The Rational Optimist (28 page)

Read The Rational Optimist Online

Authors: Matt Ridley

But do not forget the single most important problem with biofuels, the one that makes them so capable of making environmental problems worse – they need land. A sustainable future for nine billion people on one planet is going to come from using as little land as possible for each of people’s needs. And if food yields from land continue to increase at the current rate, the current acreage of farmland will – just – feed the world in 2050, so the extra land for growing fuel will have to come from rainforests and other wild habitats. Another way of putting the same point is to borrow the familiar environmentalist lament that the human race is already, to quote the ecologist E.O. Wilson, ‘appropriating between 20 and 40 per cent of the solar energy captured in organic material’. Why would you want to increase that percentage, leaving still less for other species? Ruining habitats and landscapes and extinguishing species to fuel a civilisation is a medieval mistake that surely need not be repeated, when there are coal seams and tar shales and nuclear reactors to hand.

Ah, for one good reason, you reply: climate change. I will address that issue in chapter 10. For now, simply note that if it were not for the climate-change argument, you could not begin to justify the claim that renewable energy is green and fossil energy is not.

Efficiency and demand

Civilisation, like life itself, has always been about capturing energy. That is to say, just as a successful species is one that converts the sun’s energy into offspring more rapidly than another species, so the same is true of a nation. Progressively, as the aeons passed, life as a whole has grown gradually more and more efficient at doing this, at locally cheating the second law of thermodynamics. The plants and animals that dominate the earth today channel more of the sun’s energy through their bodies than their ancestors of the Cambrian period (when, for example, there were no plants on land). Likewise, human history is a tale of progressively discovering and diverting sources of energy to support human lifestyle. Domesticated crops captured more solar energy for the first farmers; draught animals channelled more plant energy into raising human living standards; watermills took the sun’s evaporation engine and used it to enrich medieval monks. ‘Civilisation, like life, is a Sisyphean flight from chaos,’ as Peter Huber and Mark Mills put it. ‘The chaos will prevail in the end, but it is our mission to postpone that day for as long as we can and to push things in the opposite direction with all the ingenuity and determination we can muster. Energy isn’t the problem. Energy is the solution.’

The Newcomen steam engine worked at 1 per cent efficiency – that is to say it converted 1 per cent of the heat from burning coal into useful work. Watt’s engine was 10 per cent efficient and rotated much faster. Otto’s internal combustion engine was about 20 per cent efficient and faster still. A modern combined-cycle turbine is about 60 per cent efficient at making electricity from natural gas and runs at 1,000 rpm. Modern civilisation therefore gets more and more work out of each tonne of fossil fuel. This increasing efficiency would, you might think, gradually reduce the need to burn so much coal, oil and gas. As a country goes through an industrial revolution, at first more and more people join the fossil-fuel system – i.e., they start to use fossil fuels in both their work and their home – so more and more gets used. The ‘energy intensity’ (watts per dollar of GDP) actually rises. This happened in China in the 1990s, for example. Then later, once most people are in the system, efficiency does start to bite and energy intensity starts to fall. This is happening in India today. The United States now uses one-half as much energy per unit of GDP as it did in 1950. The world is using 1.6 per cent less energy for each dollar of GDP growth every year. Surely now energy usage will eventually also start to fall?

That is what I thought, until one day I tried to have an unnecessary conversation on a mobile telephone while a man was using a leaf-blower nearby. Even if everybody lags his loft and switches to compact fluorescent light bulbs, and throws out his patio heaters and gets his power from more efficient power stations, and loses his job in a steel plant but gets a new one in a call centre, the falling energy intensity of the economy will be offset by the new opportunities wealth brings to use energy in new ways. Cheap light bulbs let people plug in more lights. Silicon chips use so little power that they are everywhere and in aggregate their effect mounts up. A search engine may not use as much energy as a steam engine, but lots of them soon add up. Energy efficiency has been rising for a very long time and so has energy consumption. This is known as the Jevons paradox after the Victorian economist Stanley Jevons, who put it thus: ‘It is wholly a confusion of ideas to suppose that the economical use of fuel is equivalent to a diminished consumption. The very contrary is the truth. As a rule, new modes of economy will lead to an increase of consumption.’

I am not saying fossil fuels are irreplaceable. I can easily envisage a world in 2050 in which fossil fuels have declined in importance relative to other forms of energy. I can envisage plug-in hybrid cars that use cheap off-peak (nuclear) electricity for their first twenty miles; I can imagine vast solar-power farms exporting electricity from sunny deserts in Algeria or Arizona; I can imagine hot-dry-rock geothermal plants; above all, I foresee pebble-bed, passive-safe, modular nuclear reactors everywhere. I can even imagine wind, tide, wave and biomass energy making small contributions, though these should be a last resort because they are so expensive and environmentally destructive. But this I know: we will need the watts from somewhere. They are our slaves. Thomas Edison deserves the last word: ‘I am ashamed at the number of things around my house and shops that are done by animals – human beings, I mean – and ought to be done by a motor without any sense of fatigue or pain. Hereafter a motor must do all the chores.’

The invention of invention: increasing returns after 1800

He who receives an idea from me, receives instruction himself without lessening mine; as he who lights his taper at mine, receives light without darkening me.

T

HOMAS

J

EFFERSON

Letter to Isaac McPherson

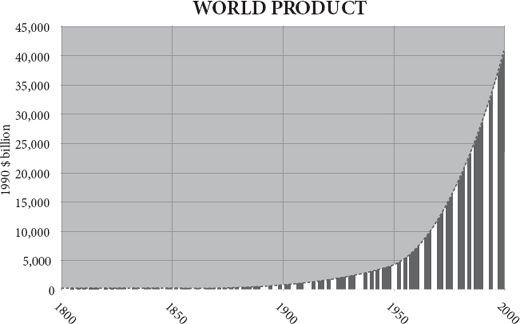

The phrase ‘diminishing returns’ is such a cliché that few give it much thought. Picking out the pecans from a bowl of salted nuts (a vice of mine) gives diminishing returns: the pieces of pecan in the bowl get rarer and smaller. The fingers keep finding almonds, hazelnuts, cashews or even – God forbid – Brazil nuts. Gradually the bowl, like a moribund gold mine, ceases to yield decent returns of pecan. Now imagine a bowl of nuts that had the opposite character. The more pecans you took, the larger and more numerous they grew. Implausible, I admit. Yet that is precisely the character of the human experience since 100,000 years ago. Inexorably, the global nut bowl has yielded ever more pecans, however many get used. The pace of acceleration of returns lurched upwards around 10,000 years ago in the agricultural revolution. It then lurched upwards again in

AD

1800 and the acceleration continued in the twentieth century. The most fundamental feature of the modern world since 1800 – more profound than flight, radio, nuclear weapons or websites, more momentous than science, health, or material well-being – has been the continuing discovery of ‘increasing returns’ so rapid that they outpaced even the population explosion.

The more you prosper, the more you can prosper. The more you invent, the more inventions become possible. How can this be possible? The world of things – of pecans or power stations – is indeed often subject to diminishing returns. But the world of ideas is not. The more knowledge you generate, the more you can generate. And the engine that is driving prosperity in the modern world is the accelerating generation of useful knowledge. So, for example, a bicycle is a thing and is subject to diminishing returns. One bicycle is very useful, but there is not much extra gain in having two, let alone three. But the idea ‘bicycle’ does not diminish in value. No matter how many times you tell somebody how to make or ride a bicycle, the idea will not grow stale or useless or fray at the edges. Like Thomas Jefferson’s candle flame, it gives without losing. Indeed, the very opposite happens. The more people you tell about bicycles, the more people will come back with useful new features for bicycles – mudguards, lighter frames, racing tyres, child seats, electric motors. The dissemination of useful knowledge causes that useful knowledge to breed more useful knowledge.

Nobody predicted this. The pioneers of political economy expected eventual stagnation. Adam Smith, David Ricardo and Robert Malthus all foresaw that diminishing returns would eventually set in, that the improvement in living standards they were seeing would peter out. ‘The discovery, and useful application of machinery, always leads to the increase of the net produce of the country, although it may not, and will not, after an inconsiderable interval, increase the value of that net produce,’ said Ricardo: all tends towards what he called a ‘stationary state’. Even John Stuart Mill, conceding that returns were showing no signs of diminishing in the 1840s, put it down to a miracle, innovation, he said, was an external factor, a cause but not an effect of economic growth, an inexplicable slice of luck. And Mill’s optimism was not shared by his successors. As discovery began to slow, so competition would drive the profits of enterprise out of the increasingly perfect market till all that was left was rent and monopoly. With Smith’s invisible hand guiding infinite market participants possessed of perfect information to profitless equilibria and vanishing returns, neo-classical economics gloomily forecast the end of growth.

It was a description of an entirely fictional world. The concept of a steady final state, applied to a dynamic system like the economy, is as wrong as any philosophical abstraction can be. It is Pareto piffle. As the economist Eamonn Butler puts it, the ‘perfect market is not just an abstraction; it’s plain daft ... Whenever you see the word equilibrium in a textbook, blot it out.’ It is wrong because it assumes perfect competition, perfect knowledge and perfect rationality, none of which do or can exist. It is the planned economy, not the market, that requires perfect knowledge.

The possibility of new knowledge makes the steady state impossible. Somewhere somebody will have a new idea and that idea will enable him to invent a new combination of atoms both to create and to exploit imperfections in the market. As Friedrich Hayek argued, knowledge is dispersed throughout society, because each person has a special perspective. Knowledge can never be gathered together in one place. It is collective, not individual. Yet the failure of any particular market to match the perfect market no more constitutes ‘market failure’ than the failure of a particular marriage to match the perfect marriage constitutes ‘marriage failure’.

In an exactly analogous way, the science of ecology has an enduring fallacy that in the natural world there is some perfect state of balance to which an ecosystem will return after disturbance. This obsession with ‘the balance of nature’ runs right through Western science, since even before Aristotle, and sees its recent expression in concepts like ecological climax, the natural vegetation that will clothe an area if it is left for long enough. But it is bunk. Take the place where I am sitting. Supposedly, its climax vegetation is oak forest, but the oaks only arrived a few thousand years ago, replacing the pines, the birch and before that the tundra. Just 18,000 years ago, where I sit was under a mile of ice, and 120,000 years ago it was a steaming swamp complete with hippos. Which of these is its ‘natural’ state? Besides, even if the climate settled down to an unvarying stability (something it has never done), oak saplings cannot thrive under oaks (oak-eating pests rain down on them), so after a few thousand years of oak domination an oak forest gives way to something else. Lake Victoria was bone-dry 15,000 years ago. The Great Barrier Reef was partly a range of coastal hills 20,000 years ago. The Amazon rainforest is in a state of constant perturbation: from tree falls to fires and floods, its diversity requires it to be constantly changing. There is no equilibrium in nature; there is only constant dynamism. As Heraclitus put it, ‘Nothing endures but change.’

Innovation is like a bush fire

To explain the modern global economy, then, you have to explain where this perpetual innovation machine came from. What kick-started the increasing returns? They were not planned, directed or ordered: they emerged, evolved, bottom-up, from specialisation and exchange. The accelerated exchange of ideas and people made possible by technology fuelled the accelerating growth of wealth that has characterised the past century. Politicians, capitalists and officials are flotsam bobbing upriver on the tidal bore of invention.

Even so, the generation of new useful knowledge is very far from routine, uniform, steady or continuous. Although the human race as a whole has experienced incessant change, individual peoples saw a much more intermittent flickering progress because the pace and place of that change was itself always changing. Innovation is like a bush fire that burns brightly for a short time, then dies down before flaring up somewhere else. At 50,000 years ago, the hottest hot-spot was west Asia (ovens, bows-and-arrows), at 10,000 the Fertile Crescent (farming, pottery), at 5,000 Mesopotamia (metal, cities), at 2,000 India (textiles, zero), at 1,000 China (porcelain, printing), at 500 Italy (double-entry book-keeping, Leonardo), at 400 the Low Countries (the Amsterdam Exchange Bank), at 300 France (Canal du Midi), at 200 England (steam), at 100 Germany (fertiliser); at 75 America (mass production), at 50 California (credit card), at 25 Japan (Walkman). No country remains for long the leader in knowledge creation.

At first blush, this is surprising, especially if increasing returns to innovation are possible. Why must the torch be passed elsewhere at all? As I have argued in the previous three chapters, the answer lies in two phenomena: institutions and population. In the past, when societies gorged on innovation, they soon allowed their babies to grow too numerous for their land, reducing the leisure, wealth and market that inventors needed (in effect, the merchant’s sons became struggling peasants again). Or they allowed their bureaucrats to write too many rules, their chiefs to wage too many wars, or their priests to build too many monasteries (in effect, the merchants’ sons became soldiers, sybarites or monks). Or they sank into finance and became parasitic rentiers. As Joel Mokyr puts it: ‘Prosperity and success led to the emergence of predators and parasites in various forms and guises who eventually slaughtered the geese that laid the golden eggs.’ Again and again, the flame of invention would splutter and die ... only to flare up elsewhere. The good news is that there is always a new torch lit. So far.

Just as it is true that the bush fire breaks out in different parts of the world at different times, so it leaps from technology to technology. Today, just as during the printing revolution of 500 years ago, communications is aflame with increasing returns, but transport is spluttering with diminishing returns. That is to say, the speed and efficiency of cars and aeroplanes are only very slowly improving and each improvement is incrementally more expensive. A greater and greater amount of effort is needed to squeeze the next few miles per gallon out of vehicles of any kind, whereas each tranche of extra megabits comes more cheaply for now. Very roughly, the best industry to be in as an innovator was: 1800 – textiles; 1830 – railways; 1860 – chemicals; 1890 – electricity; 1920 – cars; 1950 – aeroplanes; 1980 – computers; 2010 – the web. Whereas the nineteenth century saw a rash of new ways to move people about (railways, bicycles, cars, steam ships), the twentieth century saw a rash of new ways to move information about (telephones, radio, television, satellites, fax, the internet, mobile telephones). Admittedly, the telegraph came long before the aeroplane, but the general point stands. The satellite is a neat example of a technology invented as a by-product of a transport project (space travel), which found a use in communications instead. Increasing returns would indeed peter out if innovators did not have a new wave to catch every thirty years, it seems.

Note that the greatest impact of an increasing-return wave comes long after the technology is first invented. It comes when the technology is democratised. Gutenberg’s printing press took decades to generate the Reformation. Today’s container ships go not much faster than a nineteenth-century steamship and today’s internet sends each pulse little quicker than a nineteenth-century telegraph – but everybody is using them, not just the rich. Jets travel at the same speeds as they did in the 1970s, but budget airlines are new. As long ago as 1944, George Orwell was tired of the way the world appeared to be shrinking, supposedly a modern event. After reading what he called a ‘batch of rather shallowly optimistic “progressive” books’, he was struck by the repetition of certain phrases which had been fashionable before 1914. The phrases included the ‘abolition of distance’ and the ‘disappearance of frontiers’.

But Orwell’s scepticism misses the point. It is not the speed but the cost – in terms of hours of work – that counts. The death of distance may not be new, but it has been made affordable to all. Speed was once a luxury. In Orwell’s day only the richest or most politically powerful could afford to travel by air or to import exotic goods or make an international telephone call. Now almost everybody can afford the cheap goods carried by container ships; almost everybody can afford the internet; almost everybody can afford to travel by jet. When I was young a transatlantic telephone call was absurdly expensive; now a transpacific email is absurdly cheap. The story of the twentieth century was the story of giving everybody access to the privileges of the rich, both by making people richer and by making services cheaper.

Likewise, when the credit card took off in California in the 1960s, driven by Joseph Williams of Bank of America, there was nothing new about buying on credit. It was as old as Babylon. There was not even anything new about charge cards. Diner’s Club had been issuing cards for the convenience of restaurant users since the early 1950s and department stores for longer than that. What the BankAmericard achieved, especially once it emerged as Visa from the chaos of the mass mailings in the late 1960s, under Dee Hock’s reinvention, was the democratisation of credit. The electronic possibility that your card could be authorised for a purchase anywhere in the country or even the world was a powerful lubricant to specialisation and exchange in the economy of the late twentieth century, allowing consumers to express their choice to borrow against future earnings when it made sense. There was, of course, irresponsibility, but the credit card did not lead, as most intellectual grandees had feared, to financial chaos. In the early 1970s, when credit cards were new, politicians of all stripes denounced them as unsound, unsafe and predatory, a view widely shared even by those who used the cards themselves: Lewis Mandell discovered that Americans were ‘far more likely to use credit cards than to approve of them’.