk asset that's subject to theft, damage, and obsolescence.

Bad debts expense:

When to conclude that the debts owed to you by customers who bought on credit (debtors) are not going to be paid - the question is really when to

write down

these debts (that is, remove the amounts from your asset column). You can wait until after you've made a substantial effort at collecting the debts, or you can make your decision before that time. See ‘Collecting or Writing Off Bad Debts' later in this chapter.

Asset impairment write-downs:

Whether (and when) to

write down

or

write off

an asset - that is, remove it from the asset column. Stock shrinkage, bad debts, and depreciation by their very nature are asset write-downs. Other asset write-downs are required when any asset becomes

impaired

, which means that it has lost some or all of its economic utility to the business and has little or no disposable value. An asset write-down reduces the book (recorded) value of an asset (and at the same time records an expense or loss of the same amount). A

write-off

reduces the asset's book value to zero and removes it from the accounts, and the entire amount becomes an expense or loss.

For example, your delivery truck driver had an accident. The repair of the truck was covered by insurance, so no write-down is necessary. But the products being delivered had to be thrown away and were not insured while in transit. You write off the cost of the stock lost in the accident.

Depreciation expense:

Whether to use a short-life method and load most of the expense over the first few years, or a longer-life method and spread the expense evenly over the years. Refer to ‘Appreciating Depreciation Methods' later in this chapter. Depreciation is a big expense for some businesses, making the choice of method even more important.

Warranty and guarantee (post-sales) expenses:

Whether to record an expense for products sold with warranties and guarantees in the same period that the goods are sold (along with the cost of goods sold expense, of course) or later, when customers actually return products for repair or replacement. Businesses can usually forecast the percentage of products sold that will be returned for repair or replacement under the guarantees and warranties offered to customers - although a new product with no track record can be a problem in this regard.

All other SA&G expenses:

Whether to disclose separately one or more of the specific expenses included in this conglomerate total. For example, the SEC requires that

advertising

and

repairs and maintenance

expenses be disclosed in the documents businesses file with the SEC, but you hardly ever see these two expenses reported in external profit and loss accounts. Nor do you find individual top management compensation revealed in external profit and loss accounts, other than that for directors. GAAP does not require such disclosures - much less revealing things like bribes or other legally questionable payments by a business.