Read Start Your Own Business Online

Authors: Inc The Staff of Entrepreneur Media

Start Your Own Business (23 page)

The IRS also mandates that there are certain activities tax-exempt organizations can’t engage in if they want to keep their exempt status. For example, a section 50l(c)(3) organization cannot intervene in political campaigns.

Remember, nonprofits still have to pay employment taxes, but in some states they may be exempt from paying sales tax. Check with your state to make sure you understand how nonprofit status is treated in your area. In addition, nonprofits may be hit with unrelated business income tax. This is regular income from a trade or business that is not substantially related to the charitable purpose. Any exempt organization under Section 501(a) or Section 529(a) must file Form 990-T (

Exempt Organization Business Income Tax Return

) if the organization has gross income of $1,000 or more from an unrelated business and pay tax on the income.

Exempt Organization Business Income Tax Return

) if the organization has gross income of $1,000 or more from an unrelated business and pay tax on the income.

If your nonprofit has revenues of more than $25,000 a year, be sure to file an annual report (Form 990) with the IRS. Form 990-EZ is a shortened version of 990 and is designed for use by small exempt organizations with incomes of less than $1 million.

Form 990 asks you to provide information on the organization’s income, expenses and staff salaries. You also may have to comply with a similar state requirement. The IRS report must be made available for public review. If you use the calendar year as your accounting period (see Chapter 41), file Form 990 by May 15.

“To be successful in

business, you need

friends. To be very

successful, you need

enemies.”—CHRISTOPHER ONDAATJE,

CANADIAN FINANCIER AND

PHILANTHROPIST

For more information on IRS tax-exempt status, download IRS Publication 557 (

Tax-Exempt Status for Your Organization

) at

irs.gov

.

Tax-Exempt Status for Your Organization

) at

irs.gov

.

Even after you settle on a business structure, remember that the circumstances that make one type of business organization favorable are always subject to changes in the laws. It makes sense to reassess your form of business from time to time to make sure you are using the one that provides the most benefits.

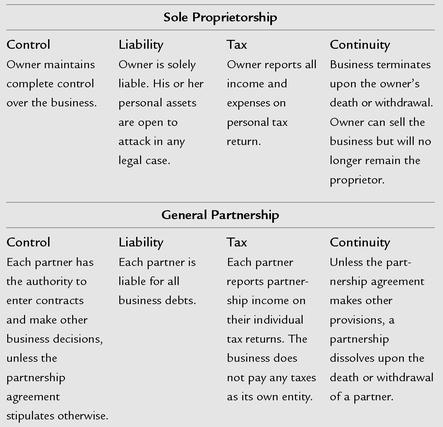

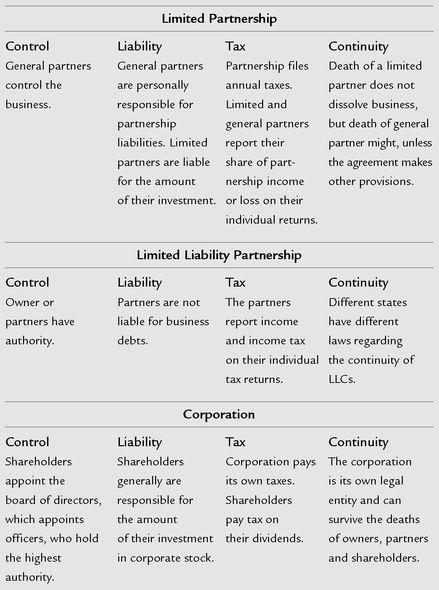

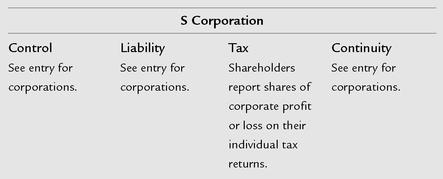

Choosing a Legal Form for Your BusinessThis table summarizes the characteristics of six different forms of business: sole proprietorships, general partnerships, limited partnerships, limited liability partnerships (LLPs), corporations in general, and S corporations. We list four characteristics for each legal form:•

Control

. Who holds authority in a business operating under this form?•

Liability

. Who is legally liable for any losses the business experiences?•

Tax

. How will business income and expenses be reported?•

Continuity

. If a business owner dies or wants to leave the business, does the business continue?

chapter 10

PLAN OF ATTACK

Creating a Winning Business Plan

T

ell friends you’re starting a business, and you will get as many different pieces of advice as you have friends. One piece of wisdom, however, transcends all others: Write a business plan.

ell friends you’re starting a business, and you will get as many different pieces of advice as you have friends. One piece of wisdom, however, transcends all others: Write a business plan.

According to a study conducted for AT&T, only 42 percent of small-business owners bother to develop a formal business plan; of those who do use a plan, 69 percent say it was a major contributor to their success.

Some people think you don’t need a business plan unless you’re trying to borrow money. Of course, it’s true that you do need a good plan if you intend to approach a lender—whether a banker, a venture capitalist or any number of other sources—for startup capital. But a business plan is more than a pitch for financing; it’s a guide to help you define and meet your business goals.

Just as you wouldn’t start off on a cross-country drive without a road map, you should not embark on your new business without a business plan to guide you. A business plan won’t automatically make you a success, but it will help you avoid some common causes of business failure, such as undercapitalization or lack of an adequate market.

“My interest is in the

future because I am

going to spend the rest

of my li fe there.”—CHARLES F. KETTERING,

AMERICAN INVENTOR AND

SCIENTIST

As you research and prepare your business plan, you’ll find weak spots in your business idea that you’ll be able to repair. You’ll also discover areas with potential you may not have thought about before—and ways to profit from them. Only by putting together a business plan can you decide whether your great idea is really worth your time and investment.

What is a business plan, and how do you put one together? Simply stated, a business plan conveys your business goals and the strategies you’ll use to meet them, potential problems that may confront your business and ways to solve them, the organizational structure of your business (including titles and responsibilities), and the amount of capital required to finance your venture and keep it going until it breaks even.

Sound impressive? It can be, if put together properly. A good business plan follows generally accepted guidelines for both form and content. There are three primary parts of a business plan.

1. The first is the business concept, where you discuss the industry, your business structure, your product or service, and how you plan to make your business a success.

2. The second is the marketplace section, in which you describe and analyze potential customers: who and where they are, what makes them buy and so on. Here, you also describe the competition and how you will position yourself to beat it.

3. Finally, the financial section contains your income and cash-flow statements, balance sheet and other financial ratios, such as break-even analyses. This part may require help from your accountant and a good spreadsheet software program.

Breaking these three major sections down further, a business plan consists of seven major components:

1. Executive summary

2. Business description

3. Market strategies

4. Competitive analysis

5. Design and development plan

6. Operations and management plan

7. Financial factors

In addition to these sections, a business plan should also have a cover, title page and table of contents.

TIPAlthough it’s the first part of the plan to be read, the executive summary is most effective if it’s the last part you write. By waiting until you have finished the rest of your business plan, you ensure you have all the relevant information in front of you. This allows you to create an executive summary that hits all the crucial points of your plan.

Anyone looking at your business plan will first want to know what kind of business you are starting. So the business concept section should start with an executive summary, which outlines and describes the product or service you will sell.

The executive summary is the first thing the reader sees. Therefore, it must make an immediate impact by clearly stating the nature of the business and, if you are seeking capital, the type of financing you want. The executive summary describes the business, its legal form of operation (sole proprietorship, partnership, corporation or limited liability company), the amount and purpose of the loan requested, the repayment schedule, the borrower’s equity share, and the debt-to-equity ratio after the loan, security or collateral is offered. Also listed are the market value, estimated value or price quotes for any equipment you plan to purchase with the loan proceeds.

Your executive summary should be short and businesslike—generally between half a page and one page, depending on how complicated the use of funds is.

Business DescriptionThis section expands on the executive summary, describing your business in much greater detail. It usually starts with a description of your industry. Is the business retail, wholesale, food service, manufacturing or service-oriented? How big is the industry? Why has it become so popular? What kind of trends are responsible for the industry’s growth? Prove, with statistics and anecdotal information, how much opportunity there is in the industry.

Explain the target market for your product or service, how the product will be distributed, and the business’ support systems—that is, its advertising, promotions and customer service strategies.

Next, describe your product or service. Discuss the product’s applications and end users. Emphasize any unique features or variations that set your product or service apart from others in your industry.

Other books

Power and Passion by Kay Tejani

Brian Friel Plays 2 by Brian Friel

Midnight is a Lonely Place by Barbara Erskine

Tethered (J + P series) by D.A. Roach

Something Fishy by Shane Maloney

Dead of Night by Lynn Viehl

The Cancun Trilogy, An Erotic Beach Romance by Lena Malick

Pleasure Me by Tina Donahue

Strange Academy (Hot Paranormal Romance) by Wilde, Teresa

El monstruo de Florencia by Mario Spezi Douglas Preston