Soldier of Finance (7 page)

Read Soldier of Finance Online

Authors: Jeff Rose

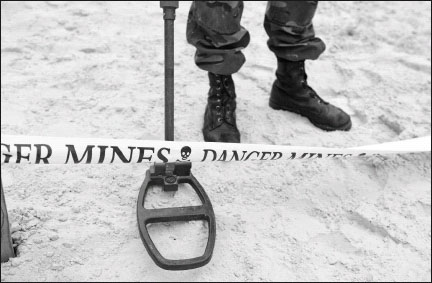

LAND MINESâYOUR CREDIT REPORT

As trained infantry soldiers, we knew that our feet were our main mode of transportation. Everywhere we went, we were on our boots. In modern combat, soldiers move around in vehicles like Humvees, but our training prepared us for walking. In real-life military scenarios, one of the dangers of being on foot is stepping into a minefield, so naturally we trained for that situation. It was one of the most annoying exercises we had to learn.

When you're confronted with a minefield, there are three options. The first is to cry, which was not really an option given to us soldiers. Anyone who actually cried would be thrown into the minefield by the drill instructor.

The second option, if you're already in the minefield before realizing it, is to retrace your footsteps, turning around and walking back exactly the way you came. The object is to step only where you have already stepped, so you look for your footprint and step into it. This option is only good if you can afford to go back the way you came. If your mission is to support some other operation, you don't have a choice. You have to move forward.

Of course, the best way to avoid problems with a mine is simply to not step on it. The trouble with that option is that mines are hidden under the surface of the ground, and they're not easily located. Fortunately, if you know how to look for them, they can be found.

To begin the search, you use your hands to smooth out the grass in front of you. Hopefully, if there is a mine under the surface, you can feel enough of a bump to recognize it. Then you either get down on your knees or lie in a prone position.

Once you know the immediate area is safe, you begin probing. During training, that meant using our bayonetsâlong Rambo knives attached to the ends of our M-16sâinserting the blade into the ground at an angle (probing straight down could set off a mine). Covering one area at a time, we pushed the blade in deep enough to detect any hard objects beneath the surface.

Eventually the “ding” of my blade hitting something would cause my breath to catch as I hoped that what I hit was just a rock. If we did find a mine, we marked it so that EOD (Explosive Ordnance Disposal) could remove it safely and securely.

As tense and exciting as it was when the bayonet clinked against something, probing a minefield was mostly tedious and exhausting. It took forever to cover a small amount of ground. I can remember spending almost an entire day, with the drill sergeants standing over us. At the end of the exercise, I was worn out.

Annoying and miserable as those days were, I would rather suffer through them than step on a mine. World War II tales depict peasants on the Eastern Front being herded across minefields ahead of the regular troops. Most lost their lives in the process. The fastest way to discover a mine is to start walking, but the price isn't worth it. Given the choice, I'd rather start probing, no matter how long it takes or how annoying it is.

The point of this illustration is that what you can't see and what you don't know about

can

hurt you. And when it comes to your credit report, you might be surprised to find what is there.

The first time I probed into my credit report, I didn't really expect to find anything. I was young and hadn't done much yet. But I was curious, so I requested a copy. Right away I found an error. The report said I was delinquent on payments for a gym membership. I had canceled the membership five years earlier and didn't even live in the same state anymore! When I was a member, I never missed a payment, but somehow, the records got mixed up. And there it was on my credit report, pulling down my credit score.

It wasn't difficult to fix. I made a phone call and sent a letter and it was done. The point is, if I had never probed my credit report for land mines, that one would have blown up in my face somewhere down the road. It would have continued to hurt my credit rating going forward.

According to a Consumer Action study, 27 percent of Americans have never checked their credit reports. Now for the sobering part: Among the credit reports surveyed by the U.S. Public Interest Research Group (PIRG), 25 percent contained serious errors that could result in the denial of credit. Altogether, 79 percent of credit reports surveyed contained an error or mistake of some kind. And those errors affect your credit score.

It is very important that you check your credit report at least once a year. The only way you can be sure the information on it is accurate is to check it. Who knows what land mines are lurking there? It takes time, but you need to probe into it so there are no surprises down the road. This needs to become a regular part of your financial reconnaissance.

According to FINRA (Financial Industry Regulatory Authority), only 42 percent of people have obtained a copy of their credit report. Even fewer have checked their credit score in the past twelve months. These statistics are unacceptable, considering how easy it is to check. I suspect that most people are afraid of what they'll find, but now that you've gone through your financial physical and filled out your SIT Report, doing this should be easy.

Several corporations are in the business of reporting credit, but three in particular are the primary sources for most people: TransUnion, Experian, and Equifax. Fortunately, the law requires that those three major credit reporting agencies allow you to check your credit once a year at no cost. You can check all three at once or you can spread it out by checking one every four months. Regardless of which method you choose, you absolutely must do it.

The big three credit reporting agencies jointly sponsor a website,

www.AnnualCreditReport.com

, where every twelve months you can request a copy of each of your credit reports. If you want to keep track of how often you have requested reports, set up calendar reminders on Google Calendar, MS Outlook, or some other calendar system.

The procedure is simple. You will be asked some basic information to verify your identity, including your name, address, and Social Security number. After completing your personal information, you will be asked to select the credit bureau from which you want to receive a report.

Once you make that selection, you will be transferred to the website for the company you chose. After you fill out the necessary personal information, your credit report will show up on the screen with an option to print. If you opt to print your report, be sure to select the option to show only the last four digits of your Social Security number on the personal information page. That way you won't have your full number on a paper that potentially can be lost or stolen.

You can also request that your credit report be mailed to you, if you prefer, or if you don't have access to a printer. It takes about fifteen days for the request to be processed and sent to you. If you're not comfortable giving your information online, you can call them toll free at 1-877-322-8228.

Obtaining your credit score is more difficult than getting a credit report, but it can be done. Of course, if you don't mind paying a few dollars, you can request it at the same time you print your report. The credit reporting companies don't mind charging you for things that are legally allowed. This is where you should be on your guard, because the companies plant a few land mines of their own. Often they offer an option to sign up for a free trial period for their other services in return for a free credit score. You then have a period of time, usually a week or thirty days, to cancel before you are charged.

If you order your credit score, be sure that you obtain the correct number. You want the FICO score, since that is the number used by at least 90 percent of lenders. But as you learned in

Chapter 4

, there are three other types of credit scores availableâthe consumer score, the rental score, and the auto formula score. If you are looking at your consumer credit score, thinking it is your FICO score, you could easily think your score is a couple of hundred points higher than what a lender sees. The Experian score is a consumer credit score; you can get the FICO score from TransUnion and Equifax. Many people get a credit score from the website

www.AnnualCreditReport.com

, but that is a consumer score,

not

FICO.

Be prepared for a shock. Your credit report is a long document. The first time I printed mine, it was over thirty pages. I didn't think I had lived long enough for that much information to accumulate. Every detail of my financial history, from the first day I got credit, was preserved there. I felt overwhelmed.

Then I remembered my enlistment physical. The United States Army not only wanted to know everything about me, they kept it in a file so that no detail would ever get lost. Every shot they gave me was recorded. Every injury, infection, medical procedure, and exam was written down. Every award I received is in that file. Every score on every test I took is there. Everything that happened to me from Basic Training through my tour in Iraq is preserved forever. That file is

me!

Your credit report is the same. For all financial purposes, that report is you. Your credit

score

is your roster number and your credit

report

is your financial identity. In your credit report, you can expect to find:

- Your personal information (name, address, Social Security number, etc.)

- Types of credit you use or have used (credit cards, mortgages, loans)

- How long each individual line of credit has been open

- Whether you have paid your bills on time (including any collection information if a debt was passed on to a collection agency)

- How much of the credit you have used, and what is outstanding

- Whether you have been looking to open new sources of credit (any credit inquiries that have been made, such as when you apply for credit)

- Banking information

- Public records (such as bankruptcy or a court-related judgment)

Take the time to go through this information in the same manner in which you would examine a minefield. Go slowly and look at

everything.

Search for errors, and take note of your financial habits. Errors can be corrected and bad habits can be changed, but you have to catch them first.

Be vigilant! Your name might be misspelled, potentially creating identity problems. Addresses are not always current. You could be listed as working for a specific employer when you quit the job long ago. Look for accounts that are not yours, or accounts that you no longer haveâ¦like a gym membership.

Examine your report for any delinquencies on payments. Perhaps you were late on a credit card or a mortgage payment. Make sure that the reports of late payments are accurate. Sometimes you make the payment on time and it still ends up on your report as delinquent.

Check dates on negative items. If a bankruptcy is more than ten years old, it should not be there. Most other defaults should disappear after seven years. Make sure nothing is on your credit report that shouldn't be there.

One of the most harmful and common things on your credit report is a duplicate entry. This can occur easily. If you are late paying a bill and you let it go until it goes to a collection agency, your delinquency is registered on your account. If you still don't pay itâand many people don't with bills such as credit cardsâeventually that agency will sell the debt to another collection agency. When the transfer is made, the debt is recorded again, meaning you will have two entries for the same debt.

A significant red flag is the appearance of erroneous personal information. If you see someone else's Social Security number, for example, that could be indicative of identity fraud, or that your report has accidentally been merged with someone else's.

Another common problem is that credit card companies often report credit card limits incorrectly. I will explain why this is a serious problem when we discuss credit cards, but you should carefully check that all of your limits are reported accurately. If your limit is $10,000 and the credit card company reports it as $5,000, it changes the utilization ratio (you will learn more about this in

Chapter 6

). A balance that is actually 30 percent of your credit limit will appear as 60 percent, which will cause a drop in your credit score.