Read Start Your Own Business Online

Authors: Inc The Staff of Entrepreneur Media

Start Your Own Business (109 page)

SMARTER TO BARTER?R

emember how pioneers would trade a deer skin for a musket? It was called bartering. Today, the concept is back in a big way—especially online. The companies are everywhere on the net: FreedomBarter

Exchange.com

,

BarterItOnline.com

,

Barter.com

,

Mr.Swap.com

... need we say more?The barter industry is growing rapidly, with barter sales increasing from $40 million in 1991 to more than $20 billion in 2000. The North America Barter Association reports that approximately $30 billion in transactions were conducted in the United States alone during 2005, while the U.S. Department of Commerce estimates that 20 to 25 percent of worldwide commerce is bartered. Bartering can be an invaluable tool for a startup company.Bartering can be good for your business in good times, but it can be even better in bad, and, let’s face facts, most startups have their share of downtimes. The main advantage to going the barter route is that if you have unwanted inventory, you can use it to trade rather than spend money you don’t have and pile more onto your already stretched-toothin budget.Here’s how bartering works: Let’s say a landscaper needs a root canal. The landscaper belongs to a bartering organization and learns that a local dentist is also part of the same organization. But it turns out the dentist doesn’t need any landscaping done. OK, fine. So the landscaper instead does work for a small public relations firm and a restaurant management consultant. For that work, he has been banking “bartering dollars,” enough to pay for other members’ services, like a dentist, who will then use those bartering dollars to get something from another member. Meanwhile, to belong to a bartering organization, you’re paying a monthly membership fee of $5 to $30.Who determines what each service or product is worth? You pay the fair market value, which is determined by buyer and seller. But beware: There are some dishonest barterers out there who will charge higher prices to members or not give a service or product that was part of a deal. You need to keep track of bartering purchases and provide clients with Form 1099-B so you can file it on your taxes.

For your operating expenses, consider items such as advertising, auto, depreciation, insurance, etc. Then factor in a tax rate based on actual business tax rates that you can obtain from your accountant.

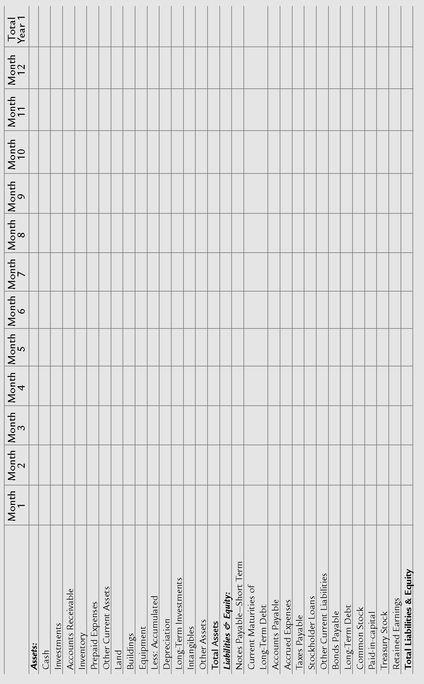

On the balance sheet, break down inventory by category. For instance, a clothing manufacturer has raw materials, work-in-progress and finished goods. For inventory, accounts receivable and accounts payable, you will figure the total amounts based on a projected number of days on hand. (See page 689 for the calculations needed to compute these three key numbers for your budget.)

Consider each specific item in fixed assets broken out for real estate, equipment, investments, etc. If your new business requires a franchise fee or copyrights or patents, this will be reflected as an intangible asset.

On the liability side, break down each bank loan separately. Do the same for the stockholders’ equity—common stock, preferred stock, paid-in-capital, treasury stock and retained earnings.

Do this for each month for the first 12 months. Then prepare the quarter-to-quarter budgets for years two and three. For the first year’s budget, you will want to consider seasonality factors. For example, most retailers experience heavy sales from October to December. If your business will be highly seasonal, you will have wide-ranging changes in cash-flow needs. For this reason, you will want to consider seasonality in the budget rather than take your annual projected Year 1 sales level and divide by 12.

As for the process, you need to prepare the income statement budgets first, then balance sheet, then cash flow. You will need to know the net income figure before you can prepare a pro forma balance sheet because the profit number must be plugged into retained earnings. And for the cash-flow projection, you will need both income statement and balance sheet numbers.

WHERE CREDIT IS DUEW

hen you book a credit sale in your business, you must collect from the customer to realize your profit. Many a solid business has suffered a severe setback or even been put under by its failure to collect accounts receivable.It is vital that you stay on top of your A/R if you sell on credit. Here are some tips that will help you maintain high-quality accounts receivable:•

Check out references upfront

. Find out how your prospective customer has paid other suppliers before selling on credit. Ask for supplier and bank references and follow up on them.•

Set credit limits, and monitor them

. Establish credit limits for each customer. Set up a system to regularly compare balances owed and credit limits.•

Process invoices immediately

. Send out invoices as soon as goods are shipped. Falling behind on sending invoices will result in slower collection of accounts receivable, which costs you cash flow.•

Don’t resell to habitually slow-paying accounts

. If you find that a certain customer stays way behind in payment to you, stop selling to that company. Habitual slow pay is a sign of financial instability, and you can ill afford to write off an account of any significant size during the early years of your business.Fiancial budget and Income Statement worksheetBalance Sheet WorksheetCash-flow Worksheet

Whether you budget manually or use software, it is advisable to seek input from your CPA in preparing your initial budget. His or her role will depend on the internal resources available to you and your background in finance. You may want to hire a CPA to prepare the financial plan for you, or you may simply involve him or her in an advisory role. Regardless of the level of involvement, your CPA’s input will prove invaluable in providing an independent review of your shortand long-term financial plan.

In future years, your monthly financial statements and accountantprepared year-end statements will be very useful in preparing a budget.

Sensitivity AnalysisOne other major benefit of maintaining a financial budget is the ability to perform a sensitivity analysis. Once you have a plan in place, you can make adjustments to it to consider the potential effects of certain variables on your operation. All you have to do is plug in the change and see how it affects your company’s financial performance.

Here’s how it works: Let’s say you’ve budgeted a 10 percent sales growth for the coming year. You can easily adjust the sales growth number to 5 percent or 15 percent in the budget to see how it affects your business’s performance. You can perform a sensitivity analysis for any other financial variable as well. The most common items for which sensitivity analysis is done are:

• Sales

• Cost of goods sold and gross profit

• Operating expenses

• Interest rates

• Accounts receivable days

• Inventory days

• Accounts payable days on hand

• Major fixed-asset purchases or reductionsSTOCKING UPI

f your business will produce or sell inventory, your inventory management system will be crucial to your business’ success. Keeping too much inventory on hand will cost you cash flow and will increase the risk of obsolescence. Conversely, a low inventory level can cost you sales.Here are some suggestions to help you better manage your inventory:•

Pay attention to seasonality

. Depending on the type of business you are starting, you may have certain inventory items that sell only during certain times of the year. Order early in anticipation of the peak season. Then make sure you sell the stock so that you don’t get stuck holding on to it for a year.•

Rely on suppliers

. If you can find suppliers that are well-stocked and can ship quickly, you can essentially let them stock your inventory for you. “Just in time” inventory management can save valuable working capital that could be invested in other areas of your business.•

Stock what sells

. This may seem obvious, but too many business owners try to be all things to all people when it comes to inventory management. When you see what sells, focus your purchasing efforts on those items.•

Mark down stale items

. Once you’re up and running, you will find that certain items sell better than others. Mark down the items that don’t sell, and then don’t replace them.•

Watch waste

. Keep a close eye on waste. If production mistakes aren’t caught early, you can ruin a whole batch of inventory, which can be extremely costly.

• Acquisitions or closings

To be an effective and proactive business owner, you will need to learn to generate and understand the financial management tools discussed in this chapter. Even if you don’t consider yourself a “numbers person,” you will find that regular analysis of your financial data will be vital as you start and grow your business.

chapter 40

PAY DAY

How To Pay Yourself

I

t’s your business and your budget—which means the size of your paycheck is entirely up to you. But while the freedom of setting your own salary sounds great in theory, in practice most business owners find it a tough call. Should you pay yourself what you need to cover expenses? What your business can afford? The salary you left behind to launch your business?

t’s your business and your budget—which means the size of your paycheck is entirely up to you. But while the freedom of setting your own salary sounds great in theory, in practice most business owners find it a tough call. Should you pay yourself what you need to cover expenses? What your business can afford? The salary you left behind to launch your business?

Other books

La telaraña by Agatha Christie

In the Arms of the Wind by Charlotte Boyett-Compo

Two of a Mind by S M Stuart

Aundy (Pendleton Petticoats - Book 1) by Hatfield, Shanna

Captured Miracle by Alannah Carbonneau

The Hungry Dead by John Russo

Buried (A Bone Secrets Novel 03) by Kendra Elliot

Everliving Kings (the Heroes of Darkness Saga) by JD Ravynsmoon

Selene of Alexandria by Justice, Faith L.

Frenzy by John Lutz