It's Not Luck (4 page)

Authors: Eliyahu M. Goldratt

I don’t agree with the objective, but prefer not to comment.

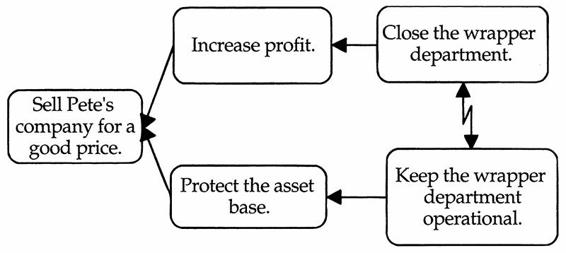

“One requirement is ‘Increase profit.’ Which means that we have to ‘Close the wrapper department.’ Another requirement is ‘Protect the asset base,’ which translates into ‘Keep the wrapper department operational.’ What a conflict!” I glance over at what he wrote:

It’s a good starting point. “Okay, Don. Surface assumptions, and challenge them.”

“In order to get a good price we must increase profit, because . . . ?”

“Because profit of a company determines its value,” I surface the assumptions.

“Yes,” says Don. “I don’t see how to challenge that, especially in Pete’s case. He doesn’t have any promising new technology, or a new patent that would make the current profits irrelevant.”

“Carry on,” I say.

“In order to get a good price we must not erode the asset base, because . . . . Once again, because the value of the assets determines the selling price of the company. I don’t see how the left side of the cloud can help us.”

When I don’t comment, he continues.

“In order to increase profit we must close the wrapper department, because . . . because the department is losing money. I have an injection!!” he declares. “Let’s turn the wrapper department into a gold mine!”

“Ha, ha.” I’m not in the mood for jokes.

“Okay,” Don says, “in order to not erode the asset base of the company we must keep the department operational because . . . because the book value of the equipment is bigger than the sales value of the equipment.” I don’t see any way to challenge that. “One last arrow,” he continues. “Closing the wrapper department is mutually exclusive to keeping the department operational, because . . . because we cannot sell the wrapper department as a standalone. Wait a minute, Alex, maybe we can?”

“Of course we can. Get me such a buyer and I have two Brooklyn bridges for him as well.”

“I’m stuck,” he admits.

“Go over the arrows again. There is usually more than one assumption for each arrow. Concentrate on the arrow that irritates you the most.”

“In order to increase profits we must close the wrapper department. This is definitely the one that irritates me the most. Why do we have to close it? Because it is losing money. Why is it losing money? Because we cannot get the big volume business. Wait a minute, Alex. If in the large volumes Pete can’t compete against the fast machines, how come he can compete for the small quantities? Something doesn’t make sense.”

“It’s not that something doesn’t make sense,” I reply. “There must be something we’re not aware of. Why don’t you call Pete and find out?”

Don places the call. After some “uh-huhs” and “I see’s,” he disconnects. “The mystery is solved,” he says. “Pete’s offset presses do have one advantage: they require much less set-up time. This allows him to compete for the small quantities, but in larger quantities, this advantage is wiped out by the speed of the competitors’ presses.”

We drive the rest of the way in silence. I don’t see how to break Pete’s cloud. Actually, I do. There is another way to increase the profits of Pete’s company. We can rewrite the forecast, ignoring our fear that prices will be reduced. This would probably double the profits. Yuck! No way am I going to use these dirty tricks.

I don’t see how to break Pete’s cloud. I don’t see how to break my cloud. I see only one thing: the need to break them. But how?

“Can you come up for a minute?” Granby asks.

“Yes, of course,” I answer, and rush up to his office. At last I will find out what he is planning to do about the board’s resolution. I knew that the final word was not yet said; I knew that he wasn’t just going to lie down and take the punches.

“Hi, Alex,” he stands up behind his desk and gestures to the other side of the room. Even better, I think to myself, it’s not going to be a formal discussion. I sink into one of the deep couches.

“Coffee, tea?” he asks.

“Coffee will be fine,” I respond, guaranteeing that the discussion will last more than five minutes.

“Well, Alex, I have to congratulate you on what you’ve done with your group. I never thought such big losses could be overcome in just one year. But as a matter of fact, I shouldn’t be surprised. You pulled a miracle as a plant manager and even a bigger one as a division manager.”

Yes, I think to myself, I pulled miracles, but Hilton Smyth, who didn’t pull any miracle, just some strings, became an Executive VP two years before me.

To Granby I say, “That’s what we’re here to do.”

“Tell me, Alex, what can we expect from you this year? With what miraculous improvements are you going to surprise us this time?”

“I have some plans,” I say. “Bob is working on a very interesting distribution system that, if successful, will really change things around.”

“Fine, fine,” he says, “so what is the actual bottom line forecast that you have. Tell me.”

“Here I have to disappoint you. As a matter of fact, I doubt if this year we will even make the forecast.”

“What?” he asks, but doesn’t seem surprised.

“The market pressure to reduce prices is immense. I’ve never seen anything like it. Yes, we factored it into the forecast, but it looks like reality will be even worse. Competition is so fierce that we need to run as fast as we can just to stay in the same place.”

If it weren’t for the coffee that Granby’s secretary is now serving, I’m sure the discussion would end here and now. I wait until the secretary leaves and then say, “Can I ask, what are your plans regarding the board’s resolution?”

“What do you mean?”

“Aren’t you going to do anything about selling the companies that you yourself bought?”

“Alex,” he says, “I have only one year until retirement. If you had some ammunition for me now, maybe I could have done something, but as it stands, I don’t have any choice but to collaborate.”

In spite of all the mental conditioning that I had tried to go through, I am still deeply surprised. The ace Granby had up his sleeve was me! There is nothing that can be done to stop that devastating decision? Through the fog I hear Granby: “Trumann and Doughty decided to directly supervise selling the companies.” When he sees my expression he continues, “Yes, Alex, I still have enough clout to fight it. I could postpone it for one year. But what’s the difference. Next year they would do it, and in my absence I would be the prime target for all the mud. No, I’d better bite the bullet now. What a bullet! I hope I won’t choke.”

“So, what should I do?” I ask. “Business as usual?”

“For your companies it is business as usual. For you it’s a lot of work. Trumann and Doughty have already lined up a series of meetings in Europe at the end of the month. You will have to accompany them.”

“Why in Europe?”

“Half the investment money comes from there, and besides, it is always a good idea to know what the international market is offering before you begin negotiations with the locals.” He stands up. “It’s a pity you didn’t have another surprise, but I understand. The market is more and more chaotic these days. It’s a good thing I’m retiring. I don’t think I have left in me what is needed to cope with such a market.”

As he accompanies me to the door he adds, “We both don’t like to sell the diversified group. Now all the snakes will come out of the closets. I hope that when the sales are over I will be left with some positive reputation.”

I leave him and head directly for Bill Peach’s office. I must get the full story.

Bill greets me with a big grin. “Did you noticed the maneuver our friend Hilton tried? But this time it backfired on him, the creep!”

Bill has his own reasons not to like Hilton Smyth. Not too long ago Hilton reported to him, but now they are on the same level. Hilton is an Executive VP in charge of as big a group as Bill is.

“Yes, I noticed,” I say, “but what did you expect from him?”

“He is sharp, .very sharp. Granby is not such a good horse anymore, so he tried to switch, he tried to snap up the CEO position. I should have thought of such a move,” he says, with a bit of admiration.

“Well, this time he is trying to play against Wall Street sharks,” I add. “He’s not even in their league.”

“Absolutely not in their league,” Bill laughs. “They played him like a violin, and once they got the resolution they wanted, immediately they turned back and put him right where he belongs, throwing all his investment plans in his face. I loved it.”

“I never thought that Hilton was a real candidate for becoming the next CEO,” I say. “You are senior and you have a better track record.”

He slaps me on the back, “A lot of my track record I owe to you, Alex. But no, I don’t fool myself. I’m not the CEO type. And after that board meeting, I don’t stand a chance.”

“What do you mean,” I ask, puzzled.

“You know; the decision to sell your companies. I was heavily involved in purchasing them, a lot of the blame will be thrown on me. At least enough to guarantee that I won’t be nominated.”

Now I am totally baffled. “Why are my companies such political poison? They are not bottomless pits anymore. Last year they even produced some money.”

“Alex,” Bill smiles, “have you checked how much we paid for these companies?”

“No,” I admit. “But how much could we have paid for them?”

“A bloody fortune. Granby was so hot to diversify, and remember we bought them in eighty-nine, when everyone expected a market up-turn—and you know what happened. Rather than going up, the market took a nosedive. I estimate that we paid at least twice what we can hope to get for them now. Alex, everyone involved in these purchases will catch some flack.”

“Wait a minute, Bill,” I say. “As long as we don’t sell the companies, they appear on our books at their purchase value. But the minute that we sell them, we have to write off the entire difference. Maybe Trumann and Doughty haven’t paid attention to this?”

“Don’t fool yourself,” he beams. “They pay attention to any number that is preceded by a dollar sign. They know exactly what they are doing. They will take the bite this year, they will improve the cash position of the company, and then next year—when they bring in some known hotshot as the new CEO—the shares will jump.”

I have to think about it, but one thing I can’t figure out. “Why are you so happy about it?” I ask aloud.

“Because now I can relax.” Seeing the puzzled look on my face, he continues. “Alex, I knew all along I wasn’t going to be the next CEO, but I was terrified that Hilton would be. If there is someone I really don’t want to work for, it’s Hilton. Any outsider is better. Now, because of his last maneuver, he’s lost Granby’s support and he definitely didn’t win Trumann’s or Doughty’s. He is doomed.”

The minute I return to my office, I ask Don to get me information about the purchases of our companies. We both analyze it. The situation is much worse than Bill said.

According to what we estimate, Pete’s company can be sold for a maximum of $20 million. It was purchased for $51.4 million. Stacey Kaufman’s company, Pressure-Steam, can currently be sold for no more than $30 million. We paid almost $80 million.

The worst of all is Bob Donovan’s company, I Cosmetics. Bearing in mind that even today it is slightly in the red, and taking an optimistic view of their assets, I don’t believe that we can sell it for more than $30 million. We paid $124 million. Yes, $124 million.

Now I understand why Granby wants the sales while he is still in control. He personally initiated and authorized the purchases. Almost $255 million. Not to mention the other $30 million or so thrown in since. For all this investment, since the purchases, we have accumulated total additional losses of $86 million. And now, for all this money, the maximum we are going to get back is only about $80 million. Talk about bad decisions!

“You see, Don,” I say to him, “that’s what happens when you read the market trend wrongly. Now I understand why everybody, including J. Bartholomew Granby III, is running for shelter. There is enough mud here to drown an elephant.”

“What will happen to us?”

“Don’t worry, Don. If push comes to shove, I’ll have no trouble finding you a good position. No problem at all. But let’s put our worries aside. We have something else to take care of right now.”