MONEY Master the Game: 7 Simple Steps to Financial Freedom (52 page)

Read MONEY Master the Game: 7 Simple Steps to Financial Freedom Online

Authors: Tony Robbins

If you’re a man, you’re guilty of this bias by biochemistry. Testosterone equals overconfidence. Study after study show that women tend to be better investors because they don’t overestimate their abilities to anticipate the future accurately. Sometimes confidence works against you. Just watch little boys. “I’m Superman! I’m going to fly! Watch me jump off this roof!” Suffice it to say, if you’re a woman reading this book, you have a built-in advantage!

When the markets are going up and up and up, investors can be mesmerized by their returns. Everybody’s seduced by the

possibility

of growth, thinking it’s the

probability

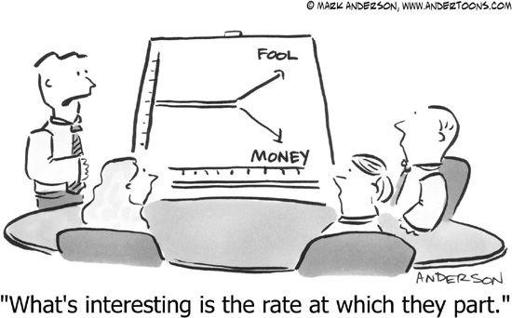

of growth. That’s where they get into trouble. As a result, they pour the majority or all of their money into investments that fit into the Risk/Growth Bucket—not just 70% but sometimes 80%, 90%, or 100%. Some even borrow money to make investments that they believe are going to go up forever, until they don’t. And because of poor asset allocation, with too much of their money riding on one horse, they lose it all or even end up in debt. And the reason people get screwed is that by the time they hear that the stock market (or gold, or the real estate market, or commodities, or any other type of investment) is a great place to go, very often the bubble is just about to end. So you need to put in place a system to make sure you don’t get seduced into putting too much of your money in any one market or asset class or too much in your Risk/Growth Bucket.

All of this may sound pretty basic, especially to sophisticated investors who feel like they’ve got everything covered. But sometimes it’s high-level

investors whose strings of successes send them veering off course. They forget the fundamentals.

Naturally, there will always be investors who can’t listen to reason, whose “irrational exuberance” runs away with them. They talk themselves into believing the biggest myth of investing:

“This time will be different.”

I know dozens of these stories, all with unhappy endings. Take Jonathan, a friend who made a fortune in business (and whose real name will remain anonymous for his privacy) and then liquidated everything to invest in the booming Las Vegas real estate market. He had some early wins, so he doubled down and borrowed like crazy to keep building condos. Every time Jonathan came to my financial programs, he heard about the importance of putting some of your wins into your Security Bucket and not putting all your eggs into any one basket no matter how compelling the returns might be today. Jonathan gave credit to me and my Business Mastery programs for the more than 1,000% increase in his business that made all these investments possible. He made more than $150 million selling his company. But he didn’t listen when it came to taking money off the table and putting it in the Security Bucket, and, boy, did he pay a price. Today he acknowledges that he let his ego get in the way of his eardrums. He wanted to be a billionaire, and he knew he was on target to become one. But then, do you remember what happened when the real estate market in Las Vegas collapsed? How far did housing prices go down? How about 61% between 2007 and 2012. Jonathan didn’t just lose everything—he lost a half billion dollars more than he had.

I sincerely hope all this is sinking in. If there’s anything you should take away from this chapter, it’s this: putting all of your money in the Risk/Growth Bucket is the kiss of death. It’s why many experts estimate that 95% of investors lose money over virtually any decade. Typically they ride the wave up (in real estate, stocks, gold), and when the wave disappears, they sink like a rock, and they’re pounded by financial losses during the inevitable crash.

Some people just won’t listen to advice. They have to learn the hard way, if at all. But to avoid those kinds of painful lessons, and to help you decide which options are right for

you,

I have to remind you that a conflict-free, independent investment manager can be the right choice. Notice how professional athletes, men and women at the top of their sport, always have coaches to keep them at peak performance? Why is that? Because a coach will notice when their game is off, and can help them make small adjustments that can result in huge payoffs. The same thing applies to your finances. Great fiduciary advisors will keep you on course when you’re starting to act like a teenager and chasing returns. They can talk you off the ledge when you’re about to make a fateful investment decision.

PICK A NUMBER, ANY NUMBER . . .

Okay, the moment of reckoning has arrived! Say you’ve still got that $10,000 bonus in your hand (or you’ve accumulated $100,000, $200,000, $500,000, or $1 million or more), and you’ve decided to invest it all. Knowing what you know so far, how would you divide it up? What’s your

new

philosophy of investing? What percentage of your money are you going to keep growing in a secure environment and what percentage are you willing to risk for potentially greater growth?

You’ve probably heard that old rule of thumb (or what Jack Bogle calls a “crude method”): invest your age in bonds. In other words, subtract your age from 100, and that would be the percentage you should keep in stocks. So if you were 40 years old, 60% should go to equities in your Risk/Growth Bucket and 40% in your Security Bucket as bonds. At age 60, the ratio should be 40% stocks and 60% bonds. But those ratios are out of whack

with today’s reality. The volatility of both stocks and bonds has increased, and people live a lot longer.

So what should it be for you? Would you like to be more aggressive with your risk, like David Swensen? With a 30% security and 70% risk? That would mean putting 30% of your $10,000 windfall—$3,000—in Security and 70%—or $7,000—into your Risk/Growth Bucket. (If you had $1 million, you would be putting $300,000 in Security and $700,000 in Risk/Growth.) Can you really afford that kind of split? Do you have enough cash? Do you have enough time? Are you young enough? Or do you need to be a little bit more conservative, like most pensions are, at 60/40? Or is 50/50 right for you? Are you close enough to retirement that you’d want to have 80% in a secure place, and only 20% in riskier investments? What matters is not what most people do. What matters is what will meet both your financial and emotional needs.

I know, it’s such a personal choice, and even the brightest stars in finance sometimes have to think long and hard about what’s right for them and their families. When I interviewed J.P. Morgan’s Mary Callahan Erdoes, I asked her, “What criteria would you use in building an asset allocation? And if you have to build one for your kids, what would that look like?”

“I have three daughters,” she told me. “They’re three different ages. They have three different skill sets, and those are going to change over time, and I’m not going to know what they are. One might spend more money than another. One may want to work in an environment where she can earn a lot of money. Another may be more philanthropic in nature. One may have something that happens to her in life, a health issue. One may get married, one may not; one may have children, one may not.

Every single permutation will vary over time,

which is why even if I started all of them the first day they were born and set out an asset allocation, it would have to change.

“And that has to change based on their risk profile,

because over time, you can’t have someone in a perfect asset allocation unless it’s perfect for them.

And if, at the end of the day, someone comes to me and says, ‘All I want is Treasury bills to sleep well at night,’ that may be the best answer for them.”

I said to her, “Because it’s about meeting their emotional needs, right? It’s not about the money in the end.”

“Exactly, Tony,” she said. “Because if I cause more stress by taking half

that portfolio and putting it in a stock market, but that leads to a deterioration of the happiness in their lives—why am I doing that?”

“What is the purpose of investing?” I asked. “Isn’t it about making sure that we have that economic freedom for ourselves and for our families?”

“That’s right, to be able to do the things you want to do,” she said. “But not at the expense of the stress, the strains, and the discomfort that goes along with a bad market environment.”

So what’s the lesson here from one of the best financial minds in the world? What’s more important even than building wealth is doing it in a way that will give you peace of mind.

So what will it be? Write down your numbers and make them real! Are those percentages a comfortable fit? Walk around in them. Live in them. Own them! Because those percentages are the key to your peace of mind as well as your financial future.

Done?

Okay!

You’ve just made the most important

investment

decision of your life. And once you know what your percentage is, you don’t want to alter it until you enter a new stage of life, or your circumstances change dramatically. You’ve got to stick with it and keep the portfolio in balance. I’ll show you how later in this section.

Are you still concerned about making the right choice? Just remember, you’ve got a fiduciary to help you. And you don’t need tens of thousands, hundreds of thousands, or millions of dollars to get started—you could get started with next to nothing for free with today’s online services.

By the way, I’m not done with you yet! There are ways to increase your returns within these buckets, and we’re going to get to that.

Now that you understand these principles, and you’ve made this decision about how much you want to put in your Risk Bucket versus your Security Bucket, let me tell you the best news of all: after interviewing 50 of the most successful investors in the world, the smartest financial minds,

I’ve uncovered the ways in which you can get Growth-like returns with Security Bucket protections.

The most important piece of advice every investor I talked to echoed was, “Don’t lose money!” But for many investors, that means having to settle for mediocre returns in the Security Bucket. In just a couple of chapters, I’m going to share with you how to have the upside

without the downside. How to have significant growth without significant risk. I know it sounds crazy, but it’s real, and it’s exciting.

As hard as we’ve worked here, I’m happy to tell you that the next chapter is easy and pure pleasure. Now I’m going to reveal a third bucket that we haven’t talked about yet, but you’re going to love it because it’s fun, inspiring, and can give you a greater quality of life today, not decades in the future. Let’s discover what’s going to go in your Dream Bucket.

David Swensen provided the specific percentage for each asset class, but he did not provide the specific indices to represent each asset class. Independent analysts used the following indices to represent each asset class, and it is assumed that the portfolio would be rebalanced quarterly.

Note that past results do not guarantee future performance. Instead, I am providing you the historical data here to discuss and illustrate the underlying principles.

20% | Wilshire 5000 Total Mkt TR USD |

20% | FTSE NAREIT All REITs TR |

20% | MSCI ACWI Ex USA GR USD |

15% | Barclays US Long Credit TR USD |

15% | Barclays US Treasury US TIPS TR USD |

10% | MSCI EM PR USD |

CHAPTER 4.3

THE DREAM BUCKET

When you cease to dream, you cease to live.

—MALCOLM FORBES

What’s a Dream Bucket? It’s where you set aside something for yourself and those you love so that all of you can enjoy life while you’re building your wealth. It’s something for today, not tomorrow! Your Dream Bucket is meant to excite you, to put some juice in your life so you want to earn and contribute even more. Think of the items you’re saving for in your Dream Bucket as

strategic splurges.

What would float your boat right now? Maybe you’d buy yourself that pair of Manolo Blahniks you’ve always wanted, or a floor-side seat at a Miami Heat game. Or a VIP tour of Disneyland for the kids. Or you could start filling that bucket for a bigger reward: season tickets. A trip to the mountains in the summer or a ski or snowboarding vacation in the winter. A new car—maybe one that isn’t so practical, like a Mini Cooper or a Mustang. A vacation condo or home.

I know a millionaire who always flew coach because he liked to save a dollar, but his wife complained about it constantly. “We have plenty of money. Why don’t we enjoy it?” she said. It was a constant source of strife between them because they traveled so much for business. After attending my Wealth Mastery seminar, he decided to use his Dream Bucket to upgrade to business class when he flew with his family. He discovered it not only made his travel life more comfortable but also (even more importantly) his home life as well. Way to flame out, dude! Maybe someday he’d like to consider chartering a private jet instead of flying commercial—and it might not be as expensive as he thinks.