Soldier of Finance (15 page)

Read Soldier of Finance Online

Authors: Jeff Rose

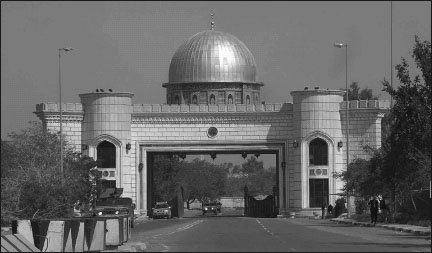

Each operation I was involved in in Iraq started from our base. We often drove patrols into hostile territory, where we were on our guard for roadside bombs, snipers, or any other kind of attack. No matter what happened on patrol, we always had a degree of security. Nothing was ever planned without provision for links with the base of operationsâour source of information about other units, fuel and ammunition, and anything else we needed. A good base was always established, fortified, and made secure before we branched out into the surrounding areas.

Similarly, be sure you have a solid base before you begin investing. Keep your priorities straight and use common sense. There is a reason we dealt with debt and credit cards first. If you haven't taken care of those issues, you are not ready to invest. It's pointless to invest money in a mutual fund, hoping to make 10%, when you're paying 20% interest on a credit card. If you haven't eliminated those interest payments, that should be your priority, not rushing out to jump into the stock market. You'll make more money paying off the debt first.

Make sure your FRAGO Fund is secure and that you've paid down your debt. Only then will you be ready to consider investments.

Go / No Go

Preparation for Investing

Have you identified the reasons you have not invested in the past?

_______ Go     ________ No Go

How much money do you think you need to get started?

_______ Go     ________ No Go

Do you give regularly to any charities?

_______ Go     ________ No Go

Have you considered working with a financial advisor?

_______ Go     ________ No Go

Are your debts paid off?

_______ Go     ________ No Go

Is your FRAGO Fund in place?

_______ Go     ________ No Go

- The reason people don't invest primarily falls into a couple of categories: They don't know how to start, or they don't believe they have enough available money to start. Additionally, they often lack the patience to allow investments to grow to maturity.

- You don't need much to begin. Start with a small amount deposited into a savings account until it builds up to a sufficient amount for other investments.

- Ten percent is a good point of reference, resulting in the minimum amount you should pay to yourself before you do anything else. Twenty percent is better, but put at least 10 percent into your future.

- Develop a habit of giving. Whether to your church or another charitable organization, giving brings benefits in everything you do. An attitude of generosity aids in creating stronger relationships with your community, neighbors, business associates, and clients.

- When looking for a financial advisor, take the time to interview more than one. Ask lots of questions and, above all, ask how they are paid in order to determine whether or not commissions they might receive will influence their advice. Fee-based and fee-only advisors are usually best.

- You can check with

www.NAPFA.org

and

www.CFP.net

to see if an advisor has negative reviews from past clients. - Pay off debts before investing. It is foolish to pay 20% interest on a credit card while you put money into an investment that only brings in 10% profit.

- Make sure your FRAGO Fund is established before you attempt any other investments.

FROM BOOTS TO HUMVEESâBEGINNING INVESTMENT VEHICLES

I covered a lot of ground over the duration of my military career. Even when stationed in one place, it seemed we were constantly on the move, and a variety of vehicles were required to transport us. The appropriate means of transportation largely depended on the purpose of our movement.

In Basic Training, I quickly learned that our main source of transportation was our boots. Our boots transported us nearly everywhere we needed to go, rain or shine. Our drill sergeant constantly reminded us to take good care of our feet, which were more important than our M-16s. If we didn't take care of them, we were as good as dead.

From the beginning, we learned how important our feet were. We marched to chow. We marched to the PX. We marched to get our hair cut. We marched to almost every single M-16 range. We marched to a parade field just so we could practice marching! During this stretch of training, I learned the true meaning of the expression “My dogs are barking,” because my feet never stopped barking at me.

The advantage of boots is glaringly obvious when you have to move under fire or travel into areas where a vehicle provides too big a target. Boots are slow, but in many circumstances, they are very practical in terms of accomplishing your mission. The limitation of boots is the inability to carry you over long distances quickly.

When I transferred units and became a field artilleryman, my mode of transportation changed. Since we were always hauling out the “big gun”âthe howitzerâwe rode in the back of a six-wheeled, five-ton truck. The bed of the truck was lined with wooden benches.

Our missions in Iraq were normally run with up-armored Humvees. Although they looked big and spacious, we always joked that they were designed for guys no taller than 5'5â³. You could never ride in them without banging a knee or an elbow against something. In spite of that drawback, a Humvee provided an optimum balance of protection against snipers and roadside bombs, while allowing plenty of mobility and maneuverability in confined city streets.

For my buddies who served in Afghanistan's mountainous terrain, the preferred vehicle was a 14-ton MRAP (Mine Resistant Ambush Protected) vehicle. These heavy mama-jamas were utilized because of their resistance to roadside bombs. Boasting more armor than any other military vehicle created, its V-shaped hull enabled it to deflect bombs that detonated underneath it.

Of all the military transportation I experienced, the most memorable was the two times I rode in a C-130 transport aircraft. Each trip was accompanied by powerful emotions. Flying into Iraq, we landed and taxied to a stop. The back door dropped and we stepped out into the Baghdad sunlight, signifying the commencement of my deployment. I didn't know what to expect. I remember thinking, “Do I need to have a gun?” “Should I look for a Humvee?” The exhilaration of being somewhere exotic and new soon wore off as I settled into the routine, but I still recall the intensity of those first moments.

The second time was the trip out. Lugging rucksacks behind us, we boarded the C-130. I sat in one of the seats along the outer shell of the plane, packed in tightly with my gear between two other soldiers, unable to move and sweltering in the desert heat. Finally the plane lumbered down the runway and into the air. The airflow started to cool things off and it got a little more comfortable. But there's no such thing as a smooth ride on a C-130, and it wasn't long before I got airsick.

In spite of the discomforts, I knew my deployment was over and I was finally going home. I didn't care how I got there; as long as we were moving, nothing else mattered. To this day, that memory gives me goose bumps.

In the military the terrain and the objective determine the mode of transportation utilized. Similarly, when it comes to saving or investing for retirement, you need to choose the right investment vehicle to accomplish your goal.

In my business, I often meet clients who have no plan of attack when it comes to investments. Instead, they utilize whatever comes along first, which is often not the best way to get them to where they need to be. People with short-term goals invest money into vehicles better designed for retirement accounts. The problem is, they lose sight of the mission objectives. The end result determines the plan. When you forget the mission, you are destined for failure.

When it came to traveling shorter distances, the only appropriate mode of transportation was walking. It never made sense to take the time to load forty troops on a bus and complete a head count to make sure everyone was on board only to dismount two blocks later.

When it comes to short-term savings, it doesn't make sense to use long-term investments. You want to keep them as liquid as possible. And by liquid, I don't mean wet like a Navy SEAL. Liquid means that you can access the money quickly.

Like a soldier, you have to be ready on the fly. Throughout my military career we constantly ran battle drills to see how quickly we could get ready. When it comes to dealing with financial emergencies, you don't want to have to wait an extended period of time to get your money.

I once had a conversation with a recent college graduate who wanted to invest some of his graduation money in stocks. He had heard from his family and friends that it was a good time to get in because the market was down. I couldn't argue with that logic, but as we talked further, it became clear that his goal was not long term. He planned to live off the investment while he attended graduate school.

The problem was a short-term goal in a long-term investment. If you expect to need the money in less than three years, never, never, never, never invest in the stock market. There is far too much fluctuation. Think of the stock market as a roller coaster. You start out pretty comfortable, fasten your seat belt, sit back, and take a deep breath of anticipation. You start to move forward, slowly climbing to the top of the first rise. Then everything changes. Suddenly you're plummeting, and your stomach rises into your throat. Just when you think you've adjusted to that, you take a sudden turn that throws you into the side of the car. You loop around several times and plummet again at a breathtaking rate. You finally slow down and start climbing again. But at the top, the whole giddy ride starts over.

The ups and downs of a roller coaster are great fun when you know that within a couple of minutes you will be back where you started and you can climb out onto solid ground againâunless you had a chili dog right before the ride! Roller coasters are ridden for the thrill.

You do not want that kind of thrill when you're trying to pay your monthly expenses. You want to know you have money there. Ask anyone who invested in stocks in 2008 how stable and secure they felt the first week in October of that year. Those who could afford to wait out the market will eventually get to the top again, but if you depend on being able to liquidate your investment quickly, you run a tremendous risk. Trying to invest in the market and make a little return in the short term is never worth seeing your savings cut in half.

To illustrate, let's compare a money market account with stocks. Let's say you have $10,000 to put into your savings and you're considering investing in the stock market. Your bank is offering 2% on its money market accounts, but your coworkers keep bragging about how they've made 15% in the past couple of months and call you a schmuck for not jumping on this gold mine. Rather than an emotional knee-jerk reaction, take the time to actually run the numbers:

Bank:

$10,000 Ã 2% Interest = $10,200

Stock Market:

$10,000 Ã 15% Potential Return = $11,500

You took a considerably greater risk and netted $1,300 more. Of course, this is one of those “best case” scenarios equivalent to never hitting a red light or traffic on your way to work. Yes, it can happen, but how often? What if the stock market dropped instead of going up, and you needed the money now?

Bank:

$10,000 Ã 2% Interest = $10,200

Stock Market:

$10,000 Ã 20% Loss = $8,000

That's a net loss of $2,200ânot a good short investment. Two typical reactions to such loss will make it worse: (1) you leave it invested and wait for it to break even, or (2) you invest it even more aggressively, trying to make back what you lost. If there was ever an act that epitomized the expression “shooting yourself in the foot,” this is it. Don't do it. The pain isn't worth it. Save the roller coaster experience for amusement parks.

One of the biggest mistakes I see many people make is the attempt to make a quick buck. It rarely turns out well. The stock market is for investments that you can leave for a long timeâwhich brings us to the right vehicle for the short term. Savings accounts are tough for a lot of people to swallow. They're boring. They don't pay anything. You don't hear Jim Cramer screaming on CNBC about investing into savings accounts. Interest rates have been low for quite some time and it almost feels like you're losing money. I assure you that you're not. Preserving your cash is the utmost priority for emergency moments. A savings account, above all things, will ensure that.

Opening a savings account is easy. In fact, you've probably already done it at least once in your life. Walk into a bank or credit union and talk to a representative. Make sure you negotiate and understand the fees involved. If you are comfortable with banking online, there are plenty of providers available. You can find good high-yield accounts (savings and money market accounts) that are FDIC-insured. A few possibilities are:

- Ally Bank

- FNBO Direct

- ING Direct

- EverBank

- Discover

You can learn more about them at

www.soldieroffinance.com/resources

.

For traveling middle distances, you will need something that can carry you a little farther than your feet can handle. In the brokerage world, we call this an investment account. If you open the same type of account at a bank or credit union, it's more commonly known as a money market account or CD. This type of account should be used for goals that you'd want to accomplish in the next three to five years. This is an excellent place to accumulate money for things like a down payment on a home or your kids' braces fund. Because these things take a little more time, it's okay to tie up your money a little bit longer.

If you're risk averse, you'll want to stick to CDs. They are a safe way to get a reasonable return. The only drawback is that you have to leave the money in them for a few years. That is why they are not as good for emergency funds. They are not quite as easy to liquidate. What makes CDs less risky is the fact that they are normally FDIC-insured. The interest rates are a little lower, but if you worry a lot, CDs will help you sleep at night.

Depending on how much you dedicate to this pool of money, you might want to consider something called CD laddering. It is a way to protect you from locking in your money for too long. A CD ladder allows you to invest your money for different lengths of time ranging from six months to five years.

Table 13-1

gives a quick example of what a $10,000 CD ladder divided equally over a five-year period might look like.