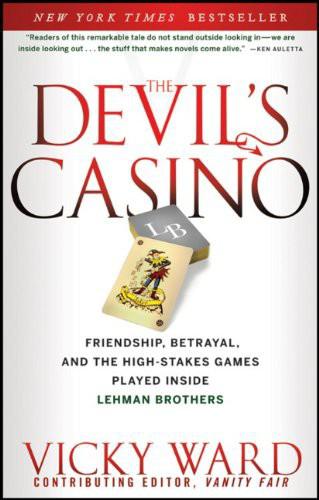

The Devil's Casino

For my sons, Orlando and Lorcan Doull.

Without your laughter,

your hugs and your very good-natured patience,

“Mummy’s annoying book” would not exist.

The mind is its own place, and in itself

Can make a heav’n of hell, a hell of heav’n.

Paradise Lost by John Milton, 1:254-255

Key Players

Richard S. “Dick” Fuld Jr.

, Lehman’s chief executive officer. An underachiever in youth, Fuld got a job trading commercial paper at Lehman in 1969.

Joseph M. “Joe” Gregory

, president and chief operating officer. Gregory started at Lehman in 1968 as a summer intern when he was 16 years old. He used to cut the lawn of Lehman’s top trader, Lew Glucksman.

T. Christopher “Chris” Pettit

, Lehman president and chief operating officer. A West Point graduate, decorated Vietnam veteran. He joined the firm in 1977 and rose through its ranks—until, that is, 1997.

Board Members of Either Amex or Shearson Noted in the Book

David Culver

John Byrne

President Gerald Ford

Richard Furlaud

Henry Kissinger

Dina Merrill (actress)

CEOs

Howard L. “H” Clark

Peter A. Cohen

Lewis L. “Lew” Glucksman

Harvey S. Golub

J. Tomlinson “Tom” Hill

James D. Robinson

Sanford I. “Sandy” Weill

Managing Directors

James S. Boshart

III

Herbert Freiman

Ronald A. Gallatin

Jeffrey Lane

Robert “Bob” Millard

The Hon. Peregrine Moncreiffe

Theodore “Teddy” Roosevelt V

Peter J. Solomon

Executives

Jim Carbone, senior deputy to Chris Pettit

Steve Carlson, head of emerging markets

John F. Cecil, chief financial officer (later also chief administrative officer)

Steven “Steve” Carlson, global emerging markets

John Coghlan, managing director of fixed income

Leo Corbett, deputy head of equities

Martha Dillman, sales

Robert A. “Bob” Genirs, Shapiro’s successor as

CAO

Nancy Hament, human resources

Allan Kaplan, banking

Bruce Lakefield

Stephen “Stevie” Lessing, senior deputy to Tom Tucker

Robert Matza, Stewart’s successor as

CFO

Paul Newmark, senior vice president and treasurer, Lehman Commercial

Paper Inc. (

LCPI

)

Michael Odrich, chief of staff to Dick Fuld

Marianne Rasmussen, head of human resources

Thomas Russo, chief legal officer until 2008

Mel Shaftel, chief of investment banking

Robert A. “Bob” Shapiro, chief administrative officer

Richard B. Stewart, chief financial officer

Kim Sullivan, sales

Thomas H. “Tom” Tucker, sales

Jeff Vanderbeek, rose to run all of fixed income, then capital markets

James “Jim” Vinci, Pettit’s chief of staff

Paul Williams, equities chief

Executives

Madeleine Antoncic, head of risk

Steve Berger, briefly co-head of banking

Steven Berkenfeld, global head of legal, compliance, audit

Jasjit “Jesse” Bhattal, replaced Tyree as head of Asia in 2000

Tracy Binkley, head of human resources

Erin Callan, chief financial officer

Steve Carlson, head of emerging markets

Jerry Donnini, head of equities

Eric Felder, replaced Reider

Scott J. Freidheim, office of chairman, later chief administrative officer

Mike Gelband, McDade’s successor at fixed income

David Goldfarb, chief financial officer turned chief administrative

officer turned global head of strategic partnerships

Hope Greenfield, chief talent officer

Jeremy Isaacs, head

CEO

of Lehman Europe from 2000 onward

Bradley Jack, banking, then co-

COO

Ted Janulis, head of mortgages

Todd Jorn, hedge funds

Alex Kirk, high-yield business

Fran Kittredge, philanthropy

Bruce Lakefield, Europe until 1999

Ian Lowitt, treasurer, later co-chief administrative officer, then chief

financial officer

Herbert “Bart” McDade, fixed income and later equities

Hugh “Skip” McGee, investment banking

Michael McKeever, briefly co-head of banking

Christian Meissner, Europe

Maureen Miskovic, risk

Andrew Morton, Nagioff’s successor in fixed income

Roger Nagioff, European equity derivatives, then Gelband’s successor

in fixed income

Chris O’Meara,

CFO

, then head of risk

Rick Rieder, head of credit

Thomas A. Russo, chief legal counsel

Benoit Savoret, Europe

Robert “Rob” Shafir, global equities

David Steinmetz, Chris Pettit’s chief of staff

Paolo Tonucci, treasurer

C. Daniel Tyree, Asia until 2000

Jeffrey Vanderbeek, head of fixed income turned vice president

George Herbert Walker IV, investment management

Mark Walsh, real estate

Ming Xu, analyst

Lehman Staff of Note

Holly Becker, equities

Marianne Burke, Dick Fuld’s secretary

Barbara Byrne, investment banking

Kerrie Cohen, press officer

Andrew Gowers, press officer

Ros L’Esperance, investment banking

Lara Pettit, sales

Marna Ringel, Scott Friedheim’s assistant

Craig Schiffer, bond salesman

Peter Sherratt, Europe

Celia Felcher Cecil

Isabelle Freidheim

Kathleen Fuld

Teresa Gregory

Niki Golod Gregory

Karin Jack

Sandra Lessing

Martha McDade

Mary Anne Pettit

Michael Thompson, ex-husband of Erin Callan

Heather Tucker

Nancy Dorn Walker

Henry, Emmanuel, and Mayer Lehman, founders

Philip Lehman, managing partner, 1901-1925

Robert “Bobbie” Lehman, took over as head of Lehman from father

Philip in 1925

Gary Barancik, partner, Perella Weinberg Partners

James L. “Jamie” Dimon, chairman and

CEO

, JPMorgan Chase

David Einhorn, chairman, Greenlight Capital

Kenneth D. “Ken” Lewis, president, chairman, and

CEO

, Bank of

America

John Mack, chairman of the board and

CEO

, Morgan Stanley

Joseph R. “Joe” Perella, chairman, Perella Weinberg Partners

Daniel Pollack, lawyer for Chris Pettit

Robert K. “Bob” Steel, president and chief executive, Wachovia, also

domestic undersecretary at the U.S. Treasury

Min Euoo Sung,

CEO

, Korea Development Bank

Mark Shafir, partner and senior investment banker, Thomas Weisel

Partners

Bruce Wasserstein, the late chairman and chief executive, Lazard

Andrew Zimmerman, analyst,

SAC

Capital

Archibald Cox Jr., chairman, Barclays Americas

Jerry del Missier, president, Barclays Capital

Robert E. “Bob” Diamond Jr., president and

CEO

, Barclays Capital

Michael Klein, independent adviser, Barclays

Rich Ricci, chief operating officer, Barclays

John S. Varley,

CEO

H. Rodgin Cohen, chairman, Sullivan & Cromwell

Steve Dannhauser, chairman, Weil, Gotshal & Manges

Victor Lewkow, attorney, Cleary Gottlieb Steen & Hamilton

Harvey R. Miller, partner, business finance and restructuring guru,

Weil, Gotshal & Manges

James M. Peck, judge, United States Bankruptcy Court for the

Southern District of New York

Daniel Pollack, lawyer for Chris Pettit

Simpson Thacher & Bartlett, Lehman’s primary law firm, Erin Callan’s

former employer

Anton R. Valukas, official examiner probing the Lehman bankruptcy

Tony Lomas, PricewaterhouseCoopers partner and administrator of Lehman’s London estate

Bryan Marsal, chief restructuring officer and co-

CEO

of turnaround firm Alvarez & Marsal

LLC

United States

Ben S. Bernanke, chairman, Federal Reserve

C. Christopher Cox, chairman, Securities and Exchange Commission

(

SEC

)

Michele Davis, assistant secretary

Timothy F. Geithner, president, Federal Reserve Bank of New York,

later secretary of the Treasury

Dan Jester, Paulson’s adviser

David G. Nason, assistant secretary

Henry M. Paulson Jr., secretary of the Treasury

Steven Shafran, Paulson’s adviser

Kendrick R. Wilson, adviser to the secretary of the Treasury

United Kingdom

Alastair M. Darling, chancellor of the Exchequer

Sir Callum McCarthy, chairman, Financial Services Authority (

FSA

)

Hector Sants, chief executive,

FSA

The most crucial talent required in business is an ability to understand people. You have to know what motivates them, what their strengths and weaknesses are. . . . If you’re a good judge of character, you will go very far. If not, it’s over.

—Stephen A. Schwarzman (2009), former Lehman Brothers partner and current

CEO

of the Blackstone Group

What do I think when I look back on that period when

I interviewed all those Lehman bankers in the 1980s? Honestly,

I was relieved that I’d never have to see many of them ever

again. They were, with some exceptions, a greedy, selfish,

deeply unpleasant bunch of people.

—Ken Auletta (2009), author of Greed and Glory on Wall Street: The Fall of the House of Lehman (1986)

W

hen I started researching this book, I thought I’d be telling the lurid story of the final few months of America’s fourth-largest investment house, Lehman Brothers, which was almost 160 years old when it gasped its last breath on September 15, 2008.

When it filed for bankruptcy, credit markets around the world trembled, and U.S. Treasury Secretary Henry Paulson Jr. and Federal Reserve Chairman Ben S. Bernanke realized with terror that they were facing the worst economic catastrophe since the Great Depression of the 1930s.

I thought I would simply be telling the dramatic story behind that harrowing moment, viewing Lehman’s history through the lens of Paulson, Bernanke, and Lehman’s chairman and CEO, Richard S. “Dick” Fuld, who held his position for nearly 15 years, and once joked--during better times, when Lehman stock rose to its all -time high--that “they’ ll be carrying me out of here feet first.” And they almost did.

What I had failed to realize until I dug far deeper into the annals of Lehman’s history was that the drama of the ending was no match for the saga of its life. The story of the 160 -year-old firm up until 1984 had been well-chronicled (in particular, by Ken Auletta in

Greed and Glory on Wall Street: The Fall of the House of Lehman

). But what happened to it in those crucial intervening years—from 1984 until 2008—had not.

Ironically, Lehman had tried to tell this story itself, and failed. In 2003, Joseph M. “Joe” Gregory, the firm’s president, asked the chief players of the preceding 20 years (among them himself, Steve Lessing, Jeff Vanderbeek, John Cecil, and Paul Cohen) to each give their accounts in the hope of compiling “The Modern History” of Lehman. He gave up after fifty pages. But in one of those rare, extraordinary gifts that biographers pray for, those fifty pages—and, more important, the many pages written by each individual—were handed to me by a source to whom I am forever deeply indebted.

“The Modern History” opened in 1994 as Lehman gets spun out of American Express and Dick Fuld, the new

CEO

, stood in front of a cascade of balloons in the Winter Garden, the party space in the World Financial Center, across the street from the World Trade Center towers in the heart of Wall Street. Fuld proudly proclaimed: “It’s a new day. We have the opportunity to create our own destiny, and I need you to do it.”

There is talk among the senior executives about the “remarkable will of Lehman Brothers,” and the “nonnegotiable values of the Lehman culture,” which include “integrity, strength of character, open communication, loyalty, and teamwork.” The unfinished manuscript discusses rating these values above the more superficial inclinations of Wall Street: Valuing spirit over education, for example, makes Lehman a “special place to work.” The firm was small but the employees were united. They were, they proudly proclaimed again and again, “one firm.” The Lehman mantra was “Do the right thing.” They were the good guys of Wall Street.