Catastrophe (4 page)

Authors: Dick Morris

Source:

Michael Grabell and Christopher Weaver, “The Stimulus Plan: A Detailed List of Spending,” ProPublica.org, February 13, 2009, www.propublica.org/special/the-stimulus-plan-a-detailed-list-of-spending.

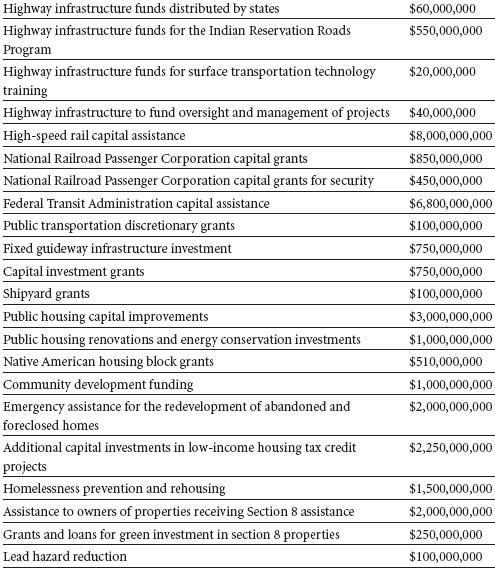

It’s all a big spender could ever wish for—an orgy of outlays.

But even that much spending wasn’t enough for Obama and his hungry Democrats. As soon as Congress passed the stimulus bill, it went to work on a supplemental appropriations bill and added another $410 billion to the spending frenzy.

Obama had promised that he would eliminate earmarks. In his cam

paign against John McCain, he excused his own earmarks as a political necessity, making plain his desire to reform the system if he were elected. But enthusiasm for the avalanche of spending overcame his commitments and Obama signed the bill—even though it contained 9,287 earmarks, whose cost totaled $12.8 billion.

6

These earmarks made a mockery of the reform Obama claimed as his mantra. But even as he violated his promises by signing the earmark-laden bill, he issued recommendations to Congress to avoid earmarks in the future, clinging to his image as an apostle of fiscal responsibility.

Take a look at some of these earmarks and gauge for yourself how fiscally responsible our president really is:

OBAMA: TONE DEAF TO EARMARKS

Earmarks in President Obama’s 2009 budget

$1,049,000 for control of Mormon crickets in Utah

7

$200,000 to fund tattoo removal clinic in California

8

$190,000 for the Buffalo Bill Historical Center in Wyoming

9

$2,673,000 for the Wood Education and Research Center

10

$300,000 to promote women’s sports in Boston

11

$206,000 to promote “wool research”

12

$2,192,000 for the Center for Grape Genetics, Geneva, NY

13

$1,791,000 to Swine Odor & Manure Management Research, Iowa

14

$45,000 for weed removal in Berkshire, MA

15

$469,000 for a fruit fly facility in Hawaii

16

$800,000 for oyster rehabilitation in Alabama

17

$4,545,000 for wood utilization research in Michigan

18

$75,000 to create a “totally teen zone” for teens in Albany, Georgia

19

$300,000 for research on migrating loons

20

$900,000 for Chicago planetarium pushed by Rahm Emanuel

21

$190,000 to buy trolleys in Puerto Rico

22

$380,000 for lighthouse renovation in Maine

23

$7,800,000 for sea turtle research in Hawaii

24

$2,600,000 to monitor the population of Hawaiian Monk Seals

25

$1,500,000 for research on pelagic fisheries in Hawaii

26

$650,000 for beaver research and management in Mississippi and North Carolina

27

$1,700,000 for a honey bee factory in the Rio Grande Valley

28

Combined, the stimulus package and the Supplemental Appropriations Bill have left us with a deficit of at least $1.8 trillion for this year—a figure equal to 12 percent of the nation’s gross domestic product (GDP).

29

Other, possibly more accurate estimates put it at $2 trillion, or 14 percent of GDP.

30

Never since World War II has our deficit been even remotely that high. When the deficit crested at 4.7 percent of GDP in 1992, Bill Clinton had to focus all his energies on bringing it down. Now its size exceeds comprehension. In the worst of its economic recession, Japan tried supporting all manner of public works—to no avail—and swelled its deficit to 10 percent of GDP. But 12 percent and rising is a new peacetime record.

So anxious were Obama and Congress to pass their grand long-term spending plans while the light was green that they didn’t even take care to spend it in 2009 to combat the recession we’re facing today. According to the Congressional Budget Office (CBO), only 23 percent of the money from the stimulus package will be spent in the fiscal year that ends on October 1, 2009.

31

For example, of the $28 billion to be spent on road construction projects, only $9.6 billion will be spent by 2020.

32

And of the $16.8 billion for renewable energy, only $2.5 billion will be spent in 2009.

33

Precisely what good spending so many years from now will do for today’s economy is a mystery.

TAKING HIS TIME: WHEN OBAMA’S STIMULUS WILL BE SPENT

Fiscal Year Amount Spent

2009 $185 billion

2010 $399 billion

2011 $134 billion

2012 $36 billion

2013 $28 billion

2014 $22 billion

2015

*

$5 billion

Source:

Congressional Budget Office.

But in Washington no one asks such questions. It’s much easier just to vote yes.

IS OBAMA’S PROGRAM SOCIALISM?

In our era of breathless, hyperventilated politics, we often attach easy labels to our politicians without worrying too much about whether they’re truly justified. In the 1950s, anyone who leaned the slightest bit to the left was pilloried as a Communist; any liberal legislation, including civil rights and Medicare, was condemned as “creeping socialism.”

So it’s wise to ask: Is it unjust to call Barack Obama a “socialist”?

No. He’s earned it.

Historically, the adjective “socialist” has referred to people who believe that the government should own the means of production. As we’ll see later, Obama may indeed be deliberately angling to take over the financial sector, giving him an unparalleled opportunity to spread his influence throughout

the economy. But he has yet to give any evidence of wanting to take all of private industry and put it under public ownership.

In modern geopolitics, however, the term “socialist” refers broadly to the Social Democratic ideology followed by the left-leaning political parties of Western Europe, who want to expand the role of government in their countries. They want to establish a broader cradle-to-grave social welfare system and to widen the influence of public institutions.

The best shorthand to determine where a nation is on the capitalist/socialist scale is to measure how much of its economy is in the public sector—in other words, what percentage of its GDP comes from government spending. By this measure, the United States has ranked well to the right of almost every other major industrialized country in the world, with the sometime exception of Japan.

The following list compares prominent nations in the proportion of their GDPs that go to government:

TOTAL GOVERNMENT SPENDING AS A PERCENTAGE OF GDP

Sweden 57.0%

France 54.0%

Italy 48.6%

Netherlands 47.1%

Germany 47.5%

United Kingdom 43.7%

Canada 40.1%

Japan 37.5%

United States 36.4%

Source: Forbes.

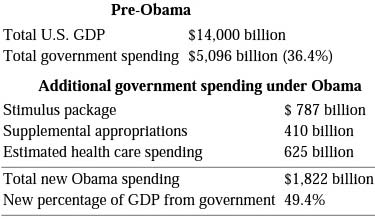

These data, of course, predate the Obama administration. To measure the impact his program on our standing in the socialist landscape, let’s do some simple math:

HOW OBAMA IS MAKING THE UNITED STATES A SOCIALIST DEMOCRACY

Now compare this table with the preceding one. Whereas U.S. government spending once accounted for 36.4 percent of our economy, it is now rising to 49 percent—sending us soaring past Britain and Germany and nestling in right under France—the very model of a modern socialist democracy!

So when it comes to Barack Obama’s spending programs, “socialist” is no political slur. It’s a simple description.

THE STIMULUS PACKAGE THAT DOESN’T STIMULATE

With so much of the spending in his program deferred until years from now, Obama’s stimulus package won’t really do much to stimulate the economy. Rather, it will create a whole new set of problems for our country down the road. In two or three years, it is likely to create massive inflation, which will necessitate a new, government-induced recession to get prices back in check.

Obama’s stimulus bill was a spending program, not an economic recovery program. And that’s a crucial difference.

To understand this, it’s helpful to review a bit of economic history.

The theory that spending equals stimulus was first popularized by the British economist John Maynard Keynes. Writing in the 1930s, he theorized that government should run deficits in times of depression to pump money into the economy and surpluses during times of inflation and prosperity to pull money out and avoid upward pressure on prices.

Before Keynes, economists had advised balancing the budget, particularly during tough economic times. The classical economists felt that running a deficit would undermine confidence in the economy and cause businesses to sit on their hands and not invest. A balanced budget, they reasoned, would induce businessmen to feel greater confidence in the economy and to put up their money for new jobs.

The classical theory was daft. Like the doctors of old who bled their patients with leeches to drain off evil spirits, the classical economists weakened the markets by raising taxes and cutting spending. Like the poor patients being bled years ago, however, the economy needed more blood, not less. It needed more spending and lower taxes, not the opposite.

The flaws of classical economic theory became glaringly apparent under President Herbert Hoover. After the stock market crash at the end of 1929, the economy seemed to be pulling out of depression as 1931 dawned. But then the economists started to bleed the patient. In order to attract more gold into the country (at that point the United States was still on the gold standard) and generate confidence in the U.S. currency, the Federal Reserve Board raised interest rates two points. To cut the deficit, Hoover raised income taxes on the top bracket from 25 percent to 63 percent and on the bottom bracket from 1 percent to 1.5 percent. To make matters even worse, Congress responded to the depression by passing the Smoot-Hawley Tariff Act in 1930, imposing sky-high tariffs to kill off foreign competition and protect American jobs. The result, of course, was to provoke retaliation from other countries and dry up foreign trade, depriving the economy of the stimulus that exports would have provided.

These “cures” made the disease worse, and the depression resumed with a vengeance. The stock market crashed. Unemployment soared to 23 percent. And by the time FDR took over in March 1933, banks were failing across the country.

Onto this stage burst the new theories of what became known as Keynes

ian economics. Keynes reasoned that if government increased spending on public works and other projects, more jobs would be created. The increase in the number of jobs and the extra paychecks flowing into consumers’ pockets would get the economy going again. The process was called “priming the pump.” The point was not to replace the private sector but to shock it back into working as it should. Like a shock from a defibrillator, the money would induce the economy to pump normally.

But it turned out that there was one problem with Keynsian economics: it didn’t work. During the 1930s—its heyday—large, persistent deficits did not end the depression. They helped a bit, lessening unemployment and easing the pain, but they failed to bring back prosperity.

The lesson of the 1930s is that when government provides jobs through deficit spending, the people who get regular paychecks are personally insulated from the worst of the depression; but the rest of the world gets little help from the change, if any. The government jobs created during the 1930s did little to stimulate the rest of the economy. The cycle Keynes predicted—in which government spending would increase purchasing power, generate more consumer spending, expand production, and lead to more private employment—never really happened.