Rise of the Robots: Technology and the Threat of a Jobless Future (18 page)

Read Rise of the Robots: Technology and the Threat of a Jobless Future Online

Authors: Martin Ford

Lipson’s suggestion that Eureqa exhibits curiosity and Koza’s argument about computers acting without preconceptions suggest that creativity may be something that is within reach of a computer’s

capabilities. The ultimate test of such an idea might be to see if a computer could create something that humans would accept as a work of art. Genuine artistic creativity—perhaps more so than any other intellectual endeavor—is something we associate exclusively with the human mind. As

Time

’s Lev Grossman says, “Creating a work of art is one of those activities we reserve for humans and humans only. It’s an act of self-expression; you’re not supposed to be able to do it if you don’t have a self.”

38

Embracing the possibility that a computer could be a legitimate artist would require a fundamental reevaluation of our assumptions about the nature of machines.

In the 2004 film

I, Robot,

the protagonist, played by Will Smith, asks a robot, “Can a robot write a symphony? Can a robot turn a canvas into a beautiful masterpiece?” The robot’s reply “Can you?” is meant to suggest that, well, the vast majority of people can’t do those things either. In the real world of 2015, however, Smith’s question would elicit a more forceful answer: “Yes.”

In July 2012, the London Symphony Orchestra performed a composition entitled

Transits—Into an Abyss.

One reviewer called it “artistic and delightful.”

39

The event marked the first time that an elite orchestra had played music composed entirely by a machine. The composition was created by Iamus, a cluster of computers running a musically inclined artificial intelligence algorithm. Iamus, which is named after a character from Greek mythology who was said to understand the language of birds, was designed by researchers at the University of Malaga in Spain. The system begins with minimal information, such as the type of instruments that will play the music, and then, with no further human intervention, creates a highly complex composition—which can often evoke an emotional response in audiences—within minutes. Iamus has already produced millions of unique compositions in the modernist classical style, and is likely to be adapted to other musical genres in the future. Like Eureqa, Iamus has resulted in a start-up company to commercialize the technology. Melomics Media, Inc., has been set up to sell the music from an

iTunes-like online store. The difference is that compositions created by Iamus are offered on a royalty-free basis, allowing purchasers to use the music in any way they wish.

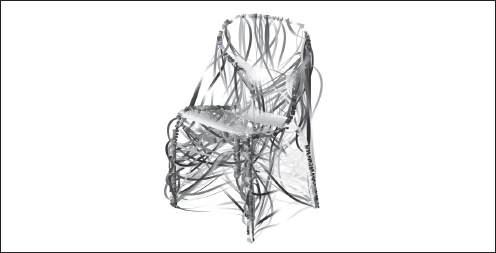

Music is not the only art form being created by computers. Simon Colton, a professor of creative computing at the University of London, has built an artificial intelligence program called “The Painting Fool” that he hopes will someday be taken seriously as a painter (see

Figure 4.1

). “The goal of the project is not to produce software that can make photos look like they’ve been painted; Photoshop has done that for years,” Colton says. “The goal is to see whether software can be accepted as creative in its own right.”

40

Colton has built a set of capabilities he calls “appreciative and imaginative behaviors” into the system. The Painting Fool software can identify emotions in photographs of people and then paint an abstract portrait that attempts to convey their emotional state. It can also generate imaginary objects using techniques based on genetic programming. Colton’s software even has the ability to be self-critical. It does this by incorporating another software application called “Darci” that was built by researchers at Brigham Young University. The Darci developers started with a database of paintings that had been labeled by humans with adjectives like “dark,” “sad,” or “inspiring.” They then trained a neural network to make the associations and turned it loose to label new paintings. The Painting Fool is able to use feedback from Darci to decide whether or not it is achieving its objectives as it paints.

41

Figure 4.1. An Original Work of Art Created by Software

My point here is not to suggest that large numbers of artists or musical composers will soon be out of a job. Rather, it is that the techniques used to build creative software—many of which, as we have seen, rely on genetic programming—can be repurposed in countless new ways. If computers can create musical compositions or design electronic components, then it seems likely that they will soon be able to formulate a new legal strategy or perhaps come up with a new way to approach a management problem. For the time being, the white-collar jobs at highest risk will continue to be those that are the most routine or formulaic—but the frontier is advancing quickly.

Nowhere is the rapid pace of that advance more evident than on Wall Street. Where once financial trading was highly dependent on direct communication between people, either in bustling trading pits or via telephone, it has now come to be largely dominated by machines communicating over fiber-optic links. By some estimates, automated trading algorithms are now responsible for at least half, and perhaps as much as 70 percent, of stock market transactions. These sophisticated robotic traders—many of which are powered by techniques on the frontier of artificial intelligence research—go far beyond simply executing routine trades. They attempt to profit by detecting and then snapping up shares in front of huge transactions initiated by mutual funds and pension managers. They seek to deceive other algorithms by inundating the system with decoy bids that are then withdrawn within tiny fractions of a second. Both Bloomberg and Dow News Service offer special machine-readable products designed to feed the algorithms’ voracious appetites for financial news that they can—perhaps within milliseconds—turn into profitable

trades. The news services also provide real-time metrics that let the machines see which items are attracting the most attention.

42

Twitter, Facebook, and the blogosphere are likewise all fodder for these competing algorithms. In a 2013 paper published in the scientific journal

Nature,

a group of physicists studied global financial markets and identified “an emerging ecology of competitive machines featuring ‘crowds’ of predatory algorithms,” and suggested that robotic trading had progressed beyond the control—and even comprehension—of the humans who designed the systems.

43

In the realm inhabited by these continuously battling algorithms, the action unfolds at a pace that would be incomprehensible to the fastest human trader. Indeed, speed—in some cases measured in millionths or even billionths of a second—is so critical to algorithmic trading success that Wall Street firms have collectively invested billions of dollars to build computing facilities and communications paths designed to produce tiny speed advantages. In 2009, for example, a company called Spread Networks spent as much as $200 million to lay down a new fiber-optic cable link stretching 825 miles in a straight line from Chicago to New York. The company operated in stealth mode so as not to alert the competition even as it blasted its way through the Allegheny Mountains. When the new fiber-optic path came online, it offered a speed advantage of perhaps three or four thousandths of a second compared with existing communications routes. That was enough to allow any algorithmic trading systems employing the new route to effectively dominate their competition. Wall Street firms, faced with algorithmic decimation, lined up to lease bandwidth—reportedly at a cost as much as ten times that of the original, slower cable. A similar cable stretching across the Atlantic between London and New York is currently in progress, and is expected to shave about five thousandths of a second off current execution times.

44

The impact of all this automation is clear: even as the stock market continued on its upward trajectory in 2012 and 2013, large Wall

Street banks announced massive layoffs, often resulting in the elimination of tens of thousands of jobs. At the turn of the twenty-first century, Wall Street firms employed nearly 150,000 financial workers in New York City; by 2013, the number was barely more than 100,000—even as both the volume of transactions and the industry’s profits soared.

45

Against the backdrop of that overall collapse in employment, Wall Street did create at least one very high-profile job: in late 2012, David Ferrucci, the computer scientist who led the effort to build Watson, left IBM for a new gig at a Wall Street hedge fund, where he’ll be applying the latest advances in artificial intelligence to modeling the economy—and, presumably, trying to gain a competitive advantage for his firm’s trading algorithms.

46

Offshoring and High-Skill Jobs

While the trend toward increased automation of white-collar jobs is clear, the most dramatic onslaught—especially for truly skilled professions—still lies in the future. The same cannot necessarily be said for the practice of offshoring, where knowledge jobs are moved electronically to lower-wage countries. Highly educated and skilled professionals such as lawyers, radiologists, and especially computer programmers and information technology workers have already felt a significant impact. In India, for example, there are armies of call center workers and IT professionals, as well as tax preparers versed in the US tax code and attorneys specifically trained not in their own country’s legal system but in American law, and standing ready to perform low-cost legal research for US firms engaged in domestic litigation. While the offshoring phenomenon may seem completely unrelated to the jobs lost to computers and algorithms, the precise opposite is true: offshoring is very often a precursor of automation, and the jobs it creates in low-wage nations may prove to be short-lived as technology advances. What’s more, advances in artificial intelligence may make it even easier to offshore jobs that can’t yet be fully automated.

Most economists view the practice of offshoring as just another example of global trade and argue that it invariably makes both parties to the transaction better off. Harvard professor N. Gregory Mankiw, for example, while serving as George W. Bush’s chairman of the White House Council of Economic Advisers, said in 2004 that offshoring is “the latest manifestation of the gains from trade that economists have talked about at least since Adam Smith.”

47

Abundant evidence argues to the contrary. Trade in tangible goods creates a great many peripheral jobs in areas like shipping, distribution, and retail. There are also natural forces that tend to mitigate the impact of globalization to some degree; for example, a company that chooses to move a factory to China incurs both shipping costs and a significant delay before completed products reach consumer markets. Electronic offshoring, in contrast, is almost completely frictionless and subject to none of these penalties. Jobs are moved to low-wage locations instantly and at minimal cost. If peripheral jobs are created, it is much more likely to be in the country where the workers reside.

I would argue that “free trade” is the wrong lens through which to view offshoring. Instead, it is much more akin to virtual immigration. Suppose, for example, that a huge customer service call center were to be built south of San Diego, just across the border from Mexico. Thousands of low-wage workers are issued “day worker” passes and are bused across the border to staff the call center every morning. At the end of the workday, the buses travel in the opposite direction. What is the difference between this situation (which would certainly be viewed as an immigration issue) and moving the jobs electronically to India or the Philippines? In both cases, workers are, in effect, “entering” the United States to offer services that are clearly directed at the domestic US economy. The biggest difference is that the Mexican day worker plan would probably be significantly better for the California economy. There might be jobs for bus drivers, and there would certainly be jobs for people to maintain the huge facility located on the US side of the border. Some of the workers might

purchase lunch or even a cup of coffee while at work, thus injecting consumer demand into the local economy. The company that owned the California facility would pay property tax. When the jobs are offshored, and the workers enter the United States virtually, the domestic economy receives none of these benefits. I find it somewhat ironic that many conservatives in the United States are adamant about securing the border against immigrants who will likely take jobs that few Americans want, while at the same time expressing little concern that the virtual border is left completely open to higher-skill workers who take jobs that Americans definitely

do

want.

The argument put forth by economists like Mankiw, of course, measures in the aggregate and glosses over the highly disproportionate impact that offshoring has on the groups of people who either suffer or benefit from the practice. On the one hand, a relatively small but still significant group of people—potentially measured in the millions—may be subjected to a substantial downgrade in their income, quality of life, and future prospects. Many of these people may have made substantial investments in education and training. Some workers may lose their income entirely. Mankiw would likely argue that the aggregate benefit to consumers makes up for these losses. Unfortunately, although consumers may benefit from lower prices as a result of the offshoring, this savings may be spread across a population of tens or even hundreds of millions of people, perhaps resulting in a cost reduction that amounts to mere pennies and has a negligible effect on any one individual’s well-being. And, needless to say, not all the gains will flow to consumers; a significant fraction will end up in the pockets of a few already-wealthy executives, investors, and business owners. This asymmetric impact is, perhaps not surprisingly, intuitively grasped by most average workers but seemingly lost on many economists.