Banker to the Poor (12 page)

Read Banker to the Poor Online

Authors: Muhammad Yunus,Alan Jolis

Tags: #Biography & Autobiography, #Business, #Social Scientists & Psychologists, #Social Activists, #Business & Economics, #Banks & Banking, #Development, #Economic Development, #Nonprofit Organizations & Charities, #General, #Social Science, #Developing & Emerging Countries, #Poverty & Homelessness

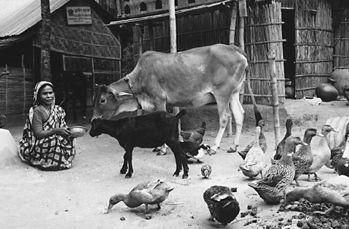

Livestock raising at Shaharail Singair branch; Leasing; Grameen Health Activities

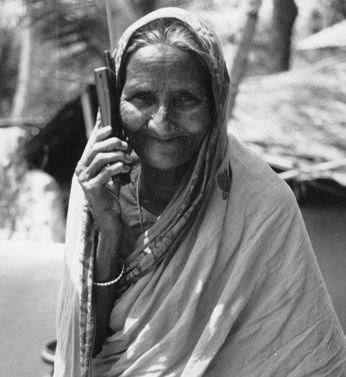

A village "telephone lady" with a Grameen cellular phone

With former President Jimmy Carter, Afrozi, and my daughter Deena, receiving the World Food Prize in Des Moines, Iowa, 1994

Hillary and Chelsea Clinton with Grameen borrowers in Grameen village Rishipara, Bangladesh, 1995

World Bank President James D. Wolfensohn and Mrs. Wolfensohn visiting Grameen Bank's Soliabakpur Banaripapra Branch. Minister Tofail Ahmed and State Minister A.K. Faizul Huq are also present.

"It will never work," said another.

"The staff will start cheating you. You don't know what it is to have internal controls. You are not a banker; you have never run a bank. You are a professor."

Fortunately for us, the secretary of the Finance Ministry, Mr. Syeduzzaman, was another friend of Grameen. Muhith enlisted his support and took my proposal directly to the president. As a military dictator, the president had no political legitimacy and perhaps he saw in Grameen a chance to score some political points. Whatever his thinking, it worked in our favor. With the president's blessing, it was a mere formality to present the proposal in the cabinet. The cabinet approved it without raising any new issues, and the Ministry of Finance was awarded the responsibility of implementing the plan.

I wanted the new Grameen Bank to be 100 percent owned by the borrowers. That is how I had been presenting my case all along. But Finance Minister Muhith was convinced that my proposal would have a better chance of passing if I offered a block of shares to the government. Seeking help, I approached Dr. Kamal Hossain, a former foreign minister and senior aide to Bangladesh's first president, who had played a central role in drafting Bangladesh's constitution.

A great admirer of Grameen, Hossain immediately took over all the details of drafting our legal framework. He suggested we offer 40 percent of our shares to the government and keep 60 percent for our borrowers. We went over countless drafts, discussing each paragraph, line, and word in exhaustive detail. Finally we submitted our draft to the ministry.

In late September 1983, while I was on a tour of Rangpur, I received a call saying that the president had signed the proclamation and that the Grameen Bank was born. That was a day of rejoicing. My tiny project in Jobra had grown into a formal financial institution! But back in Dhaka, when I finally read the full text of the proclamation, I was shocked to see that the ownership percentages had been reversed—the government had kept 60 percent of the ownership and the borrowers had been granted only 40 percent. In effect, Grameen had become a government-owned bank. I felt betrayed.

The first thing I did was to call the finance minister. A patient man, Muhith sympathized with my position. "Yunus, I know you are angry at me," he began. "But you wanted to have a bank, didn't you? This was the only way I could get it for you."

"But this is contrary to everything I was working for," I said.

"No, it is not. I have a very clear plan for your bank. I didn't want to get shot down. If I had presented the proposal your way, it never would have gotten through the cabinet. So I changed it to make it easy for the cabinet to approve. Now you go ahead with the task of setting up the bank. Once it is established, you can come back to the Finance Ministry to change the ownership structure. That will be a much easier task. I promise you that within two years I'll get the ownership ratios reversed. You have my word."

I was not quite convinced. I went back and discussed the issue with my colleagues. We all felt we had no choice and that, like it or not, the Grameen Bank was born. We had better take what we had and steer it in the right direction.

Grameen's operations as a full-fledged independent bank began immediately. We signed loan agreements with all the commercial banks to take over our portion of their assets and liabilities effective October 1, 1983. Our first working day fell on October 2. We decided to have an opening ceremony.