The Empire Project: The Rise and Fall of the British World-System, 1830–1970 (21 page)

Read The Empire Project: The Rise and Fall of the British World-System, 1830–1970 Online

Authors: John Darwin

Tags: #History, #Europe, #Great Britain, #Modern, #General, #World, #Political Science, #Colonialism & Post-Colonialism, #British History

The head and centre of this far-reaching financial and commercial activity was the City of London. Essentially, the City was a cluster of markets attracting buyers and sellers from all parts of the world. Some of these markets were organised as ‘exchanges’ like the Wool Exchange (established in 1875), the London Metal Exchange (1882), the Baltic Exchange (dealing in grain) and the Coal Exchange. Mincing Lane was the market for commodities like sugar, cocoa, coffee and spices, with regular auctions at its sale rooms. A large number of City firms dealt in the import or re-export of commodities, sometimes for immediate sale, sometimes as options or ‘futures’. Many tended to specialise by country or type of produce, and one entirely in the import of hair.

20

Because the commodity trades usually required the advance of credit to faraway producers, and because of the lapse of time before the harvest came to market, the dealers in London were also lenders.

21

They, in turn, required the services of specialised finance houses, ‘accepting houses’ or merchant banks, who could tap the reservoirs of short-term borrowing drawn to the City from bank deposits throughout the country. The merchant banks, headed by the great houses like Rothschilds, Barings (the ‘sixth great power’ until its crash of 1890),

22

J. P. Morgan, Kleinworts and Schroders, but including many that were far smaller and more specialised, lent money on their own account but were usually the agents through whom large loans or an issue of securities were negotiated by public or private borrowers. Including the Bank of England and the joint stock banks catering for the ordinary public, they made up the ‘Inner City’ of high finance.

23

London was also the headquarters of more than forty British-owned overseas banks like the Bank of London and the River Plate or the Chartered Bank of India, Australia and China, with branches in Bombay, Calcutta, Rangoon, Singapore, Hong Kong, Shanghai, Manila and Batavia (modern Jakarta). By 1900, banking had become increasingly cosmopolitan and British banks faced competition

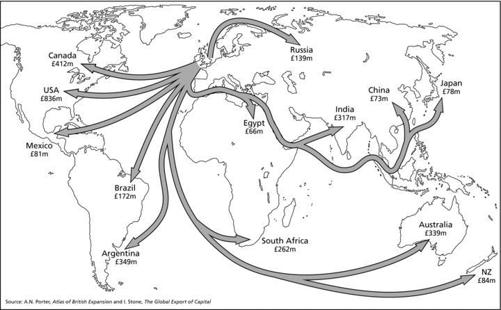

Map 6 British foreign investment to 1914

from foreign banks in London serving the commercial needs of their own traders.

But the most dynamic element in the commercial life of the late-Victorian City was the Stock Exchange.

24

Until mid-century it had been largely concerned with the sale of government bonds. Thereafter, railway shares and loans to foreign states rapidly widened its business. In the 1880s and 1890s, expansion was frantic. Membership (the entitlement to deal) grew from 1,400 (1871) to over 5,500 by 1905. By the early 1900s, one-third of all quoted securities around the world were traded in London and around 60 per cent of the Stock Exchange's share listings were for overseas enterprises.

25

In the search for capital, most roads led to London. The Exchange itself was informally divided into sections including Consols; the ‘Yankee’ market (American railways); Home rails; and, in the 1890s, the ‘Kaffir Circus’ for South African gold shares. Stockbrokers developed specialist expertise in lines of business or regions. In 1898, the

Stock Exchange Year Book

listed over 650 railway companies, a large proportion of them overseas; more than 1,000 firms engaged in mining or ‘exploration’; and several thousand loosely described as ‘investment, trust and finance’ – a category which included Cecil Rhodes’ ‘British South Africa Company’ with its private empire north of the Limpopo. As the communications revolution seemed to throw open more and more commercial opportunities in the non-European world, and distant prospects were gilded by gold discoveries on the Rand, in Australia and at the Yukon, the Stock Exchange became the great arena where private savings were mobilised for investment overseas. Circling round it were the ubiquitous company promoters, scrupulous or predatory, whose role was to convert a commercial idea into a marketable security. Their skill in the ‘financial arts’, remarked the radical economist J. A. Hobson, was often exercised to ‘scoop out’ the real assets of an enterprise while selling on its ‘shrivelled carcase’ to a bamboozled public.

26

Proximity to the Stock Exchange and merchant banks, and access to the flows of market information was the reason why many British-owned overseas firms based themselves in the City. This was especially true of overseas railway companies with their constant thirst for new capital. Finsbury Circus was the favoured address of British-owned Argentine rails like the Buenos Aires Great Southern or the

Oeste

. Similar needs made the City the world headquarters for mining enterprise.

27

Large shipowners like Cunard, British India, Peninsular and Oriental and Shaw Savill (trading to Australasia) were drawn to London by its ship-chartering market. London was the principal centre for insurance. Railway, mining and shipping enterprise also required the services of non-financial expertise: consulting engineers and other technical specialists. In short, there was scarcely any large commercial or financial venture linking Britain (and much of Continental Europe) to the ‘new economies’ of the wider world that, in one aspect or many, did not pass through a London agent. In a vast swathe of the world outside Europe and the United States, commercial development and even financial solvency turned upon decisions made in the City. Here was a plenitude of influence that matched that of Whitehall and Westminster, the political capital of the British system.

Indeed, the great commercial and financial emporium centred on London (with the lesser marts of Liverpool and Glasgow) was more than just an adjunct to British world power. It was the great cosmopolitan intermediary between the British domestic economy and the outside world. It might almost be seen as an autonomous partner attached to the British world-system by sentiment, self-interest and domicile, but largely indifferent to the strategic or administrative preoccupations of its political managers – except where they impinged directly on its economic prospects. It had grown up willy-nilly over the remains of the old mercantile system liquidated after 1846. Its well-being was acknowledged as a vital national interest. Its leaders and spokesmen periodically emphasised its contribution to British wealth. It shaped powerfully the conception of the British interest in India. It massively – perhaps at times decisively – reinforced the allegiance of the white dominions to their faraway motherland. It was the conduit for the large British investment in the United States, half-rival, half-associate in a world of voracious imperialisms. But the commercial power it exerted was no mere extension of Britain's imperial influence and authority. The managers of the commercial empire, especially the City elite, had wide autonomy and fiercely resisted outside regulation. Their priorities were rarely the same as those of the political and official world at the far end of the Strand. It was true that many bankers were drawn from the same class as the political and administrative elite. But many other interests were represented in the City, and in parts of it capitalism was anything but gentlemanly.

28

Even in the most respectable quarters overseas business was carried on with little regard to the ‘national interest’, partly because, with so little inclination to think analytically, such a notion existed only in the haziest form.

29

For their part, officials and politicians were inclined to treat the commercial cosmopolis as an allied but not necessarily friendly power. Its independence was warily recognised. But its political judgment was laughed at;

30

and its morals widely distrusted. The sensational growth in the wealth and social power concentrated in the City after 1890 aroused alarm as well as satisfaction. On both Left and Right, the appearance of a new City-based ‘plutocracy’ was regarded with deep suspicion.

31

On both political wings, the ‘cosmopolitan’ outlook of the financial world was equated with rootlessness, restlessness and the readiness to sacrifice public good for private gain. The cosmopolitan financier, indifferent to any consideration but profit, was the villain in J. A. Hobson's radical unmasking of the hidden forces behind imperial expansion and the South African War. His famous analysis of the export of capital, on which the City prospered, insisted that its social function was to perpetuate poverty and ‘under-consumption’ at home by rewarding the ‘over-saving’ of the rich.

32

The Tariff Reformers blamed cosmopolitan indifference to the domestic industrial economy for the hostility of the financial world towards their programme of imperial unity. In his ‘City’ speech in January 1904, Joseph Chamberlain warned his audience not to forget that ‘the future of this country and of the British race lay in our colonies and possessions…the natural buttresses of our Imperial State’.

33

His economic expert, W. J. Ashley, gloomily forecast Britain's future as a declining rentier state: ‘the history of Holland is to be repeated.’

34

There were other grounds for doubting the congruence of the interests of the City with those of nation or empire. The Barings crisis in 1890 and the American crash in 1907 showed that the City's huge exposure to overseas markets could destabilise the whole financial system. Some observers warned that the speculative manias and fraudulent promotions bred by the Stock Exchange could damage Britain's real interests overseas and unsettle her imperial ties.

35

But, down to 1914, this criticism made little headway. Economic orthodoxy proclaimed the unalloyed benefit of a large foreign portfolio and even Leftish opinion came to concede that the City's influence in world affairs was benignly pacific.

36

Nor was there yet much sign of conflict between the City's cosmopolitan functions as the owner and manager of a vast property empire outside British sovereignty and its role as the emporium for ‘Imperial’ trade between Britain, the dominions, India and the Crown Colonies. Quite the contrary. London easily mobilised the vast stream of capital that flowed to Canada after 1900. Its multilateral payments system made it much easier for Britain to profit from India's surplus on foreign (i.e. non-Empire) trade, remitted to London as the ‘home charges’.

37

Its foreign investments stimulated British production of cotton, ships, locomotives and coal – for bunkering and as the outward freight that made British shipping so widely profitable.

38

It made Britain the ‘telegraph exchange of the world’,

39

and hence ‘British’ news the most widely circulated. Its vast income stream lifted the social and cultural prestige of the British metropolis to its zenith.

40

New frontiers of commerce

In all these ways, the City (with the smaller cosmopolises in Glasgow and Liverpool) was the grand ally of the (formal) Empire. Its own sphere of unofficial or ‘semi-colonial’ expansion was also growing rapidly after 1880. Here it was engaged in turning the sketchy ‘informal empire’ of mid-Victorian times into prosperous new tributaries of its great commercial republic. Four great zones lay at the edge of the ‘developed’ world but beyond the imperial frontier: tropical Africa, the Middle East, China and Latin America.

None of these was wholly unfamiliar to British merchants and lenders, but none had lived up to its early promise. By the 1860s and 1870s they had become much more appealing. In part this was a side-effect of accelerated commercial development elsewhere. As new regions were ‘colonised’ by banks, railways, shippers and brokers, merchant houses scoured remoter neighbourhoods for fresh trades where competition was less harsh and windfall gains more likely.

41

Technology was on their side. With the rising volume of long-distance trade, seaborne travel became faster, cheaper and more regular, lowering the start-up costs of merchant enterprise. After 1870, the Suez Canal changed the geography of shipping in the Indian Ocean in Europe's favour. The expanding telegraph network carried the ‘information-head’ of market intelligence into ever deeper hinterlands, reducing business risk. With a weekly steamer service even the mystery and horror of the West African coast was tamed.

42

Secondly, merchants and lenders could hope to profit from the increasing readiness of previously conservative, secluded or simply disorganised states to embrace financial and administrative modernisation – sometimes by ‘quick-fixes’ like the Reuter's Concession in Iran where most of the modern commercial sector was handed over (if only briefly) to a single foreign entrepreneur.

43

Thirdly, British-based enterprises were well placed in the later nineteenth century to piggy-back on older mercantile pioneers. It was usually local men who first opened the trade paths in ‘backward’ regions, plugging them into larger commercial circuits. But, once their trade was worth the taking, they were often no match for interlopers with cheaper credit, better shipping and vastly superior commercial intelligence of markets and prices. Europeans were sometimes ‘trade-makers’, but they were just as likely to be ‘take-over’ merchants, squeezing out or subordinating older practitioners – nowhere more so than in Africa.

44