The Singularity Is Near: When Humans Transcend Biology (17 page)

Read The Singularity Is Near: When Humans Transcend Biology Online

Authors: Ray Kurzweil

Tags: #Non-Fiction, #Fringe Science, #Retail, #Technology, #Amazon.com

The Singularity as Economic Imperative

The reasonable man adapts himself to the world; the unreasonable one persists in trying to adapt the world to himself. Therefore all progress depends on the unreasonable man.

—G

EORGE

B

ERNARD

S

HAW

, “M

AXIMS FOR

R

EVOLUTIONISTS

,”

M

AN AND

S

UPERMAN

, 1903

All progress is based upon a universal innate desire on the part of every organism to live beyond its income.

—S

AMUEL

B

UTLER

,

N

OTEBOOKS

, 1912

If I were just setting out today to make that drive to the West Coast to start a new business, I would be looking at biotechnology and nanotechnology.

—J

EFF

B

EZOS, FOUNDER AND

CEO

OF

A

MAZON.COM

Get Eighty Trillion Dollars—Limited Time Only

You will get eighty trillion dollars just by reading this section and understanding what it says. For complete details, see below. (It’s true that an author will do just about anything to keep your attention, but I’m serious about this statement. Until I return to a further explanation, however, do read the first sentence of this paragraph carefully.)

The law of accelerating returns is fundamentally an economic theory. Contemporary economic theory and policy are based on outdated models that emphasize energy costs, commodity prices, and capital investment in plant and equipment as key driving factors, while largely overlooking computational capacity, memory, bandwidth, the size of technology, intellectual property, knowledge, and other increasingly vital (and increasingly increasing) constituents that are driving the economy.

It’s the economic imperative of a competitive marketplace that is the primary force driving technology forward and fueling the law of accelerating returns. In turn, the law of accelerating returns is transforming economic relationships. Economic imperative is the equivalent of survival in biological evolution. We are moving toward more intelligent and smaller machines as the result of myriad small advances, each with its own particular economic justification. Machines that can more precisely carry out their missions have increased value, which explains why they are being built. There are tens of thousands of projects

that are advancing the various aspects of the law of accelerating returns in diverse incremental ways.

Regardless of near-term business cycles, support for “high tech” in the business community, and in particular for software development, has grown enormously. When I started my optical character recognition (OCR) and speech-synthesis company (Kurzweil Computer Products) in 1974, high-tech venture deals in the United States totaled less than thirty million dollars (in 1974 dollars). Even during the recent high-tech recession (2000–2003), the figure was almost one hundred times greater.

79

We would have to repeal capitalism and every vestige of economic competition to stop this progression.

It is important to point out that we are progressing toward the “new” knowledge-based economy exponentially but nonetheless gradually.

80

When the so-called new economy did not transform business models overnight, many observers were quick to dismiss the idea as inherently flawed. It will be another couple of decades before knowledge dominates the economy, but it will represent a profound transformation when it happens.

We saw the same phenomenon in the Internet and telecommunications boom-and-bust cycles. The booms were fueled by the valid insight that the Internet and distributed electronic communication represented fundamental transformations. But when these transformations did not occur in what were unrealistic time frames, more than two trillion dollars of market capitalization vanished. As I point out below, the actual adoption of these technologies progressed smoothly with no indication of boom or bust.

Virtually all of the economic models taught in economics classes and used by the Federal Reserve Board to set monetary policy, by government agencies to set economic policy, and by economic forecasters of all kinds are fundamentally flawed in their view of long-term trends. That’s because they are based on the “intuitive linear” view of history (the assumption that the pace of change will continue at the current rate) rather than the historically based exponential view. The reason that these linear models appear to work for a while is the same reason most people adopt the intuitive linear view in the first place: exponential trends appear to be linear when viewed and experienced for a brief period of time, particularly in the early stages of an exponential trend, when not much is happening. But once the “knee of the curve” is achieved and the exponential growth explodes, the linear models break down.

As this book is being written, the country is debating changing the Social Security program based on projections that go out to 2042, approximately the time frame I’ve estimated for the Singularity (see the next chapter). This economic policy review is unusual in the very long time frames involved. The predictions

are based on linear models of longevity increases and economic growth that are highly unrealistic. On the one hand, longevity increases will vastly outstrip the government’s modest expectations. On the other hand, people won’t be seeking to retire at sixty-five when they have the bodies and brains of thirty-year-olds. Most important, the economic growth from the “GNR” technologies (see

chapter 5

) will greatly outstrip the 1.7 percent per year estimates being used (which understate by half even our experience over the past fifteen years).

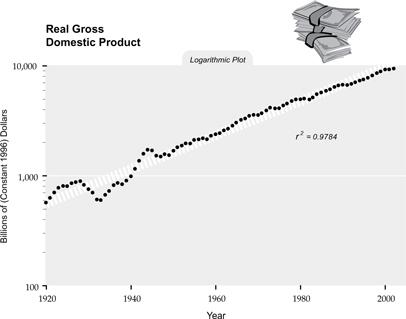

The exponential trends underlying productivity growth are just beginning this explosive phase. The U.S. real gross domestic product has grown exponentially, fostered by improving productivity from technology, as seen in the figure below.

81

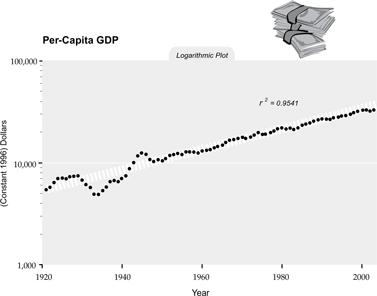

Some critics credit population growth with the exponential growth in GDP, but we see the same trend on a per-capita basis (see the figure below).

82

Note that the underlying exponential growth in the economy is a far more powerful force than periodic recessions. Most important, recessions, including depressions, represent only temporary deviations from the underlying curve. Even the Great Depression represents only a minor blip in the context of the underlying pattern of growth. In each case, the economy ends up exactly where it would have been had the recession/depression never occurred.

The world economy is continuing to accelerate. The World Bank released a report in late 2004 indicating that the past year had been more prosperous than any year in history with worldwide economic growth of 4 percent.

83

Moreover, the highest rates were in the developing countries: more than 6 percent. Even omitting China and India, the rate was over 5 percent. In the East Asian and Pacific region, the number of people living in extreme poverty went from 470 million in 1990 to 270 million in 2001, and is projected by the World Bank to be under 20 million by 2015. Other regions are showing similar, although somewhat less dramatic, economic growth.

Productivity (economic output per worker) has also been growing exponentially. These statistics are in fact greatly understated because they do not

fully reflect significant improvements in the quality and features of products and services. It is not the case that “a car is a car”; there have been major upgrades in safety, reliability, and features. Certainly, one thousand dollars of computation today is far more powerful than one thousand dollars of computation ten years ago (by a factor of more than one thousand). There are many other such examples. Pharmaceutical drugs are increasingly effective because they are now being designed to precisely carry out modifications to the exact metabolic pathways underlying disease and aging processes with minimal side effects (note that the vast majority of drugs on the market today still reflect the old paradigm; see

chapter 5

). Products ordered in five minutes on the Web and delivered to your door are worth more than products that you have to fetch yourself. Clothes custom-manufactured for your unique body are worth more than clothes you happen to find on a store rack. These sorts of improvements are taking place in most product categories, and none of them is reflected in the productivity statistics.

The statistical methods underlying productivity measurements tend to factor out gains by essentially concluding that we still get only one dollar of products and services for a dollar, despite the fact that we get much more for that dollar. (Computers are an extreme example of this phenomenon, but it is pervasive.) University of Chicago professor Pete Klenow and University of Rochester professor Mark Bils estimate that the value in constant dollars of existing goods has been increasing at 1.5 percent per year for the past twenty years because of qualitative improvements.

84

This still does not account for the introduction of entirely new products and product categories (for example, cell phones, pagers, pocket computers, downloaded songs, and software programs). It does not consider the burgeoning value of the Web itself. How do we value the availability of free resources such as online encyclopedias and search engines that increasingly provide effective gateways to human knowledge?

The Bureau of Labor Statistics, which is responsible for the inflation statistics, uses a model that incorporates an estimate of quality growth of only 0.5 percent per year.

85

If we use Klenow and Bils’s conservative estimate, this reflects a systematic underestimate of quality improvement and a resulting overestimate of inflation by at least 1 percent per year. And that still does not account for new product categories.

Despite these weaknesses in the productivity statistical methods, gains in productivity are now actually reaching the steep part of the exponential curve. Labor productivity grew at 1.6 percent per year until 1994, then rose at 2.4 percent per year, and is now growing even more rapidly. Manufacturing productivity in output per hour grew at 4.4 percent annually from 1995 to 1999,

durables manufacturing at 6.5 percent per year. In the first quarter of 2004, the seasonally adjusted annual rate of productivity change was 4.6 percent in the business sector and 5.9 percent in durable goods manufacturing.

86

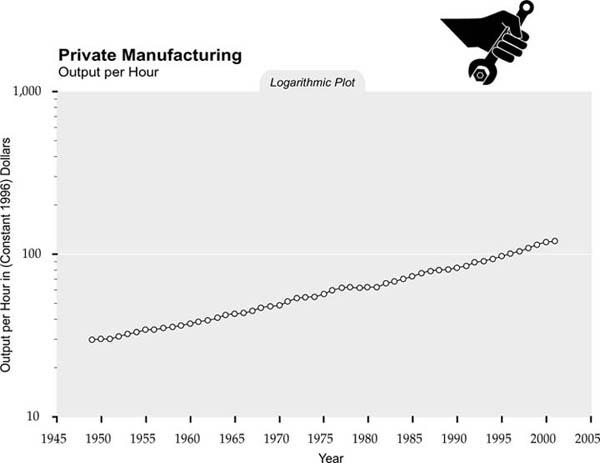

We see smooth exponential growth in the value produced by an hour of labor over the last half century (see the figure below). Again, this trend does not take into account the vastly greater value of a dollar’s power in purchasing information technologies (which has been doubling about once a year in overall price-performance).

87