The Alpha Masters: Unlocking the Genius of the World's Top Hedge Funds (36 page)

Read The Alpha Masters: Unlocking the Genius of the World's Top Hedge Funds Online

Authors: Maneet Ahuja

John Paulson provides omega services in mergers, bankruptcies, corporate restructurings, spin-offs and recapitalizations, and litigations. All of these are complex transactions that involve skills, which take time to learn from the perspective of both theory and experience. They are all risk-transfer activities in that other investors don’t have the time or skills to devote to these activities and transfer risks to the speculators such as Paulson. Paulson provides a road map of how to become and to think like a speculator. He knew he would need to learn from the best to hone his skills and work his way into a position to understand and to execute the business. This is why others are willing to transfer risk: they don’t have the expertise. And he concentrates on risks and how to achieve his positions to mitigate his downside risks by trading off returns and risk mitigation. Unlike other investors, who think risk is a control issue, Paulson and the others chronicled in the book, think of risk and return as two sides of the same coin.

David Tepper learned the risk-transfer business from the perspective of a trader. He understands an investor’s needs and typical responses to situations (especially the bad ones) and when and why they are willing to give up returns for long-term gains. As a result, he is willing to take large positions in intermediate short-term supply/demand imbalances in the market. He is not afraid to lose money on positions and hold them for longer periods, as “hot money” leaves positions and “cold money” wait to take over the positions from him. He is willing to step in to buy the distressed debt of companies in the largest bankruptcies as other investors wish to transfer risks to him.

Ray Dalio learned that governments and central bankers spin stories to suit what they want to report. Investors react to these spins believing that these government entities are imparting information about the future. He decided that the historical reaction of markets to shocks provides excellent information on the current market’s reaction to today’s shocks regardless of official pronouncements. Using myriad time series, Bridgewater identifies approximately 15 or so strategies that are constructed to be factor neutral (long and short securities in each strategy to be zero beta) and uncorrelated with each other because they are in different geographical regions, or exhibiting different responses to shocks. (Although Dalio identifies his returns as alphas, I am not sure whether they are omega in my definition in that investors respond to macro information or shocks, and Bridgewater intermediates supply/demand imbalances using time series to establish the value fixed points in his system.) The uncorrelated risks reduce the risk of the portfolio of strategies dramatically, and the risk level can be increased to target risk levels through leverage while dramatically enhancing lower expected returns per strategy.

Although this is the ultimate goal of all hedge funds, most don’t control risk and take significant factor exposures. Bridgewater realized that by concentrating on alpha strategies, unconstrained management (i.e., no benchmark other than LIBOR), it could enhance investor returns and provide them with lower risk than by combining both alpha and beta strategies. Or, to put it differently, it is always possible to port an alpha-producing strategy to any factor exposure and provide superior risk-adjusted returns. The unconstrained alpha strategy produces abnormal returns; the beta strategies produce systematic returns.

Ahuja is an energetic lady. That energy flows throughout the book. She has a great group of

Masters

who explain their craft, who they are, and how they think, through informative and stimulating interviews. I don’t know how she was able to assemble this amazing group (or even how she got me to write this afterword), but we are fortunate to have so many wonderful insights in one place.

1

The classic example of efficiency gain is the farmer transferring the risk of his wheat crop to the miller who stores the crop until the bakers ask for the flour to make the bread and cakes that we consume. The miller hedges generalized market risks by selling futures contracts and giving up return to speculators who carry the inventory risk forward until the bakers buy the flour. Without this service, the miller would not be able to store as much wheat and consumers would incur higher prices for bread and cakes. This risk transfer has occurred since the 1630s.

2

Everything being equal, the price of all securities is lower, or the expected return is higher because of this phenomenon. This is a “pooling equilibrium”— the good companies cannot distinguish themselves from the bad because they use the same accounting methods and the same outside accounting firms that attest to the efficacy of their statements. Chaos tries to cull out the sick companies from the pool. And, the more successful he is, the less the provision of “bad” inputs will persist.

Appendix

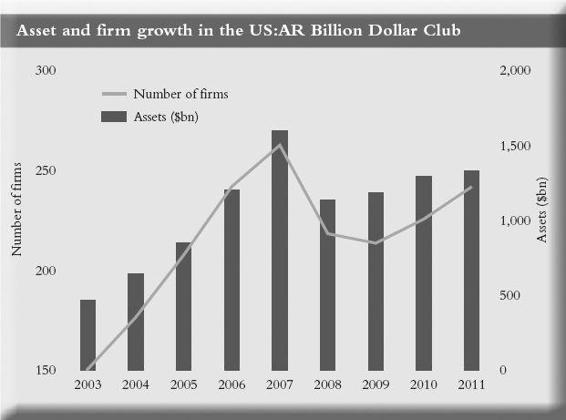

The Billion Dollar Club is a biannual survey carried out by

Alpha

magazine, which ranks all hedge funds in the United States that have more than $1 billion in assets.

Source:

Hedge Fund Research, Inc. (HFR).

This chart depicts the growth in assets and number of Billion Dollar Club firms from 2003 to 2011.

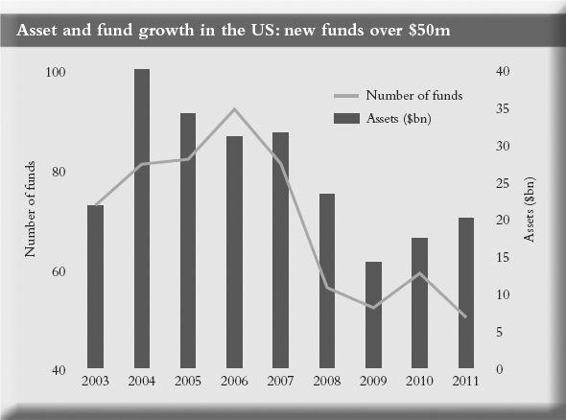

Source: HedgeFund Intelligence.

This chart depicts the number of new fund launches above $50 million and their total assets from 2003 to 2011.

Source: HedgeFund Intelligence.

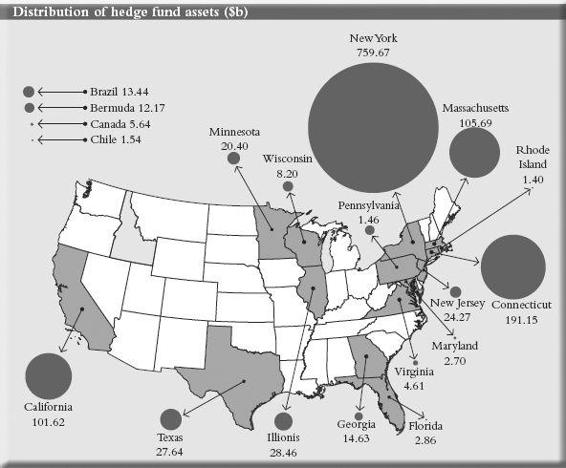

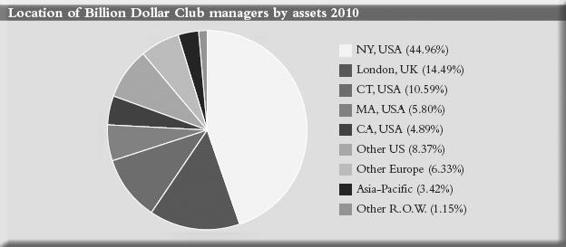

This is the geographic dispersion of assets held by the Billion Dollar Club firms.

Source: HedgeFund Intelligence

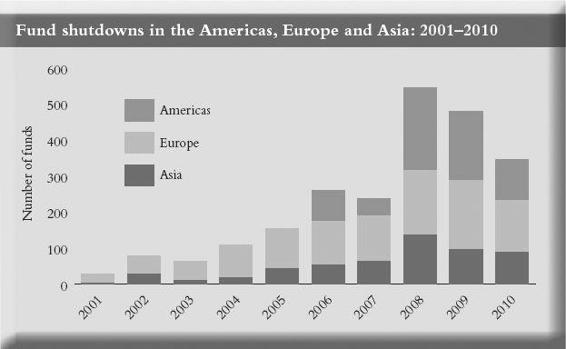

This chart presents the global fund shutdowns across America, Asia, and Europe from 2001 to 2010.

Source: HedgeFund Intelligence

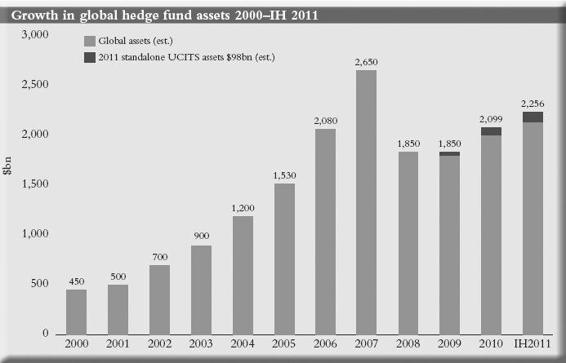

This chart depicts the growth in global hedge fund assets from 2000 to the first half of 2011. From 2009, it also takes into account UCITS.

Source: HedgeFund Intelligence

This is a pie chart depicting the location of Billion Dollar Club managers by assets.

Source: HedgeFund Intelligence Figures have been rounded, except for the total

This is a bar graph presenting the distribution of global assets in the hedge fund industry.