Understanding Business Accounting For Dummies, 2nd Edition (41 page)

Read Understanding Business Accounting For Dummies, 2nd Edition Online

Authors: Colin Barrow,John A. Tracy

Tags: #Finance, #Business

Every company that stays in business for more than a couple of years experiences a discontinuity of one sort or another. But beware of a business that takes advantage of discontinuities in either of the following ways:

Discontinuities become ‘continuities':

This business makes an extra-ordinary loss or gain a regular feature on its profit and loss account. Every year or so, the business loses a major lawsuit, abandons product lines, or restructures itself. It reports ‘non-recurring' gains or losses from the same source on a recurring basis every year.

A discontinuity becomes an opportunity to dump all sorts of write-downs and losses:

When recording an unusual loss (such as settling a lawsuit), the business opts to record other losses at the same time - everything but the kitchen sink (and sometimes that, too) gets written off. This

big-bath theory

says that you may as well take a big bath now in order to avoid taking little showers in the future.

Putting the profit and loss account in perspective

The profit and loss account occupies centre stage; the bright spotlight is on this financial statement because it reports profit or loss for the period. But think of the three primary financial statements - the other two being the balance sheet and the cash flow statement - as a three-ring circus. The profit and loss account may draw the most attention but you have to watch what's going on in all three places. As important as profit is to the financial success of a business, the profit and loss account is not an island unto itself. To understand and manage profit, managers have to follow through to the financial effects of revenue and expenses on the assets and liabilities of the business and pay particular attention to cash flow, which Chapter 7 explores.

The term

financial report, or package of accounts,

is the umbrella term referring to a complete set of financial statements. Financial statements are supplemented with footnotes and other commentary from a business's managers. If the financial statements have been audited, the accounting firm includes a short report stating whether the financial statements follow generally accepted accounting principles. Most financial reports, even by small businesses, are bound between two covers. A financial report can be anywhere from 5 pages to more than 50 pages to even 100 pages for very large, publicly owned business corporations. More and more public corporations make their annual financial reports available on their Web sites, and Yahoo provides direct links to most public companies' reports and accounts online (go to

http://uk.finance.yahoo.com

and click on ‘Free annual reports').

The term

financial statement

refers to one of the following three key summaries prepared periodically by every business:

Profit and loss account:

Summarises sales revenue and expenses and ends with the net income (profit) earned for the period, or the loss suffered for the period.

Balance sheet:

Summarises the balances in the business's assets, liabilities, and owners' equity accounts at the close of the period.

Cash flow statement:

Summarises the sources and uses of cash during the period.

The annual financial report of a business must include all three of these financial statements. Some businesses also prepare other schedules and summaries of a more limited focus that may also be called a financial statement - but in this book the term

financial statement

refers only to the three primary financial statements that we just listed.

In response to contractual or regulatory requirements some businesses issue special financial reports that do not include a complete set of financial statements with all footnote disclosures, or they may not adopt generally accepted accounting principles for certain matters. The distribution of these special financial reports is limited to specific parties. These special reports should be distinguished from the

general-purpose

financial reports that are distributed to the owners and creditors of the business based on generally accepted accounting principles (GAAP).

Chapter 6

:

The Balance Sheet from the Profit and Loss Account Viewpoint

In This Chapter

Coupling the profit and loss account with the balance sheet

Seeing how sales revenue and expenses drive assets and liabilities

Sizing up assets and liabilities

Drawing the line between debt and owners' equity

Grouping short-term assets and liabilities to determine solvency

Understanding costs and other balance sheet values

T

his chapter explores one of the three primary financial statements reported by businesses - the

balance sheet

, or, to be more formal, the

statement of financial condition

. This key financial statement may seem to stand alone - like an island to itself - because it's presented on a separate page in a financial report. In fact, the assets and liabilities reported in a balance sheet are driven mainly by the transactions the business engages in to make profit. These sale and expense transactions of a business are summarised for a period in its

profit and loss account,

which is explained in Chapter 5.

You've probably heard the expression that it takes money to make money. For a business it takes

assets

to make profit. This chapter identifies the particular assets needed to make profit. Also, the chapter points out the particular liabilities involved in the pursuit of profit.

In brief, a business needs a lot of assets to open its doors and to carry on its profit-making activities - making sales and operating the business day-to-day. For example, companies that sell products need to carry a

stock

of products that are available for delivery to customers when sales are made. A business can purchase products for its stock on credit, and delay payment for the purchase (assuming it has a good credit rating). In most cases, however, the business has to pay for these purchases before all the products have been sold - the stock-holding period is considerably longer than the credit period. The business needs cash to pay for its stock purchases. Where does the cash come from?

In fact a business needs many more assets than just stock. Where does the money for these assets come from? Assets are the first act of a two-act play. The second act looks at where the money comes from, or the

sources of capital

for businesses. As Chapter 1 explains, the

balance sheet

of a business is the financial statement that reports its assets on one side and the sources of capital on the other side.

Of course, as we repeat throughout this book, you need to use all three primary financial statements to paint a business's complete financial picture. The

profit and loss account

details sales revenue and expenses, which directly determine the amounts of assets (and two or three of the liabilities) that are summarised in the

balance sheet.

The

cash flow statement

answers the important question of how much of the profit has been converted to cash, and the company's other sources and uses of cash during the period.

This chapter connects sales revenue and expenses, which are reported in the profit and loss account, with their corresponding assets and liabilities in the balance sheet. The chapter also explains the sources of capital that provide the money a business uses to invest in its assets.

Coupling the Profit and Loss Account with the Balance Sheet

Sales revenue generates the inflow of assets and expenses cause the outflow of assets and these increases and decreases in assets have to be recorded. Also, some expenses spawn short-term liabilities that have to be recorded. In short, accounting for profit involves much more than keeping track of cash inflows and outflows. Which specific assets and liabilities are directly involved in recording the sales revenue and expenses of a business? And how are these assets and liabilities reported in a business's balance sheet at the end of the profit period? These are the two main questions that this chapter answers.

This chapter explains how the profit-making transactions reported in the profit and loss account connect with the assets (and some operating liabilities) reported in the balance sheet. We stress the dovetail fit between these two primary financial statements (the profit and loss account and the balance sheet). And don't forget that business accounting also keeps track of where the money for the assets comes from - to invest in its assets, a business needs to raise money by borrowing and persuading owners to put money in the business. You shouldn't look at assets without also looking at where the money (the capital) for the assets comes from.

The

balance sheet

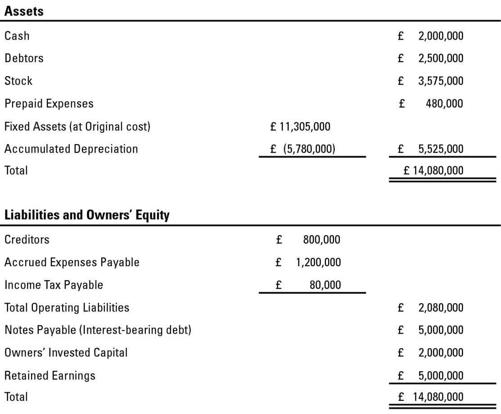

, or statement of financial condition, summarises a business's assets, liabilities, and owners' equity at a point in time and, as shown in Chapter 5, can be summarised in the following equation:

ASSETS LIABILITIES OWNERS' EQUITY

Cash + Noncash Assets = Operating Liabilities + Retained Earnings

Figure 6-1 shows a balance sheet for a fictitious company - not from left to right as shown in the accounting equation just above, but rather from top to bottom, which is a vertical expression of the accounting equation. This balance sheet is boiled down to the bare-bone essentials - please note that it would need a little tidying up before you'd want to show it off to the world in an external financial report (see Chapter 8).

Figure 6-1:

A balance sheet example showing a business's various assets, liabilities, and owners' equity.